September 8, 2022

Read time: ± 6 minutes

New here? Read our past issues to get the most from this post.

This issue is written by Nicholas Shorvon, a Fine Art Consultant and Broker, providing a bespoke and personal service.

Today we’re talking about art prints. The art world is made up of a series of niche markets, and one of the most underrated (and misunderstood) is the print market.

There are many reasons to buy art now, and signed limited edition prints can be a great ‘entryway’ in. But they also have much more going for them, and can be considered an excellent investment opportunity in any financial climate.

Let’s explore!

Table of Contents

The misconception about art prints

The blue-chip prints market (from historically-established artists whose work is held by the biggest institutions and galleries) sees long-term strong and steady growth. We’ll get to the reasons behind that in a second, but first, I want to stress why they are important artistic media in their own right.

There is a misconception that prints belong to a less important art discipline than others. They are often, wrongly, considered copies of another piece, when they are actually a fraction of the whole artwork.

Printmaking is steeped in tradition, which highly skilled craftsmen dedicate their lives to. In this relationship, the artist is akin to an architect, and the printmaker is a highly skilled bricklayer (you would not want an architect to lay the bricks).

Why are art prints so popular?

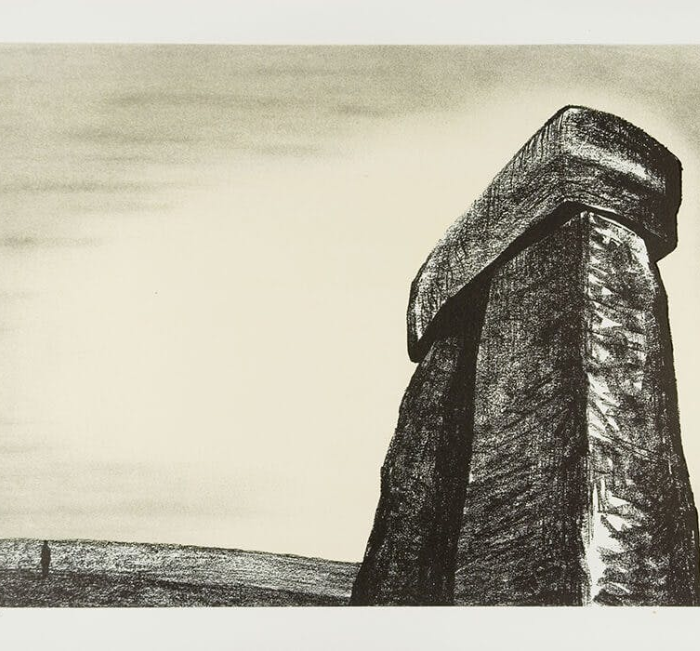

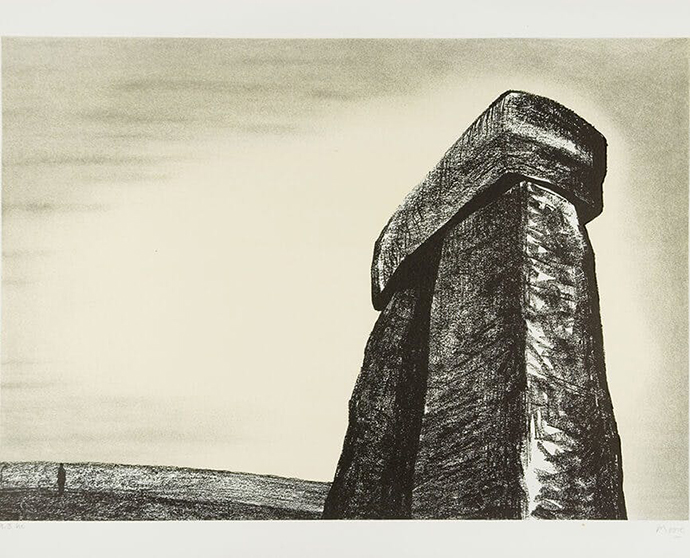

One of the most celebrated exhibitions in 2022 is Henry Moore at Hauser and Wirth in Somerset, curated around works influenced by Stonehenge. The main room showed a full suite of his beautiful Stonehenge lithographs.

Institutions exhibit these as stand-alone masterpieces, equal to his other works. Anyone who has a full suite has a large and extremely rare fraction of one of his best works. These prints are affordable on the secondary market and present a great opportunity to get work by a blue chip artist who would otherwise be out of reach.

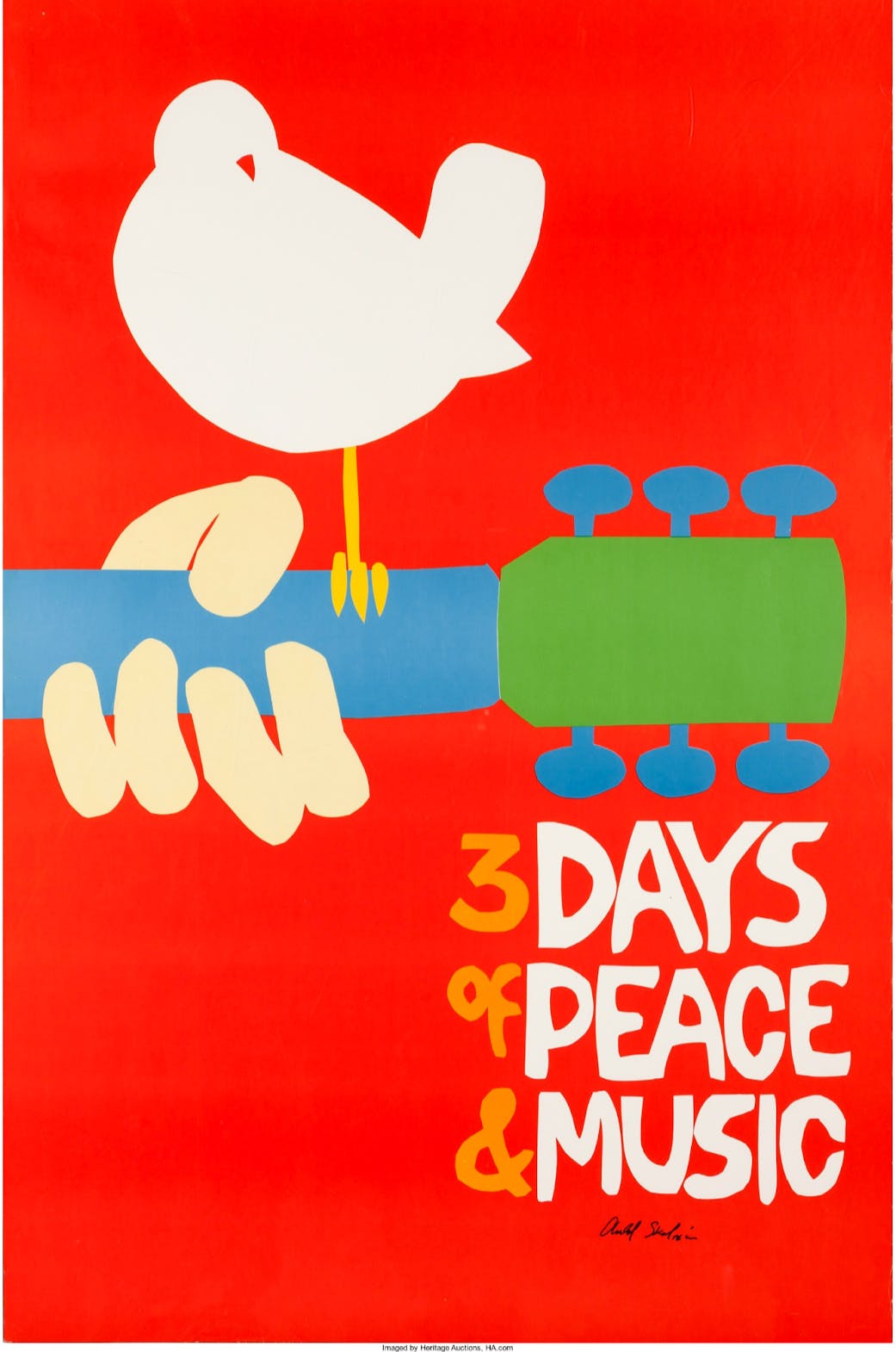

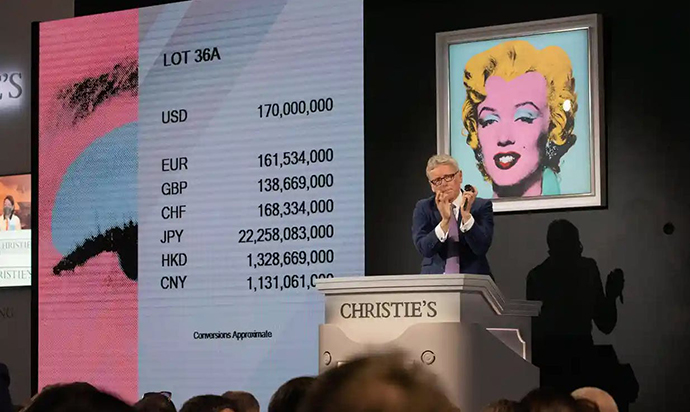

This is why prints are so popular. On the rare occasions when a great work by a true blue-chip artist (which isn’t already owned by a museum) comes to market, it’ll be tens of millions of dollars out of reach. Whereas you can buy a print by said blue-chip artist and it’ll benefit from many of the unique piece’s achievements. The top pulls up the bottom.

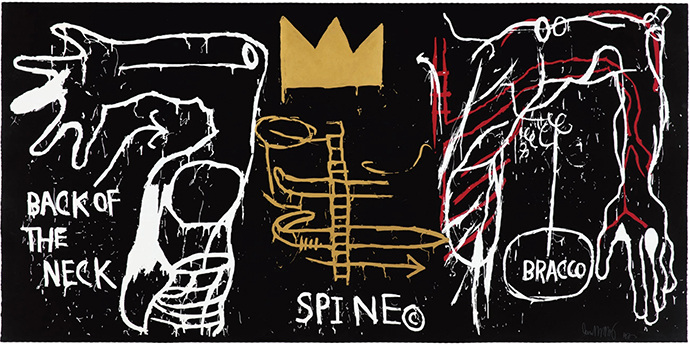

Basquiat’s Back of the Neck is at the very top end of the blue-chip print market, and is a very good example of performance, with an edition of just 24 prints. (2017; 2020; 2021)

Ultimately, the reason the market has grown so steadily is a combination of this innate accessibility characteristic and an ever-growing pool of buyers.

The increase in demand

There was a time when artist-print-buying was the habit of a small pool of collectors (mostly Western, white males). But the opposite is now true. Every year, the interest in, and access to blue-chip art grows, creating an increasingly diverse range of collectors.

There are constantly new major international institution spaces opening, more museum footfall, and more modern and contemporary fine art being taught at every level of education, with an ever-growing number of degrees.

Academics, curators, institutions, collectors and galleries are all keen to loan more pieces to more diverse places to increase access to art history. Yet, despite this massive increase in demand, there isn’t a parallel increase in blue-chip supply.

As a result of being unable to buy paintings for $100M (Basquiat/Picasso/Warhol), signed limited editions at $10k-500k become very appealing (especially when other blue chip prints have achieved $1m+).

Valuating art prints

One trait multiples have by nature, which unique artworks don’t, really appeals to investors: there is a lot more data to work with.

Unlike, say, a painting, which can be hard to value from one to the next, prints provide repeated sales data and price comparisons. Comparing one painting’s auction results and valuations to another painting’s is difficult because the works are different, whereas one can compare results for prints more easily because they are naturally more similar items.

However, be aware – auction data is best viewed as a useful indicator, rather than a precise current valuation.

When a unique piece goes to auction and doesn’t make its reserve, it has a negative sales record, which is publicly available and can make it very hard to sell, whereas with prints, if one doesn’t sell, another will soon enough. Equally, a strong auction result for a unique piece by an artist will only serve to increase the value of subsequent prints by that artist.

Finding the right prints

Due to the strong growth in demand, if you acquire a quality print from the right artist, you should expect security and long-term performance. So how do you find the right candidate?

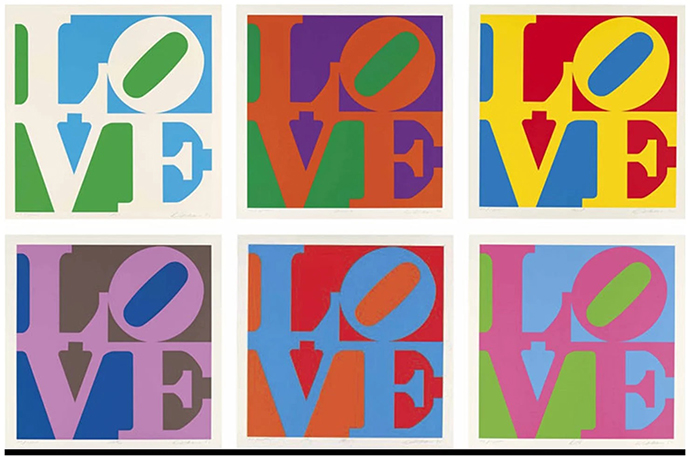

Firstly, avoid anyone who isn’t a blue-chip artist with unique artworks held in museums/institutions/collections globally, achieving multi-millions for paintings/unique works at auction. Collectors often like iconic and popular repeat motifs.

Right now, an easy win is to buy the best female and other underrepresented (yet established) artists, as the art world readjusts to balance out years of prejudice.

Buying primary market multiples can be wise, especially if you are quick on a popular edition (galleries/publishers will adjust the price depending on how quickly they are selling).

Be aware though – the primary market is higher risk, as the multiples market is driven by supply and demand. A limited edition print’s performance can’t be judged until it starts to resell on the secondary market. Security grows as a history of sales drives prices due to increased scarcity and desirability/visibility.

The fundamentals of buying secondary market art also apply to prints.

They, too, can be a bit of a minefield. There are many things to consider, including authenticity, condition, purchase price, aesthetic desirability/resale potential, and historical significance within the artist’s career as a whole.

Take Warhol for example: A Marilyn painting sold this year for a record 150M: a repeat motif and one of, if not the, most iconic series in the world. The print is the perfect piece for an investor looking for a storage of value with excellent speculative price.

Then there are his Ladies & Gentleman prints and the Electric Chair prints from the death and disaster era, academically highly regarded; these prints remain arguably undervalued due to their subject matter. However, it’s not inconceivable that in 30 years they will be seen as ahead of their time, making them an excellent investment for a higher-risk investor.

Two very popular pieces which have seen enticing growth are the soup cans and the Queen Elizabeths. They perform differently on the 30-year test. Perhaps over time, the love and affection for the Queen will shrink (along with the print’s potential).

However, in the short term, and particularly in the immediate years after she is succeeded, her popularity means the print’s worth will likely grow very fast – giving it potential as a flipper!

The soup cans are more historically significant and internationally appealing, so in this respect, they are also a very savvy buy for a long-term investor.

Where to purchase art prints

All of that was the easy bit. Now you have to buy your piece. And there are three ways to do that:

- Auction;

- Gallery;

- Broker.

The auction house is generally your last resort, try to avoid them unless it’s the only way to secure a specific, desired piece. They are very expensive as they end up taking 40-50% by charging both buyer and seller (and just to reiterate: make sure you see the work in person as their condition reports aren’t always reliable).

The gallery route is also expensive thanks to large overheads such as retail space, and costly art fairs.

Dealers and brokers will charge significantly less than the other two, and this is generally the best route, not just for the saving on commission, but for their bespoke service and guidance. Once they discuss with you your intentions, they can source various options through their network.

They can judge the condition and value for you by comparing pieces with other examples they have seen throughout their career.

And that’s pretty much it the end of our Buyer’s guide to Art Prints. Good luck!

That’s all for today’s Cultural Assets Insider. I hope you found it useful.

Until next time,