537 ICOs Raise $13.7 Billion in 2018 | ICO regulation

It was a busy week. Based on talks at Cambridge University we create new research collaboration, I gave an interview about our Altfinator project and advised some ICO projects. We also started a new initiative in The Netherlands to grow and professionalize the Dutch Alternative Finance industry to a higher level in the coming 3 years. After the summer this initiative will be officially launched.

For this newsletter I have chosen several articles on ICOs, one of the new types of fundraising. This industry is developing fast and companies have raised billions of euros. In the newsletter some input on the regulations and an overview of the largest global ICOs.

This week we focus on the status of Alternative Finance in Switzerland with Simon Amrein.

Further news this week:

- UK Government Ups Crowdfunding without Prospectus to €8 Million

- First 5 Months of 2018 Saw 537 ICOs Raise $13.7 Billion

- ICO regulation in Europe and Asia

- Altfinator Helps Innovative European SMEs Gain Access to Alternative Finance by Educating SME Advisors

- 2nd EU Alternative Finance Research Conference

Table of Contents

UK Government Ups Crowdfunding without Prospectus to €8 Million – Matching Germany

A new report by PwC Strategy& and the Crypto Valley Association provides an update on the global initial coin offering (ICO) market. In the first months of 2018, 537 ICOs raise combined $13,7 billion, more than all ICOs which took place before 2018 combined.

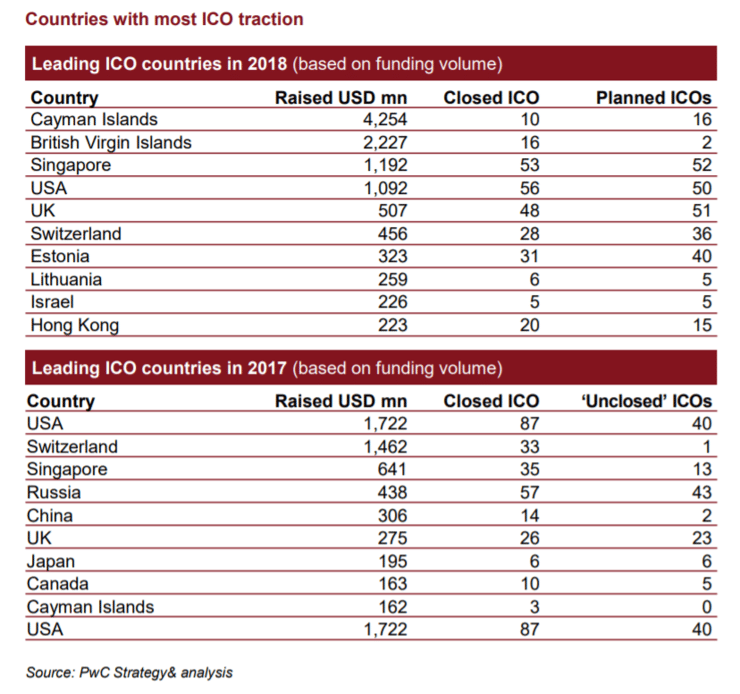

Switzerland, US and Singapore largest ICO countries

While Switzerland, the United States, and Singapore continue to be leading centres for ICO activity, the United Kingdom and Hong Kong have emerged in 2018 as increasingly significant actors within the nascent global market.

Smaller jurisdictions including Liechtenstein, Gibraltar and Malta are also following in the footsteps of Switzerland to position themselves as ICO-friendly hubs

Larger ICOs

Since November 2017 several large scale ICOs have entered the Top 15, dwarfing previous records from 2017, with Telegram ($1.7 bn) and EOS ($4.1 bn), the first true ICO Unicorns have appeared.

The largest 15 ICOs in the report mentioned were:

- EOS – $4.1 billion

- Telegram – $1.7 billion

- Dragon – $320 million

- Huobi – $300 million

- HDAC – $258 million

- Filecon – $257 million

- Tezos – $232 million

- Sirin Labs – $157.9 million

- Bancor – $153 million

- Bankera – $150.9 million

- Polkadot – $145.2 million

- The DAO – $142.5 million

- Polymath – $139.4 million

- Basis – $133 million

- Orbs – $118 million

3 types of ICO regulation

ICO regulation continues to emerge around the globe: many jurisdictions have issued their respective guidelines and crypto regulation.

By now, three models are emerging:

- US (securities-driven)

- Europe (balanced)

- Asia (binary)

ICO replacing VC funding

ICOs continue to crowd out traditional VC funding, especially in technology and Blockchain-related startups. Hybrid models (combining classic VC/PE funding and ICO) are increasingly establishing themselves as a valid funding alternative

The full report can be downloaded here (PDF).

ICO regulation in Europe and Asia

The international law-firm Osborne Clarke created with their local offices a detailed overview of the ICO regulation in a number of European and Asian countries.

Legal classification of a “Token”

The new form of corporate financing for digital companies via Initial Coin Offerings (“ICOs”) raises several questions in the field of financial regulatory law. What is the legal classification of a ‘Token’? What are the legal “pitfalls” for both issuers of the Tokens and platforms that offer the exchange of Tokens? Many members of the crypto industry still seem to believe that ICOs are unregulated. However, they are, in fact, mistaken, as ICOs are definitely on the regulator’s radar.

Regulation in several countries in Europe and Asia

Osborne Clarke created an ICO brochure with the regulation on ICOs in Germany, Belgium, France, Hong Kong, Italy, The Netherlands, Singapore, Spain, and the UK.

The full report can be downloaded here (PDF).

Altfinator Helps Innovative European SMEs Gain Access to Alternative Finance by Educating SME Advisors

Last week I gave an interview on our new European project Altfinator, to train and educate SME advisors on alternative finance solutions.

Missing link

In recent years, interesting alternative forms of financing such as crowdlending and crowdfunding have emerged to provide the underserved European SME market with debt and equity financing. However, these alternative solutions have been hampered by a missing link in their distribution: SME advisors.

Train 5.000 SME Advisors

The information dissemination and education efforts target the entire support system of innovative SMEs which includes start-up networks, business accelerators, traditional SME advisors, such as accountants, financial intermediaries, traditional financial institutions, as well as policy makers.

The ambitious goal of the project is to train and educate approximately 5.000 of these SME advisors in the first 2 years.

Focus on South and Eastern Europe

Initially, the project focuses on 8 countries: Portugal, Spain, Italy, Lithuania, Poland, Slovakia, Hungary, Romania, Ukraine and uses best practices from the UK, The Netherlands, Estonia and the US. After the initial phase, the training will be expanded further through national and local organizations in other countries.

2nd EU Alternative Finance Research Conference

After a successful event last year with researchers from 21 different European research organisations, this year’s conference, co-organised by Oxford University Saïd Business School and Utrecht University will take place October 2 in Utrecht .

The conference is one of the main events in Europe for (academic) researchers to share research outcomes and create new research networks.

Organized by European Centre for Alternative Finance

The event will be organized by the European Centre for Alternative Finance. This research centre has a central role in guiding the European research agenda and policy discussions on Alternative Finance in Europe. More information on the program can be found on the ECAF website.

Registration for conference

The registration for the conference (free): Conference registration form.

Conference highlights

This year’s keynote speaker will be Nir Vulkan (Oxford University). The academic sessions allow for in-depth discussion and networking about the following topics: Equity crowdfunding and peer-to-business lending, reward and donation-based crowdfunding and as well on alternative finance, ICOs and Fintech more broadly.

Representatives from the European Commission will also participate and share insights on the new crowdfunding regulation, Capital Market Union developments and focus on Fintech within Europe.

Network of European researchers (COST)

Part of the conference will be the kickoff and submission of EU proposal for the creation of an European network of alternative finance researchers. Interested academic researchers who are willing to participate in the network can request additional information by sending an email to [email protected].

Registration for this (COST) network of researchers: COST registration.

Call for papers

The call for papers can be downloaded here.

Expert of the week : Simon Amrein (Switzerland)

What is the current status of Alternative Finance?

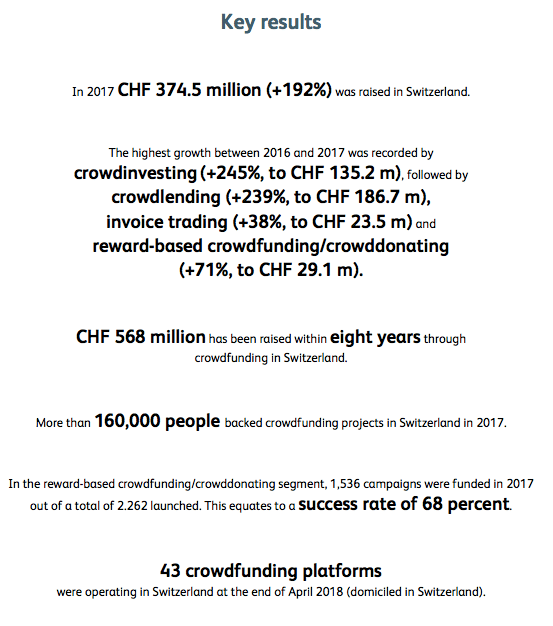

The volume of Crowdfunding was CHF 375m (€324m) in 2017. But it depends on the definition of alternative finance. We systematically collect data on crowd-based finance (reward & donation based crowdfunding, crowdinvesting, crowdlending).

I suggest to take a look at our crowdfunding monitoring, which is the annual market study we publish. Here are the key figures for 2017.

This does not include b2b platforms for example for companies and institutionals, which is also a fast growing market in Switzerland with large volumes.

Recently, we have seen the first applications of blockchain technology for credit processes in crowdfunding sector in Switzerland. With regards to regulation, there is still one major issue for p2plending/crowdlending platforms: loans to private individuals cannot be funded by more than 20 investors according to the Swiss Banking Ordinance. We expect this to change soon.

Can you give us an inspiring case from your country?

I believe b2b platforms for corporates, municipalities and institutional investors are interesting cases (for example loanboox, instimatch and remaco direct lending). They are entering the private debt market / short-term lending market that has traditionally been dominated by brokers and banks. The volumes are already quite big, the brokerage fees low.

Then, I would also take a look at the project oomnium. Their aim is to start with a blockchain crowdfunding (reward based) platform next year. It is an initiative from the largest reward based crowdfunding platform in Switzerland (wemakeit).

Finally, we have seen also the establishment of an association for marketplace lending platforms (Swiss Marketplace Lending Association). It was started in order to work with common definitions of risk and return metrics and, increase transparency and awareness for the sector.

What are the biggest obstacles for growth?

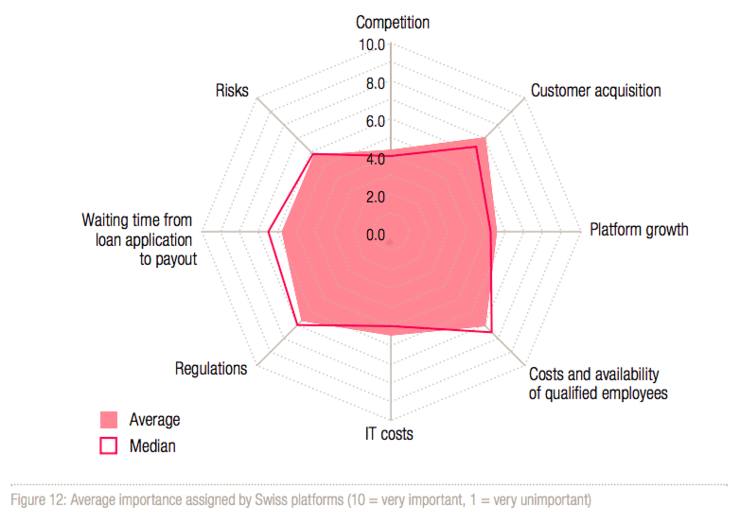

The Swiss market is growing rapidly. It will be key to find both enough borrowers and lenders going forward. Awareness of alternative finance as an alternative financing source has to increase. In our study “crowdlending survey 2018”, where asked exactly that question to crowdlenders

For Swiss platforms, increasing their awareness is one of the key challenges. Competition (within the sector as well as with banks), on the other hand, is relatively unimportant.