IPOs by P2P-lenders in Europe | €500m raised by crowd investing in Germany

Tomorrow I’ll be in Milan to give a key-note on Alternative Finance trends in Europe at an event of Politecnico di Milano where the latest numbers of crowd investing in Italy will be presented. Next week I’ll share all the details on the Italian Alternative Finance market.

This week I will focus on the alternative finance market in Lithuania with Vytautas Šenavičius. Lithuania is aiming to be the fintech hub in the CEE-region and has very supporting Fintech / crowdfunding / ICO regulation.

Further news this week:

- Lithuania launches a remote Fintech licence

- Seedrs update on Secondary Market – 2.990 transactions

- European P2P lending platforms will launch IPOs

- German SMEs raise €500 million through crowdfunding

Table of Contents

Lithuania launches a remote Fintech licence

The Lithuanian government is planning to position Lithuania as the main Fintech hub in the CEE-region. The country already has very supportive regulations for companies starting a crowdfunding platform, or launching ICOs. The latest development is the introduction of a remote Fintech license.

Bank of Lithuania

The Bank of Lithuania – the country’s regulator – has introduced a procedure which will allow companies to apply remotely for fintech licences. The aim of this regtech tool is to help the process of submitting and managing applications for e-money and payment institution licences – and make the country “become even more approachable for Fintech innovators across the world”.

Access to European market in 3 months

International companies interested to access the EU market will be able to apply directly online for a variety of financial licences valid across Europe. According to Invest Lithuania, it means companies will get the “convenience of being able to set up their business from wherever they are”. When all necessary documents are submitted, it takes three months to obtain the licences, compared to 12 months normally in other EU countries.

Virtual limited liability companies

Lithuania’s Fintech ecosystem now has over 120 firms. In April, it became the first country to offer entities from around the world the opportunity to register and manage companies using blockchain. Called virtual limited liability companies (VLLCs), the idea is to offer a sandbox regulatory system that helps newcomers to set up operations. In January, the Bank of Lithuania unveiled a regulatory and technological sandbox platform, called LBChain, for blockchain testing.

Read also the detailed overview and challenges of Lithuania by lawyer and government advisor Vytautas Šenavičius in the second part of this newsletter.

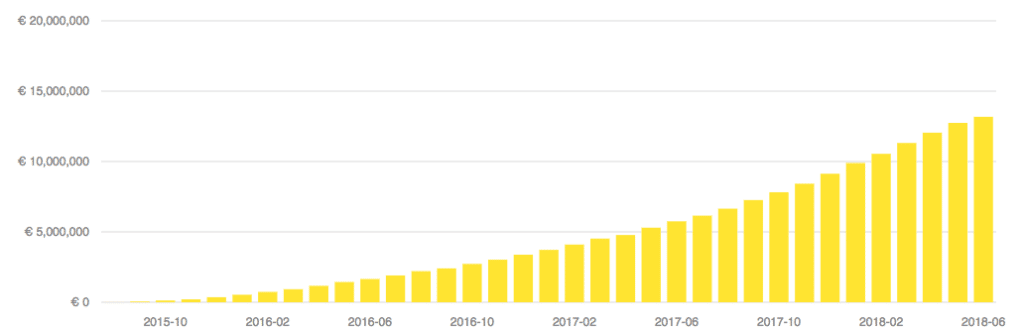

Seedrs update on Secondary Market – 2.990 transactions

Several European P2P platforms are planning an IPO. The first platform that publicly announced their IPO is the Portuguese peer-to-peer lender Raize. Their IPO will be the first in Europe for a P2P lender and is also the first IPO in Portugal since 2014. The German online lender Creditshelf is planning to be listed at the Frankfurt Stock Exchange later this year.

UK P2P-lenders

The biggest European P2P platforms are located in the UK and Funding Circle, Zopa and RateSetter are reviewing the possibilities for an IPO.

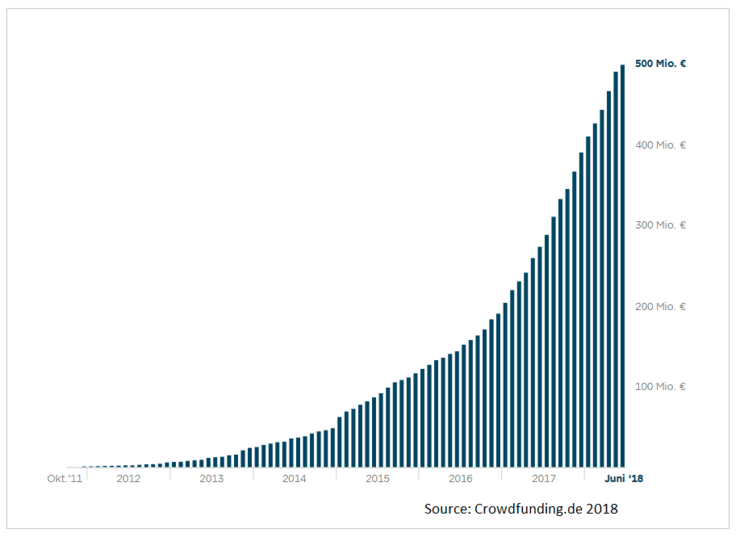

German SMEs raise €500 million through crowdfunding

Research from Crowdfunding.de shows that the German crowdfunding market, passed the €500 million raised for SMEs.

Key insights of the report:

- The €500m was raised since 2011, but in the last 15 months half of the funds are raised.

- Real estate projects are currently representing the fastest-growing and highest-volume of crowd investment.

- There was a shift from silent participations (specific way of investing in German companies) to subordinated loans.

- The three largest platforms account for more than 50% of the total volume (EUR 280 million).

- Most of the crowd investments are still “active”.

- Berlin is the crowdfund capital in Germany with an inflow of EUR 96 million.

Full report can be downloaded here (PDF).

Expert of the week : Vytautas Šenavičius (Lithuania)

What is the current status of Alternative Finance?

Lithuania is aiming to be the fintech hub in the region. Hence alternative finance as fintech alternative for traditional financing is one of the top priorities. Currently there are two largest trends for alternative financing in Lithuania : ICO and crowdfunding.

ICO (Initial Coin Offering)

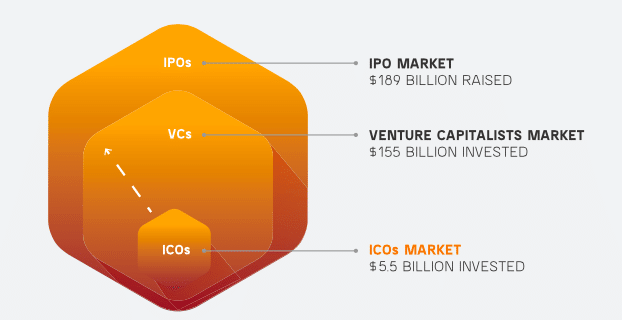

Regarding ICO Lithuania have recently published guidelines that include taxation, supervision, audit issues related to ICO. Ministry of Finance also published news that Lithuania introduces world’s first security ICOs platform, opens up for global blockchain based businesses

Hence Lithuania is becoming more and more open and certain (from legal side) jurisdiction within EU to raise capital through ICO. As of 2017 Lithuania also has Law on Crowdfunding which could be applied for ICOs. Together with additional guidelines it makes safer for investors, transparent and compliant business environment.

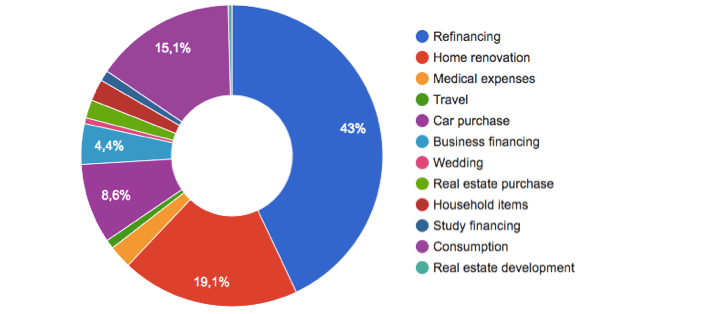

Crowdfunding

Last year the number of crowdfunding platforms doubled in Lithuania. Currently there are six platforms in the public list of crowdfunding platforms. A number of real estate crowdfunding platforms are entering the market (including Rontgen, Profitus, Savy).

Law on Crowdfunding allow to issue securities through the crowdfunding platforms. Crowdfunding platforms, such as Finansų bite verslui (securities tokens through DESICO project), Rontgen, Savy, Profitus (bonds and other traditional securities) are planning such activities in the future.

Can you give us an inspiring case from your country?

Lithuania introduces world’s first security ICOs platform, opens up for global blockchain based businesses. Blockchain-based startups will be able to access the DESICO licensed and regulated crowdfunding platform. Such project is extremely important as ICO industry lacks investors’ protection and legal certainty.

Moreover, efforts to develop fintech jurisdiction in Lithuania could be an inspiration for other smaller member states. Fast licensing, newcomers programme for startups, legislatives initiatives from Ministry of Finance, Ministry of Economy, Bank of Lithuania boost the alternative finance business in Lithuania.

What are the biggest obstacles for growth?

Lithuania is not a large member state. Hence one of the obstacles when we talk about traditional crowdfunding is the fact that most of the investors are from Lithuania. Hence it is still an obstacle to raise capital from abroad.

Regarding P2P business there are still some obstacles for the legal entities to invest into consumer credits through P2P platforms. However, the Ministry of Finance is aiming to solve those issues.