Welcome to Sports Memorabilia Insider for February 24th, 2022 – FREE edition.

Each week we give you the scoop on undervalued, mispriced and hidden gems in Alternative Investing.

Table of Contents

If you like our emails, try the podcast

Horacio sat down with Amir Carlisle, Co-founder and CEO of The Players Company – a modern financial collective for athletes, by athletes. Amir talks about the vision of The Players Company, his football career, the perils of athletes and money, and a desire to help bridge the racial wealth gap.

Sports Memorabilia in 2022

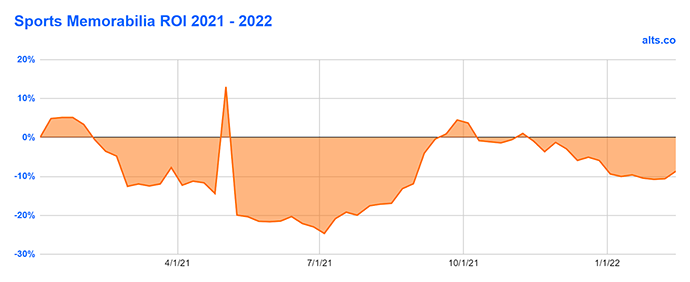

Finally! The sports memorabilia index appeared to wake up from its multi-week slumber as it drifted upwards 1% last week. Time will tell if this is the long-awaited breakout or just a temporary blip.

The index remains down 3% YTD, but up 16% from the depths reached back in July 2021.

Last Week

Fractional Secondary Markets

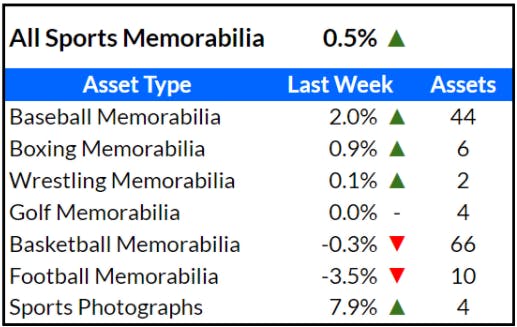

All sports memorabilia assets were up slightly more than a half percent for the week. The two titans of the index moved in opposite directions – baseball was up 2% for the week, while basketball was slightly in the red with a .3% loss.

Vintage game-used baseball memorabilia continued a strong two-week run as the Rally 1962 Mickey Mantle World Series Signed bat gained 96.1%, and the Rally 1951 Joe DiMaggio game-worn jersey was up 89.6%.

Game-worn sneakers on Rally led the decliners as both the 1988 game-worn Air Jordans III’s dropped 45% and the Zion Williamson game-worn sneakers, perhaps influenced by rumors of further setbacks in his rehab, fell 40%.

Buyouts

The Collectable George Mikan 1948 Bowman RC Original Photo received a buyout offer of $85,000 ($13/share), representing a 30% return over IPO and 19.27% return over last traded price; updating inferred value to $85,000.

This Week and Next

Fractional Market IPOs

Rally and Collectable each present an IPO this week.

1984 Michael Jordan Debut Ticket Stub (PSA 5)

- Market Cap: $160,000

- Retained Equity: $0

- Inferred Value: $140,000

- Drop: 2/24/2022 on Rally

- Our view: [INSIDERS ONLY]

2016 Kobe Bryant Game-Worn & Photo-Matched ‘Black History Month’ Sneakers

- Market Cap: $72,000

- Retained Equity: $0

- Inferred Value: $30,000

- Drop: 2/23/2022 on Rally (Early Access)

- Our view: [INSIDERS ONLY]

Secondary Markets

Rally debuts four memorabilia assets for live trading this week.

Note: Market cap data correct as of 2/22

1980 Muhammad Ali Sparring Gloves (Inscribed to Stallone)

- Platform: Rally

- Market Cap: $35,000

- Inferred Value: $20,000 (updating inferred value to reflect recent comps)

1962 Wilt Chamberlain 100 Point Game Ticket (PSA 3)

- Platform: Rally

- Market Cap: $80,500

- Inferred Value: $121,000

Zion Williamson Game-Worn Sneakers

- Platform: Rally

- Market Cap: $25,075

- Inferred Value: $13,000

1988 Michael Jordan Game-Worn/Dual Signed Sneakers

- Platform: Rally

- Market Cap: $40,000

- Inferred Value: $18,000

Auctions

The Heritage Winter Platinum Sports Auction, which wraps this upcoming weekend, has some sports memorabilia pieces relevant to fractional investors:

- 1996 Greater Milwaukee Open Full Ticket – Tiger Woods Professional Debut (PSA 9) – Currently at $55,200; Collectable will be IPO’ing the same ticket in a PSA 8 at a future date.

- 1948 “The Babe Bows Out” Photo – PSA/DNA Type 1 – Currently at $26,400; this is an oversize version of the photo measuring 14” x 9.5” so it should sell at a premium to the Collectable offering, which measures 8” x 10” with a market cap of $49,500.

- 1968 Mickey Mantle’s Last New York Yankees Game-Worn Jersey, Mears A10 – Signed and Photo Matched – Currently at $720,720; Rally has a 1960 Mantle game worn/signed jersey from 8 years earlier and same grade, but not photo matched currently trading at $514,250

- 1986 Michael Jordan Game-Worn and Signed Nike Air Jordan 1 Sneakers – Photo Matched – Currently at $420,000; Rally has a similar asset from one year earlier that lacks signature or photo-matching currently trading at $152,000.

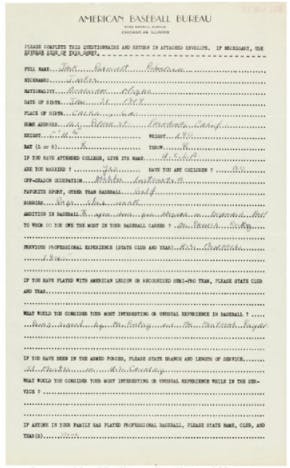

- 1946 American Baseball Bureau Questionnaire Filled Out and Signed by Jackie Robinson – Currently at $1,680,000; not fractional-market relevant, but this is a museum-worthy piece that will probably only come on the market once or twice in a lifetime. Here’s hoping that whoever wins this allows the public to view this somehow.