Welcome to Deep Dives, where we explore interesting companies in the alt investment space.

I hope you enjoyed last week’s review of Hoken, the company that lets you buy, sell, and trade hotel room reservations.

Today, we’re looking at land loans, specifically through the lens of a company called One Call Capital — a land financing company founded by two Alts community members: Paul Thompson and Brad DeGraw.

I’ve spoken with Paul quite a bit over the past year. He’s a lending expert who realized there were no good solutions for funding land flips, especially something known as transactional funding.

We’ll get into what this means in a bit.

And they’ve got a land flipping webinar this Thursday where you can learn more:

Register for Land Flipping Webinar

First, a bit more about flipping land.

Table of Contents

Land flipping mechanics

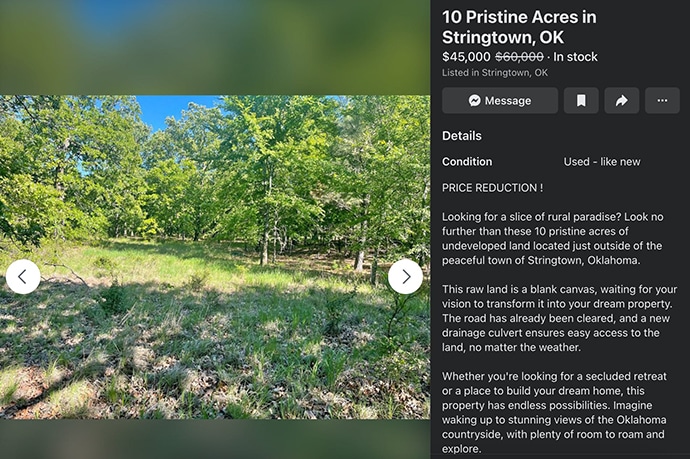

Land flipping is easy in theory. You buy undeveloped land intending to sell it for a profit.

These types of flippers don’t develop the land. They aim to find a suitable piece of earth, acquire it for a good price, sit on it, and sell it later.

It’s a way to capitalize on the potential appreciation (and development prospects) of raw, untouched land; before it gets turned into homes, apartments, or farmland.

What is transactional funding?

Two things make land flipping tricky: fees and timing.

Fees add up quickly:

- Cost assessments

- Holding costs

- Real estate agent commissions

- Legal fees

- Property taxes

And in this world, timing is everything.

Successful land flipping relies on accurately predicting trends and timing sales accordingly. Flippers aim to sell the land during high demand and limited supply to maximize profits.

It’s important to have all your research done beforehand. And it’s crucial to have your cash ready to go.

What is One Call Capital?

One Call Capital solves two problems:

For borrowers

When an individual or investor needs quick cash to get a deal over the line, there aren’t many options for these types of short-term loans (also known as bridge loans).

So Paul’s strategy is to focus on providing small loans (typically under $100,000) to land flippers needing quick transaction funding.

Their quick turnaround time means borrowers can win the deal and maximize their returns.

Loans are typically repaid within 6 months, at an interest rate between 7 and 12%

Borrower qualifications:

- No need to be accredited

- Experience completing 6 similar deals

- Not currently in bankruptcy

For investors

Since Paul was already recycling cash through his land financing deals, he figured why not start a separate fund to offer investors?

The One Call Capital Fund is a passive income fund that targets 12% annual returns.

It’s designed for income investors looking for consistent yield without volatility or chaos. Investors can choose to receive quarterly dividends or reinvest them into the fund for compounding interest.

- Type: Passive income fund

- Accreditation: Accredited investors only

- Location: International investors OK

- Minimum investment: $100,000

- Time horizon: 1 year

- Preferred Return: 12%

- Target returns: 15%

Land flipping Webinar

This could be up your alley if you’re an accredited investor looking for high-yield, low-risk alternative real estate vehicles.

Paul is hosting a live webinar this Thursday for capital investors to learn more about how to get involved:

Potential capital investors can also email Paul directly at [email protected].

Q&A

We’ve got a short Q&A with Paul:

What’s the story behind One Call Capital? How did you get started?

I’m sort of this tech-savvy guy who used to work in corporate America for 17 years. I wanted to build something of my own, so I ventured into real estate. I’ve been involved in hundreds of transactions. But I noticed that land flippers needed money fast to snap up good deals. At first, I started to fund their deals with my own cash. Then I started a small company with a few investors. With a proof of concept confirmed, I created One Call Capital Fund, a place where capital investors can put their money to work while earning a great return. That’s how we got started.

So, what problem are you solving? Who are you aiming to help?

Well, we spotted two groups of people who needed a hand. First, there were land flippers who needed quick cash to get a deal over the line. Second, there were investors who had cash but weren’t getting much for it in regular savings or retirement accounts. So, we’re helping both – giving quick cash to land flippers and offering investors much better returns for their money.

What makes investors choose you guys over other options?

Honestly, it’s the combination of higher returns and short-term commitment. Most of our investors love that they can invest for only a year at a time and still see great returns. Plus, they like that we spread out the risk over multiple loans. And let’s not forget that the loans are backed by real estate that’s worth at least twice the loan value.

So, what makes you different from the competition?

The thing is, we’re pretty much the only ones focusing specifically on short-term loans for raw land projects. Other guys in this space tend to be small or private companies with less money to lend out. So we’ve carved out our little niche here, which gives us an edge.

When did you realize you were onto something big?

We knew we had hit gold when land investors started calling us their “secret weapon”. Now we’ve got people lining up for our services, and our investors are so happy they’re bringing their friends along for the ride.

What does the future hold for One Call Capital?

We’re all about being the one-stop-shop for both land investors and capital investors. So, our game plan is to really nail down our position as the go-to guys for raw land projects and funding. No need to complicate things – we’re good at what we do, and we plan to keep doing it better.

Summary

Land flipping is a numbers game, and Paul and his team are filling a small but critical niche in this world.

If you’re an accredited investor looking for 12% returns, consider the One Call Capital Fund. Potential investors can also email Paul directly at [email protected].

That’s it for this week. See you next time.

-Stefan

Further reading

- We love to write about investing in farmland.

- When it comes to investing in this type of raw land, Investopedia has a great primer.

- Kiplinger had a good piece on land in its purest form.

- As the saying goes, all real estate is “Location, location, location.” Here’s Crexi’s list of top cities for land investing.

Disclosures

- One Call Capital is an Alts sponsor. This was a paid deep dive.

- Our ALTS 1 Fund has no land holdings, nor have we invested in One Call Capital

- This issue contains no affiliate links.

This issue is a sponsored deep dive, meaning Alts has been paid to write an independent analysis of One Call Capital. One Call Capital has agreed to offer an unconstrained look at its business & operations. One Call Capital is also a sponsor of Alts, but our research is neutral and unbiased. This should not be considered financial, legal, tax, or investment advice, but rather an independent analysis to help readers make their own investment decisions. All opinions expressed here are ours, and ours alone. We hope you find it informative and fair.