Welcome to Inverse Cramer by Alts.co: Tracking Jim Cramer’s stock picks so you can do the opposite

You are subscribed to receive Weekly updates.

We are now doing Daily updates too. You can add Daily updates here.

Quick links:

Man, Jim has gotta stop talking about the banks…

First SVB, then First Republic, then First Horizon, and now Western Alliance. It’s just a never-ending stream of wrong calls.

Ah well. Gives us something to talk about.

Keep ’em coming

Table of Contents

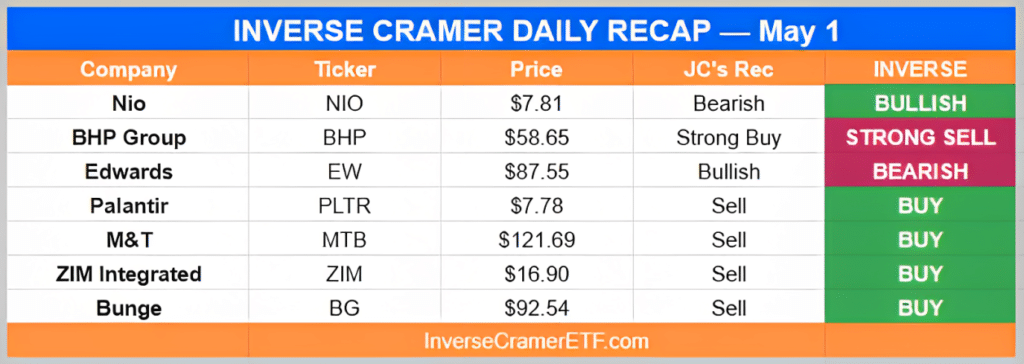

Monday May 1

I like them here with China coming back with 6% yields. Been one of my faves. I think you absolutely need to put on a position.

– On BHP Group ($BHP)

They’ve really been suffering from this whole run from other banks that aren’t nearly as good as them. The 4% yield in the stock here at $120 is ‘a good stock’. I don’t want to pound a table on any bank, as I don’t like the regional banks that much.

– On M&T Bank ($MTB)

Sigh pic.twitter.com/dmojk9C093

— Inverse Cramer (Not Jim Cramer) (@CramerTracker) April 30, 2023

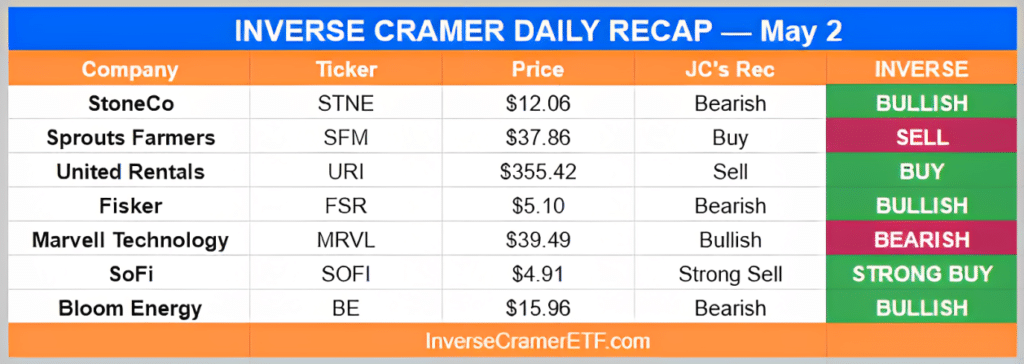

Tuesday May 2

I think you let it run. And you are right 1st quarter was excellent. I was quite surprised. A lot of people were surprised. I would stay on that.

– On Sprouts Farmers ($SFM)

In the end it turned out that SoFi is not gonna be any different from other regional bank even though it’s kind of an online bank. Its trading to that cohort, and that cohort is absolutely nauseating.

– On SoFi Technologies ($SOFI)

Wow pic.twitter.com/YZw8nqtVY4

— Inverse Cramer (Not Jim Cramer) (@CramerTracker) May 2, 2023

Whelp, you know what to do.

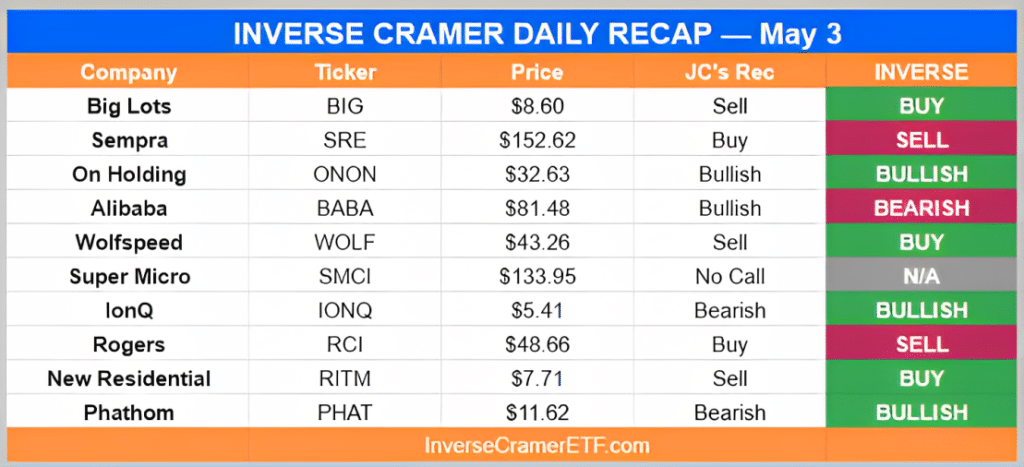

Wednesday May 3

I like it. I think you should buy some now. If it drops to 4%, buy some later. If I want to buy 100 shares, I’ll buy 50 now and 50 later if it cracks to 4%.

-On Sempra ($SRE)

I think this is one of the most exciting new companies I’ve seen for a very long time. We’ve got a bad market with hurdles to go through before I’ll pull the trigger on it. But that is a great one and I like it.

-On On Holding ($ONON)

I’m not a big fan of the Chinese stock as you may know. But if I have to own one it’s them.

-On Alibaba ($BABA)

Last week Jim said: “The collapse of First Republic bank could mark the end of the banking crisis”

— Inverse Cramer (Not Jim Cramer) (@CramerTracker) May 4, 2023

Currently: pic.twitter.com/S9I0dPPKEI

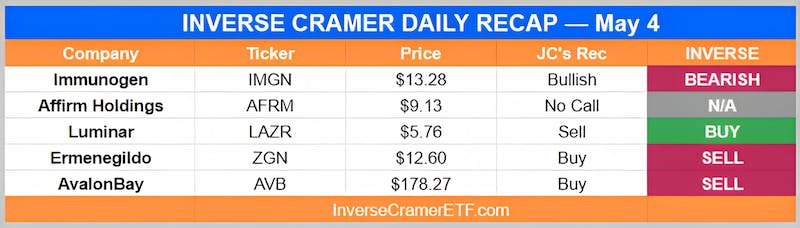

Thursday May 4

Ermenegildo is sure to be a benchmark of designer’s men’s wear. I’m wearing it now. The stock is going higher. It is undervalued in 12. I’m surprised it’s there. We’re gonna do a piece on that.

– On Ermenegildo ($ZGN)

I think AvalonBay has a tremendous shortage of product, and they know how to do it. I think it’s a buy.

-On Avalon Bay ($AVB)

3/1 9:38 AM on Squawk on the Street Jim said about $FHN "The bank is still being extremely run well, I say the stock should be $20." He may have mean down 20% pic.twitter.com/fv4csqXRJe

— Matthew Tuttle (@TuttleCapital) May 4, 2023

Friday May 5

Very very expensive and hasn’t pivoted yet. Still losing money. It’s not my cup of tea.

– On Samsara ($IOT)

I like the devices very much. I’m gonna try it this weekend.

– On InMode ($INMD)

If the FDIC does not offer "emergency": insurance of up to $1 million for banks that do not have credit risk then this all ends. It is quite simple. it is a travesty to let an index etf destroy the fabric of American banking…

— Jim Cramer (@jimcramer) May 4, 2023

Cramer Classics

Jim is undefeated in the banking sector pic.twitter.com/r9ThgckX7B

— Not Jim Cramer (@cramercoin) May 6, 2023

They look so pretty next to each other

Weekend Bonus

Burry has reactivated his Twitter. This is a big deal because he’s predicted 18 of the last 2 recessions pic.twitter.com/R8d00bQ6av

— Inverse Cramer (Not Jim Cramer) (@CramerTracker) May 5, 2023

That’s a wrap. As always, we’ll be following Cramer’s every move so you can do the opposite.

Enjoy the week ahead.

-IC

Disclosures

- This issue was sponsored by Tuttle Capital and OneFul Health

- I am long $NIO

- We have no ALTS 1 investments in any companies mentioned in this issue