Hundreds of investing and finance newsletters hit my (and maybe your) inbox every week. This is the best of the best.

This week, we bring you

- Capital Hill… The New Wall Street?

- A Brewing Crisis for American Colleges

- Analyzing Stocks: How Many Factors Are Useful?

- Do Any Countries Actually Like Their Leaders?

- Nothing’s Changed Since 1427

- Facebook Enters Adulthood

- 3 Stocks To Consider

Table of Contents

Capital Hill… The New Wall Street?

In 2023, members of the US Congress were responsible for nearly $1 billion in trading volume, and 32 members beat the S&P 500 index.

Shockingly, Nancy Pelosi’s 65.5% return doesn’t even make the top 5 highest-performing portfolios among the 32 market-beating traders.

With more than 11,000 trades to sift through, the full analysis is worth a read.

A Brewing Crisis for American Colleges

In the shadow of high-profile scandals and heated debates over free speech, America’s universities confront a more profound crisis: a demographic shift and growing doubts about the four-year degree’s value.

As birth rates decline and skepticism rises, colleges face the challenge of proving their worth.

More from The Sunday Morning Post.

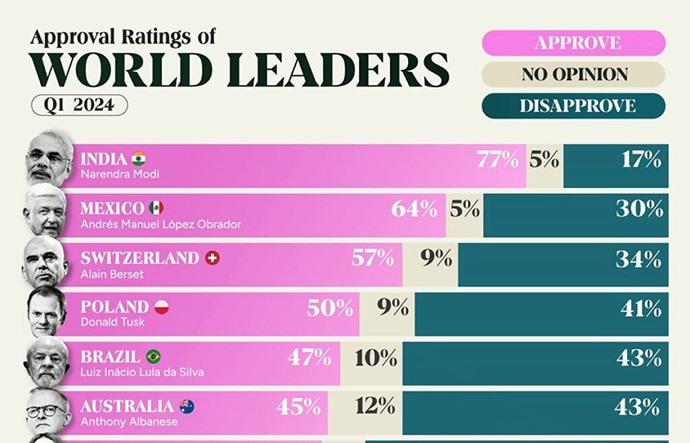

Analyzing Stocks: How Many Factors Are Useful?

A study by Alexander Swade sifted through 153 equity factors and found that just the top 20 are needed to span the entire factor universe in the US.

How badly are most equity investors overcomplicating things? Are 133 factors truly worthless?

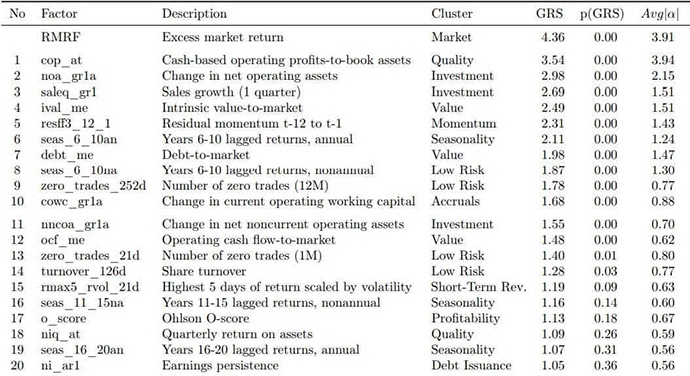

Do Any Countries Actually Like Their Leaders?

From Modi’s soaring 77% in India to Scholz and Yook’s dismal 20% in Germany and South Korea, discover who’s hot and who’s not in global politics.

Get the full visual breakdown.

Nothing’s Changed Since 1427

A group of Italians took the classic “it’s not about getting rich… it’s about staying rich” to a whole new level.

In Florence, the top five families from the year 1427 have managed to remain the city’s richest for a staggering 600 years, and “any family who was in the (1427) top third is almost certain to still be there today.”

Facebook Enters Adulthood

As it celebrates 20 years amidst recent Senate scrutiny, Facebook’s journey from a Harvard dorm to a tech giant has been a wild ride.

Boasting a $226 average revenue per North American user, a historic $196 billion one-day surge in market cap, and 3.19 billion daily active users, what’s next for the social media behemoth?

What I’m reading

I get a lot of mail asking where I find all this good stuff. Here are a few of my favorite newsletters, all of which are free to subscribe to:

Get Smarter About Crypto in 5 minutes a day

The “IKEA instructions for investing” to help you become a better investor.

Free daily hot stock trading ideas, and market insights from a 20-year trading veteran.

Stock ideas

Let’s check back in with Yellowbrick Road, which highlights 15 stocks every week. Here are three of my favourites from this past week.

Analysis provided by public.com. Remember to always DYOR.

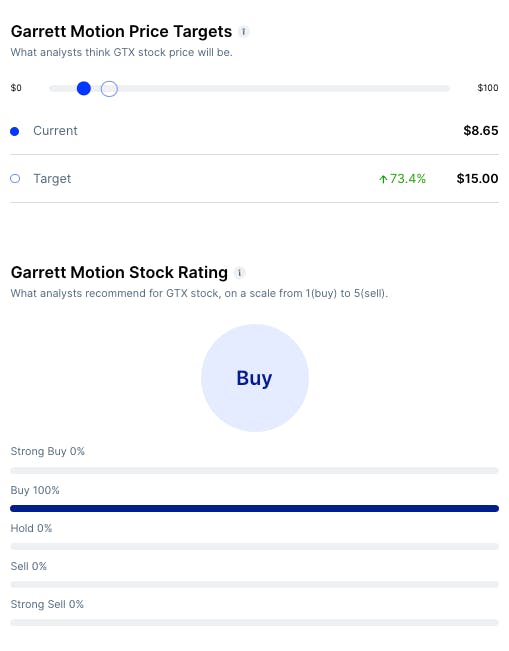

Garrett Motion ($GTX)

Bull Case:

- Hybrid Advantage: Expertise in electric-boosting technologies positions it well amidst the current slowdown in battery electric vehicle growth.

- Valuation: Trading around 5 times the projected 2024 free cash flow, the stock appears undervalued.

- Bullish Analysts: Analysts project a 66.9% upside.

Bear Case:

- Dependence on ICE and Hybrid: The long-term shift to fully electric vehicles could pose challenges for GTX’s reliance on ICE and hybrid technologies.

- Insider Selling: Recent insider selling, totaling $14.26 million last quarter, could signal lack of confidence.

- Technological Risks: Intense competition in the automotive industry pose risks of falling behind in innovation.

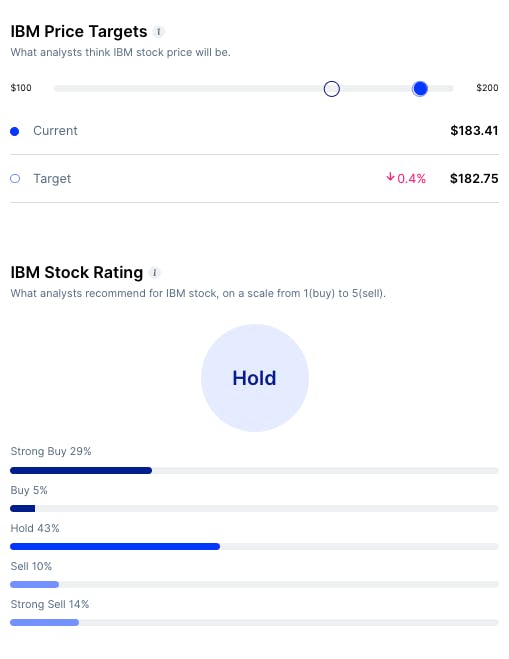

IBM ($IBM)

Bull Case:

- AI and Open Source Strength: IBM’s focus on open-source AI and hybrid cloud solutions, exemplified by Watsonx integrated with Llama 2, positions it as a leader in enterprise AI.

- Financial Resilience: Recent earnings exceeding expectations, particularly a notable EPS beat, showcase IBM’s strong performance.

- Valuation Opportunity: Trading at a forward earnings multiple below industry average and peers like Accenture suggests IBM may be undervalued.

Bear Case:

- Legacy Operations Drag: Despite AI and cloud pivot, IBM’s substantial legacy operations may impede agility and growth.

- Dividend Payout Concerns: High dividend payout ratio raises questions about IBM’s ability to reinvest adequately in innovation.

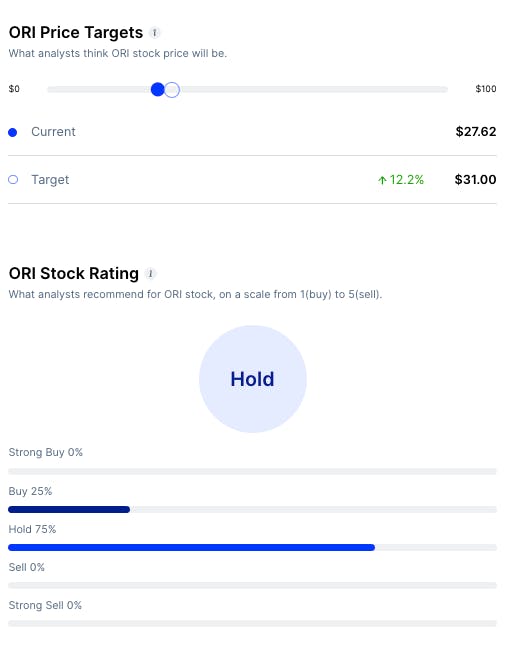

Old Republic International ($ORI)

Bull Case:

- Strong General Insurance Performance: ORI’s General Insurance business had an 18% increase in value and a significantly improved combined ratio of 90%, showcasing strong underwriting discipline.

- Investment Income: Benefiting from higher interest rates, ORI’s investment income grew by 26% in 2023.

Bear Case:

- Missed Earnings: Quarterly earnings fell short of expectations.

- Revenue Decline: ORI experienced a slight decrease in revenues.

- Uncertain Futures: A mixed sector outlook introduces uncertainty regarding ORI’s future.

That’s it for this week.

If you write amazing content and want to be featured, please send it through for consideration.

Cheers,

Wyatt

Disclosures

- There are affiliate links above; we’ll get a couple of bucks if you take action after you click.

- Nothing above is financial advice. DYOR, you filthy animal.