READ TIME: ±6 minutes

Hello and welcome to Alts Cafe for July 25, 2022.

This is everything you need to know about what’s going on in the world of alternative assets. Best enjoyed with your morning coffee.

We’re moving Alts Cafe to Mondays from now on because it feels like a more useful day to get all this good stuff.

Let’s go!

Table of Contents

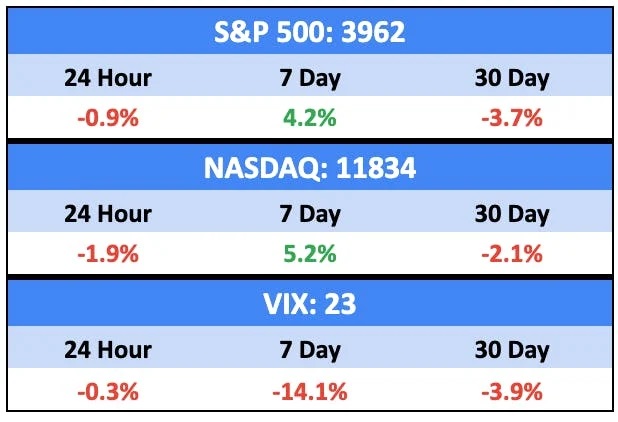

Pulse check: What’s the overall market doing?

Some analysts are saying we’ve hit a bottom.

Off around 17% for the year, the S&P 500 is only halfway to the lows we saw in 2000 and 2008, though. If you think this downturn is going to look like those ones, it’s wise to be wary.

Both those downturns saw 15% to 20% mini bounces on the way down to an overall 35% haircut.

What are we doing?

Fractional Alts picks:

No changes here for now.

ALTS 1 fund news:

No new acquisitions.

Crypto

Here’s what you need to know:

Crypto continues to rip, led by Ethereum, which is surging on supposed news that the ETH 2.0 is imminent.

The Fear and Greed index is actually off slightly since our most recent Alts Cafe late last week.

For the most part, everything is still super correlated, with Ethereum giving more beta.

Bullish News

- Cathie Wood’s Ark Invest, ETF issuer Exchange Traded Concepts, Cullinan Associates, and Utah-based Refined Wealth Management all significantly added $COIN to their portfolios, as per June 30 filings.

- The Texas Republican Party is moving to add crypto sovereignty to the state’s constitution.

Bearish News

- Game developer Mojang Studios banned NFT integrations and blockchain technology in the widely popular Minecraft video game.

What to do with that info:

We’re still on the sidelines, but the FOMO is hitting hard.

Real Estate

Here’s what you need to know:

I did a deep dive into America’s real estate landscape last week. Check it out for my full view on things.

Here’s the TL;DR:

- Home prices will come down

- Inventory will go up

- Rents will go up

- Consumer discretionary spending will go down (or will it?)

- The construction industry will lay off a big part of its 7.6m workforce

- Foreclosures will rise

There are going to be a lot of opportunities that come out of this. Just my guesses on who I think will be the winners and losers here:

Winners:

- Rental units

- Self-storage

- Mobile home parks

Losers:

- Single-family homes

- Commercial real estate (except rentals)

- Student lets

- America

What to do with that info:

Look into some opportunities to invest in multi-family units.

And watch these numbers.

NFTs

Here’s what you need to know:

Nearly everything is in the green right now, with only the seven-day charts bleeding slightly, as the NFT market has pulled back a bit over the last week.

Volume is still crazy low, with only around $20m per day trading hands.

Just have a look at all these Top 50 projects with zero volume in the last 24 hours –

There are some household names in there with just crickets around the trading floor. From what I can tell, all the meaningful volume is accruing to the top ten or so projects with very, very little going to lower-tier stuff.

If anyone wants to do the analysis for this (volume of top ten projects divided by total NFT volume over the last twelve months or so), please let me know. I’ll show your data and give you a shout-out next week.

Supposing this is right, investors are dipping their toes back into the NFT market’s (relatively) safest projects while steering clear of the riskier stuff.

A few questions from me around this:

- If BTC and ETH move down again to ±$10k BTC, does the market collapse again for these blue chip projects?

- If the crypto market remains stable or goes sideways for the next year or so, money will come back into NFTs. Once investors are ready to move past blue chip stuff, will the cash flow into existing projects that have tumbled, or will shiny new projects take the lion’s share?

What to do with that info:

It all depends on your view of the two questions above. Do you:

- Buy blue chip NFTs and hedge against a crypto drop by selling calls or buying puts?

- Find existing second-tier projects that have shed 90% but are still active?

- Keep your dry powder for new projects minting through the second half of 2022?

If you have a view on any of the above, I’d love to hear it.

Startups

Here’s what you need to know:

I’ve been banging on for weeks that it’s time for venture investors to prey on invest in undervalued startups, and it looks like someone’s doing just that.

Gavin Baker’s hedge fund is raising a “vehicle dedicated to opportunistic venture wagers amid a challenging period for startups.” AKA buying out startups that have a path to profitability but can’t raise any money in this market climate.

What to do with that info:

Make sure you RSVP for our capital raise this week if you like making money.

That’s all for this week.

Hope you enjoyed your coffee and this edition of Alts Cafe.

Cheers,

Wyatt