Hello and welcome to Alts Cafe

This is everything you need to know about what’s going on in the world of alternative assets, best enjoyed with your morning coffee.

Let’s go!

Table of Contents

Macro View

It was a pretty good week! And so far, it’s been a pretty good year.

Just remember, it’s the hope that kills you.

Here’s what you need to know:

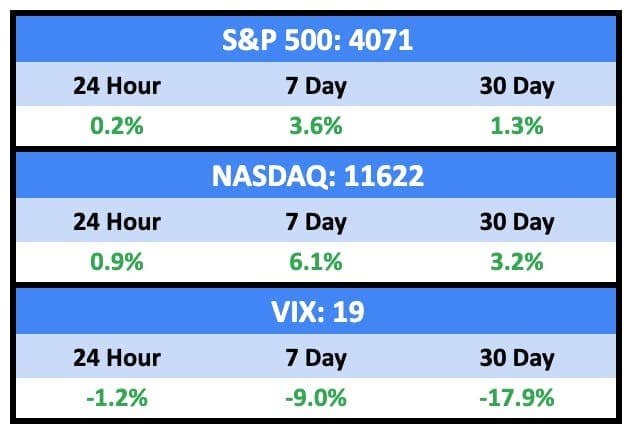

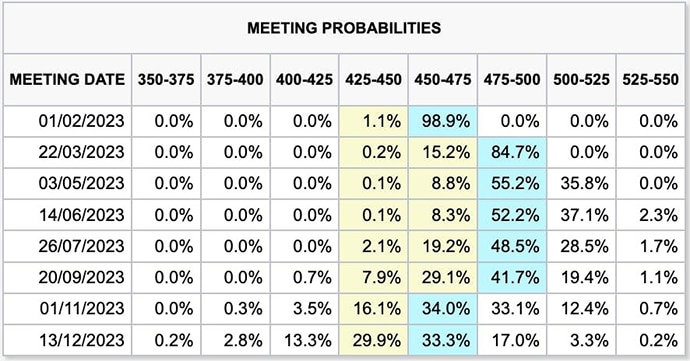

Later this week, we’ll get the first US rates announcement of the year.

Nearly everyone expects a 25bp rise, followed by another quarter percent in March, before the FOMC calls it quits.

The markets are pricing in a 60% chance that rates will top out at 5% before coming back down slightly by the end of 2023. Good news for most, though it’s worth noting that these forecasts are almost always wrong in one way or another.

Even if they are correct, that’s still nearly a year with elevated rates, which will continue to cause problems in the housing market (more on that below).

Bullish News

- US GDP rose 2.9% in the fourth quarter.

- US natural gas futures fell below $3 for the first time since May 2021, amid mild winter weather.

- Canada is probably done hiking rates.

Bearish News

- Consumer Debt is a big problem in America:

- Corporate layoffs are spreading beyond big tech companies.

- Natural disasters caused global economic losses of $313 billion in 2022. That’s 57% higher than the average since 2000.

What are we doing?

ALTS 1 fund news:

Nothing to report here.

Real Estate

Here’s what you need to know:

There’s a curious bit of psychology going on with the American homes market (and elsewhere), and it has to do with a powerful bias called the sunk cost fallacy. Here’s the problem:

Buyers are facing sticker shock from mortgage rates that are double what they were just a year ago. Buying a home now is too expensive, and many buyers think both rates and prices will come down in 2023.

Sellers, many of whom bought at or near the peak, have two problems. First, 85% of them are currently on a mortgage rate lower than what they’d be able to get now. Second, many of their homes are now worth less than they paid.

So buyers can’t afford a new house, and sellers can’t afford to sell their existing home. Both sides seem to be capitulating, though, with buyers leading the way:

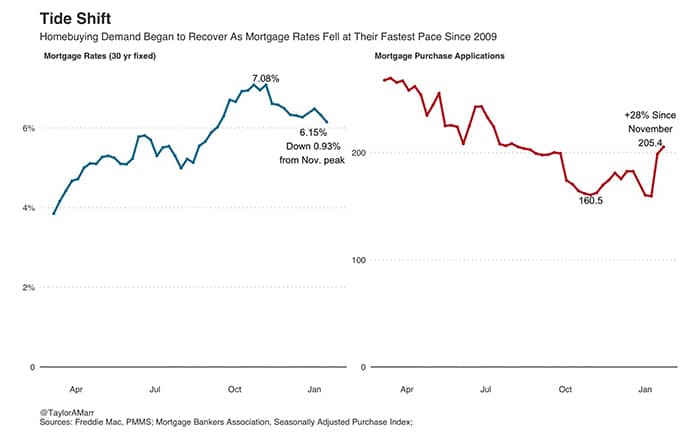

Mortgage rates are down a bit (payments are now 10% lower than their late 2022 peak), and some people just have to move–new job, divorce, etc. But…

Sellers are coming to the table a bit as well (new listings are up 10% since November), but there’s a lot more psychology at play here. Many of them are selling for a loss (either on paper or real) and are moving into a house that’s not nearly as nice as what they’re in now. People hate selling for a loss. And they abhor the idea of moving into a home that’s inferior to what they’re moving out of.

So they’re delaying — hoping the market will improve, praying they’ll somehow be able to both sell their current home for more money and buy something else for less. Except the only way that’s going to happen is with a seismic shift in interest rates, and that’s not likely in 2023.

It’s a classic and powerful case of the sunk cost fallacy, and right now, it’s moving markets.

Bullish News

- Sales of new US single-family homes increased for a third straight month in December.

- Average mortgage rates dropped to 6.13% in the US, the third straight weekly decline.

- Mortgage applications are up 28% from early November.

- Most building materials shortages have eased. The exceptions are HVAC, ceramic, clay, and cement.

- Better.com is trying to unlock the frozen mortgages market with a new 24-hour approval product.

Bearish News

- Sales of existing homes fell for the 11th consecutive month in December 2022.

- Sales of existing homes in the US dropped 17.8% in 2022, the most since 2008.

- Goldman Sachs thinks home values in San Jose, Austin, Phoenix, and San Diego will decline 25% from peak to trough.

- The Biden administration has rolled out a renters’ rights package that will limit rent increases and give other protections to tenants.

- Over 800,000 UK households will see their mortgage rates more than double this year as they come off low fixed-rate deals.

- Blackstone faces $5bn of withdrawal requests from more property funds.

How to invest in real estate right now:

Sit on your hands or chase yield. [Unchanged]

Crypto & NFTs

Here’s what you need to know:

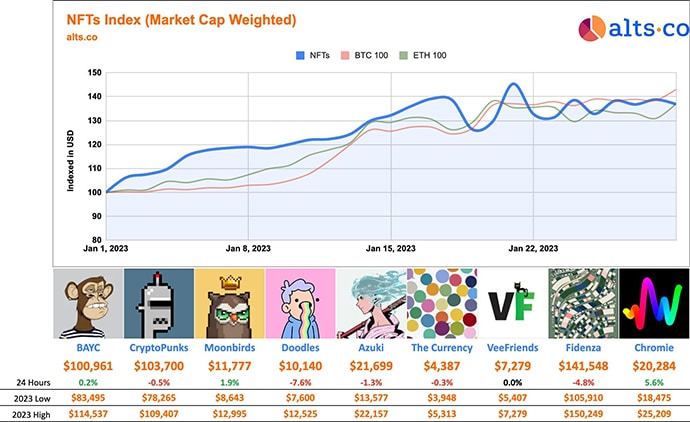

Crypto has had a fantastic 2023 so far, and there are no real signs of the asset class reversing, though the major coins have flattened out recently.

The Fear and Greed Index is absolutely ripping in 2023. We’re now into “Greed” territory.

Blue-chip NFT projects are up well over 35% on average so far in January:

Bullish News

- Amazon is getting into NFTs.

- Cryptocurrency miners are turning their machines back on.

- Trading volume on Coinbase picked up in the early weeks of 2023, though other exchanges saw continuing declines.

Bearish News

- Crypto startup funding fell to its lowest in two years.

- CoinTracker, a crypto tax company, has laid off 20% of its staff.

- FTX owes money to 116 pages worth of people and companies.

- Irish central bank chief calls for ban on crypto advertising.

- Binance accidentally mixed customer funds with B-Token collateral.

How to invest in Crypto & NFTs right now:

Dollar cost averaging if you’re bullish.

Startups

Here’s what you need to know:

Last week, Stonks, The Premoney List and Stat Significant teamed up to release some telling numbers about the US startups markets. Some highlights:

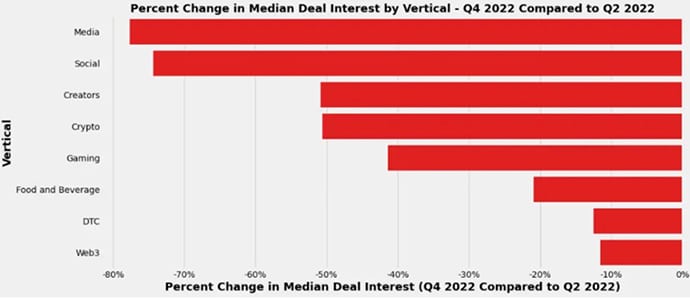

- The biggest (relative) losers last year were climate tech, crypto, and social. Fundraising was down 48%, 38%, and 33% in Q4 relative to Q2, respectively, for the beleaguered sectors.

- Interest in media and social startups was waaaaay down. They were off 78% and 75%, respectively, in Q4.

- AI fundraising was up over 600% in Q4.

All in, it looks like media companies (👋) were hardest hit at the end of 2022.

There were twice as many media companies raising capital in Q4 than there were in Q2, but investor interest in the sector was down nearly 80%.

Caleb, over at Tech Safari, is hosting a virtual event around investing in the African tech ecosystem on 7th February. Check it out if you’re into that scene (or would like to be).

Bullish News

- Remote work startup Deel has hit $295m ARR. That’s up 417.5% from $57 million in ARR achieved at the end of 2021.

- Worldwide, sales of electric vehicles in 2022 passed 10% market share for the first time; 11% of total car sales in Europe (Plug-in hybrid vehicles were another >9%), EVs were 19% in China, and 5.8% in US (up from 3.2% in 2021).

- The bioeconomy is growing fast . In the US alone, it is approaching 2.4% of the national GDP. What’s more, it is growing at more than 20% per annum, far faster than the economy as a whole.

- There were 1.7 million applications for new businesses that were likely to hire employees in 2022. That’s down slightly from 2021’s all-time record of 1.8 million, but still well above pre-pandemic norms. Last year’s applications are up nearly 28% from before the pandemic.

Bearish News

- In 2022, Stripe tried to raise a down round to pay taxes.

- Payments startups Bolt laid off more people last week. CEO Maju Kuruvilla “told an all-hands meeting … that ‘quite a few’ of Bolt’s recent moves, including partnerships, new products, and acquisitions, had not worked out.”

- Nearly 70k tech employees have already been laid off so far in 2023.

How to invest in startups right now:

I’m looking into the bioeconomy.

It’s not as hot&sexy as AI, but it’s got a significant tailwind and is a bit under the radar.

Quick Hits

Music Rights

HarbourView Equity Partners, the music and entertainment investment firm, has lined up $200 million in debt for buying music royalty assets

That’s all for this week. Hope you enjoyed your coffee and this edition of Alts Cafe.

Any comments, questions or concerns – let us know.

Cheers, Wyatt