Hi everyone,

Alright, I’m really excited about this one. Today, we’re diving into Kalshi — the first and only prediction market platform to have CFTC approval.

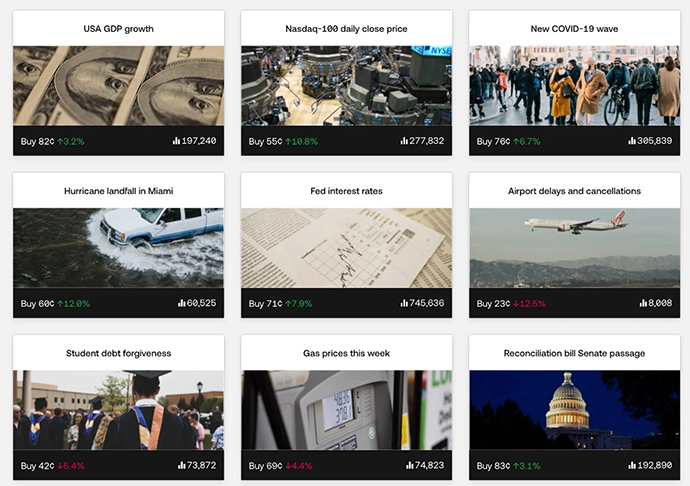

Kalshi offers all US investors a new way to purchase futures, by letting them invest in what are called event contracts. Finally, you can make money off your predictions.

Earlier this year, we invited Kalshi’s co-founders Tarek & Luana to our podcast:

Table of Contents

Quick Summary

- Type: Trading on outcomes of world events (future contracts)

- Requirements: None (open to non-accredited investors) 🙌

- Location: US-only (international waitlist)

- Minimum investment: $0.01

- Average return: Varies, up to 100x

What are prediction markets?

Simply put, prediction markets are a sophisticated form of betting. Investors take a position on the outcome of a future event.

When we hear “betting,” we likely think about sports (especially horse racing) or casino games. But prediction markets are a whole new ball game.

Unlike other investments, prediction markets are binary — either the prediction comes true, or it doesn’t. There’s no middle ground. You can buy futures betting on the amount of rainfall a city gets, if a bill will pass Congress and become law, or how soon humans will walk on the moon again.

Why prediction markets?

So, why bother with a prediction market over the stock market, or any other legal betting exchange?

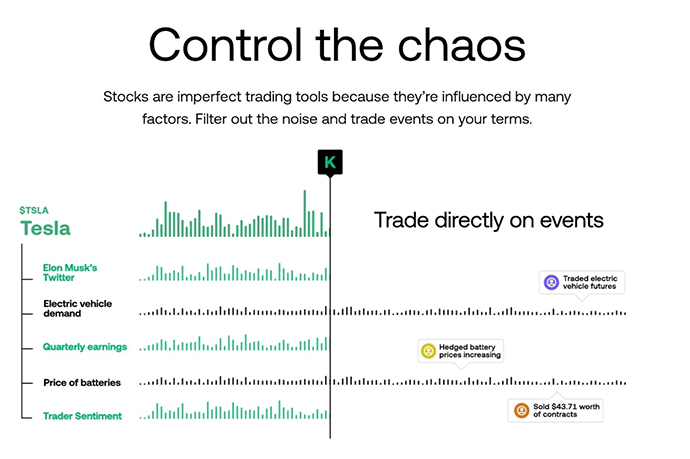

Traditional markets are intended to reflect world events through the price of an asset. For example, if demand for semiconductors surges while supply falters, you’d expect microchip stocks to rise.

But even within the most sound investments, there are things out of your control. Say you invest in a microchip company, and the CFO gets ousted for fraud. How can do you possibly price in that risk?

Making predictions about stock prices is extremely difficult when hundreds of factors influence those prices. Through no fault of your own, a well-priced and well-researched investment can easily bite the dust.

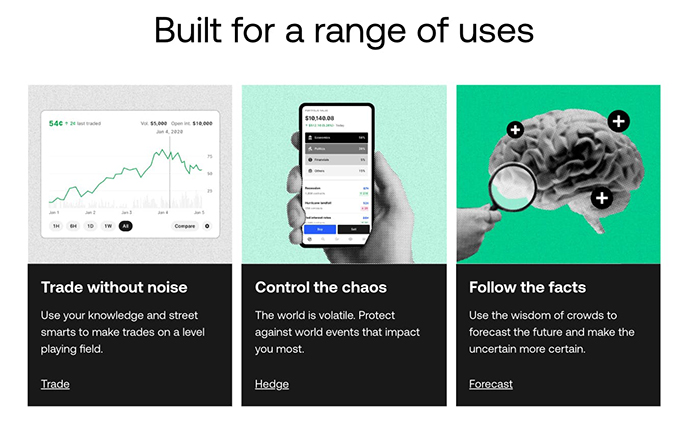

Prediction markets remove the noise from an investment. Human psychology — which ultimately has the final say in stock prices — is pretty unpredictable. Binary outcomes are clear and make more sense.

Event contracts can be advantageous to traditional (equity) markets in two main ways:

- Traditionally, people have to invest in equity markets, or stocks, when trying to predict the impact of events on the economy.

- Stock prices often have little to do with the outcome of an event that should influence its price — especially in the short term.

In a nutshell, prediction markets simplify your investments. They let you put your money where your mouth is and avoid all the small, seemingly insignificant factors that can tank even the best of investments.

The importance of CFTC regulation

Okay, before we go any further, we need to talk about the CFTC, or the Commodity Futures Trading Commission.

CFTC regulation isn’t just what sets apart legitimate derivatives exchanges from gambling platforms. It’s what lets prediction markets operate in the first place.

Getting CFTC approval is a very big deal.

The past decade has not gone smoothly for several prediction market companies:

- In 2012, Irish prediction market InTrade was taken to court by the CFTC for violating various rules. Six months later, the platform was gone for good.

- Earlier this year, Polymarket settled a $1.4 million-dollar suit with the CFTC for offering noncompliant event contracts.

- And in just the past week, one of the world’s largest prediction markets, PredictIt, also found itself in hot water. The New Zealand-based platform, which has been around since 2014, was banned from servicing US Investors by the CFTC. (Interestingly, the CFTC didn’t publicly disclose what PredictIt did to deserve the shutdown.)

This is why CFTC regulation is so important. Without it, the agency has a clear path to probe and potentially penalize prediction markets. And the big winner from all of this activity is none other than, you guessed it, Kalshi.

Kalshi is the first and only prediction market platform to have CFTC approval.

This is huge. Kalshi investors don’t have to worry about the big bad agencies coming to shut them down, take away their investments, or smash their liquidity.

What is Kalshi?

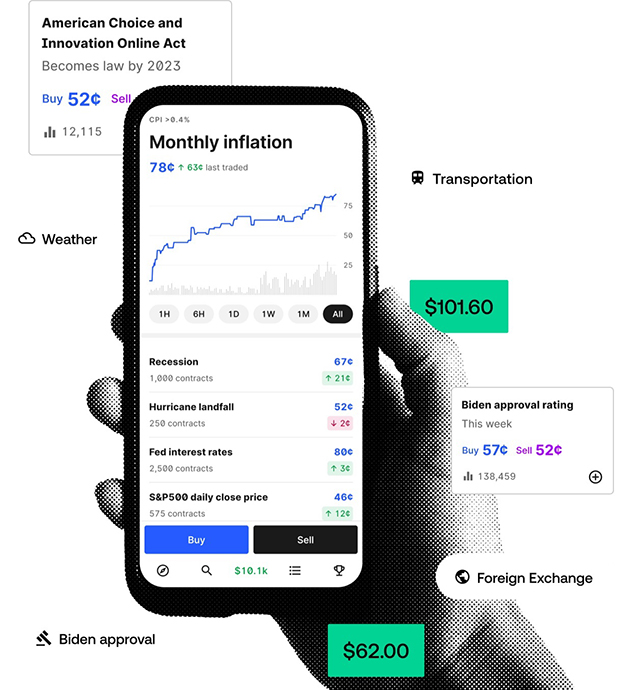

Kalshi is an innovative event contract platform that lets you bet on the outcome of hundreds of global events with as little as a penny.

Though event contracts are still a relatively untapped market, Kalshi utilizes CFTC regulation, a seamless mobile app, deep liquidity, and a strong team to ensure the smooth and successful running of the business.

The founders

Kalshi was founded by Tarek Mansour and Luana Lopes Lara in 2019.

Luana was studying a Master’s in Computational Cognitive Science, while Tarek was studying Deep Learning in Computer Science and AI (both at MIT).

How does Kalshi Work?

Kalshi’s event contracts allow investors to make trades based on their opinions about a specific yes-or-no question. These contracts are traded between other Kalshi members — it all stays within the community.

Kalshi’s questions are straightforward. It’s stuff like, “Will the number of Americans working from home one day a week remain at 50% by the end of January 2023?”

Investors have two choices: YES or NO.

The event contracts are intended to be simple for the investor to understand. The point is to give everyone a novel opportunity to debate politics, culture, the economy, and other fun stuff. (Negativity is frowned upon, and betting on war, deaths, etc is a big no-no.)

Members can take a YES or NO position on each question. When the contract ends, the side with the correct prediction wins. Investors get paid by those on the other side of the trade.

Investors can even take both sides to hedge their positions. After all, our positions on issues change over time. But remember, so do the prices!

How are event contracts defined?

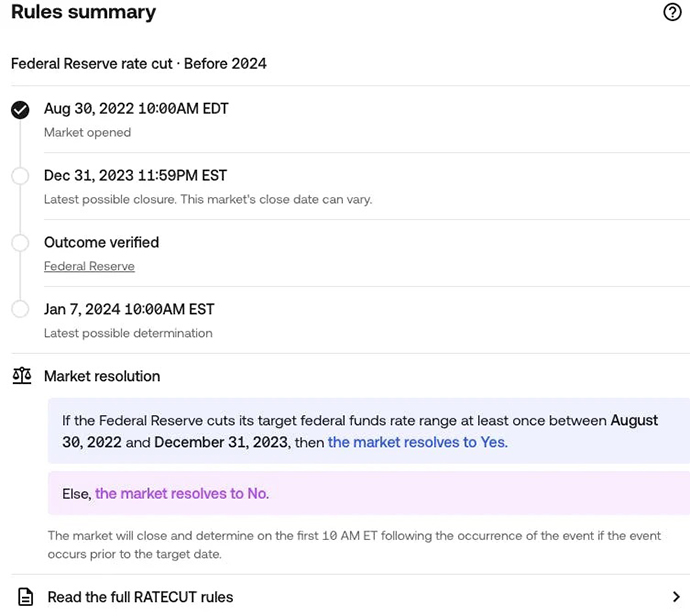

Kalshi has a large internal contracts team, including two international debate champions (!) asking questions like:

- “Are these contracts relevant?”

- “Are they in the news?”

- “How much volume will they attract?”

- “Will the contracts rely on reliable data?”

Ideas for new markets can even come from user suggestions (which is super cool).

Each contract contains 40-60 pages with details, including rules around strikes (disputes), expirations, and settlement sources.

These details are important. For example, one popular contract is predicting the high temperature in New York City for a given day. For this type of contract, there are four different ranges available. But the most important measure is who Kalshi uses to get the temperature and where they get it.

When predicting the high temperature, Kalshi uses the National Weather Service and its readings from Central Park. Contracts are designed to be as specific as possible to keep disputes to a minimum.

The mechanics

Every trade on Kalshi is a match made between a market maker and a market taker.

Market makers

Market makers place what are called resting orders, which are offers to purchase a set quantity of contracts at a certain price. This provides liquidity in a market.

The benefit of being a market maker is that there are no fees for resting orders. This incentivizes users to create an order book (all of the resting orders available) for each contract.

Market takers

Market takers are able to see these available resting orders, and trade with them.

For example, if there’s a contract with the question “Will inflation rise to 8% by the end of December 31, 2022?”

There might be a market maker that sets the market at Yes for 60¢, allowing someone else to take the opposite contract at 40¢.

The person that takes the opposite position of the market maker is a “taker” at NO for 40¢. This person will pay a fee based on 40¢ and the number of contracts they buy. The market maker who created the contract at 60¢ will pay a fee based on 60¢ and the number of contracts they could match at that price.

The benefit of being a market taker is that the user can place a trade immediately. They are taking the price offered by the market makers and are able to act immediately on their convictions.

Event payouts

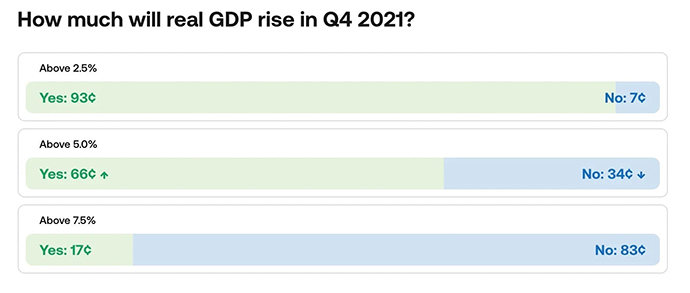

A successful event contract always pays out $1. But it’s critical to understand that the YES and NO choices are not equally distributed at 50¢ each.

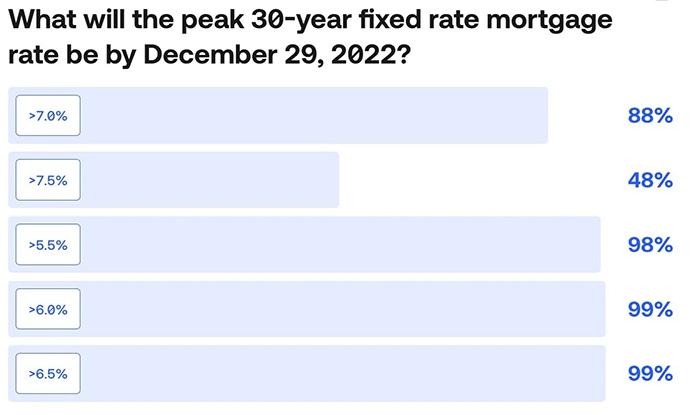

Let’s look at a current example. One of the event contracts reads Peak Mortgage Rate.

The resolutions for mortgage rates greater than 7% can be bought at YES for 84¢ or NO for 17¢.

If mortgage rates go above 7% by December 29, the buyers at 84¢ will get paid one dollar, meaning they each made 16¢ for each contract they purchased.

Conversely, those who bought No for 17¢ will lose 17¢ for each contract they purchased.

The 84/17 cent split was created by a market maker whose buy-ins were based on their perceived probabilities of the mortgage rate rising above 7%. If the market maker started 100 contracts for YES at 84¢, then no more than 100 contracts will be bought for NO at 17¢.

Traders can also close their positions early to mitigate risk. A trader who bought a contract at 10¢ can sell their contracts for 30¢ to lock in a profit.

As an event contract draws closer to its end date, the contracts will generally move toward the expected result. This is similar to the time-value decay of equity-based options. For example, the day before the monthly job reports number is issued, the value of a YES contract for jobs at XXX level may be .92, while the NO contract is .08.

The markets are showing a strong certainty for one outcome (with the potential for an outsized return if the NO contract is successful).

The Orderbook

The Orderbook in any market can list different prices. Still, orders are only executed when matched between a maker and a taker. A maker can create ten contracts in a market, but if another taker is only willing to take 6 of those contracts, then only six are executed.

The remaining four contracts that the maker created will stay in the order book waiting for them to be executed by another taker.

The Orderbook shows all the available options made available by the market makers.

Order Types

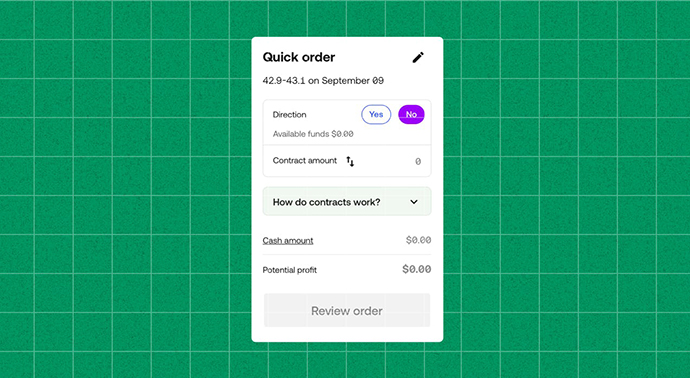

Like the regular stock market, Kalshi offers different order types:

- Quick Orders: a request to immediately buy a specific number of contracts at the best available prices

- Sell Orders: a sell order is a request to sell contracts you own. Like a quick order, sell orders are carried out immediately at the best possible price.

- Limit Orders: a request to buy a specific number of contracts at a particular price, or better.

- Limit Sell Orders: similar to limit orders, you specify the quantity and price you want to sell, rather than buy.

How does Kalshi make money?

Kalshi earns money from trading fees. Fees are based on the prices of contracts and the number of contracts purchased.

Kalshi’s fees are proportionally lower when a higher dollar amount of contracts is purchased.

For example, someone who purchases 100 contracts at 50¢ will pay $1.75 in trading fees. Refer to Kalshi’s fee trading tables.

What we like about Kalshi

- CFTC regulated. This is enormous. Kalshi is the first CFTC regulated prediction market, meaning that it is a federally regulated market. It must comply with federal guidelines. Deposits into the marketplace are held in a federally regulated clearinghouse.

- Ultra-low minimums. Curious investors can start trading for less than $1. There is no minimum deposit and investors do not need to be accredited

- Direct investing. Trading directly on events is possible rather than trading indirectly through equity markets.

- Huge hedging opportunities. Companies can use Kalshi to hedge risks in a similar manner to currency/commodity futures. A company in Miami could take the YES side of the question “Will a Category 1 Hurricane hit Miami in 2022” to offset potential losses to their business from a hurricane event.

- Nine categories. Kalshi offers a variety of markets across nine different categories. The choices allow traders to participate in markets that interest them and where they may have an informational edge.

- Limited downside risk. Kalshi doesn’t allow margin or leverage trading, so the most you can lose on a trade is the total cost of your purchased contracts.

- Info galore. Kalshi provides a wealth of information on its site to learn more about its features and to do your research on current events.

- Sell a position anytime. Traders can buy or sell their stakes until the event occurs or the contract expires. Traders can sell at any point to take a profit or play out their prediction until the end.

Potential risks with Kalshi

- Slightly complex. Kalshi does a great job trying to simplify things for new users. But as with any market, Kalshi’s markets take time to navigate and understand fully.

- Read the fine print. Not reading the event contract fine print can cost traders money who use different sources than the ones outlined by Kalshi.

- No middle ground. Event contracts are by their nature all or nothing (similar to futures and options). This could be a good or a bad thing, depending on your investing style. But if the event contract isn’t successful, it will expire and be worthless.

- Flirting with gambling. One should only invest in the Kalshi platform what they can afford to lose. The short-term win/lose nature of the contracts can be mis-used as a substitute for gambling if proper research isn’t done on the contracts.

- CFTC risk. Kalshi currently enjoys a good working relationship with the CFTC, but this could change in the future and make their event market inaccessible to US-based investors.

Conclusion

Kalshi is the first-ever CFTC-regulated prediction market. The approval by the CFTC has given Kalshi legitimacy among traders.

Through Kalshi’s event contracts, this new prediction market gives people an alternative to equity markets. It opens up a window of opportunity for existing investors looking for an alternative to equities and for a new kind of investor that has shied away from traditional stock markets.

Kalshi has the potential to provide less risk for investors who can make informed investments on specific events within defined time periods that avoids the inherent volatility of the equity markets

Founders Tarek Mansour and Luana Lopes Lara are creating a paradigm shift for investors. The change allows investors to make a direct bet on their predictions, rather than trading indirectly on stocks at the whim of the market.

It’s this bet on oneself that will resonate with current and future traders for years to come.

Disclosures

- None of the authors of this issue are currently invested in any event contracts through Kalshi.

- There are no Kalshi event contracts in the ALTS 1 Fund

This issue has been a sponsored deep-dive, meaning Alts has been paid to write an independent analysis of Kalshi. Kalshi has agreed to offer an unconstrained look at their business & operations. Kalshi is a sponsor of Alts, but our research is neutral and unbiased. This should not be considered investment advice, but rather an independent analysis to help readers make their own investment decisions. All opinions expressed here are ours, and ours alone. We hope you find it informative and fair.