€8 Million Equity Crowdfunding Limit Germany

A warm welcome to my updated (CrowdfundingHub) newsletter. You subscribed earlier and after a pause I am restarting with a new layout and a weekly update on trends in Alternative Finance in Europe. I hope your are still interested in Alternative Finance news. If you are not interested anymore, you can always unsubscribe at the bottom of the page – Ronald Kleverlaan

This new version of the newsletter has a different format then the previous one. Every week I will personally share some of the most important international stories with trends in Alternative Finance. I will also invite a local European expert to give an overview on current developments in their country.

Last week I was at Cambridge Centre for Alternative Finance for their annual event to discuss global trends in Alternative Finance. This year one of the keynote speakers was Queen Máxima from the Netherlands with a speech on digital transformation and financial inclusion. Next week I’ll post a longer summary of the findings in this newsletter.

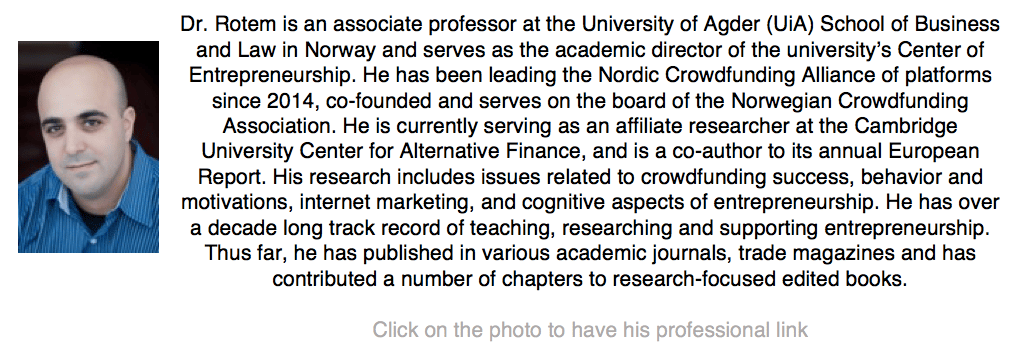

This week we will focus on the status of Alternative Finance in Norway with Rotem Shneor.

Further news this week:

- Crowdfunded electric car Uniti has over €50m in pre-orders

- Germany raises the Equity Crowdfunding Limit to €8 Million

- Conference CCAF: Reimagining Alternative Finance: Global perspectives and local insights

- French renewable energy crowdfunding platform Lumo sells to Societe Generale

- Prepare Yourself! The Security Token Tsunami Is About To Hit

- Expert of the week : Rotem Shneor (Norway)

Table of Contents

Crowdfunded electric car Uniti has over €50m in pre-orders

Uniti, an electric car project from Sweden that raised growth capital via several investment crowdfunding rounds, reported to have received pre-orders of €50 million for their first vehicle that will cost between €14,900-€19,900. A success story from a company that has been active in using their customers to raise funding and keep them engaged.

Serial-crowdfunding

Uniti first offered shares in its company on FundedByMe in 2016 and raised €1,2 million at a valuation of €9,8 million and 567 investors from 45 countries participated in the campaign. Following an investment round in Q1 of 2017, 17 international investors became shareholders in Uniti. The round closed in Q2 with a total amount raised of €600,000 at a valuation of €20 million.

In 2017, Uniti launched a self-crowdfunding campaign that received the backing of 950 investors from 37 different countries. In total the company has raised 35 million Swedish krona (€3,4 million) to develop the first version of the car.

Brewdog – (serial) crowdfunding champion

Another great example of a company that raised growth funding through several crowdfunding investment rounds is the Scottish BrewDog. Through their “equity for punks” program they have raised already £41 million by 50.000 investors before accepting investment from an external investor boosting the valuation of the company to over £1 billion (2765% ROI for early crowd investors).

With their latest funding round (Equity for punks V) they raised almost £20 million extra, making it the biggest equity crowdfunding company worldwide.

Germany raises the Equity Crowdfunding Limit to €8 Million

Last Friday the Cambridge Centre for Alternative Finance organised their annual event with a selective group of international policy makers and researchers on Alternative Finance. This year one of the key-note speakers was Queen Máxima from The Netherlands.

Fintech for Inclusiveness

A lot of forum talks and key-note presentations, including the talk of Queen Máxima, where focusing on the possibilities of Fintech for financial inclusiveness.

The second focus was regulation. How can regulators and industry participants work together to build a sustainable a stable industry.

Next week I will share a more detailed overview of the sessions.

French renewable energy crowdfunding platform Lumo sells to Societe Generale

The French renewable energy crowdfunding platform Lumo, one of the first investment platforms in France, is acquired by the French bank Societe General.

A strong sign the French banks a focusing more on Alternative Finance.

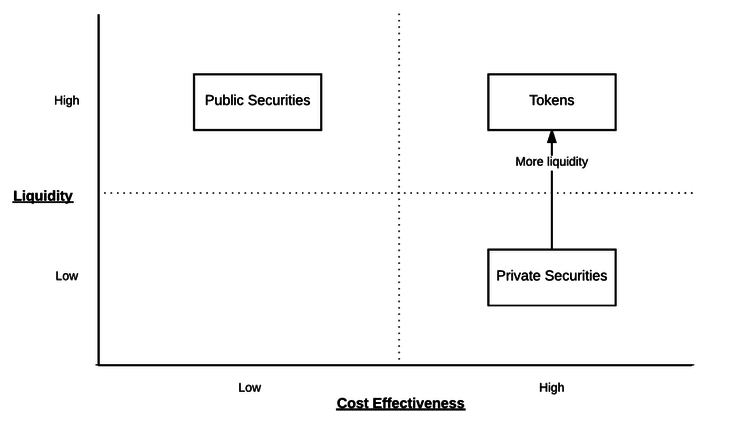

Prepare Yourself! The Security Token Tsunami Is About To Hit

The next phase in raising capital will come from Security Token Offerings (STO), a specialized form of ICOs in which companies will provide tokens which are connected to an asset such as shares in a company. It will take some time to see the first examples, but in 2019 we will see several good structured and professional companies offering these fundraising models. Some people even suggest that this model will (partly) replace the Venture Capital industry in the future and are giving very good reasons why the traditional security industry is a mess and should be replaced by security token solutions.

Desico

One of the organisations I am advising in this new industry is Desico. They are one of the front-runners in Europe. It is very interesting to see that with active support of the Lithuanian government this company is setting the standard for security tokens in Europe. Based on their framework, companies can start their own ICO round through an online platform, just as how this is currently done by crowdfunding campaigns and Desico will manage all the administrative, legal and financial issues around the offering. This is specifically interesting for companies planning to do a smaller ICO (€250k-€5m).

Important trends supporting this development

Lou Kerner wrote an interesting article about the main trends that support this development and explains why security tokens will be very important in the near future:

- The Smartest People In Finance Are Quitting Wall Street & Devoting Their Life To Crypto – A lot of high-profile bankers from companies as Goldman Sachs and Credit Suisse are moving to this new industry after they have seen the “Crypto-Light” and understood the potential.

- People Want Liquidity – People pay for liquidity. All else being equal, the more liquidity you give investors, the lower return they require. It will also make it easier for investors to move into a new asset class.

- The Security Token Rails Are Being Laid – The mechanics of how Security Tokens are made, traded, custodied, & remain security compliant, are complex. That’s why the few STO’s to date have succeeded. But that’s changing and a number of companies are creating the frameworks and standards that can be used by companies that want to start an STO. A good overview can be found by these articles of Tatiana Koffman and Christopher King.

- We’re Entering The Golden Age of Securities Innovation – With the digitization of securities, and the use of smart contracts, securities can be more innovative. It is simple to digitize existing shares in a fund, but securities can be structured based on complete new models.

- Security Token Regulations Have Been In Place For 85 Years – A comment based on US law, but also valid for European countries. Investment in securities is structured in law already for a long time. We even have a pan-European framework for it: MiFID2-II. The basics are clearly understood. Specific additional adjustments will be made if necessary.

- I Want My MTV — Fractional Ownership Will Be Huge – Shares are fractional ownership of a company. While fractional ownership’s not new, tokenized private ownership solves for both the trustless verification of ownership as well as the liquidity of that ownership, ushering in an era of unprecedented growth in fractional ownership. Fractional ownership of art and real estate is already possible. We’re going to see fractional ownership of songs, movies, TV shows, restaurants, bikes, etc.

- Enhanced Transparency Equals Enhanced Value – Tokens can be made very transparant through a blockchain solution providing more transparency.

- The Security Token Meetup – It’s All About The Communities – STOs are all about creating communities and involving the, STOs provide also solutions for existing and new communities to give (financial returns) back to the people who are involved and active in the communities.

Expert of the week : Rotem Shneor (Norway)

What is the current status of Alternative Finance?

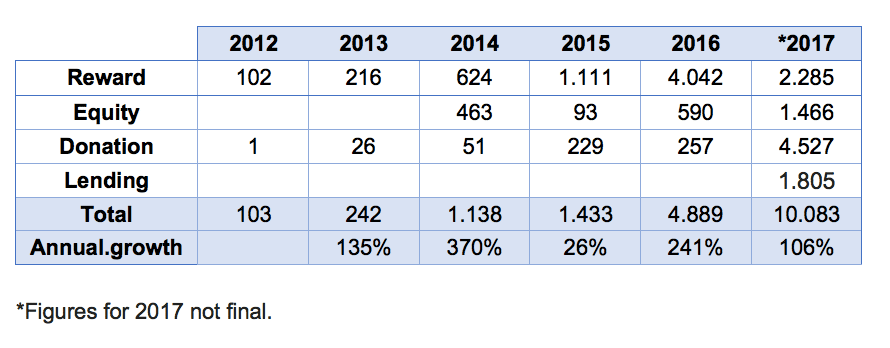

The market is growing fast, but still represnts relatively small volumes, reaching EUR 10.1 million according to current estimates for 2017, growing from EUR 4.9 million in 2016.

Only in 2017 and 2018 the financial authorities have began to approve concessions to investment model platforms. Currently, there is only one P2P Business lending platform operating with concession, while five other platforms are waiting for such concession (at different stages of progress). One platform, has began operting in P2P Consumer lending via a proxy license of a partner financial services firm.

In the equity domain, platform require a MiFID license, with two active platforms holding such license. There is an additional platform operating without such license but is under review of the financial authorities with an uncertain future.

Hence, thus far, most activity has revolved around donation and reward crowdfunding with five active local platforms and a few international platforms. A number of new local platforms are expected to launch in near future. Only in recent years have we seen the begining of a fast growing investment crowdfunding activity to take place.

Can you give us an inspiring case from your country?

Unique and innovative – Crowdfunding Course at University of Agder in cooperation with national government entrepreneurship support agency – Innovaton Norway. It will run as a master level course, where students will learn both theory and practice, and will build crowdfunding campaigns for real ventures. At the end of course, these ventures will decide whether to go live with campaigns or not. You can find here an example of the course contents.

It may be interesting to note that banks are quite active. Some of the largest banks have launched own platforms- DNB launched Startskudd (reward and donation), SR-Bank group owns both a P2P Business lending platform (Monner) and a donation platform (Spleis). And Cultura Bank expected to launch own donation platform soon. Others are also expected to follow.

Some donation platforms have partnered with schools for donation days, allowing pupils to manage their fundraising for good causes via the platform in dedicated pages. An effort that has been quite successful in previous rounds.

Finally, when it comes to campaigns and platforms we dont really have anything out of the ordinary (for the time being). But since Norwegians are mastered at elegant simple solutions and design, we may expect some interesting devellopments in the future.

Extract from : “Crowdfunding: Status and Prospects” report written by ROTEM SHNEOR and TOR HELGE AAS (Norwegian version).

In English : Crowdfunding has the potential to become an important capital acquisition method for entrepreneurs and project owners in the Nordic region.

What are the biggest obstacles for growth?

Non-crowdfunding specific regulation with respect to investment models, which leads to conservative and restrictive interpretation of existing laws. These laws do not properly fit the crowd economy reality and need to be adjusted.

Most people are insufficiently educated about the prospects, benefits and risks associated with crowdfunding. Some efforts have begun in this direction including seminars, conferences, university guest lectures, and a new crowdfunding course to be launched at University of Agder in Fall 2018.

Event : Monday 13th of August 2018

Norwegian public have investors have enjoyed from investing in high margin investments for a few decades in the Oil&Gas and Real-Estate industries, which has reduced their interest in early stage high risk investments in general, and in other sectors in particular. This requires some cultural change that will take some time to implement, in willingness to include high risk investments in portfolios, as well as understanding the risks involved.