A look at Propel(x) and the SGTF

Hi everyone,

Today we’re looking at Propel(x) — a business that’s breaking down the barriers of what we can and cannot invest in. Their platform lets you invest in institutional opportunities at only a fraction of the typical investment minimum.

In this issue, we’ll focus on their latest offering — The Svelland Global Trading Fund (SGTF).

Table of Contents

Quick Summary

- Investment type: Hedge fund via special purpose vehicle (SPV)

- Requirements: Qualified purchasers

- Minimum investment: $25,000

Institutional investment opportunities

Private equity, hedge funds, and capital funds can potentially be some of the most lucrative alternative asset opportunities.

But they’re also some of the least accessible:

- Minimum investments into most hedge funds start at $100,000. That’s nearly double the median salary in the US.

- A 2022 study showed that the best-performing hedge funds tend to charge the most.

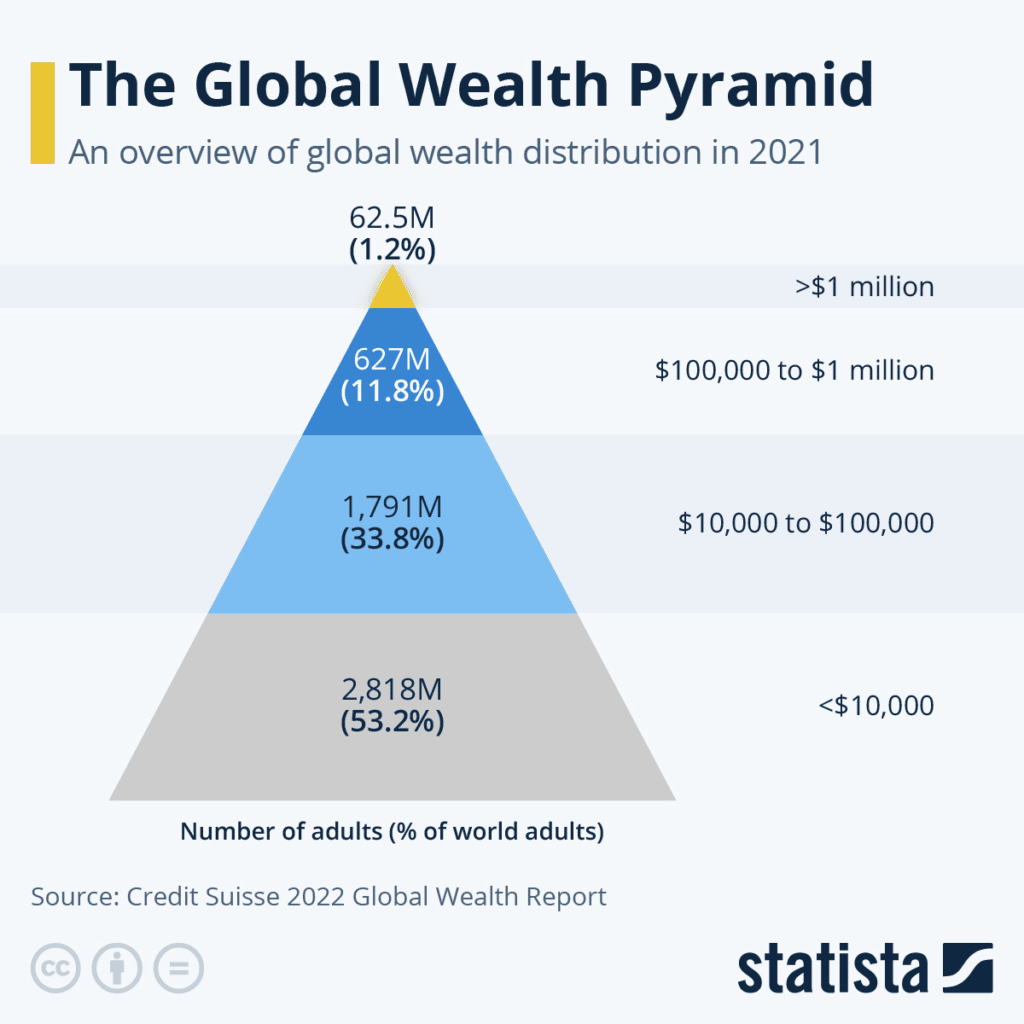

For decades, those outside the tip of the global wealth pyramid were pretty much blacklisted from these investment vehicles.

But as technology has advanced and alternative assets have become more popular, more and more investors want access to these opportunities. This is now possible largely thanks to solutions like Propel(x).

What is Propel(x)?

Propel(x) is an innovative player in the alternative investment space.

They provide a digital platform for accredited investors to put their money into startups, VCs, and hedge funds that are all typically reserved exclusively for the financial elite.

Where you would once have to invest a minimum of $100k+ to access these investments, Propel(x) lets accredited investors diversify their portfolios for as little as $5,000 per investment.

In the past three years, Propel(x) has experienced rapid growth:

- Franklin Templeton ($1.53 trillion AUM) signed on as a strategic investor in 2020.

- They financed startups bringing Covid-19 solutions to the market.

- Helped finance pre-IPO startup Varo Bank in 2021 – its app now has 150k+ downloads on the Play Store.

- Re-positioned from a VC firm to a complete solution, including alternative assets.

- Brought hedge funds to the masses by launching the Svelland Global Trading Fund. (More on this later!)

Today, there are 3,500+ registered users on the platform, with the average user investing over $73,000 in 2021 alone.

Companies included in the Propel(x) system have raised over $2 billion both on and off the platform.

Leadership

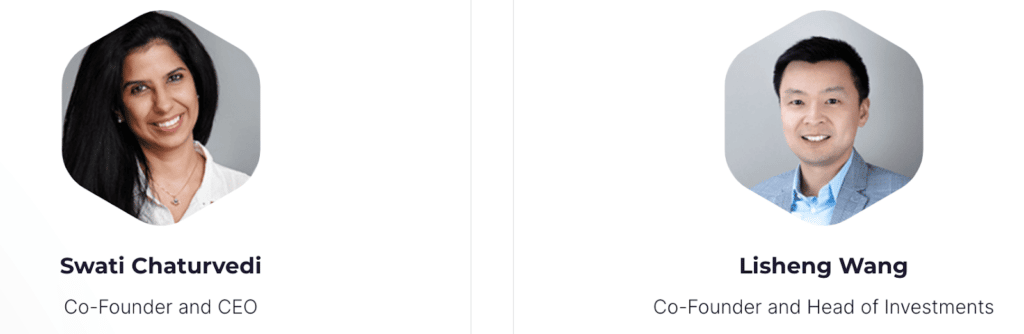

Propel(x) was co-founded by Swati Chaturvedi and Lisheng Wang, classmates at the Massachusetts Institute of Technology.

Before starting Propel(x), Swati worked as an investment professional at Exigen Capital, Siemens Venture Capital, and Temasek Holdings. She has also been a management consultant working across a variety of industries.

Lisheng is a partner at TSVC and a board member at Propel(x). Prior to his venture investing and entrepreneurial efforts, Lisheng worked in portfolio management, corporate development, and software engineering at major financial services and software companies, including Wells Fargo, KeyBank, and Microsoft.

Both co-founded Newton Fund, an early-stage DeepTech venture capital firm, and the MIT Alumni Angel Investors group in 2013 and continue to be on its screening committee.

What sets Propel(x) apart?

A major draw of Propel(x) is the platform’s flexibility.

Investors can buy into offerings (typically startups or alt funds) directly, or through pooled investment vehicles. These are available with a minimum investment of between $5,000 and 25,000, a substantially lower minimum than most traditional investment methods.

Propel(x) is here to make an impact on society. The company does this through the investment opportunities they focus on.

Swati Chaturvedi coined the phrase deep tech. The term refers to disruptive tech startups trying to solve societal, scientific, and engineering issues with their business model. (As opposed to shallow tech, which are easily replicable and don’t disrupt the market).

Propel(x) is aware of its social responsibility and has included a focus on environmental social governance (ESG) types of investments.

The team also makes sure their investors are fully informed. This includes investor webinars, issuer Q&A, and reports brimming with information.

Propel(x) Testimonials – Voice of Investors

Some customers have praised how easy it is to access the annual K-1 forms related to their investments through the Propel(x) portal.

Lastly, their broker reviews are a useful feature that makes it super easy for investors to conduct due diligence.

The forms are a few pages long and spell out key investment details for any business raising capital on the Propel(x) platform. This usually includes information on the founders, background checks, the financial position of the company, operating agreements, insurance, and more.

You can check out an example broker review on the Propel(x) blog.

Portfolio

As we mentioned before, Propel(x) has a list of portfolio companies which have cumulatively raised $2B+ from the Propel(x) platform and other sources, including:

- Neocis ($163.1M funded) — a dental implant surgery business that utilizes robotics.

- Cyberdontics ($19.3M funded) — a robotic restorative dentistry platform.

- Cruzfoam ($18M funded) – a regenerative materials technology startup.

- InsightFinder ($10M funded) – an AI-based incident prediction platform.

- Brelyon ($18.8M funded) – a startup pioneering a new category of ultra-immersive display technology.

- TaskHuman ($20M funded) – a digital coaching platform.

For more information on those companies, check out Crunchbase.

Investment offering: The SGTF

Alright, this is what we really want to talk about.

Propel(x) has introduced access to the Svelland Global Trading Fund (SGTF) — a commodities focused hedge fund run by Svelland Capital.

Why is this a big deal?

Access to these types of funds is usually pretty limited. An Initial minimum investment in the SGTF is $3 million. (Pfft, pocket money, am I right?)

But thanks to Planck Fund Management Corporation (a subsidiary of Propel(x)), qualified purchasers can get involved for as little as $25,000. Qualified purchasers can be a bit similar to accredited investors in terms of criteria, but they’re not the same.

This is achieved through Planck creating a syndicate that allows investors to pool funds to access investments with higher minimum investment thresholds.

You can find more information on The SGTF here. Keep in mind you need to register to the Propel(x) site first, in order to access the info.

Performance

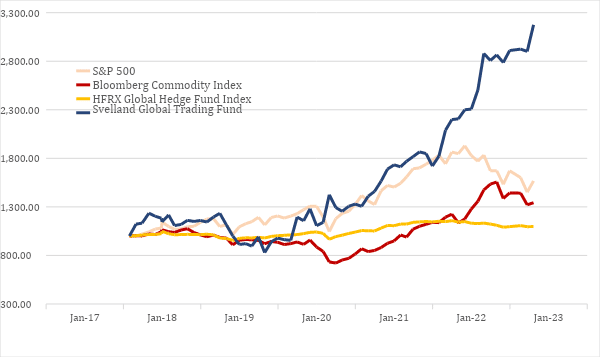

The Svelland Global Trading Fund’s three-year CAGR (Oct 2019 to Oct 2022) is 45.15%

This vastly outperformed most indices, including the S&P 500, and the HFRX Global Hedge Fund Index, during the period. Since August 2017, the net value of invested assets (NAV) in the Svelland Global Trading Fund has grown 217.71%, net of fees (NAV calculated by Apex Group, a 3rd party Fund Administrator for SGTF).

Fund details

Svelland’s investment process starts with understanding in detail the supply and demand dynamics of the “physical” commodity markets within their investment universe.

The fund’s typical investment holding period is highly changeable, from longer term strategic trades to more short term tactical. 2022 has been a “trading year” for the fund due to the market volatility.

The SGTF focuses on the commodities sector. The strategy trades across three buckets 1) Commodity futures (such as; Brent crude and products, Aluminum, Copper and Iron ore) and Options 2) Commodity & renewable related equities and 3) Freight futures. At present, the Fund doesn’t trade coal or power.

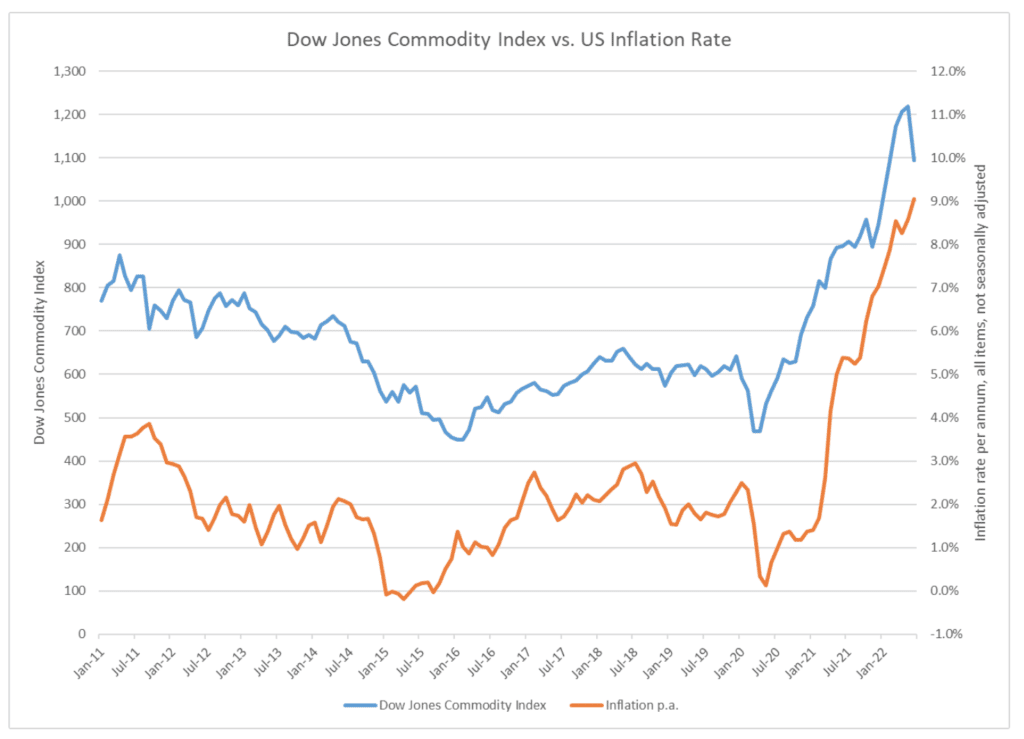

It’s good to see that for 11+ years, the Dow Jones Commodities Index has shown a similar trend to the rise and fall of inflation. (But do keep in mind that past performance is no guarantee of future performance.)

Since 2017, the fund has only posted a negative annual return once – in 2018. This was a tough year for most investments — it was just the second time the S&P and Dow had a down year since 2008. The main driver for the SGTF drawdown towards the back end of the year was the volatility created by President Trump’s trade war on China and its focus on commodities, specifically the way he often communicated to the market via Twitter. Early 2019, there was a tragic dam collapse in Brazil (Brumandinho – Vale dam burst). This unexpected event created shocks in the commodity and shipping markets which adversely impacted Svelland’s positions.

Fees

Investors in the fund will incur a 1% annual management fee and a 5% annual performance fee when using Propel(x) to invest (via the Planck SPV).

This is on top of the Svelland Fund’s native fees which are 1.75% (management) and 20% (performance)

The combined overall fee structure 2.75% and 25% is comparable to what many hedge funds/alternative investment funds charge.

Liquidity

There is a three-month “soft-lock,” which will incur a 5% penalty if assets are liquidated prior. Otherwise, the Fund requires 30 days’ notice before an investment can be redeemed.

The first close of the SGTF investment opportunity is November 20th. So, if you’re interested, you may want to act fast.

What we like

- Strong fund performance (SGTF). The SGTF has consistently posted solid performance and has a low negative correlation to the S&P 500.

- Management experience (SGTF). SGTF was launched by Tor Svelland, who has extensive experience in the freight and commodity sectors with prestigious firms such as Goldman Sachs and Trafigura.

- Specialized focus (SGTF). SGTF employs a unique strategy that combines commodity and freight futures with equity exposure — this strategy allows SGTF to make concentrated bets on compelling investment opportunities and focus on specific commodities (such as LNG) where they hold a knowledge advantage.

- Hedge against inflation (SGTF). Inflation rates are running rampant across the globe at the moment. Commodity funds like the SGTF can be a great hedge, as commodities will typically (but not in all cases) also increase during inflationary periods.

- SDIRA support (Propel(x)). If you read last week’s deep dive, you should know all about how powerful an SDIRA can be for your retirement!

- Access to unique opportunities (Propel(x)). Funds like the SGTF often require upfront capital over $1M+, which is out of reach for many investors. Propel(x) is a great resource for deal flow opportunities that individual investors may not have access to on their own.

- Due diligence and education (Propel(x)). Propel(x) performs due diligence on the investment opportunities on their platform (but does not make investment recommendations) and supplements this with additional information about the opportunities, such as webinars and reports.

Potential risks

- Volatility (SGTF). Hedge funds are notoriously volatile. This can be especially true for funds that trade commodities with leverage. Although SGTF does trade with leverage, it does not trade with any additional leverage except from what is built into the exchange margins of the futures contracts and what they receive on equities from their Prime Brokers

- Lack of diversification (SGTF). Commodities have been the rare bright spot in the financial markets in 2022. Still, the SGTF’s lack of exposure to other sectors could have an outsized negative impact on the returns if commodities were to enter a bear market.

- Only available to qualified purchasers (Propel(x)/SGTF). Although Propel(x) is lowering the barrier to entry to institutional investment opportunities, qualifying as a qualified purchaser can still be difficult.

- External factors can influence commodities (SGTF). Geopolitical situations like the Ukraine/Russian war can significantly impact the supply and demand of certain commodities and create volatility. So long as there is volatility in commodities hedge funds like SGTF can capitalize on it. If commodities become ‘unloved’, that could impact returns.

- Risky nature of startup investing (Propel(x)). Propel(x) offers investment opportunities in exciting early-stage companies looking to change the world fundamentally — these types of companies can often be high-risk, high-reward investments. As a rule of thumb, you should only invest what you’re prepared to lose when it comes to investing in startups.

Closing thoughts

Getting access to some of the world’s most intriguing deep-tech startups for $5,000 is exciting, and a global hedge fund for just $25k is a particularly unique opportunity.

Creating equal investment opportunities is the key to Propel(x)’s mission.

So, if you’re a qualified purchaser looking to tap into opportunities normally hidden from the public, you should check out The SGTF on Propel(x)

Disclaimer:

This message is not an offer to sell or the solicitation of an offer to buy any security, which only can be made through official offering documents that contain important information about risks, fees and expenses. Private Placements are a high-risk investment. Private investments are highly illiquid and risky and are not suitable for all investors. Past Performance is not a guarantee of future performance. Performance figures stated above for SGTF are based on calculations of NAV from a third-party administrator, the Apex Group. Securities, when offered, are typically offered either through Propel(x)’s affiliated regulated broker-dealer, Hubble Investments. The SGTF offering is done through Planck Fund Management Corporation, a subsidiary of Propel(x). Please visit the Propel(x) website for Issuer Specific Risks concerning SGTF.

Disclosures

- None of the authors of this issue currently own any shares or assets of Propel(x), or have any SGTF involvement.

- We have no Propel(x) shares or assets in the ALTS 1 Fund.

- Nothing in this piece should be considered financial, legal, or tax advice.

- This issue contains affiliate links, meaning that Alts and its associated entities may receive compensation for referring customers to the noted companies.