Hundreds of investing and finance newsletters hit my (and maybe your) inbox every week. This is the best of the best.

This week, we bring you

Table of Contents

The Bank of Mom and Dad is Closing

As the cost of living continues to rise, more adult children are living at home, relying on their parents for financial support.

This is causing significant strain on parents’ retirement plans, with over a quarter reporting that they’ve had to delay retirement.

How much longer can the Bank of Mom and Dad stay open?.

Hawaii’s New Approach to Conservation: A $25 Tourist Fee

In response to the catastrophic wildfires, Hawaii is contemplating a $25 ‘climate impact fee’ for tourists.

This is expected to generate tens of millions of dollars annually, with a significant portion dedicated to disaster insurance and creating fire breaks to safeguard vulnerable communities.

With 18% of their state GDP coming from tourism, can you blame them?

Cathie Wood’s $14.3 Billion ETF Implosion

The ARK Innovation ETF has been under the spotlight for erasing a staggering $14.3 billion in shareholder value over the past decade.

Despite a brief rebound in 2023, the fund’s performance has been marred by significant losses leading to its ranking as one of the top wealth destroyers.

Wood’s heavy reliance on high-risk, cash-burning companies, has been a key factor in the underwhelming performance.

Single-Family Rentals Surge

via CalculatedRisk Real Estate News

Single-family units built specifically for rent nearly doubled from 44,000 in 2020 to 85,000 in 2023, according to recent Census Bureau data.

Despite multi-family units still leading the market, the increase in single-family rentals suggests a significant change in housing preferences and investment strategies.

Get the full story from CalculatedRisk.

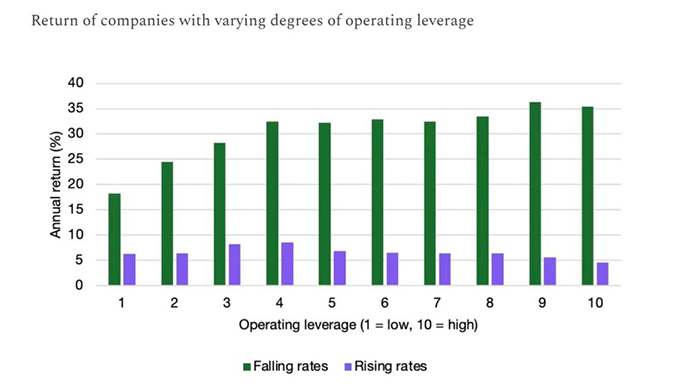

The Highs and Lows of Operating Leverage

Companies with high operating leverage can be a double-edged sword.

These companies typically outperform those with lower operating leverage in times of declining rates and looser monetary policy. However, this can quickly turn into a disadvantage under tighter financial conditions, making them more vulnerable to losses.

As we enter a phase of potentially lower interest rates, investors might want to study up on this dynamic.

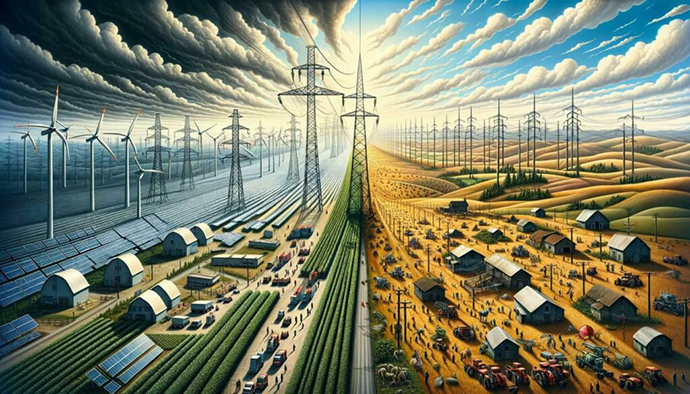

The Stark Reality of Expanding America’s High-Voltage Grid

The ambitious vision of rapidly decarbonizing the US through extensive high-voltage transmission grid expansion needs a harsh reality check.

Despite the rhetoric, the US is far from adding the needed capacity, with 2023 witnessing a significant shortfall in new high-voltage lines.

Costs are skyrocketing, and rural America’s resistance is growing, challenging the feasibility of such a vast expansion to meet renewable energy goals.

Is the dream of a net-zero economy by midcentury fading away?

What I’m reading

I get a lot of mail asking where I find all this good stuff. Here are a few of my favorite newsletters, all of which are free to subscribe to:

The newsletter that helps entrepreneurs learn how to build wealth.

The world’s biggest ideas, disruptive trends, most exciting early-stage companies, and groundbreaking entrepreneurs.

Interviews, articles, memes & research reports from Twitter, Substack, YouTube & more. Get smarter about investing.

Stock ideas

Let’s check back in with Yellowbrick Road, which highlights 15 stocks every week. Here are three of my favourites from this past week.

Analysis provided by public.com.

Remember to always DYOR.

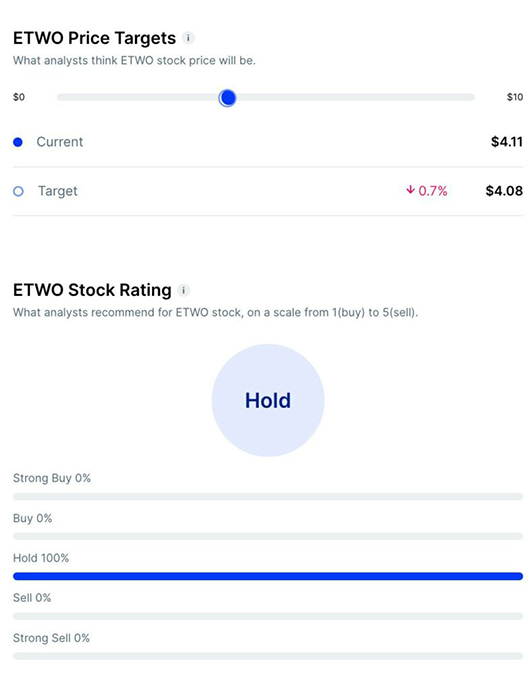

E2open Parent Holdings ($ETWO)

Bull Case:

- Leadership Changes: A new CEO aims to enhance operational efficiency.

- Innovation: ETWO focuses on improving supply chain efficiency, predicting savings, and delivering continuous customer value.

- Undervaluation: Analysts suggest ETWO is undervalued, offering potential upside if strategic goals improve financial performance.

Bear Case:

- High Executive Turnover: Significant turnover in key roles may impact long-term strategy and execution.

- Revenue Concerns: Recent quarters show ETWO missing EPS raises concerns about financial health.

- Market Performance: ETWO’s underperformance compared to the broader US software industry raises concerns about investor confidence.

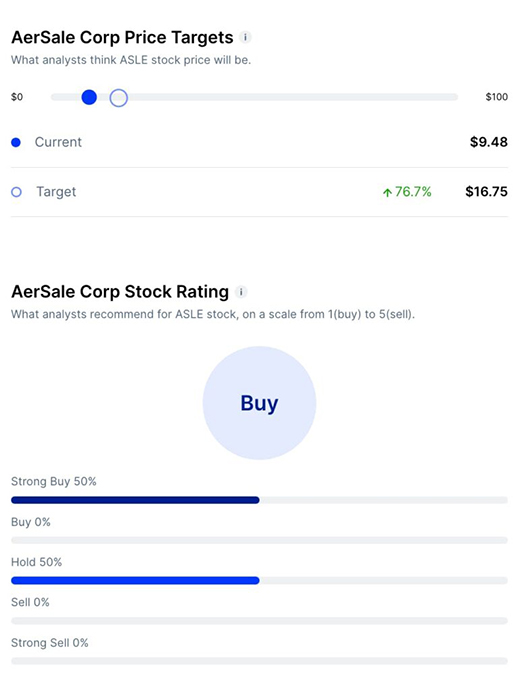

AerSale ($ASLE)

Bull Case:

- Strong Recovery: AerSale’s robust recovery in late 2023, along with significant investments driving adjusted EBITDA, positions it well for potential growth in FY 2024.

- Insider Confidence: CEO Finazzo’s substantial insider investment since August 2023 reflects positive internal confidence.

Bear Case:

- Market Volatility: Significant price fluctuations and a drop from its 52-week high signal market uncertainty.

- Certification Delays: Although AerSale has completed certification flight testing for AerAware, past delays could impact investor confidence.

- Sector Risks: The aviation sector’s sensitivity to economic changes, fuel prices, and regulatory shifts pose potential challenges.

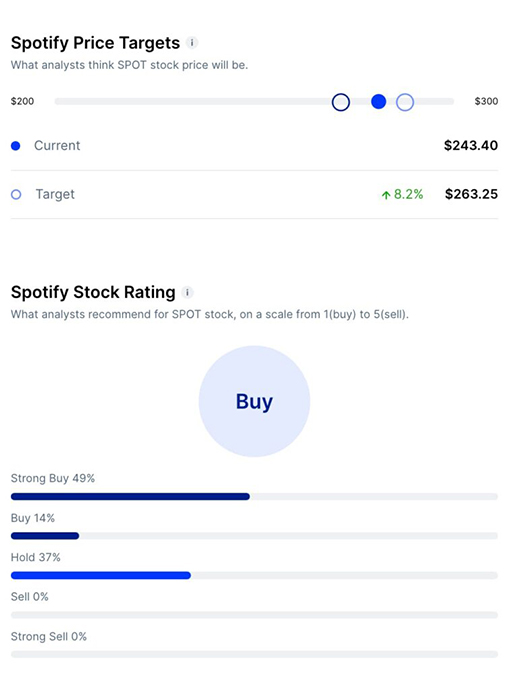

Spotify ($SPOT)

Bull Case:

- Subscriber Growth: Spotify exceeded premium subscription goals in Q4 2023, adding 10 million paid users.

- Margin Expansion: A strategic shift to audiobook content aims for sustainable stronger bottom-line trends.

- Analyst Ratings: UBS upgraded Spotify to “buy,” driven by expectations of continued advertising growth.

Bear Case:

- Competition: Spotify faces stiff competition in the audio streaming market, potentially challenging its market share growth.

- Regulatory and Licensing Challenges: Regulatory hurdles and fluctuating music licensing costs pose operational and financial risks.

That’s it for this week.

If you write amazing content and want to be featured, please send it through for consideration.

Cheers,

Wyatt

Disclosures

- There are affiliate links above; we’ll get a couple of bucks if you take action after you click.

- Nothing above is financial advice. DYOR, you filthy animal.