Hello everyone,

Today, we’re looking at The Entrust Group — one of America’s longest-running Self-Directed IRA (SDIRA) custodians and administrators.

SDIRAs are the perfect opportunity to change how you invest in your future, but they’re often poorly understood.

In this issue, we’ll try to fix that.

Table of Contents

Quick summary

- Type: Self-directed IRA

- Requirements: US investors only

Retirement funds in the US

Social security (SS) has been around for a really long time — nearly a whole century.

During the 70s, the first 401(k) was introduced almost entirely by accident. A benefits consultant realized a recently passed legislation provided a great vehicle for employees to save in a tax-advantaged manner for retirement. A few years later, 401(k)s were already adopted by a large number of companies.

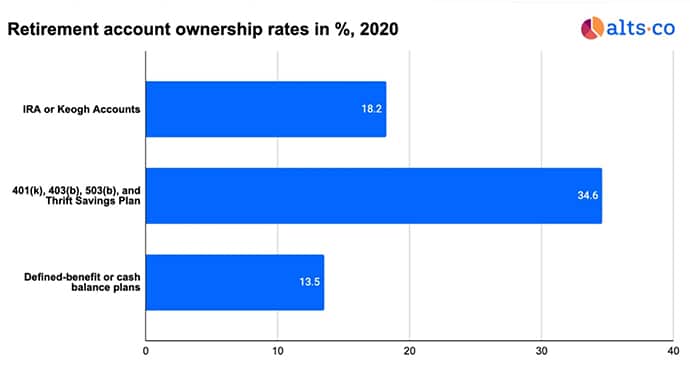

Today, the 401(k) is the US’ most popular retirement account (34.6%), offered by more than half of all corporate firms, and holding $7+ trillion AUM.

In 1986, the Tax Reform Act was passed into law, and with it — the US Individual Retirement Arrangement (IRAs) was born. They were designed to give everyone access to a retirement savings plan, regardless of employment status. The Roth IRA followed along 12 years later. We’ll explain the difference between the two below.

People could now contribute up to $6,500 to their traditional IRA each year, which reduced their taxable income by the deposit amount (a Roth IRA didn’t reduce taxable income). This money could be invested in traditional securities like stocks, bonds, and whatever else the IRA broker offers.

It was an upgrade in flexibility over other retirement accounts.

But what if you want your hard-earned retirement money to buy a stake in your favorite sports team?

Thankfully, there’s a solution – the Self-Directed IRA.

What is a Self-Directed IRA (SDIRA)?

A Self-Directed IRA (SDIRA) is an IRA that gives you total control over your retirement account.

With a Self-Directed IRA, you can choose to invest in almost anything.

- Real estate

- Cryptocurrencies

- Startups

- Private lending

- Precious metals (have to be 99%+ pure)

- Movie productions

- Water rights

- Bowling alleys!

There are a few restrictions, though – the most notable being collectibles, coins, and life insurance. These restrictions are in place to prevent abuse of the tax advantages of IRAs to invest in opportunities that may be used for personal benefit.

How does an SDIRA work?

Opening an SDIRA requires upfront time, paperwork, and fees. All this can be made easier with the help of an IRA custodian (administrator) like The Entrust Group.

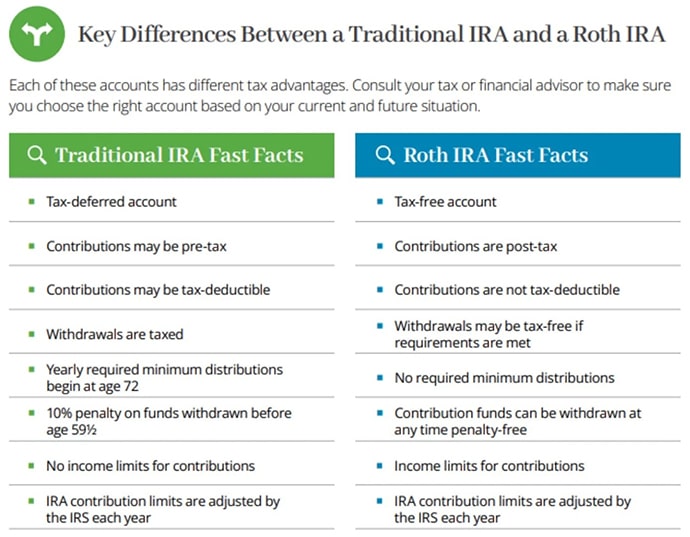

The first thing is to decide what type of SDIRA you want: traditional or Roth.

Both options let you invest in the same type of assets. So, what you choose will depend on your specific tax goals.

If you want tax-deferred growth, it’s best to stick with a traditional SDIRA. This option reduces your taxable income by the amount of money contributed.

A Roth SDIRA is the better choice for those that desire tax-free growth. Money contributed to a Roth SDIRA is post-tax, but asset growth can be withdrawn after retirement for free. There are also income limits associated with Roth accounts.

After determining a tax strategy, you can decide whether you want an IRA LLC or a Checkbook IRA.

This process can be quite confusing (it’s important to DYOR) but IRA LLC has advantages like:

- Lower administration fees (as there’s only one asset owned)

- Faster transactions (as you don’t need your SDIRA admin to sign documents)

- Fewer transaction fees

The advantages of an SDIRA

Investing in pretty much anything (as long as the IRS approves…) is a big plus.

You can create your retirement model based on your risk profile, areas of interest, or specialized knowledge.

But the real reason SDIRAs can be super desirable is taxes — with a traditional SDIRA, contributions can reduce your taxable income by up to $6,500 every financial year. All this while accessing investment options like vacation rentals, gyms, and billboards.

Investments in a traditional IRA grow tax-deferred (but not tax-free) — taxes are due when distributions are taken.

However, you can use a Roth IRA account to grow your retirement portfolio tax-free. If you hit a startup winner, your earnings won’t be smashed by capital gains taxes. The most powerful force in the universe — compound interest — can grow your account balance tax-free (providing certain conditions are met).

The disadvantages of an SDIRA

- You are completely responsible for your account. You will be the one selecting investments instead of outsourcing this to a manager when investing in standard IRA offerings such as mutual funds and ETFs.

- You can’t borrow against an SDIRA’s balance. (Although there’s a loophole where you can borrow against an SDIRA, so long as it’s paid back within 60 days).

- Fees can be heftier than other account types (these can be minimized by using a checkbook LLC mentioned earlier).

How successful your SDIRA is will depend on a few things, including the administrator you choose to administer your SDIRA. Their recordkeeping fees, infrastructure to access alternative investments, and customer service can drastically alter the self-direction experience.

Who is The Entrust Group?

The Entrust Group is one of America’s largest and longest-running self-directed IRA administrators.

The company was founded in 1981 by Hubert Bromma, who developed the business from an idea into a nationwide enterprise with 30+ physical offices.

In 1981, Mr. Bromma developed the first truly “Self-Directed IRA” for a number of banks. In 1993, he consolidated a banking and pension management practice that he had owned since 1981 into Entrust.

The expertly-trained staff is there to make it easier for the financially savvy to invest in alts, providing administrative and recordkeeping services, education, and the infrastructure necessary for anyone to be able to invest how they want.

What sets The Entrust Group apart?

Reputation

The Entrust Group started operations less than a decade after IRAs came into existence and has been offering SDIRA services ever since. As one of the oldest SDIRA administrators, the Entrust Group has a well-earned reputation as a leader in the SDIRA space.

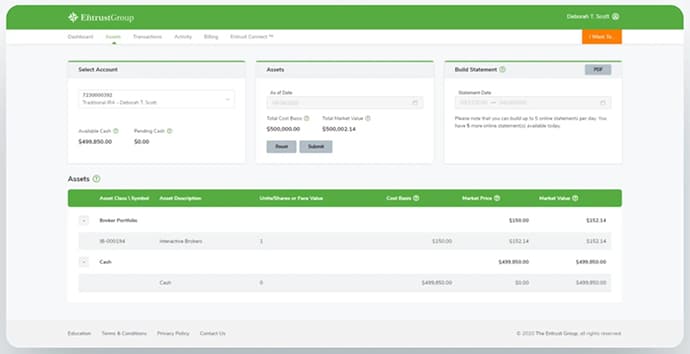

Online portal

A key to the company’s service is the sleek online portal that provides everything you need to manage your SDIRA.

An SDIRA can be confusing, but The Entrust Group has made their platform as streamlined as possible. You can open your account in less than ten minutes, make investments, and manage your portfolio using only the website.

Entrust Connect

The almost limitless investment options you get with an SDIRA can be a bit overwhelming to choose from for some investors.

The Entrust Group helps make this task easier with Entrust Connect — an exclusive online marketplace offering customers access to private offerings.

It’s a nice way to get new alternative ideas for your retirement portfolio.

myDirection Card

This is a unique service that’s targeted toward real estate investors.

There are numerous expenses when owning an investment property (repairs and maintenance, utilities, property taxes, etc). When holding an investment property in an IRA, the IRA funds are used for paying these expenses.

The myDirection card lets property owners bypass the hassle of transferring funds into the account and writing checks.

Financial advisor flexibility

The Entrust Group supports both individual and advisor SDIRA accounts.

Customers can access their services independently or through their professional manager. This is relatively unique for retirement funds, as many require only one or the other.

It’s worth mentioning that The Entrust Group doesn’t offer any personal financial advice but does allow third parties (such as registered investment advisors) access to your account.

Resources

The Entrust Group has a wealth of resources at its disposal.

The platform’s learning center is massive — the blog contains hundreds of posts, ranging from real estate investment ideas to preventing fraud and scams.

The team also runs regular video webinars on various topics.

As a custodian, The Entrust Group needs to ensure its customers have access to all the information they need – and its comprehensive resource center is a big plus.

The Entrust Group process

The Entrust Group’s goal is to provide all the benefits of an SDIRA without any of the confusion.

- First, you’ll choose an account type. There are seven different ways to self-direct your retirement accounts. The Entrust Group has a PDF guide on selecting the account type best suited for your retirement philosophy.

- The second step is to decide whether you want to establish an LLC. This process is lengthy, and involves registering the LLC with your state and preparing various documents. The Entrust Group doesn’t set up the LLC, but can have the SDIRA provide funding to the LLC.

- Customers can then open an account with The Entrust Group by filling out a ten-minute document and providing basic info, social security number, credit card info, and digital identification (passport, driver’s license).

- The account can now be funded. This will require a rollover, transfer, or contribution – all of which can be done via The Entrust Group’s online portal.

- It’s then time to invest. Each asset will have a different process. For specific details, you can read The Entrust Group’s guides. If you have an LLC, you can buy assets using the checking account you’ve set up, without involving the SDIRA custodian. If not, you can use the online portal to submit a request for investment and fill out the relevant paperwork.

Services

IRA administrators provide record-keeping and other related services.

They aren’t fiduciaries and don’t provide oversight or review of the investment options (i.e., an opinion on the benefits/risk of an investment). They do review any proposed investments to ensure that they can custody them, though.

Services that The Entrust Group provides are:

- Administration of SDIRAs, including the management of contributions, distributions, and other payments

- Facilitate buying, selling, and holding alternative assets

- Annual IRS reports and general recordkeeping

- 24/7 access to your retirement portfolio

- myDirection Visa Card for managing real estate investments

- Education library with hours upon hours of content

- Personal client services and consultations

- Smartphone app (available for both Android and Apple)

There are a few things The Entrust Group doesn’t offer (they are pretty standard for an SDIRA custodian though):

- Investments (although there’s a client marketplace where investors/sponsors can share opportunities)

- Investment advice

- Financial advice

- Legal guidance

Regulation

The Entrust Group focuses on alternative assets, but securities are still part of a well-diversified portfolio. Therefore, the company is regulated by the Securities and Exchange Commission (SEC).

Additionally, they are regulated by the CFTC, the Department of Labor (for employee benefit plans), and, of course, the IRS.

They also undergo a voluntary financial audit every year from Stovall Grandey and Allen.

Fee structure

The fees for opening and maintaining an SDIRA can make or break a custodian’s usefulness.

Make sure you understand the fees that SDIRA managers charge. Each manager can charge different fees for different transactions – the low cost option may not always be the best, but it is important to know when and how much you will be charged for the SDIRA services.

The Entrust Group is transparent regarding its account fee structure. You can see the rates for standard services on their fee portal.

The most relevant fees are:

- $50 to open an account

- $95 per purchase, sale, or swap of most alternative assets (excl. Real estate) – this is where a checkbook LLC, while costing more upfront to establish, can save on fees over the life of the IRA

- Free ACH transfers

- An annual fee as low as $199 and as high as $299 + 0.15% of total asset value

- $250 to close an account

The annual cost for someone who’s invested $40,000 using the Entrust Group’s SDIRA services would be around $344.

Assuming the asset’s value stayed the same, the first year’s costs are equivalent to a 0.86% fee. However, in the second year, the fees would drop to $199, which, at .49%, is similar to management fees charged by mutual funds/ETFs.

What we like

- Flexibility and diversity. SDIRAs give you control over your retirement funds. There’s a universe of investment options outside of the standard equity/bond offerings found in most IRA plans. If you’re an expert on movie theaters, why shouldn’t you be able to invest in them?

- Ability to invest in single assets. SDIRAs make it easier to invest in single assets, such as an individual property or business – managed IRAs will often invest in these types of assets using a fund approach that provides broad exposure but lacks a singular focus.

- Range of account types. There are seven account types available for The Entrust Group customers.

- Excellent online portal. The company’s platform makes setting up an SDIRA and investing easy.

- Debit card. Real estate investors can use The Entrust Group’s myDirection VISA to take the hassle out of standard property management expenses payment.

- LLC support. The Entrust Group supports both checking and non-checking SDIRA accounts (for checkbook IRAs, the investor is responsible for setting up the LLC, along with any annual reporting requirements).

- Alternative investment marketplace. You can access unique opportunities in private equity and real estate via Entrust Connect. (Keep in mind these offerings are from other companies, and Entrust Group provides no opinion on their investment qualities).

Potential risks

- Complex fee structure. Initial account setup fees can be higher than traditional IRA options (mutual funds/ETFs). Some SDIRA providers charge different fees for the different assets you hold, as well as some based on the value of your account. With The Entrust Group, the biggest influence is the value of the asset(s) you hold, but as they have a cap on their fees, there’s a max on how much variation there can be.

- With great power comes great responsibility. SDIRAs are riskier than managed IRAs or other retirement accounts (investing in individual properties or businesses carries a higher risk of capital loss). SDIRA custodians, unlike 401(k) plan administrators, don’t provide fiduciary oversight – make sure you know what you are investing in and are comfortable with the risks.

- No checkbook control. The Entrust Group doesn’t provide checkbook control; customers must set up bank accounts and LLCs outside of the platform (though the Entrust Group can recommend service providers that can assist)

- Mixed reviews for support. Some customers have flagged that contacting a human for help can be difficult. None of these complaints are recent, though, so they may have already been addressed.

Closing thoughts

SDIRAs have been around for a while, but are still not well understood. This lack of awareness shuts off access to many attractive investment options.

However, The Entrust Group offers many great resources for beginner investors and a portal that further simplifies investing with an SDIRA. One of our favorite parts is this list of 90+ alts you can buy with an SDIRA.

The Entrust Group is one of the pioneers of self-directed IRAs. They’ve been around since the 80s and are still managed by the original founder. So, if you’re interested, their downloadable guide is one of the best free resources to learn about SDIRAs —

Disclosures

- None of the authors of this issue are currently using The Entrust Group.

- Nothing in this piece should be considered financial, legal, or tax advice. SDIRAs are complex; please consult your financial advisor for answers to specific questions you may have about investing via SDIRAs.

- There are no The Entrust Group shares in the ALTS 1 Fund

This issue has been a sponsored deep-dive, meaning Alts has been paid to write an independent analysis of The Entrust Group. The Entrust Group has agreed to offer an unconstrained look at their business & operations. The Entrust Group is a sponsor of Alts, but our research is neutral and unbiased. This should not be considered investment advice, but rather an independent analysis to help readers make their own investment decisions. All opinions expressed here are ours, and ours alone. We hope you find it informative and fair.