Hi everyone,

This week, we’re exploring Vauban from Carta — a company that takes the heavy lifting out of starting a venture fund or spinning up a syndicate SPV.

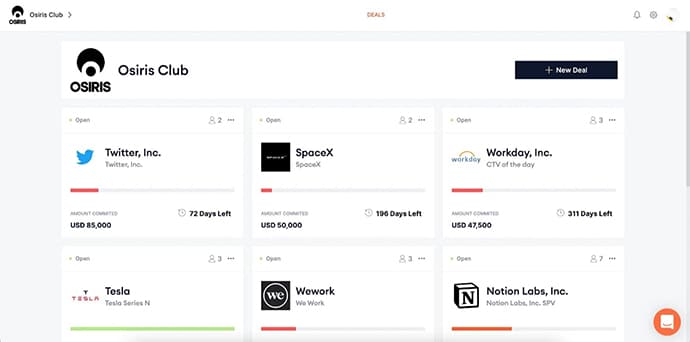

They make it easy for VCs, angel syndicates, and investors to manage all of their investment projects. Think of Vauban as the Shopify of the VC industry. You can basically build and manage all your deals and co-investors from a single online dashboard.

But how exactly does it work, and why is it a game-changer?

Quick Summary

- Who’s it for: Angel investors co-investing in deals, VCs launching funds or deal-by-deal SPVs, and founders fundraising their next round.

- What it costs: Starting from $2,500+

Table of Contents

The current state of Venture Capital

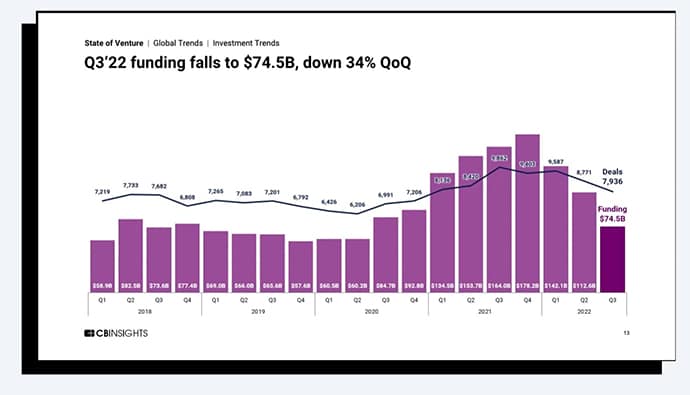

Startups – especially in the tech industry – have had a rough year.

Jobs are getting cut left and right, and borrowing money is becoming more expensive worldwide. This performance was mirrored in VC spending, down a massive 53% ($9b) YoY.

The last five years have been smooth sailing, so there’s a premium for people who’ve seen cycles & down rounds, who have built a track record, and managed a portfolio during difficult times. This is also an opportunity for new entrants who are brave enough to assume the risks.

We’ve all heard the stories about the angel investors that invested in the “Facebook”s of the world back in 2008 and made a gazillion dollars. In a downturn, innovation doesn’t slow down (and may even increase), but the real opportunity is that deals become less competitive, and you can muscle your way in to get allocation.

Tourist investors leave the space, gun-shy existing angels sometimes slow down, and more established VCs take longer with extended due diligence (or impose higher hurdles for startups to receive funding).

If you’ve been looking to get your foot in the door, you might find it open a crack…

The problem for investors

The experience of getting started for emerging managers or syndicate leads is not dissimilar to the experience of startup founders. Starting a VC requires capital, a professional network, fundraising, tools and software, and technical knowledge.

In the case of VC, the stumbling block (after capital) is usually access to technical knowledge. E.g., how and where do I set up a fund? Fund vs. SPV? How do I stay compliant?

Costs are another consideration. Hiring lawyers, accountants, and fund admins to structure your vehicles can be a huge barrier.

For established VCs and seasoned Angels, the challenges are a bit different. Cost is still a factor, as GPs have a responsibility to their LPs to keep operating costs low, and paying lawyers by the hour starts to feel irresponsible with digital solutions available. However, the quick reaction to hot deals and the ability to deliver a smooth experience for LPs, are the biggest considerations for more established investors.

That’s where Vauban comes in.

What is Vauban from Carta?

Vauban from Carta is the easiest way to launch & run your venture investing.

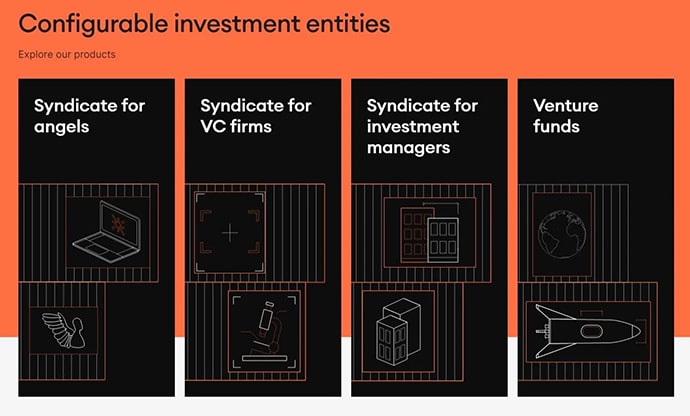

They provide everything investors need under one roof to create syndicates, SPVs, and venture funds.

The Vauban products can be used by almost everyone in the startup industry – VCs, angel investors, and founders. In each case, the platform’s goal is the same: to make the industry more efficient and cost-effective for all.

Vauban brings deals to life, removing the hassle of outsourcing lawyers, accountants, etc. How? They’ve digitized the workflow of this process and have brought specialists in-house to deliver a fast digital experience for setting up venture deals. Just like a merchant with products to sell would use a digital platform like Shopify to build a store, Venture investors with deals to invest in use Vauban to set up their VC.

You can set up a Shopify store in one afternoon and unlock the same powerful tools that a big box retailer has at their disposal. Vauban is similar — getting started takes about 5 minutes, and you’ll immediately have access to tools built for leading VCs and the most demanding institutional LPs.

The backstory

The Vauban story starts a decade ago when the two founders met during business school and tried to “hack the algorithms” by trading Forex on eToro. Like most who try to hack the market, they lost most of their money – but the two realized they made a good team.

Their next venture was another failure. They built a mobile app intending to be the “Tinder for fashion,” spent months designing a logo, and completely forgot to interview a single one of their users. (Not to mention, they knew nothing about fashion).

But these mistakes laid the groundwork for Vauban’s success.

Originally, Vauban’s platform let customers make their own hedge funds. But they soon found this structure just wasn’t working for them or their clients. So, they went through a funding round and pivoted away from hedge funds – losing 80% of their clients in the process.

But the switch to private markets and VC proved a good decision. Vauban’s clientele grew 300% in the year following. By July this year, Vauban had over $1B in AUM and was acquired by financial services firm Carta.

The team

Vauban was founded in London by French friends Rémy Astié and Ulric Musset.

How does Vauban work?

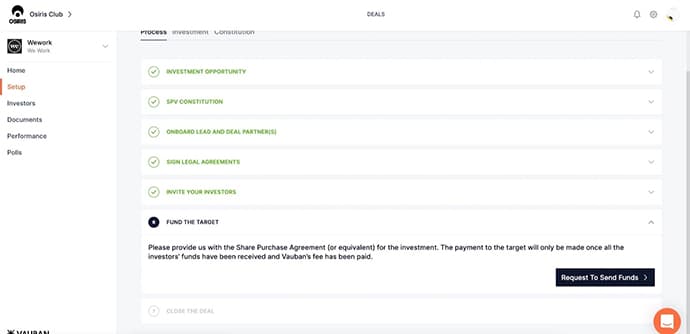

There are a few key use cases for Vauban, each with a slightly different process and cost, but launching your investment vehicle always follows these steps:

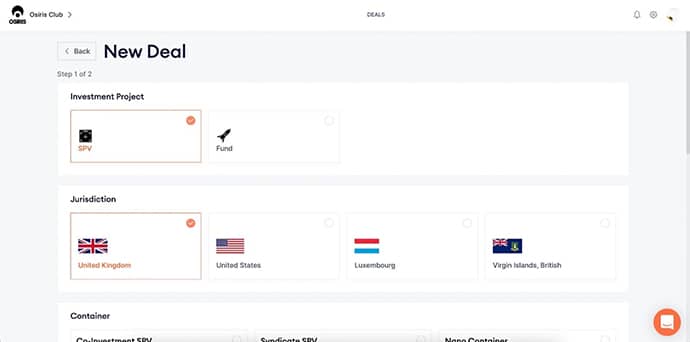

- Set up a new deal on your Dashboard.

2. Create a vehicle suitable to your investment needs by selecting jurisdiction, structure, carry, and more.

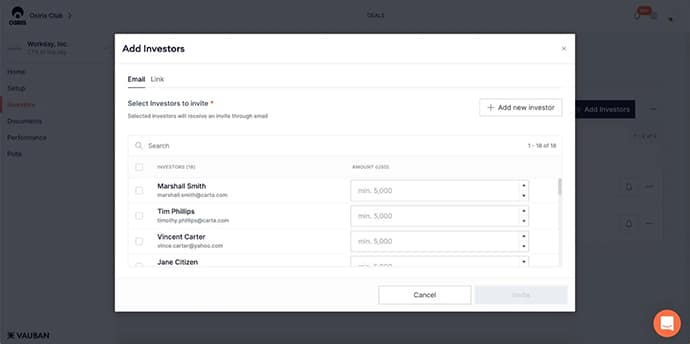

3. Invite your investors.

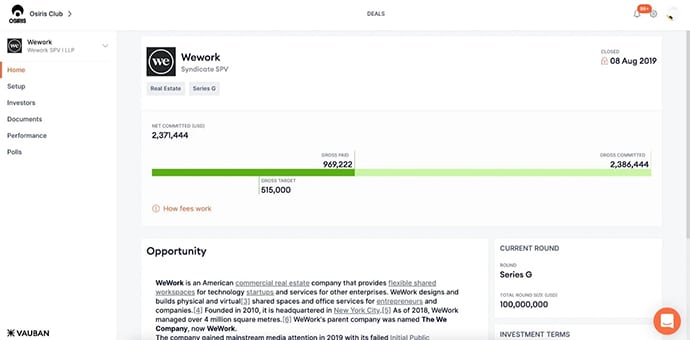

4. Track your progress.

5. Once all investors are onboarded, monitor the fundraising status from the deal page and deploy the capital into startups.

Who uses Vauban

Angel investors

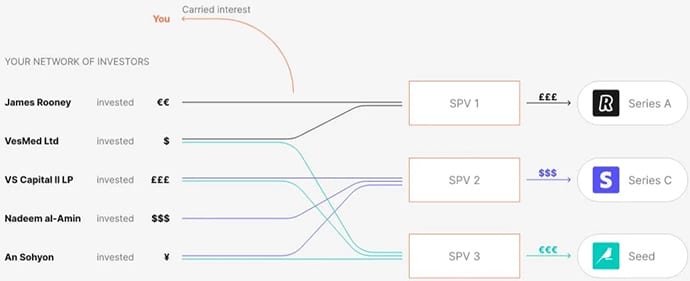

Vauban makes it considerably easier to launch your own angel syndicate to share deals with your network.

By joining forces, angels unlock allocation in companies with high minimum tickets and build a bigger, more diversified portfolio.

Creating an angel investor syndicate can be much smoother when using Vauban vs. traditional methods.

A neat feature for angel investors is the Carried Interest – where you get to keep a “performance fee” on successful opportunities you shared with others. You can think of it like a finder’s fee.

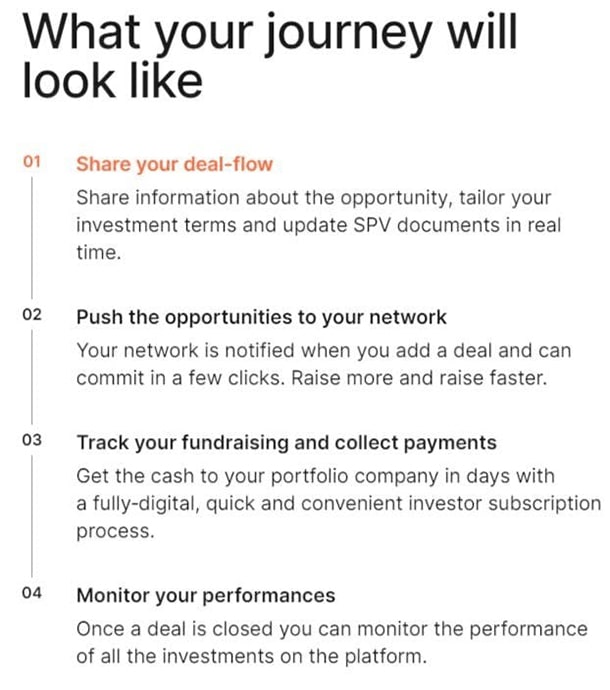

VCs

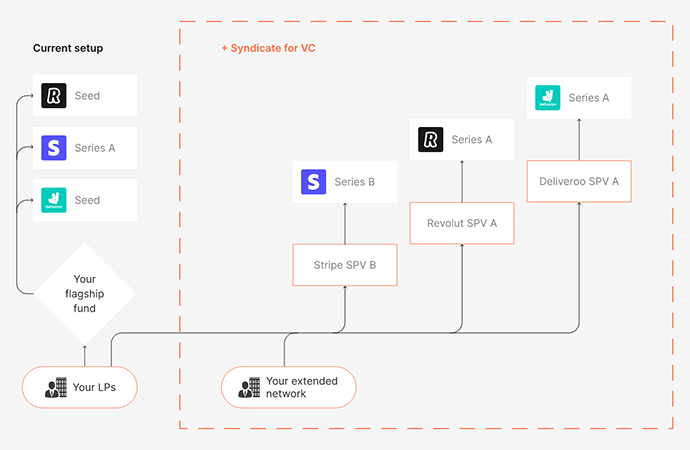

VCs can use Vauban as a full toolbox to run their VC firm and as a co-investment solution that can manage SPV formation and administration.

VCs can build and oversee a community of investors, add new founders to their networks, and continuously add capital to strong-performing portfolio companies on a deal-by-deal basis.

Vauban also supports launching a venture fund. This process is normally tiresome and lengthy, and leaves people at high risk of papercuts. But the Vauban platform claims they’ve automated this whole process, making it “ten times faster and cheaper”.

It takes VCs about four weeks to get their funds up and running using Vauban, as opposed to the 3-6 months it normally takes.

The Vauban service comes with everything a VC needs to manage their fund – fund formation and admin, investor onboarding and management, legal and accounting, etc.

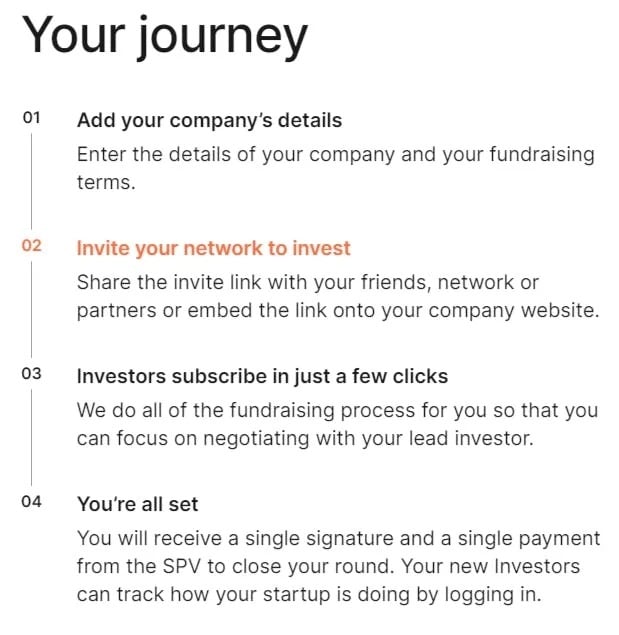

Founders

Founders can use Vauban to clean up raising their seed rounds from multiple small-ticket investors, and to continue growing their business.

Nobody likes a messy cap table. Using Vauban, startups can bundle customers, partners, and angels into one SPV — called a Cap Table Vehicle — as one line on the cap table.

A clean cap table can be crucial for raising future rounds from established VCs. It can simplify complications like governance issues with too many stakeholders having voting rights.’

Vauban in action: An African case study

Zachariah George was one of Vauban’s early adopters as part of his journey to capitalize on the developing nations in Africa. He identified that innovation was rife throughout these countries – but these ideas simply lacked the capital to realize their potential.

So, George created a VC accelerator called Startupbootcamp AfriTech.

His strategy was to enter African startups a bit later than normal – usually around Series B and C funding. To do so, he would use SPVs managed by Vauban. Their biggest success story was a Nigerian Neobank, Kuda, which is now valued at over USD $500m.

Vauban simplifies investing in international opportunities that could otherwise be an extremely difficult and bureaucratic process for VCs.

What sets Vauban apart?

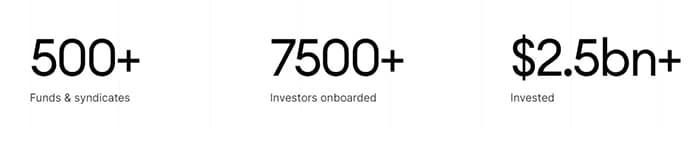

Vauban has built a strong history of supporting VCs. They’ve launched 500+ funds, onboarded 7,500+ investors, and managed $2.5bn+ in invested capital on the platform.

Vauban’s ace in the hole is its versatility:

- They offer the biggest suite of products for VCs and angel investors.

- The team can also support multiple domiciles, accommodating investors from the UK, USA, BVI, Luxembourg (tax havens), and so on.

- They’re actually holders of a world record. Using their platform, you can create an end-to-end SPV in just two and a half hours – faster than any competitors.

In general, digitizing the entire fund management/VC investment process onto one platform makes everything stable. Competitors without these perks, like Assure, have been taken out in the past year.

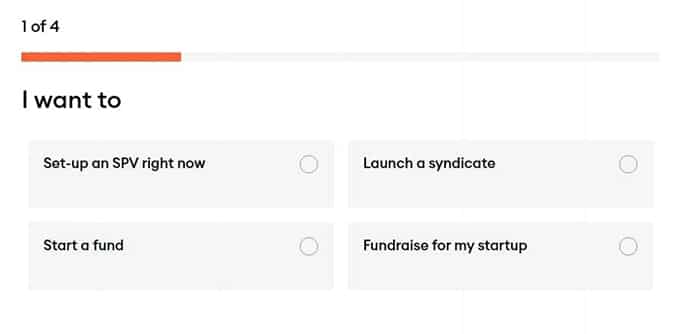

How to get started with Vauban

You can get started with Vauban in under five minutes.

You’ll need to outline your intentions – are you setting up an SPV, fundraising, etc.?

Then, you’ll have to fill out some basic info (name, phone number, and email), and someone from Vauban will be in touch to assist you on your journey.

Costs

The pricing structure of Vauban will vary depending on its use case. For syndicates/VCs/startups, there are seven different SPVs that Vauban offers.

The cheapest is $2,000 + 2%, and the most expensive package comes in at $35,000. The ideal SPV for international alt VCs, Delaware SPV, is US $8,000. For startups, Vauban charges $2,500 (UK) or $6,000 (US).

Launching a venture fund on Vauban starts at $20,500 for fund formation and yearly administrative costs of $31,600.

What we like

- Established clientele and company traction. Vauban has demonstrated strong customer growth and traction over the past few years. They’ve got over $2.5B invested on their platform from 500+ funds and syndicates.

- Impressive flexibility. Vauban’s services are impressively flexible. They cater to pretty much everyone in the private investment industry, and provide nearly every service you might need (investor onboarding, SPV creation/structure, banking, admin, etc.).

- One-stop shop. As we’ve learned with the ALTS 1 fund, there are a lot of moving parts when launching small private investments. Vauban’s solution consolidates many of the different solutions into one offering making management and integration easier.

- Clear points of difference. Vauban are the world-record holders for end-to-end SPV creation. Maybe we should call the Guinness World Records?!

- Fast action. Vauban are fast. They cut the time it takes to launch funds or create SPVs significantly. Pretty much every daunting task (raising funds, managing investors) can be made quicker via Vauban.

- Partnership with Carta. Vauban was acquired by Carta in 2022. This gives the platform some stability, as Carta is one of the largest financial infrastructure providers in the world.

- Trustworthy and strong customer support. Vauban has an excellent star rating (4.7) and reviews on the Trustpilot platform.

- Excellent UX. Vauban flaunts their user design as one of their more compelling features, and we agree. It’s seamless to navigate both the platform’s front and back-end.

Potential risks

- VCs and startups are struggling. VCs are spending less money, funding volumes or IPOs are down the second half of this year vs. the first half, tech startups are fledgling, and interest rates are rising. The environment for private investment is quite rocky at the minute.

- Navigating Regulations: Some Vauban products do not require regulatory oversight, but some do. Depending on jurisdiction, some have hosted solutions provided by Vauban, while others are “bring your own manager.”

- High startup fees. Compared to other methods of opening a VC fund or creating an SPV, Vauban is quite cheap. However, those just getting started may still be turned off by the industry’s hefty costs and high risks.

- BYOI (Bring Your Own Investment). As noted above, Vauban is a platform to make private market investments easier to manage, but they are not a source of deal flow. Users will need to identify investment opportunities and have their investor network in place to make full use of Vauban’s services.

- Switching costs. One of the great characteristics of a software business model is the sticky nature of the service. Once locked into a provider, there are time and expense considerations when switching to a competitor – interested users should do their initial research to determine if Vauban offers what they need at an economical price.

Final thoughts

Doing pretty much anything in the private investment world can be a serious pain.

Setting up a fund, syndicating deals, or raising funds is time-consuming, expensive, and filled with all sorts of complex legal and accounting requirements.

Vauban is the intermediary that wants to banish these annoying aspects of the industry. They are cheaper, more cost-effective, and trying to make lives easier.

Whether you’re deep in this industry or just interested in how it all works, you can reach out to Vauban and see what it’s all about.

Disclosures

- None of the authors of this issue currently own any shares or assets of Vauban/Carta.

- We have no Vauban/Carta shares or assets in the ALTS 1 Fund.

This issue is a sponsored deep-dive, meaning Alts has been paid to write an independent analysis of Vauban. Vauban has agreed to offer an unconstrained look at their business & operations. Vauban is a sponsor of Alts, but our research is neutral and unbiased. This should not be considered financial, legal, tax, or investment advice, but rather an independent analysis to help readers make their own investment decisions. All opinions expressed here are ours, and ours alone. We hope you find it informative and fair.