We’re slowly entering the spending revolution of crypto, when people get the tools and means to use crypto for everyday purchases, such as buying real estate.

During the pandemic, crypto was one of the things that got popular in the online sphere. People were constantly speculating on random coins and NFTs.

As people accumulate coins, the industry slowly enters the phase of spending. What do I mean by this? Simple. You want to be able to spend your coins on things that you really need, for example, an iPhone 2000.

Today, this is not possible.

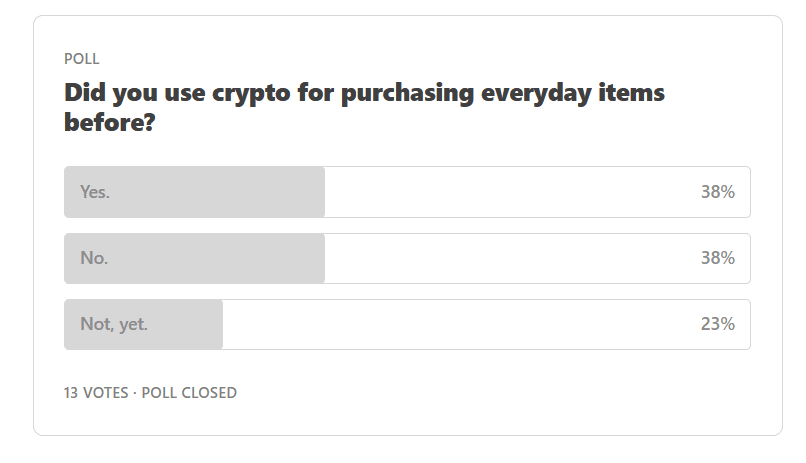

Did you use crypto for purchasing everyday items before?

Crypto users still need to convert their bitcoins back to euros to be able to spend them. There’re fees, waiting times and good old international bank transfers.

Below, I listed 3 ways to buy a house with crypto today.

1. Crypto transfer

If you are planning to buy a house with Crypto, all you have to do is to find a seller, who accepts digital currencies. Make a deal, sign all the required documents and send the right amount to the seller’s crypto wallet address.

It’s advised that you use escrow companies to ensure all the ownership documents are legit and in your hands to avoid scams and fraud.

2. Crypto-to-Fiat transfer

Fiat money is a government-issued currency like Euros. If you only have Bitcoin and desire a house, but the seller does not accept digital currencies, you must sell your Crypto.

There are many platforms where you can exchange Fiat currency. In the end, you will pay with Fiat, the traditional way.

3. Using Proptee

Proptee uses Non-Fungible Tokens and blockchain technology to make real estate investing truly global and effortless. By issuing or minting 100,000 tokens for each property, we can sell fractions of properties to many investors at once.

You have the ability to deposit crypto to Proptee (USDC today) and use it to quickly purchase real estate fractions with a tap of a button. Once these tokens are purchased, owners can sell them to anyone at any time. Creating a fully functional secondary market.

This way, real estate investing becomes available for everyone, liquid and borderless. Investing in multiple countries from the comfort of your home is not a dream anymore, it’s a reality.