Hello and welcome to Alts Cafe

This is your weekly quick-fire analysis on all things Alts investing.

TLDR:

- You think real estate is bad now? Just give it a year.

- Even the good news in crypto is pretty bad really.

- The next 18 months could be the biggest for startups formations ever.

Like these posts? Please give us a shout on your socials, we’d appreciate it.

Wyatt

Table of Contents

Macro View

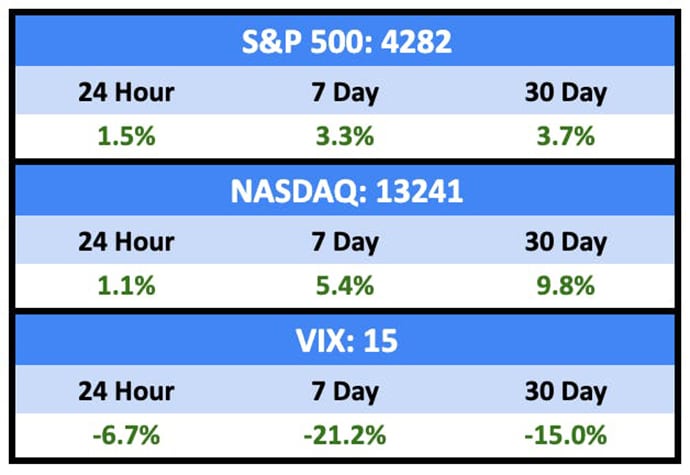

Markets leaped with joy as Congress and the White House reached a compromise on the debt ceiling.

Bullish News

- The US sorted out the debt ceiling at the 11th hour.

- The Fed is likely to pause interest rate hikes in June, but there’s a 68% chance it’ll raise rates in July.

Bearish News

- Real GDP growth is expected to slow to 0.9% in 2023, down from 2.1% in 2022.

- Deutsche Bank predicts that default rates will reach 9% for U.S. high-yield debt, 11.3% for U.S. loans, 4.4% for European high-yield bonds, and 7.3% for European loans.

What are we doing?

ALTS 1 fund news:

We’re still checking out an investment in the Deathcare space 👀

Real Estate

Bullish News

- Houston, Texas was the best real estate market in America over the last ten years.

- Concord, NH was the country’s hottest housing market in April.

Bearish News

- If you don’t already own a home, you’re going to have to wait awhile.

- Related, mortgages are back above 7%.

- Office sales are down 90% in San Jose.

- Commercial real estate transaction volume is forecast to drop in 2023 to $425 billion, down from $730 billion in 2022.

- Prices across all property types are expected to decline 8% in 2023 – the largest all-types drop since 2010.

- There are only 70k homes for sale in the US.

- Deal transaction volume was the lowest it’s been since August 2020.

How to invest in real estate right now:

I’m still out of the real estate market [no change].

Crypto & NFTs

Here’s what you need to know:

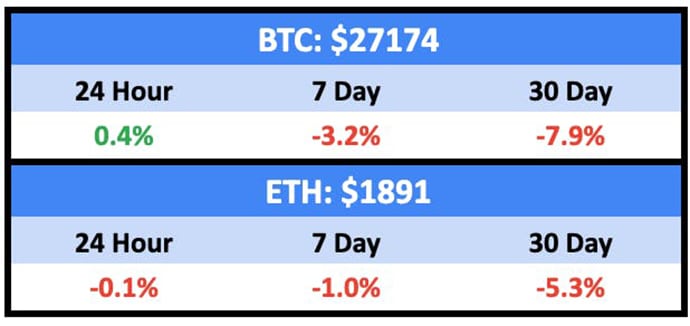

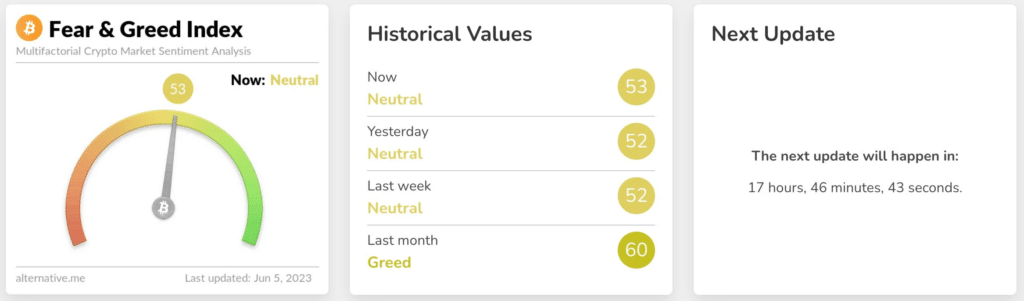

All quiet on the crypto front with both BTC and ETH down slightly.

Treading water:

NFTs saw a slight pop as they continue a nice two-week trend upward:

Bullish News

- Dogecoin “investors” are suing Elon for insider trading.

- Memecoin mania is driving a record number of people to trade on decentralized exchanges, with more than half a million users transacting on Uniswap last month.

- Is there a way back for Moonbirds and the PROOF Collective?

- Coinbase, which is completely unbiased, says the US needs to embrace crypto for national security reasons.

Bearish News

- Cowen, an investment bank, is shutting down its crypto division.

- Crypto trading volume was down 27% MoM in May and clocked its lowest tally in 32 months.

- Traders are losing faith in Binance. They’re keeping collateral at banks and selling on-platform assets at a discount.

- Binance is cutting staff.

How to invest in Crypto & NFTs right now:

It’s accumulation season.

Startups

Bullish News

- Due to the tsunami of tech layoffs over the last twelve months, 2023 and 2024 could be the biggest two years for company formation — ever.

- Chamath and all his SPAC buddies are getting rinsed in court.

- Corporate VCs at Salesforce, Amazon, Solana, and Workday are jumping on the generative AI bandwagon.

- Italy, which has banned ChatGPT, is setting up a fund to invest in AI. Che cazzo?

- Former Brazilian Economy Minister Paulo Guedes is preparing to launch a “green” investment fund. 100% this is somehow a scam.

- Chewy, the online pet retailer that IPO’ed in 2019, smashed earnings last quarter providing a glimmer of hope for the struggling e-commerce sector.

Bearish News

- It’s tough out there for seed-stage companies:

- Fewer than 10% who raised a round in 2022 have secured follow-on funding. Seven in ten who raised in 2021 have yet to raise again.

- Those who are able to raise take 25 months to do so, compared to 21 months just a year ago.

- Andreessen Horowitz is preparing to launch a fund-of-funds.

- Zume, which raised $375 million from SoftBank to automate pizza-making with robots before switching to developing sustainable packaging, has shut down.

- Grocery startups Instacart and Gopuff are struggling.

- Elon has destroyed nearly $30 billion of Twitter’s value.

- Fidelity also slashed the value of its stake in Reddit by 41%.

- The

idioticshort-sighted California bill that would force Big Tech companies to pay media outlets for posting and using their news content got closer to reality last week.

How to invest in startups right now:

Gonna keep saying it — stay far away from AI startups that are just ChatGPT skins.

That’s all for this week. I hope you enjoyed your coffee and this edition of Alts Cafe. ☕

Cheers,

Wyatt

Disclosures

- This issue of Alts Cafe was brought to you by our very clever friends at FameSwap. If you subscribe to Patent Drop, we get a few bucks.

- We hold a PROOF Collective NFT, BTC and ETC in our ALTS 1 Fund. Apart from those, we don’t own any other assets or vested interests in the companies mentioned in this email.

- We are investigating an opportunity in the Deathcare space for our fund, and will say more as soon as there’s something to share.

- We haven’t yet bought Milo a subscriber base. He seemed happy enough with a set of rip-off Minecraft figurines.