New here? Read up on our past Real Estate issues to get the most from this post.

July 22nd, 2022 | ± 6 minutes

HIGHLIGHTS:

- Is the American real estate market in trouble?

- Who will be the winners and losers if the market takes a tumble?

- A compelling investment opportunity in Chicago

Let’s go!

Table of Contents

Real Estate in 2022

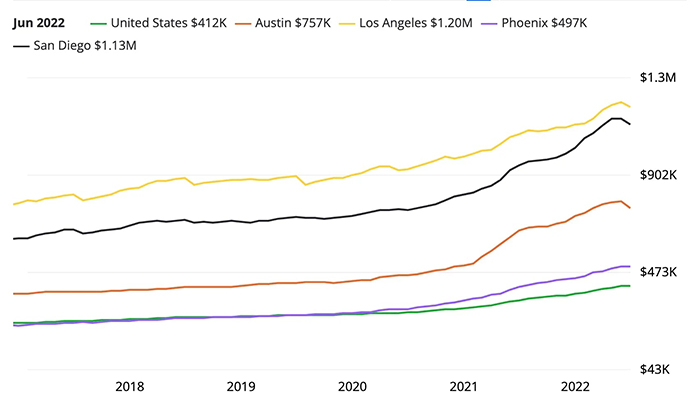

It’s been a heck of a couple years for US residential real estate, with prices doubling in many parts of the country.

Cities like Austin, Phoenix, Los Angeles, and San Diego have been on fire since 2020, but if you look at the very end of the X-Axis above, you can just about see a correction coming.

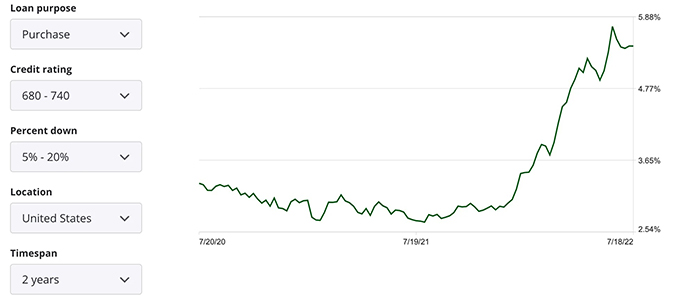

No big surprise that housing prices are coming back down, given the rise in mortgage rates recently. Rates have nearly doubled in the last year.

Rising prices + rising mortgage rates have double-whammied new home buyers with skyrocketing mortgage payments.

The average payment today is $2,387, which is a 44% increase compared to $1,663 a year ago when homes were cheaper, and mortgage rates were at 2.88%.

And rates are set to increase further with another 75bp bump later this month.

Despite the in-affordability of buying a new home, rental prices haven’t kept up — they’re up around 14% year over year compared to 20% for home prices and 44% for mortgage payments.

And home-builders have finally realized there’s a problem with their confidence index suffering the second biggest drop in history. Construction also slowed for the second straight month. The construction industry employs 7.6m people in America.

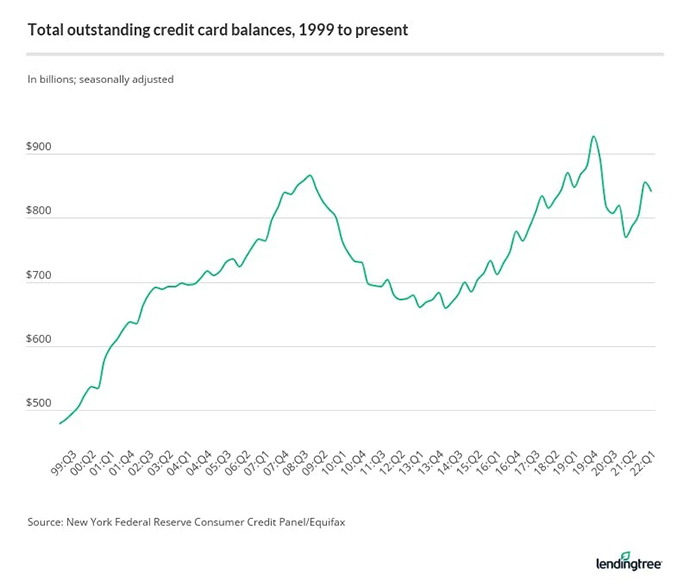

This last bit isn’t strictly real estate, but I think it’s germane here – American Credit Card Debt is at historically high levels.

So, something (and possibly many things) is going to give over the rest of 2022:

- Home prices will come down

- Inventory will go up

- Rents will go up

- Consumer discretionary spending will go down (or will it?)

- The construction industry will lay off a big part of its 7.6m workforce

- Foreclosures will rise

Let’s fast forward to the average American family perhaps six to twelve months from now:

- Their mortgage is twice as high as it was two years ago

- ±10% inflation coupled with only 5% wage increases has destroyed their buying power

- They’ve got tons of credit card debt, and their cards are maxed out

- Their mortgage is underwater (they owe more than their house is worth)

They’re f*cked. And God help them if one or both parents work in construction.

There are a lot of moving parts here, and I’m not smart enough to predict what’s going to happen, but my Spidey senses are all tingling.

There are going to be a lot of opportunities that come out of this. Just my guesses on who I think will be the winners and losers here:

Winners:

- Rental units

- Self-storage

- Mobile home parks

Losers:

- Single-family homes

- Commercial real estate (except rentals)

- Student lets

- America

Opportunities this week

Lofty.ai

This one launches today. It’s a triplex in Chicago, with all three units rented out.

The platform is projecting 17.1% IRR, which I think is a bit optimistic, but the cash on cash return (just from rent) is 9.1%.

The unit is submitting rental increase petitions to the local government, and if they’re approved, the cap rate would increase to an egregious 14.5%

The downside is protected here due to my macro thesis above (rentals will be winners), and I would view any appreciation here as a bonus.

If you dig the Chicago market, here is another multi-family opportunity that caught my eye.

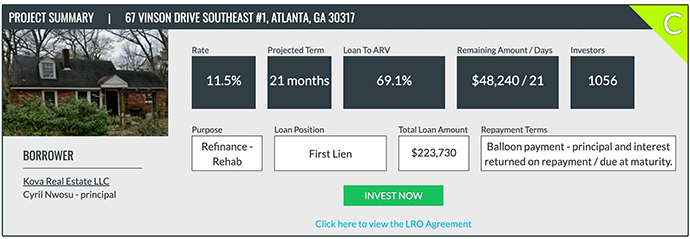

Groundfloor

For those of you who (probably correctly) think my macro thesis above is wrong, there’s a nice opportunity over on Groundfloor:

It’s a 21-month loan paying 11.5% on a rehab project in Atlanta.

The borrower has significant experience in the space and is working full-time on the project.

In other news:

- China is facing a mortgage boycott as its real estate industry implodes.

- Foreign purchases of American homes are down 8% year over year

- Blackstone raised a $30B real estate fund

- Vietnamese homebuilder Hung Thinh Land is raising $200m at IPO, valuing the company at over $2B.

That’s all for this week.

Cheers,

Wyatt