Hundreds of investing and finance newsletters hit my (and maybe your) inbox every week. This is the best of the best.

This week, we bring you

Table of Contents

The Crucial Role of Small Developers

In 2022, nearly 25% of all multifamily units were started by just 25 developers. An exploration of the construction financing process reveals why smaller, community-focused projects have been struggling to compete with large-scale institutions.

Coby Lefkowitz suggests potential solutions to shift this balance and prevent the complete homogenization of urban landscapes.

Amazon Goes Nuclear

Amazon’s acquisition of a nuclear-powered data center from Talen Energy signals a significant shift in the tech giant’s approach to powering its expansive cloud computing operations.

This strategic move, involving a $650M purchase of the Cumulus data center, underscores Amazon’s commitment to zero-carbon power sources.

With a decade-long agreement in place, will this become the new normal for data centers?

Suburbia: The New Financial Hub

Wall Street is moving closer to home, literally.

Charles Schwab’s move to Darien, Connecticut, for example, signals a broader trend across major U.S. cities like Boston, Chicago, and Los Angeles, where financial services are opting for suburban locales over city centers.

As higher-ranking professionals start to expect both proximity to home and an upscale office experience, the future of the finance industry’s work culture will be interesting to watch.

Fantasy Funds: New Rules For PE In Sports

The National Women’s Soccer League (NWSL) introduced firm guidelines on private equity and barring sovereign wealth fund investments in its teams.

The league limits PE funds to passive minority stakes in no more than three teams, with individual holdings ranging from 5% to 20% of a club’s equity, while completely excluding state-owned funds like Saudi Arabia’s Public Investment Fund (PIF) from ownership.

All-Time Highs… For Annuities?

Climbing interest rates have propelled annuity sales to record levels, reaching $385 billion in 2023.

With guaranteed rates hitting their highest since 2011, retirees and investors are increasingly drawn to annuities as a hedge against market volatility.

The Centenarian At The Forefront of FinTech

Moody’s, the 115-year-old ratings giant, has made an impressive transition into a leading fintech entity.

With a stronghold in financial markets data and analytics, Moody’s demonstrated robust growth, achieving approximately 10% year-on-year revenue growth and maintaining an impressive 90% Net Revenue Retention Rate.

Their strategic pivot towards data and risk analytics, boosted by significant acquisitions, has solidified its position in the modern fintech landscape.

More from Fintech Brain Food.

What I’m reading

I get a lot of mail asking where I find all this good stuff. Here are a few of my favorite newsletters, all of which are free to subscribe to:

The newsletter that helps entrepreneurs learn how to build wealth.

Free daily hot stock trading ideas, and market insights from a 20-year trading veteran.

Crypto made simple. Actionable alpha in 5 minutes, 3x a week.

Stock ideas

Let’s check back in with Yellowbrick Road, which highlights 15 stocks every week. Here are three of my favourites from this past week.

Analysis provided by public.com. Remember to always DYOR.

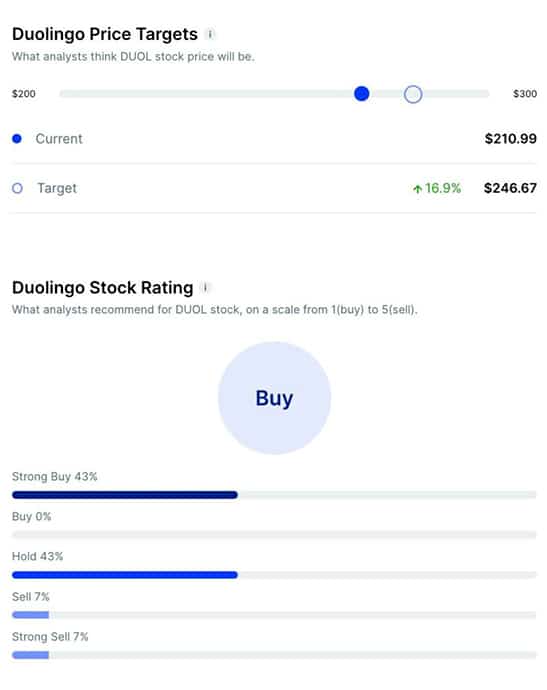

Duolingo ($DUOL)

Bull Case:

- User Engagement: Duolingo improved its daily active user to monthly active user ratio.

- Revenue Growth: Sales for the first nine months of 2023 increased by 43% compared to the same period in 2022.

Bear Case:

- High Valuation Concerns: Duolingo’s stock trades at around 20 times its revenue.

- Monetization Trends: There’s an indication of decelerating monetization, with a decrease in the average revenue per daily active user (ARPDAU) metric.

- Insider Selling Activity: Several insiders and institutional holders have recently sold significant stakes.

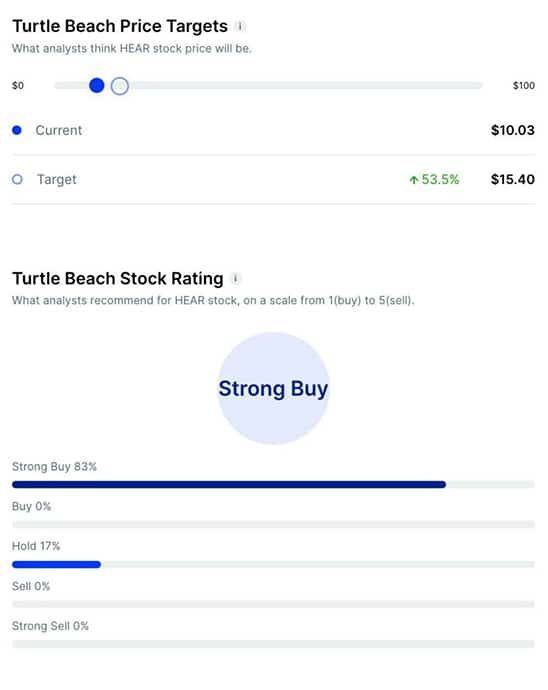

Turtle Beach ($HEAR)

Bull Case:

- Innovative Products: Turtle Beach has been launching new products such as the innovative Atom Controller for iPhone users and accessories for VR.

- Insider Confidence: Directors and the CEO have made several purchases of the stock, signaling their belief in the company’s value.

- Product Expansion: The company has introduced several new products across different gaming accessory categories, including gaming headsets, PC gaming mice, and flightsticks designed for Xbox.

Bear Case:

- Financial Concerns: Both earnings per share (EPS) and revenue missed analyst expectations.

- Competitive Pressure: The gaming accessories market is subject to rapid technological changes.

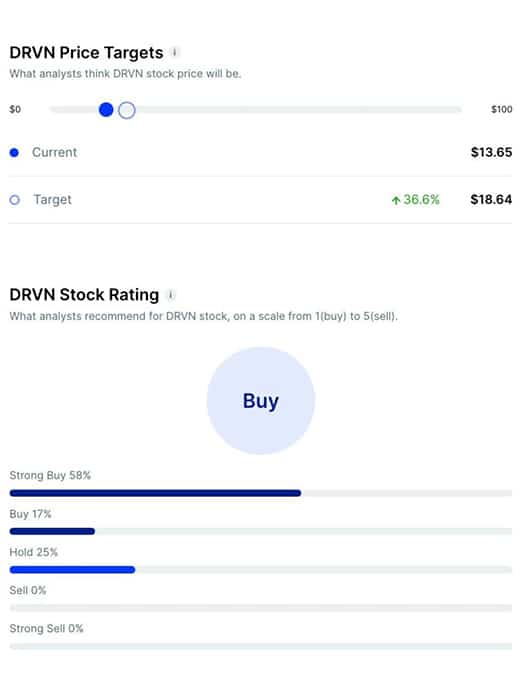

Driven ($DRVN)

Bull Case:

- Bullish Analysts: Analysts have set a 12-month target price range for DRVN that indicates a possible upside of 67.2%.

- Resilient Earnings: DRVN has recently exceeded quarterly earnings estimates.

- Institutional Support: A substantial portion of DRVN’s shares are held by institutional investors.

Bear Case:

- Underperformance Relative to Market: DRVN has underperformed compared to the broader market so far this year.

- Concerning Financials: The company has a negative return on equity (ROE) of -47.10% and a high debt-to-equity ratio of 4.82.

- Forecast Adjustments: There have been revisions (decreases) to both the company’s earnings and revenue forecasts for upcoming quarters and fiscal years.

That’s it for this week.

If you write amazing content and want to be featured, please send it through for consideration.

Cheers,

Wyatt

Disclosures

- There are affiliate links above; we’ll get a couple of bucks if you take action after you click.

- Nothing above is financial advice. DYOR, you filthy animal.