READ TIME: ±4 minutes

Hello and welcome to Alts Cafe for June 30, 2022.

This is everything you need to know about what’s going on in the world of alternative assets. Best enjoyed with your morning coffee.

Let’s go!

Table of Contents

Pulse check: What’s the overall market doing?

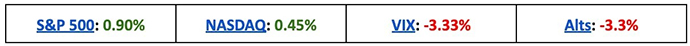

Today is the last of 2022’s first half, and it’s set to be the worst start to the year since 1970. Futures are down as well, indicating no end in sight.

Fed Chairman Jerome Powell confirmed the beatings will continue until morale improves. For him, a recession is preferable to inflation, and rates will continue to rise until the latter is stamped out.

What are we doing?

Fractional Alts picks

This week we put a buy on Rally’s 1938 Macallan Red Ribbon whisky. It IPOs tomorrow.

ALTS 1 fund news

We’ve just finalised the purchase of two exciting new assets for the ALTS 1 fund. We’ll announce them next week.

Crypto

Here’s what you need to know:

Things are still trying to sort themselves out. Up? Down? Sideways?

A former board member from Coinbase thinks there’s more downside before we see a bottom.

Crypto winter is here ❄️. I was on the @Coinbase board until 2021 and led its Series D for @IVP. I’ve lived crypto cycles since 2013. Here are my predictions on how and when this crypto winter will end, and how to emerge stronger. 🧵👇/1

— Tom Loverro (@tomloverro) June 28, 2022

Bullish News

- Goldman is raising a $2 Billion fund to buy distressed assets from Celsius. (CD)

- FTX is taking a lot of action during the downturn:

- Binance is going to launch a zero-fee crypto trading offering on its platform. (CD)

Bearish News

- Celsius is hiring restructuring consultants to prepare for a possible bankruptcy. (WSJ)

- The number of hedge funds betting against Tether is increasing. (WSJ)

- Cypherpunk Holdings, a Canadian crypto firm, sold all of its Bitcoin and Ethereum to prepare for the crypto winter. (CD)

What to do with that info:

I’m still sitting on the sidelines.

Real Estate

Here’s what you need to know:

Sales actually ticked up slightly in May, which was a surprise to most experts (and non-experts like me), though it’s off 24% from 2021.

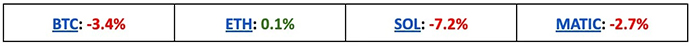

Those year over year numbers are reflected in the Home Purchaser Sentiment Index (HPSI) as well. The index has fallen through the floor over the last eighteen months, and there’s not much lower it can go.

Surprisingly (or maybe not), the percent of “Don’t Know” responses are super low – less than 5%. No matter who you are or what your financial position, everyone’s got an opinion on the housing market.

What to do with that info:

Reiterating last week – if people don’t want and can’t afford to buy, they’re going to rent. Consider looking into multi-family homes.

NFTs

Here’s what you need to know:

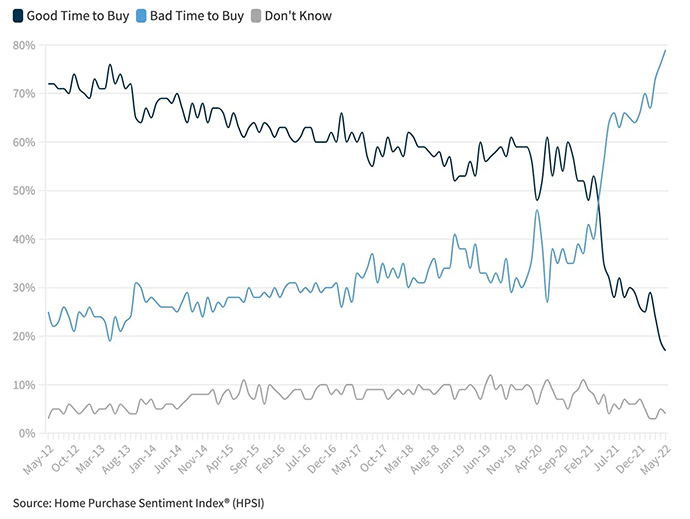

NFTs had a great week…until yesterday. The nine projects in our index were off an average of 6.9%, which gave back all the gains for the week.

The biggest news story was a breach at Opensea.io (again!). Someone sold Opensea’s mailing list to an unnamed third party. If you’ve got an account at Opensea, be on the lookout for phishing scams.

It’s worth noting the deadline for The Currency is coming up. At the end of July, holders will have to decide whether they want to hold onto the NFT or burn it for the physical version. Our art expert, Nicho, put together a great piece on whether or not to burn The Currency. Have a look if you’re on the fence.

Random one for all those who like to DYOR: I found this tweet today, which is full of free NFT tools. Check it out if you’d like.

If you spend ETH on NFT tools you’re wasting money

— NFT God (@NFT_GOD) June 29, 2022

There are hundreds of free tools out there that will make you a profitable trader.

Here’s my top 4 favorite free NFT tools and how I use them:

What to do with that info:

NFTs are down but art is up — does mean you should buy a couple copies of The Currency and burn them? At an $8k floor price, I’m considering it.

Startups

Here’s what you need to know:

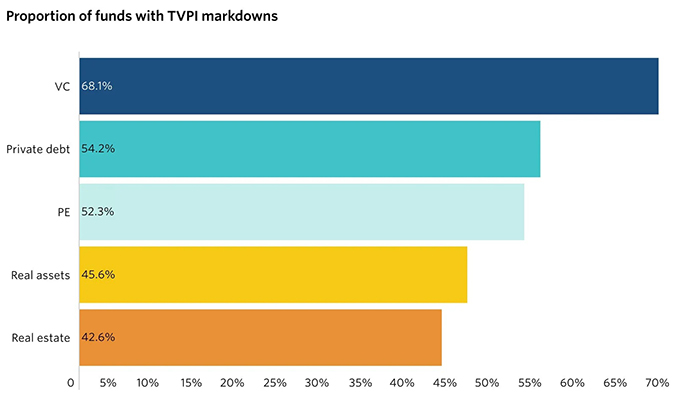

68% of venture funds marked down their assets in the first quarter of 2022, which is the highest since the middle of 2016. That said, the average markdown was only 3.5%, which is still quite a bit off the 7.8% and 15.7% realised during the 2008 and 2000 crises.

This is going to get a lot worse through 2022 and could easily surpass the dotcom markdowns – valuations have been so much higher the last couple of years, so they have farther to fall.

What to do with that info:

If you’re an LP, you’re probably in for some unpleasant news from your GPs. If you’ve got dry powder, you’re in a great position.

[Side note – if you’re an institutional investor looking to lead a round in a groundbreaking fintech startup, hit me up]

Wine and Spirits

Here’s what you need to know:

It’s not all doom and gloom out there. Wine and spirits have had a fantastic 2022.

Whisky is up over 16%, while the Liv-EX 1000 wine index is up over 10% year to date. Not bad in this climate.

In late April, a cask of forgotten The Macallan sold for an eye-watering $1.3m – a new record for any cask of whisky. That comes to roughly $2,426 per distilled bottle, which is also a record.

The seller bought the cask for $5k thirty-three years ago and promptly forgot about it until Macallan reminded him about it this year.

On another positive note, the U.K. and India are planning on working out a trade deal by the end of 2022. India is the world’s largest consumer of whisky, but a 150% import tariff stifles interest in scotch. If that tariff was removed or decreased, it would have large implications for the scotch whisky industry.

What to do with that info:

Buy a time machine? But really, wine and spirits tend to hold up very well during economic downturns. Get in touch if you’re looking for investment opportunities in the space. Our check out this week’s sponsor!

Quick hits

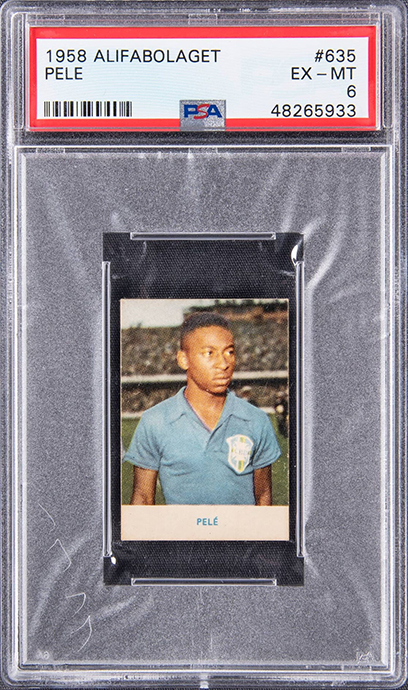

Vintage soccer cards continue to do well. The 1958 Alifabolaget Pele PSA 6 set an all-time high when it sold for $195,600 via Auction with Goldin. The card sold for $148,830 eight months ago.

Another comic is getting turned into a Netflix series as Neil Gaiman’s The Sandman is set to come to the small screen. There are over 1,000 CGC 9.8 versions of the original book, which is probably what’s kept it below $1k. The series ran for 75 issues, so there will be no shortage of material to cover in the show.

I’ve been getting into The Boys lately, and it’s a bit of a cult favourite with 8.7/10.0 on IMDB. Issue #1 there has as smaller population (712) and can be had for around $400.

That’s all for this week. Hope you enjoyed your coffee and this edition of Alts Cafe.

Cheers,

Wyatt

{{ snippet.alts-co-divider }}

{{ snippet.alts-1-fund-version-a }}

{{ snippet.social-media-icons }}