Today, we’ll look at something controversial — offshore finance.

Ever since the release of the Panama Papers, there’s been a renewed interest in rich dudes avoiding taxes by stashing their money in offshore accounts.

What many people don’t realize, however, is that there are perfectly legal ways to minimize your tax liability using offshore bank accounts. The practice is referred to as “tax evasion,” but it could just as easily be called “tax planning.”

This industry is enormous, and we can’t not talk about it. Economists estimate that $32 trillion in assets are held in offshore havens around the world. To put that in perspective, that’s roughly 188x the value of assets held in Amazon warehouses.

So, what exactly is offshore finance, and is it really as bad as its reputation?

Let’s find out 👇

Table of Contents

The Panama Papers

You might remember the Panama Papers from a few years ago, and the big international outcry that followed. But what were they all about?

In 2016, the investing world was rocked by the release of 11.5 million documents detailing all the shady stuff (mostly tax evasion and money laundering) that politicians, celebrities, and other rich, well-connected folks were up to.

The papers were leaked from the files of an obscure company called Mossack Fonseca — a Panama law firm that quietly created shell companies, which make it nearly impossible for the asset holders’ governments to tax them.

At its peak, Mossack Fonesca was the world’s 4th-largest provider of offshore financial services. With offices around the world, they set up over 250,000 shell companies, and commanded 5-10% of the global shell company market.

In 2014, somebody (nobody knows who) sent 2.6 terabytes of data to a German reporter, who passed it to the International Consortium of Investigative Journalists. For the next year, 100+ journalists pored over the documents, which dated all the way back to the 70s.

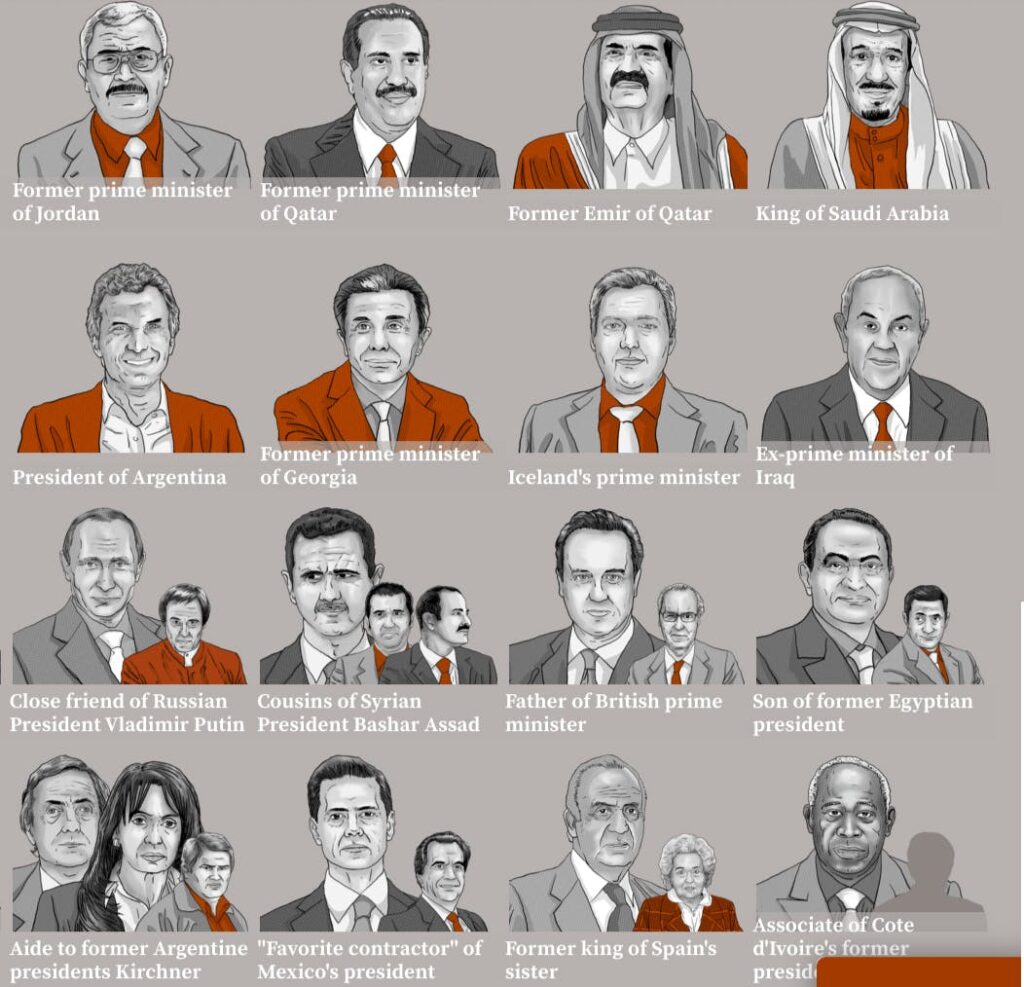

This was the largest financial leak in history. It revealed Presidents, Prime Ministers, Saudi Kings, and celebrities (including Donald Trump, Volodymyr Zelensky, Lionel Messi, Stanley Kubrick, and Emma Watson) all used shell companies to avoid domestic tax obligations.

A particularly intriguing paper trail was discovered pointing directly to Vladimir Putin. The docs showed Putin enriched his friends and family to the tune of $2 billion. Although Putin was never actually named in the docs, the paper trail conveniently went through the same Swiss ski resort where his daughter was married.

To be perfectly clear: Much of what the Panama Papers uncovered was perfectly legal! There are certainly legitimate reasons for wanting to set up companies offshore.

But some of the maneuvers were a bit like Hunter Biden’s Ukraine gig: Legal, but morally dubious. It was clear firm’s services were used to facilitate massive money laundering, tax avoidance and criminal activity, including drug and arms dealing.

After the leak, the firm went into damage control. Clients were pissed their privacy had been revealed, and moved their business to hundreds of other offshore finance firms in havens around the world.

In 2019, Netflix released a film about the Panama Papers called The Laundromat.

The founders sued Netflix to halt its release, but a US District Court Judge ruled the film was understood to be “fictionalized for dramatization,” did not defame Mossack and Fonseca, and was protected as free speech under The First Amendment.

One thing to remember: Mossack Fonseca’s services were hardly unique. They were one of the largest, but similar offshore financial services are offered around the world.

What is offshore finance?

An offshore finance haven is a state or country with ultra-low effective tax rates for foreign investors.

It’s basically any place that charges foreign companies very low or no taxes to park their cash, provides secrecy, and offers little financial oversight.

As you can imagine, these places easily become a destination for global wealth that would otherwise attract scrutiny or be more heavily taxed in home countries. And it’s money that, if taxed, could be used to improve the lives of millions.

Using tax havens is legal, but the devil is in the details. Taxpayers are supposed to record most offshore transactions in the their country of residence, but whether or not they actually do so is a whole other story. Offshore finance firms look the other way on tax matters, and actively protect the identities of their account holders as best they can.

The world’s most popular offshore finance havens

The Cayman Islands 🇰🇾

The British-owned Cayman Islands are like Mecca for the offshore world. There’s no property, income, payroll, corporate or capital gains tax.

People have been taking advantage of this for decades, and it’s benefited the territory tremendously: The Cayman Islands has the highest standard of living in the Caribbean, with a GDP per capita of $91,392. That’s over 50% higher than the US, and one of the highest in the world.

Ken Taves

In 1999, the US Treasury and FBI were on the trail of a global credit card fraud ring. The ringleader was a guy named Ken Taves, who charged nearly a million credit card holders over $45 million for, uhh, adult internet services that his “company” never provided.

To hide the income, the business transferred $25 million to an offshore account in the Caymans. Normally this would be a safe haven for criminals and illegal businesses. But thanks to global pressure, the FBI broke through the nation’s financial secrecy shield.

Taves went to prison. Later a slew of OECD countries banded together to force the Caymans to adjust their secrecy laws.

Ken Taves is still around today. He lives in Malibu, and has shifted his life to “wellness.” He’s got an interesting Instagram and personal blog.

The Colombian Cartel

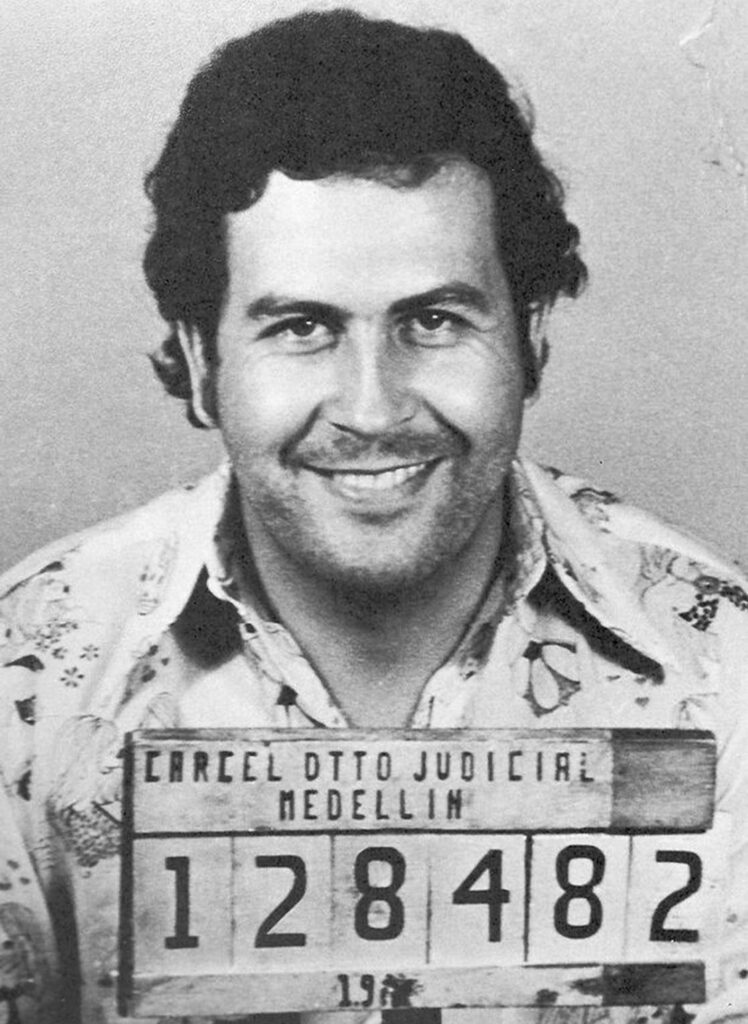

You’ve probably heard of the Medellin Cartel; the infamous Colombian cartel headed by Pablo Escobar. At its height in the 80s, the cartel controlled most of the world’s cocaine trafficking, and used the Caymans to stash their cash.

It’s estimated that the cartel laundered over $10 billion through the Cayman Islands between 1970 and 1980.

The cartel also owned Norman’s Cay, an island in the Exumas used as a stopover base for smuggling coke into the US. This is the same island Billy McFarland wanted to use for the Fyre Festival, but was rejected. (Note: If you’re looking to buy an island, nearby Saddleback Cay is on sale for $11.8 million).

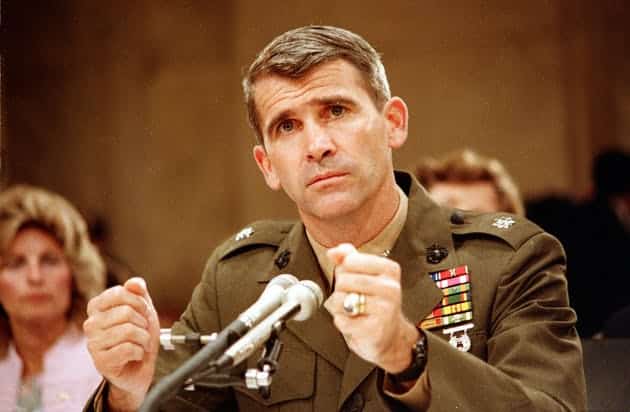

The Iran-Contra Affair

The Iran-Contra affair was a political scandal in the US during the Reagan Administration. Members of the National Security Council sold arms to the Iranian government for $48 million.

This was problematic because Iran was the subject of an arms embargo, so selling them a whole bunch of weapons to fight Iraq was a big violation. Oh, and the proceeds were then used to fund Contra rebels down in Nicaragua. Cool stuff!

Anyways, the proceeds of the Iran-Contra affair were also held in a bank in the Cayman Islands.

The resultant hearing was a bit farcical. Oliver North, the man responsible for stashing the illegal funds in the Caymans, destroyed hundreds of documents. Most of the people involved were prosecuted, six of them were eventually pardoned by George Bush.

Belize 🇧🇿

The tiny Central American/Caribbean nation of Belize is another popular financial haven.

It’s easy and completely legal to incorporate a company in the country. Offshore corps only need one director, and they don’t even have to be a Belize citizen.

Best of all? These offshore businesses are completely exempt from all forms of taxation. And in case that isn’t enough to wet your whistle, Belize has also eliminated stamp duty and has some very powerful privacy laws for international banking.

Ireland 🇮🇪

Few industries utilize offshore finance havens quite like tech. Apple, Google, and Facebook (Meta) all have large Irish operations.

Why?

Ireland offers some of Europe’s most advantageous tax rates (just 15%). This is less than half of America’s upper tax bracket. In 2011, Apple used an Irish tax loophole to pay just 0.05% tax on an astounding $22 billion in profits it earned.

An outcry led to the TCJA repatriation tax, which is a one-time tax on past profits of US corporations’ foreign subsidiaries. Already America’s largest taxpayer, Apple repatriated $285 billion back onshore, resulting in a 38 billion dollar tax bill.

Bermuda 🇧🇲

Bermuda isn’t just known for making ships disappear — they can also make your taxes disappear.

This remote British territory in the North Atlantic (sensing a theme yet?) has no taxes on personal income, corporate profits, capital gains, or dividends.

Switzerland 🇨🇭

Ah, Switzerland: Neutral in wars, neutral in finances. The wealthy European nation offers a sweet combo of low corporate tax, and some of the world’s most rigid financial privacy laws.

Perhaps the wildest instance of secrecy comes from this famous tax haven.

In the 1990s, the country came under massive fire for its financial laws. A group of US residents launched high-profile civil lawsuits against several Swiss banking institutions, claiming that Swiss privacy laws had allowed Nazi officers to store the assets of Holocaust victims.

After their deaths, many holocaust victims had unclaimed finances, which Nazis plundered and hid in dormant Swiss bank accounts. This included funds, watches, jewelry, and even gold from the teeth of concentration camp victims.

The lawsuits were eventually settled. Switzerland came to terms with its “neutral” past, and Swiss banks agreed to pay out a whopping $1.25 billion.

Legal offshore finance

Again, to be clear, there are perfectly legal reasons to play the offshore game. Some do it for privacy, others do it to diversify their assets, and nearly everyone does it to minimize their tax liability.

Better tax planning

Tax advantages are the biggest reason people use offshore finances.

Many small countries offer huge tax incentives to attract investors and businesses to help boost economic activity within their borders. It’s only when people use offshore accounts to deliberately evade taxes that it becomes illegal.

In many cases, you’d be dumb not to do this on some level. Oxfam estimates that 90% of the world’s top companies use legal tax havens to save $483 billion each year. For context, that’s about the size of Poland and Finland’s GDP combined.

A 2020 public report from the Australian Tax Office revealed a full third of Aussie companies earning $100m+ didn’t pay any tax that year. And 168 of those hadn’t paid a cent since 2013. Yikes. (C’mon guys, we gotta pay for that healthcare somehow!)

Financial secrecy

In some countries, the banks cannot legally disclose details about bank account holders to foreign authorities. Where they draw the line depends on a bunch of factors, but in some places it’s pretty close to an omertà, where even Interpol can’t break through.

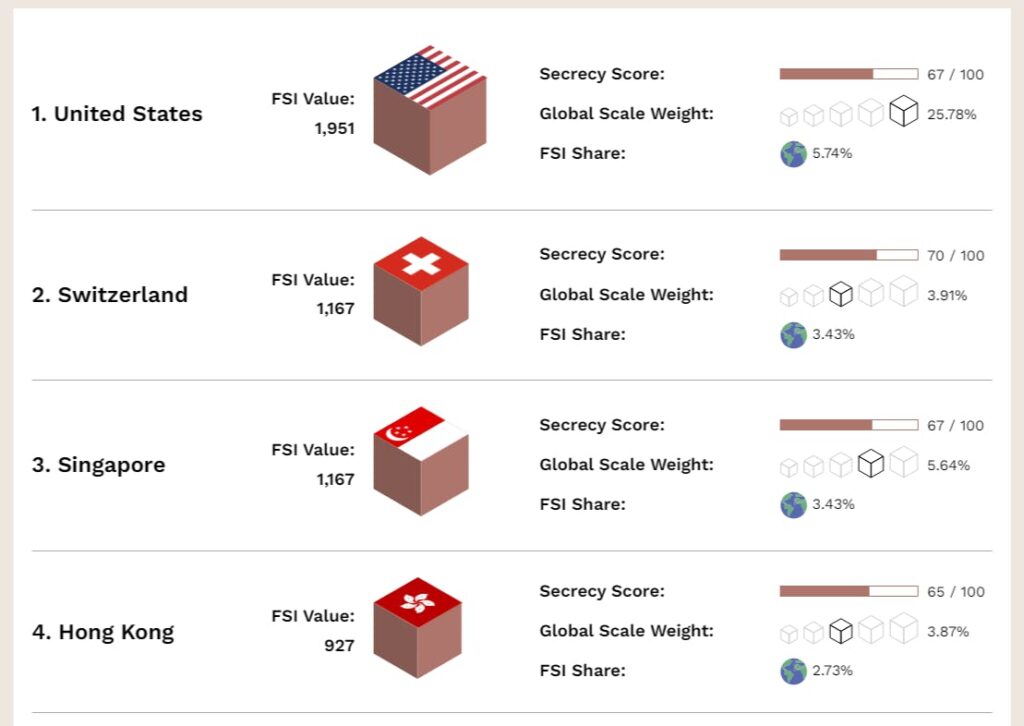

Financial secrecy isn’t the most honest sector of offshore finance. It fosters criminals and tax evasion. But to some extent, everyone has a right to privacy. According to the Financial Secrecy Index, the most “secretive” countries are actually The US*, Switzerland, Singapore, and Hong Kong.

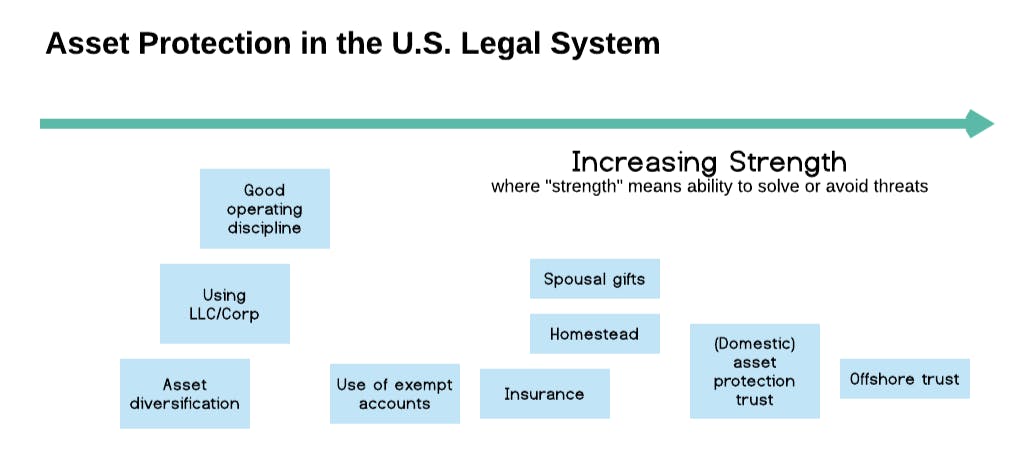

Asset protection

Asset protection is a bit different. It isn’t about keeping your money secret – it’s about controlling your possessions using legal loopholes.

It’s easy to forget that many nations still persecute people (and go after their finances) based on political and religious beliefs.

Individuals can protect assets from debtors and governments by signing the ownership of those assets to an offshore legal entity.

Risks of offshore finance

Ethics aside, there’s a lot to be careful of here.

Developing nations become financial havens to incentivize investment. However, these nations are often more prone to civil conflict and unrest.

Take the Arab Spring in 2010. At the core of the unrest were anti-government corruption protests that ballooned into full-blown conflict across several countries.

The impact of the Arab Spring on offshore investors was also dramatic. Middle-Eastern stock markets fluctuated wildly, foreign direct investment stagnated, and infrastructure projects were cut short.

In a more recent example, the ongoing war between Russia and Ukraine has had significant ramifications for offshore investors. Thanks to international sanctions, the Russian Ruble plummeted 40%, and international investors quickly got cold feet.

Oil companies were the first to pull out:

- BP withdrew its 20% stake in the Russian oil company Rosneft, causing a loss of nearly $25B.

- ExxonMobil halted a massive project on a Russian island, Sakhalin-1, costing them $3.4B.

How to get started in offshore finance

Plenty of legitimate businesses can help you gain more financial freedom and privacy without turning you into an evil supervillain.

- The Offshore Company is one of the largest and oldest offshore providers on earth. As the name implies, they have been helping businesses and HNWIs establish offshore trusts, bank accounts, corporations, and LLCs for over a century.

- Flag Theory is like an offshore compliance consultant. They provide compliance services to businesses that want to offshore their finances. They operate in 50+ jurisdictions and aren’t tied to any particular country.

- Sovereign Research and Advisory Group offers a team of experts to help you with offshore tax and estate planning. The team focuses on legal asset protection through portfolio diversification.

- Nomad Capitalist is another leading offshore consulting firm. The team espouses a low-tax expat lifestyle, and has experience in law, administration, and finance. Their founder is fond of blocking people on Twitter who disagree with him, but they know their stuff.

- International Man was founded and run by Doug Casey and specializes in asset seizure protection. They protect business owners and HNWIs from losing their assets should their home country fall into economic or political turmoil.

Closing thoughts

Offshore finance is a pretty big deal. Governments are missing out on billions in tax revenue every year.

Estimates are difficult because this stuff is so secretive in the first place, but tax havens cost the US alone an estimated $70 billion a year — around one-fifth of its total corporate tax revenue. And somewhere between $8 – $37 trillion of personal cash is stashed away in global havens.

In the hedge-fund industry, it is considered perfectly normal to domicile funds in the Caymans or the British Virgin Islands. And this stuff isn’t just restricted to Caribbean islands. As Bloomberg’s Jesse Drucker reported earlier this year, thanks to its relatively lax disclosure laws, even America is emerging as a major tax haven and destination for offshore funds. Anonymous cash is moving in and out of the US all the time, with American lawyers and financial intermediaries helping to facilitate the flow.

But offshore finance still gets a bad rap. There are many reasons why people and businesses would want to hold assets and bank accounts offshore. The right to privacy is very important, and not everyone with an offshore account is evading taxes,

The IRS is well aware that much of the world’s wealth is hidden in offshore accounts. In fact, the IRS has a special division dedicated to catching tax evaders with hidden offshore accounts. And they’re getting pretty good at it. In 2013, the IRS announced the Offshore Voluntary Disclosure Program (OVDP), which provides a compliance avenue to resolve income tax liabilities relating to foreign financial assets.

It’s essentially an olive branch; a form of amnesty for those who may or may not be doing something that is quite possibly but also definitely sort of illegal. 😄 You’ll pay a penalty, but hey, it beats prison!