Today’s issue is brought to you by Alts community member Logan Nagel, an analyst and writer focusing on commercial real estate and PropTech. He’s written for publications such as Commercial Observer, The Briefcase, and Urban Land.

Today, Logan takes us through one of the most popular, lucrative, (arguably) unfair, and misunderstood real estate tax loopholes in the world: The 1031 exchange.

Some of you may be familiar with this law but need to learn exactly how it works. For others, this will be news to your ears (and slightly mind-blowing).

Real estate moguls like Donald Trump have built real estate empires, avoided paying taxes, and created generational wealth using this law.

Let’s explore 👇

Table of Contents

Using tax loopholes to boost returns

In this issue, we’ll tell you about two big tax loopholes: 1031 Exchanges and Delaware Statutory Trusts.

These are incredible loopholes to take advantage of, and BV Capital does exactly this.

BV Capital is a private equity company offering direct access to alternative real estate investments, including 1031 exchange opportunities and private deals for accredited investors, financial advisors, RIA’s & family offices.

BV has some new projects coming soon:

- A vacation home community on West Galveston Island, TX

- A multi-family apartment building in Arlington, TX

- Ground-up construction mixed-use development in Corpus Christi, TX

See all BV Capital Investments →

BV Capital also has a 1031-eligible deal right now, but it’s what’s known as a 506b deal, so they can’t advertise it.

Interested in seeing this special deal?

If you’re accredited, click here and we’ll send you more info.

What is the 1031 exchange?

The 1031 exchange is probably the most popular tax law that everyday investors don’t seem to know about.

When I first started working in multifamily brokerage with Cushman & Wakefield, I noticed that a ton of the buyers and sellers we worked with were taking advantage of this law.

At a high level, the way the law works is simple. Let’s say you buy an investment property for $500,000. After a few years, the property has increased to $800,000, and now you want to sell it.

Ordinarily, selling the property means you’ll incur a capital gains tax on your $300,000 profit. This capital gains tax can be quite high — typically 15-20%. Plus, depending on your income, you’re likely to incur a net investment income tax, which can add another 3.8% or so.

All in, you can expect the government to yank roughly 20-25% from your gains. In the example above, that would be around $60,000 – $75,000. That’s a big bite.

But what if there was a way to defer this tax indefinitely? To kick the can down the road, and reinvest the profits into another investment?

This is where the 1031 exchange comes in.

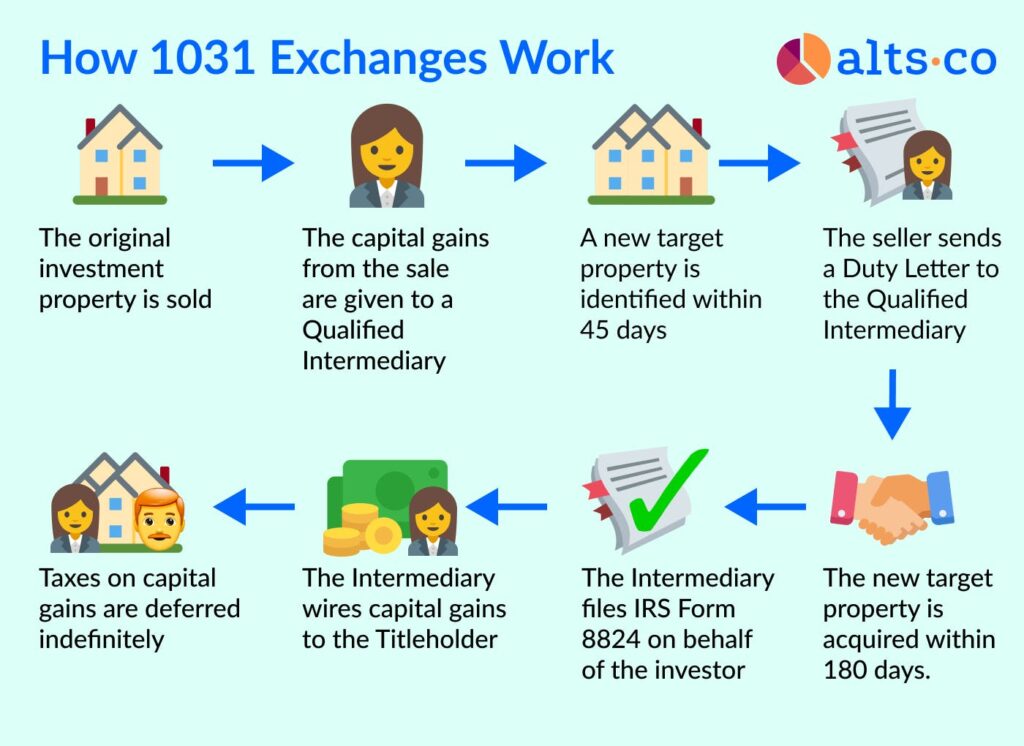

The 1031 is a tax-deferred process by which one real estate investment property is swapped for another. This “swap” allows investors to delay/postpone payment of the capital gains tax, over and over again, until they die.

Top be clear, the law doesn’t get rid of the tax obligation — eventually the tax must be paid by someone. But critically, there is no limit to how many times you can do it, and there’s no cap on the amount you can defer.

So it’s used as an easy loophole for American real estate investors to create lifelong wealth.

How popular is the 1031 exchange?

For real estate investment pros, the 1031 is incredibly popular.

Take it from Bob Knakal, Managing Director and head of the New York Private Capital Group at leading real estate service firm JLL.

He notes:

We estimate that about 70 percent of sellers purchase another asset within 180 days of selling their property, providing them with the ability to defer their capital gains tax exposure. – Bob Knakal

Seventy. Percent.

So, yes, the pros know something you don’t: 1031 exchanges are absolutely critical to investors’ growth plans. It’s nothing less than a key strategy in their success.

Why was the 1031 exchange created?

1031 exchanges aren’t new. In fact, they date way back the Revenue Act of 1921. The name comes from Section 1031 of the IRS code.

The law was originally created to promote and facilitate investment in real estate. Prior to its introduction, when farmers sold a property, their high tax liability could significantly reduce the amount they have to reinvest in new properties. At worst, their tax bill would be so high that it would discourage them from selling in the first place.

The thinking went that introducing a tax deferral would be a positive incentive. It would be used to encourage ongoing investment in real estate, as investors could reinvest effectively, which helps society move forward.

Basically, the tax deferral was seen as a way to stimulate economic growth, as it promotes further real estate investment. By deferring taxes, investors have more capital available to invest in new properties, engage in property development, and create economic activity.

We’ll get to the controversy a bit later. But first, let’s talk about how this actually works.

How the 1031 exchange works

A 1031 swap is what’s known as a “like-kind exchange” of two investments. This means that the investment you buy into must be materially similar to the investment you sold.

- Paperwork must be done before selling. This isn’t something you can pull off after the fact. Nor can it be a last-minute decision. You need to take care of all paperwork before selling your original property.

- No personal use allowed. While you can exchange residential homes, you cannot like-kind exchange any properties you have ever lived in, including vacation homes. These must be investment properties only. (Although there is a workaround where you can rent to a tenant for part of the year)

- 45-day identification limit. After your property sells, you have 45 days to identify in writing one or more target properties that you want to exchange. You don’t need to acquire every property you identify, but every property you acquire must have been identified ahead of time.

- The new property must be more expensive. The property you acquire must be equal or greater in price than the property you sell.

- 3 properties max. One-for-one swaps are the most common. but investors can actually target up to three properties for acquisitions. (An exception is the 200% rule. With this option, investors can exchange into more than three properties as long as the total value of all acquired properties is no more than 200% of the value of the property sold.)

- 180-day closing limit. After you’ve identified target properties, you have 180 days from the date of sale to close on the new purchase.

- Profits must be reinvested. It probably goes without saying, but the untaxed profits from your sale must be given to a Qualified Intermediary. These middlemen send the capital gains to the Titleholder, and take care of the paperwork. (More on choosing a Qualified Intermediary below)

There are other varieties, such as the Reverse 1031 exchange.

In a Reverse Exchange, the target property is acquired before the sale of the original property. Reverse exchanges have special rules and risks. They require a third party to hold the new property’s title in escrow. And since the sale of the original asset isn’t guaranteed, there’s a risk the whole thing falls apart!

Regardless of your choice, if you fail to meet the IRS’s requirements, you’ll wind up realizing the gains and paying a hefty tax bill. Goodbye, profits!

But if you follow the law, congratulations — you’ve just deferred paying taxes forever.

Oh, and remember, you can do this over and over again; continuing to defer capital gains while forever expanding your investment portfolio.

What happens to the deferred taxes when you die?

Okay, this is possibly the craziest part.

If the person who created the 1031 exchange dies, their investments generally become part of their estate.

Now, the exact tax implications for the heirs depend on the estate tax laws in place at the time of death. But generally, heirs inherit the property at the current fair market value, in what’s known as the “stepped-up basis.”

This effectively resets the cost basis of the property from its original purchase price, to the value on the date of the owner’s death. It’s like saying the new owners of the property (i.e., the heirs) “bought” the property at the market price on the day the original owner died (as opposed to, say, forty years prior!)

In a nutshell, this eliminates the need to complete the 1031 exchange. The heirs can sell the properties on this stepped-up basis without incurring the massive capital gains taxes!

Eventually, investors who are about to die either cash out and accept the capital gains tax payment, or pass away, leaving their heirs free of the capital gains tax bill, since the basis for the asset steps up to market value upon death.

This is why 1031 exchanges are so often used to create generational wealth for entire families. They’re like an estate planner’s dream come true.

What are Qualified Intermediaries?

One challenge with 1031s is finding a Qualified Intermediary.

1031 exchanges are complex processes with paperwork to file, deadlines to keep track of, and many ways to lose your deferred status. You also need a trusted party to hold your sales proceeds in escrow while identifying a target property to acquire.

For this reason, investors are usually required to work with professionals, called Qualified Intermediaries (QIs). These middlemen have deep 1031 experience and facilitate the stickiest parts of the exchange.

The costs of hiring a QI ranges from around $500 to $1,500+. (Not a bad deal, considering you’ll save probably 60x that amount in taxes.)

Selecting a QI is a critical decision. Regulation of the niche is scant, and QI firms occasionally go bankrupt during transactions. For example, when a company called LandAmerica Exchange Services filed for bankruptcy in 2008, $450m of investor funds were caught between the 1031 investors and LandAmerica’s creditors.

Investors didn’t recover their funds until five years later, and they all wound up on the hook for the capital gains taxes they tried to defer in the first place! Yikes.

Beyond formal QIs, title companies, tax advisors, and well-informed brokers can also assist with 1031 transactions.

Things to be careful of

Beyond the arcane nature of the tax code itself, one particularly noteworthy issue to watch out for is timing.

Effectively executing a 1031 exchange requires you to carefully time the sale of your existing asset with the purchase of its replacement. This means that whether it’s a buyer’s or a seller’s market, one half of your exchange or the other may be frustrating.

Another big pitfall to watch out for here is finding yourself in a position where your new purchase falls through once you’ve already closed on your original sale. In this situation you may wind up scrambling to find a replacement property.

At best, this is a lot of unnecessary stress. You may need to get more flexible around the property characteristics and return profile you’re looking for. At worst, you’ll get screwed, take the capital gains hit and be forced to buy a new property you’re not completely sold on.

Controversy and the future of 1031s

For obvious reasons, 1031 Exchanges have become controversial over the years.

This law is seen by many as a tax loophole used by the wealthy to shelter their money. It’s important to understand that this law isn’t static or guaranteed; in fact it is often questioned, scrutinized, and periodically threatened.

The end of tax-free art flipping

In 2014, President Obama tried to place limits on 1031 tax deferrals.

However while his plan was unsuccessful, three years later a Republican congress under President Trump actually eliminated 1031s for non-real property such as artwork!

See, although 1031s were most commonly used in real estate transactions, it quietly became popular among savvy art collectors who realized they could use it to buy & sell artwork as well. — not only because the value of art had skyrocketed to unprecedented levels, but because art remains one of the few assets that incurs the highest capital gains rate (28%).

In 2017, a bipartisan Congress delivered a blow when it passed a tax plan that tightened this up. Artwork investors could no longer avoid capital gains tax by reinvesting the proceeds from an art sale into a new piece of art.

To be fair, that was probably long overdue. This was like a loophole within a loophole.

President Biden’s attempts

President Biden has also proposed changes to 1031s — twice.

The Biden administration first tried using the Inflation Reduction act, which passed with no changes made to 1031s.

Most recently, the administration suggested a maximum deferral cap of $500,000 per transaction (or $1 million for couples filing jointly). The budget estimated a revenue gain of $1.5 billion – $2.2 billion per year (a solid 10% of the 2024 budget)

This “capped deferral” would be a disaster for professional real estate investors who rely on the law to operate.

However, there seems to be litle appetite to touch the law. Language around 1031s is completely absent from the White House’s 2024 budget, and the proposal seems to have lost steam once again.

Other tax-deferral schemes

Even if something does happen with 1031s, there are other new tax-deferred options to be aware of: Opportunity Zones and Delaware Trusts.

Qualified Opportunity Zones (QOZs)

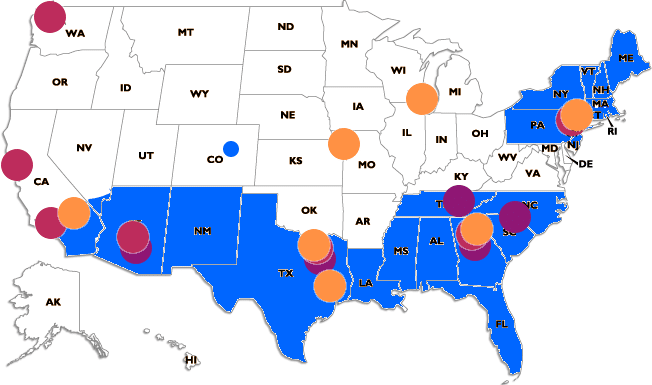

“Opportunity Zones” came into effect in late December 2017. These zones are economically distressed communities where new investments may be eligible for preferred tax treatment.

Qualified opportunity zones are geographic areas identified by the government as in need of additional investment. Qualified Opportunity Funds (QOF), which invest in these areas, are another option to defer capital gains.

Like a 1031 exchange, investors have 180 days from the time of the sale to invest in a QOF. They do not require a QI to facilitate the transaction. However, QOF investments are only eligible for capital gains deferral until the end of 2026.

- According to IRS guidelines, the gain from the sale must be invested within 180 days.

- If the opportunity fund investment is held for over five years, there is a 10% discount on the amount owed.

- If held for more than seven years, that 10% becomes 15%.

- Further tax benefits can accrue if the collector holds the investment for at least 10 years.

There is some speculation that the timeframe for deferring capital gains via Qualified Opportunity Funds is extended out past 2026. This could make investments in these funds an even more valid option as a 1031 backup plan.

Delaware Trusts

Instead of acquiring property directly, investors in the middle of a like-kind exchange can pour their funds into what are known as Delaware Statutory Trusts (DSTs).

With a DST, investors purchase fractional shares of an investment vehicle which itself owns one or more investment properties — in many cases higher quality, more expensive buildings than the individual investors may have been able to individually acquire.

This model is more passive, and there may be better solutions for experienced real estate investors.

Editor’s closing thoughts

1031 exchanges have become mission-critical for professional real estate investors. They reduce your tax burden, maximize your returns, and allow you to continually “trade up” forever.

But one of the most surprising things I’ve learned about 1031s is how common they’re becoming for ordinary investors.

Interestingly, researchers found that between 2010 and June 2020, the median sale price of 1031-exchanged properties was just $575,000! This indicates that smaller investors may be starting to use the strategy. Word is getting out.

Yes, it’s true that successfully executing an exchange requires the right team of professionals, a fair amount of organization, and a few thousand bucks in fees. But so what? This seems like a small price to pay given the tax benefits. Unless I’m missing something major, it seems like if you’re buying an investment property, there’s really no big reason not to use them.

From a societal standpoint, I think 1031s will continue to be on the political chopping block. This law probably wasn’t so controversial back when real estate prices were “normal.” But when you have 200% price growth over 30 years, it’s hard to see how 1031s lead to a “more efficient use of capital.”

To me, this all feels like a gigantic loophole in US tax policy. And given the housing crisis, I feel it’s a loophole that might be on borrowed time.

But trying to forecast what will happen in the future is unlikely to prove useful for investors. In the meantime, the law is the law. You can complain about it, or you can take advantage of it while it still exists.

The choice is yours. 🏠

Further reading

- Want to speak with a QI? The Federation of Exchange Accomodators has a good directory of service providers.

- For a deeper discussion of how Qualified Individuals fit within a 1031 exchange, check out this article from the CPA Journal

- Yes, the Trump administration killed 1031 exchanges for artwork. But it also handed art investors a new tax break.

- Maybe the 1031 goes away someday, maybe it doesn’t. But there are plenty of other unfair tax laws around the world. Take California’s Prop 13 for example. Yeah, that’s probably never going away.

- Here in Australia we have an very controversial real estate tax law called negative gearing. We’ll do an issue on this someday.

Disclosures

- This issue was sponsored by BV Capital.

- Our ALTS 1 Fund holds no interest in any companies mentioned in this issue

- I have never personally partaken in a 1031 exchange. I’ve lived in both properties that I own, so I don’t qualify.

- Alts is a non-paid partner of ModeMobile

- This issue contains no affiliate links