Last month, Zillow announced it will start offering mortgage loans with down payments as low as 1%.

Immediately after, commentators rushed to chime in, proclaiming, “Here we go again!” and “This won’t end well!”

But I wanted to find out the real story here. How does this program actually work? How does it fit in with Zillow’s existing business model? And is it really that risky?

To find out, I asked Aziz Sunderji, who writes one of my favorite real estate newsletters, Home Economics.

In this issue, Aziz breaks down Zillow’s strategy in detail.

Turns out, it is a risky move, but not in the way you might think.

Let’s explore 👇

Table of Contents

How Zillow’s new loan works

Okay, first things first.

Zillow’s program is being piloted to qualified buyers only — those with a FICO score above 620, who earn less than 80% of their region’s median income. It’s being rolled out in Arizona to start.

In Zillow’s words, this is an effort to help these borrowers climb onto the property ladder earlier than they would otherwise be able to.

Zillow looks at a hypothetical client of the 1% program:

- A renter in Phoenix

- Who earns 80% of the area’s median income

- Who saves 5% of their pay

- Who is looking to buy a $275k home

This client would only need to save for 11 months under their program, vs 31 months if a 3% downpayment was required.

Not a bad deal for borrowers…

Usually, taking higher leverage on a loan entails paying a higher interest rate. But in this case, Zillow is offering the 1% downpayment loans at the same interest rates as its other products.

Although some worry this puts borrowers into an inappropriately risky product by giving them an unsustainably large loan, this isn’t necessarily the case.

Yes, a smaller down payment requirement allows a borrower to get a larger loan with the same amount of cash. But Zillow limits how much clients can borrow by requiring that they spend no more than half of their gross monthly income on debt (this is known as a debt-to-income ratio, or DTI of 50%).

Zillow’s perfect client (the household earning 80% of Phoenix-area income) can’t borrow more than $300,000 without breaching Zillow’s DTI cap.

And while financing a big asset with a small amount of equity causes the investor’s financial position to swing more aggressively, it’s worth remembering that one of the wonderful things about mortgages (from the borrower’s perspective) is that they offer staggering amounts of leverage without margin calls.

So a bigger loan, even if it introduces more day-to-day volatility in a borrower’s financial position, is not necessarily a problem.

That is, from the borrower’s perspective.

…but it’s risky for lenders

From the lender’s perspective, these products are certainly more risky.

Not least because the likelihood of the borrower falling “underwater” (owing more on the mortgage than the value of the home) increases with leverage, and raises the possibility of a borrower screwing over the bank by just walking away.

Today, research shows that, in terms of default risk, every 20% increase in the loan-to-value is equivalent to a 100-point reduction in FICO score.

It’s worth keeping in mind that Zillow is not exactly skimming the cream of the crop in terms of creditworthiness here—indeed, part of the mission is to extend loans to those who don’t have enough saved up to make even a 3% down payment (again, for Zillow’s illustrative client in Phoenix, this is only $9k).

Now, Zillow does require a FICO score of 620. But that’s a pretty low score!

The median FICO at origination is currently 769, and the riskiest 10% of borrowers have a score of 654. So only 3% of mortgages are below 620 to begin with.

To be fair, many of Zillow’s potential borrowers may have higher scores than 620, but not that many. Zillow caps the 1% down payment program at those who earn more than 80% of their local area median income.

This all desperately begs the question: Why is Zillow doing this right now? Amidst a generational downturn in the housing market, why is Zillow doubling down on mortgages with such a risky product?

Pump up the volume

One motivation is likely PR.

While lower-income and first-time borrowers struggle to get onto the property ladder, Zillow can be seen as the good guys. They’re helping, not hurting.

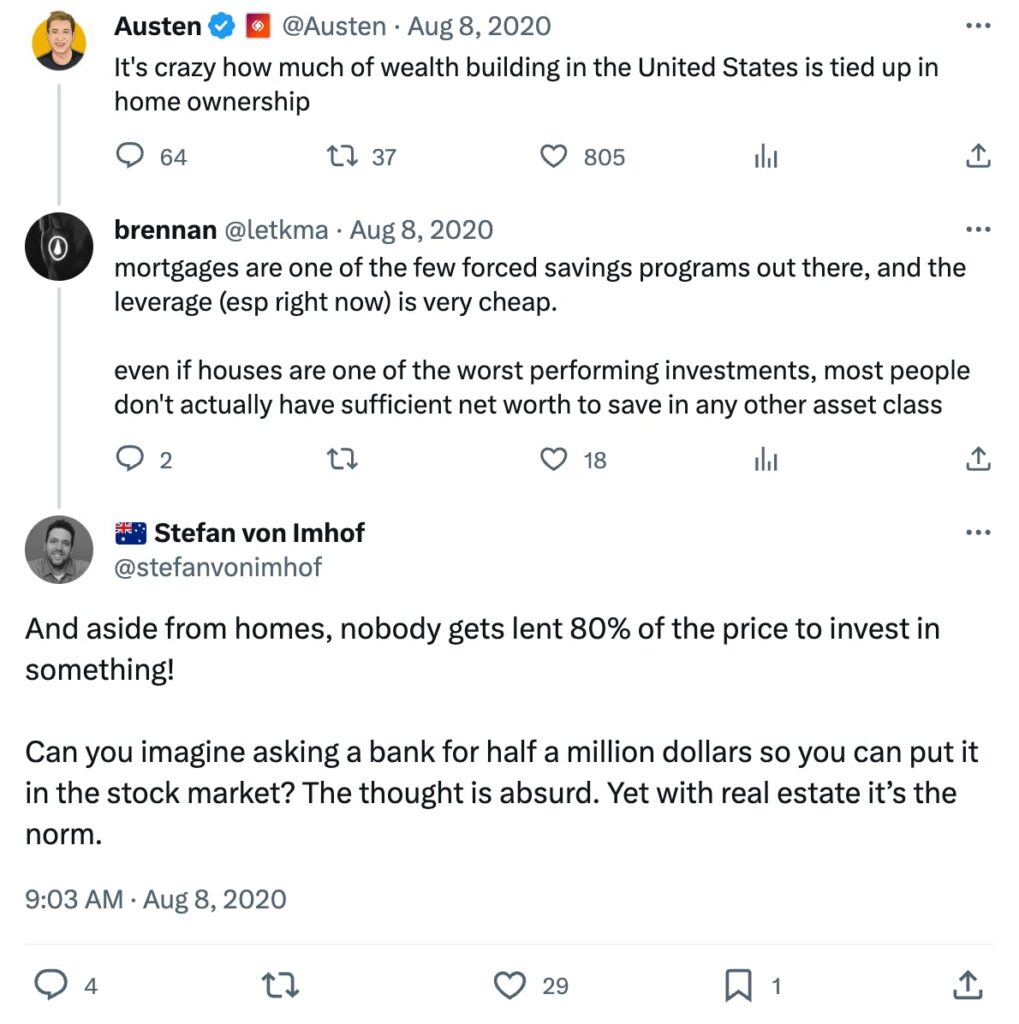

Just watch this interview with Zillow’s chief economist, who provides a masterclass in ignoring the reasonable but inconvenient question: will Zillow experience defaults when borrowers have such little skin in the game?

Instead, he focuses on his talking point: Zillow is helping people get onto the property ladder.

But the main reason Zillow is offering 1% down payment mortgages may be the simplest: the mortgage business is in the dumps.

Applications have fallen to the lowest level since the mid 90s, and Zillow hopes that 1% down mortgages are a shot in the arm for loan volumes.

To be clear, mortgages are only one part of Zillow’s business. They accounted for $24m in revenue in Q2 2023. That’s much smaller than the residential business ($380m) where Zillow sells leads to real estate agents, and provides them with marketing and customer relationship management tools.

Still, mortgages remain a big swing factor in Zillow’s financials; an area that management is trying to grow.

Benjamin Keys, a real estate finance professor at Wharton writes:

Zillow is fundamentally a volume-based business, so they’re looking for solutions to increase some of that volume. I think of this down payment program as one potential direction for them to innovate. – Benjamin Keys

How risky are 3% 1% loans?

But what Zillow is offering here may not be as innovative, or as risky, as it first seems.

The product is still a “conventional” 3% down payment mortgage. It’s just that Zillow is covering 2% of it in the form of a grant to the borrower.

And Zillow is hardly the first mover here. It flew under the rader, but competitors like United Wholesale Mortgage and Rocket Mortgage both started offering 1% downpayment mortgages earlier this year.

1% down payments are closer to the norm than many realize.

Although most people consider a 20% downpayment the standard, 64% of first-time buyers put down less than that. And fully one-quarter put down <5%.

So, this 1% downpayment offering is probably less of a source of risk than a sideshow. It’s too small to be meaningful in the US mortgage landscape. In fact, it’s too small to be very meaningful, even within the context of Zillow’s mortgage business.

Instead, the more important risks for Zillow stem from the far larger sum of mortgages with more typical down payments within its overall mortgage operation.

In that business, it now faces two much more important risks.

The “Tinder of mortgage finance”

Zillow’s mortgage operation exposes it to serious liquidity risks.

See, today Zillow is not really a mortgage lender. It’s a mortgage originator and distributor. The company simply links lenders (mostly pension funds and insurance companies that invest in mortgage-backed securities) with borrowers.

That’s it. It’s like the Tinder of mortgage finance.

In Zillow’s own words:

We sell substantially all of the mortgages we originate and the related servicing rights to third-party purchasers

Here’s how it works in practice.

- First, Zillow buys mortgage “warehouse credit lines” from banks. Think of this like short-term borrowing that provides the funding for Zillow to offer mortgage loans.

- Next, Zillow enters into very short-term repurchase agreements (“repos”) with these lenders — temporarily swapping mortgages as collateral for cash.

- As soon as they can, Zillow sells the mortgages to Fannie Mae or Freddie Mac (government-sponsored enterprises), or bundles them into a mortgage-backed security

So basically, they’re only hanging onto these mortgages for a short period.

And when they sell, they do so at a price above their cost of originating the loan. Sale proceeds are used to unwind the repo agreement in Step 2, and repay the warehouse lines of credit providers in Step 2.

Zillow pockets the difference and moves on to the next loan. Rinse, repeat. Easy money.

The amount of time the mortgages remain on Zillow’s books (“dwell time”) isn’t clear, but the Mortgage Bankers Association suggests typical dwell times are “a few days to weeks”, with an average of 15 days.

The bottom line is this:

- Borrowers get long-term home loans (Yay! New homeowners on the housing ladder!)

- Investors get long-term investments

- The middlemen providing the bridge financing (i.e., Zillow, and the banks who provide Zillow with those warehouse lines of credit) make a bit of money from the bid/offer spread between the two.

In a nutshell, Zillow is greasing the wheels of American housing without taking credit risk!

Zillow’s chief economist refuses to answer the question about default risk because it’s not a great look to go on national TV and say, “Look everyone, we’re not the ones holding the risk here. We’re just flipping these things to another investor as fast as we can!”

Focusing on the quality of the assets elides Zillow’s real risk, which resides in the stability of its own funding.

Problem 1) Can Zillow hold the reservation?

We all know that banks who give loans to people with bad credit get screwed. Their assets fall below the value of their liabilities, and they ultimately become insolvent.

But in most cases, the actual nail in the coffin comes from those who lend to the bank taking flight.

To pick just one recent example: Silicon Valley Bank had highly questionable assets on its balance sheet, but it was depositors fleeing en masse that brought about the bank’s demise.

It’s no different for “nonbank” mortgage originators like Zillow — except their funding sources are not everyday depositors, like what brought down Silicon Valley Bank, but the warehouse lenders above them.

The most notorious “bad lender” of the Great Financial Crisis, Countrywide Financial, made exorbitantly big loans to wildly unqualified buyers. But the company was ultimately brought to its knees by its warehouse lender, Bank of New York, who made margin calls.

The FDIC’s take is worth quoting at length here:

The new post-crisis generation of nonbanks seem vulnerable to liquidity pressures similar to those…during the financial crisis. Nonbanks depend on short-term credit, particularly warehouse lines of credit provided by banks. This funding can become more expensive and less accessible when financial market conditions tighten, and this tightening alone can cause the nonbank to go out of business. In times of stress, warehouse lenders face strong incentives to cancel lines of credit and seize collateral as quickly as possible.

To paraphrase Jerry Seinfeld: anyone can make the loans — it’s your ability to hold the loans that actually matters!

And Zillow’s ability to hold onto risky mortgages — even temporarily — is subject to the whims of the market. In fact, Zillow even identified this as a key risk in their 10-K:

These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including…our ability to operate and grow Zillow Home Loans, our mortgage origination business, including the ability to obtain or maintain sufficient financing and resell originated mortgages on the secondary market.”

Zillow can happily originate mortgages while markets are well-functioning. Everything will go swimmingly until asset prices start to fall, lenders make margin calls, and Zillow is forced to liquidate mortgages at fire sale prices to meet those calls.

Again, from Zillow’s 10k:

The master repurchase agreements contain margin call provisions that provide the Lenders with certain rights in the event of a decline in the market value of the assets purchased under the master repurchase agreements.

Basically, liquidity could blow up in Zillow’s face one day.

It might not, of course. Or if it does, the hope is that it takes such a long time to happen, that by the time liquidity does become an issue, the company’s balance sheet is sufficiently “fortress-like” to survive.

In the meantime though, Zillow’s foray into mortgages is steadily coming into conflict with its entire reason for existence: aggregating the transactions between real estate market participants.

And herein lies the second risk posed by Zillow’s mortgage business.

Problem 2: Zillow can’t have its cake and eat it too

Zillow is now doing a lot of things, but as I mentioned above, it’s fundamentally an aggregator; it brings buyers and sellers together in one spot, coasting off network effects, a monopoly on buyer attention, and in theory, returns to scale.

The problem is that most of Zillow’s revenue sources are not infinitely scalable.

For instance, take their original primary source of revenue, and one that still accounts for a large share: advertising. Zillow places ads for vendors on its listing pages.

But listings are limited (especially these days), and Zillow can’t really expand its advertising without degrading the user experience.

More importantly, Zillow makes far more revenue from selling leads to its “Premier Agents.” But here, too, we might wonder about its scalability.

Consider how this business works for a minute:

- Agents pay Zillow for leads

- The more they pay, the more leads they get

- But it’s a competitive auction: when more agents are bidding for leads, the price goes up

So unless Zillow can indefinitely expand its supply of leads (and there is no reason to think it can) at some point, the cost per lead bumps up against reality: there is only so much money that agents are willing to pay for a lead.

Between a rock and a hard place

Zillow is subject to the demands of being a publicly traded company. It needs to grow. This helps explain the foray into mortgages.

But expanding mortgages risks bringing it into conflict with its clients, who also do that business.

One last line from Zillow’s 10-K:

Our recent entry into the mortgage lending business may also cause a negative reaction within the mortgage industry, including among some of our mortgage advertisers which could harm our reputation, results of operations and financial condition.

This is a lot like their mistake with Zillow Offers (Zillow’s iBuying business). As Ben Thomson writes:

Zillow Offers was the exact same category of mistake: the company sacrificed its horizontal position in the pursuit of vertical integration, ultimately making itself into a worse Aggregator. – Ben Thomson, Stratechery

Moreover, it’s not clear Zillow has any real advantage in the mortgage business. Just like it lost out in iBuying to OpenDoor (a company that specializes in flipping) Zillow is a minnow compared to competitors like Rocket Mortgage.

As Mike DelPrete points out, in order to make meaningful inroads in the mortgage business, Zillow will have to expand its Premier Agent program, and attach mortgages at a higher rate than they have been thus far.

This will be a challenge. And at the very least, it’s expensive. Heck, Zillow’s mortgage business posted a $167m loss in 2022, and has generated a cumulative loss of $283m since 2017.

Editor’s closing thoughts

Despite what many say, Zillow’s new 1% down payment business isn’t that big of a risk for the company.

Remember, Zillow isn’t the lender here. 3% loans (that become 1% loans) aren’t particularly risky. And even if they were, Zillow is doing them on too small a scale to move the needle on the company’s risk profile.

The bigger risks for Zillow are that a) they get hit with a sudden liquidity crunch and get stuck holding the bag, and b) that they get so addicted to feeding investors’ appetite for growth that they end up cannibalizing their other, more important lines of business. That could bite them in the long run.

But this doesn’t seem like anything close to the 2007 housing bubble. These aren’t NINJA loans. It’s more like a publicity stunt.

This all feels like picking up pennies in front of a steamroller. It seems like there would be better opportunities for growth in a down market.

Still, this opportunity is staring them in the face, and their competitors are already offering the same thing. It’s easy to see how Zillow leadership could be lured by easy short-term revenue.

Plus, it does help first-time homebuyers with lower income and decent credit, who need help getting into the market.

Anything to get more Americans into homes, right? 🏡

Further reading

- Zillow shut down its high-profile home-flipping business in 2021, saying its technology was insufficient to support it. (This is the same tech that powers the Zestimate. So yeah, take that number with a grain of salt.)

- 64% of first-time home buyers are now putting down less than 20% as a down payment

- It’s easy to forget that the US is the only country where 30-year fixed-rate mortgages are standard. But do they make the overall economy less dynamic?

- Meanwhile, homeowners struggling to pay their FHA loans have a new option: 40-year mortgages are here. (Going from a 15 to a 30 year mortgage boosts buying power by ~39%. But going from 30 to 40 increases it by just ~8%)

- One of my favorite issues Aziz wrote is Why Denmark’s housing market works better (TL;DR — Danes can buy back their loans, making them portable)

Disclosures

- This issue was sponsored by CalTier.

- Neither we at Alts nor the author have any significant relationship to Zillow Group, Inc.

- Our ALTS 1 Fund holds no interest in any companies mentioned in this issue

- This issue contains no affiliate links