New here?

The WC is a selection of five useful and interesting handpicked by CIO Wyatt Cavalier and dropped into your inbox every Wednesday.

Like these posts? Please forward us to your smartest, most interesting friends.

Wyatt

Table of Contents

F*cked up auction items

A couple weeks ago I found this abomination at auction.

I wish there were a market for a newsletter focussing exclusively on fucked items available for auction because I can’t imagine a better use of my time. pic.twitter.com/dJ23USMg6W

— Wyatt Cavalier (@itiswyatt) April 25, 2023

Some psychopath paid $450 for it in the end, and I daren’t think what he (come on, you know it’s a he) has done with it.

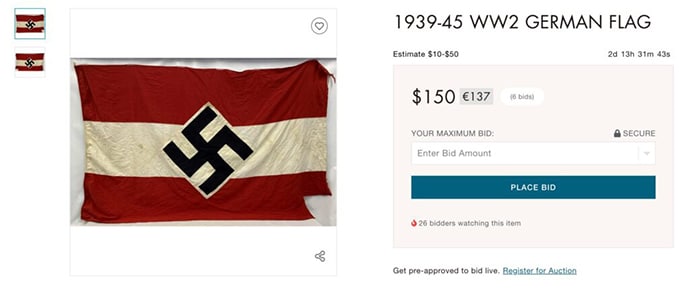

And this kind of stuff comes up all the time. Look, here’s a giant (88 inches!) Nazi flag.

There are 22 people watching the item, and there have been six bids.

Along with that, I found 39 other pieces of Nazi paraphernalia, available at auction today. That’s just right now. Multiply that by 50 and you get a sense of the total market for this garbage.

Not into white supremacy? What about alligators? Specifically, alligator heads?

Maybe you can make a hat out of it.

Anyway, if you want a monthly feed of fucked up stuff available at auction, let me know.

Dig deeper into weird/awful stuff you can buy at auction:

- These are the 6 craziest things ever sold at auction.

- The Market for Disturbing Nazi Artifacts Is Growing. Who Is Buying Them—and Why?

Chick-fil-A is a juggernaut

You may be surprised to learn that Chick-fil-A, the homey chicken sandwich fast food chain based in Georgia, is an insanely successful company.

Its nearly 2,000 standalone locations pull down a median of $8.6m per year each. That’s twice what McDonalds restaurants make and over 5x what a typical Burger King generates. The worst performing Chick-fil-A restaurant still makes more than an average Wendy’s.

Part of the success is down to expanding slowly and carefully. Their “intensive and lengthy selection process” ensures only top-class operators take the helm of one of their 100 new restaurants per year. Just .003% of franchise applicants are accepted to the programme.

But that slow growth may be about to change: The company plans to spend $1 billion expanding into Europe and Asia by 2030. Impressive stuff.

Saying all that, I’d be remiss if I didn’t note the downside of the Chick-fil-A moneymaking machine:

Its leadership has very specific and problematic views about gay rights, among a raft of other outdated ideas.

Dig deeper into Chick-fil-A:

Streaming killed the DVD star

Netflix finally killed its DVD business.

If you’ve been around long enough, DVDs by mail were your onramp onto the streaming service, so it was a bit nostalgically sad to hear this — like learning there’s only one Blockbuster store left.

And I thought that was it — a loveable but outdated business dies.

But then I saw that DVDs by mail were still 1.5% of Netflix’s revenue in 2019. So 1.5% of $31 billion.

That’s a $500m business they axed. Which seems crazy.

There’s value here — like, billions of dollars at fair market value.

Redbox tried to buy it, but Netflix said no, leaving a lot of money on the table.

I get not wanting to sell to a competitor.

But surely they could put some underperforming exec in charge of the division and let it cashflow off for another decade, subsidising the creation of more content, acquiring more subscribers, or paying for Reed Hastings’s wacky projects.

Byrne Hobart at the Diff thought the same thing, and he looked into it.

This is the theory:

- Netflix killed the division at the alongside two other initiatives:

- Cracking down on subscriptions / password sharing

- Introducing an ads-backed product

- Netflix execs did the math, and figured they can convert enough of those physical DVD customers into streaming ones, so it’s more profitable to kill off the entire channel.

It’s a big bet.

Dig deeper into Netflix:

- Netflix’s billionaire founder is secretly building a luxury retreat for teachers in rural Colorado

- Redbox Owner Interested in Buying Netflix’s DVD Business

4. The lesser-known resource curse

There’s a phenomenon, usually in developing countries, where nations that suddenly discover a vast store of natural resource should see loads of positive benefits from the windfall but don’t.

It’s called the resource curse.

The typical / dogmatic explanation is similar to what happens when someone wins the lottery. They blow it all on stupid stuff and end up worse off than when they started, because they lacked the fundamental and foundational ability to manage the new resource properly.

Developing countries lack institutional discipline to spend wisely, so much of the profit ends up in off-shore bank accounts owned by the country’s ruling elite.

There’s a more nuanced (at least partial) explanation that I’d not heard of before, and perhaps you haven’t either. It’s called Dutch Disease, and it goes something like this:

- Picture a country with a strong export-based manufacturing centre like Norway used to have. Perhaps they make great tractors that are exported worldwide. It costs $10k to buy enough Norwegian kroner to purchase a Norwegian tractor.

- But suddenly a treasure trove of resources is discovered – perhaps a gazillion barrels of oil in the North Sea, and its value eclipses the original source of income.

- That new resource is exported widely, which inflates the value of the country’s currency. The Norwegian kroner is now worth 20% more than it used to be.

- So now that same Norwegian tractor costs $12,000 instead of $10,000. I can buy a comparable Swedish tractor for $11,000, so I buy from there instead. Or, instead of ordering 20 tractors, I can only afford 15 this year.

Either way, bummer for the tractor industry — and any other Norwegian industry that exports goods.

Some of the companies in those industries go under, others downsize, tax revenue decreases, and many of the workers need new jobs, etc.

Some countries manage this well. Norway’s funnelled all this resource money into its sovereign wealth fund, which now has $1.2 trillion dollars in it.

But loads of countries, including the Philippines and Venezuela, get crushed by the curse.

Dig deeper into nationwide natural resources:

- Chile plans to nationalize its vast lithium industry

- Is the resource curse hard-baked into African economies? China’s approach hints that it may not be.

5. The American rollercoaster

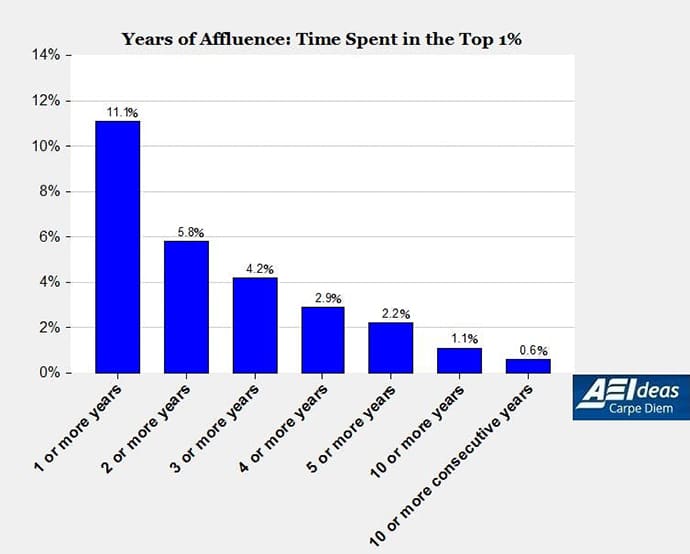

A nine-year old opinion piece from the New York Times is making the rounds this week, and the data is surprising.

At some point between the ages of 25 and 60:

- 73% of Americans will find themselves in the top 20 percent of the income distribution

- 56% will enter the top 10%

- 39% will enter top 5%

- 12% will enter in the top 1%

That’s an extraordinary amount of movement, both up and down, over a lifetime. To bring it home a bit:

- Nearly three out of four Americans will be in the top quintile at some point

- Two in five will earn enough that they probably consider themselves wealthy

- One in eight will be in the 1%

Two immediate takeaways here, and one question. First the question:

How does this stack up against other developed countries?

I have to think it’s way more fluid in the US than it is elsewhere.

Observation one:

This must be insanely stressful. You don’t know from year to year how much you’ll earn, where you’ll stand relative to your neighbours, or when the bottom might fall out. Because eleven out of every twelve one-percenters ain’t there now.

Observation two:

This may contribute significantly to why Americans — even poor Americans — are happy to push for tax cuts for the wealthy and why they revere successful people so much. They have a legitimate reason to think they are (or will be soon) a wealthy and successful person.

Dig deeper into American exceptionalism:

That’s all for this week, hope you enjoyed it.

And if you did, be a friend and spread the word. We appreciate it 😘

Cheers, Wyatt

Disclosures

- This issue was sponsored by our very clever knowledgable friends at Cult Wines and beatBread.

- We’re in talks with Cult Wines to see about allocating them in our ALTS 1 fund.

- I have never been to a Chick-fil-A. True story.