Hello and welcome to Alts Cafe

This is a quick-fire look at what’s driving your alts week.

What’s on deck today:

- Equities are so hot right now

- Real estate is looking at a 1980s-style housing recession

- The vultures are coming for your startup

- Is there a private credit bubble?

- Ethereum is mooning

Table of Contents

Macro View

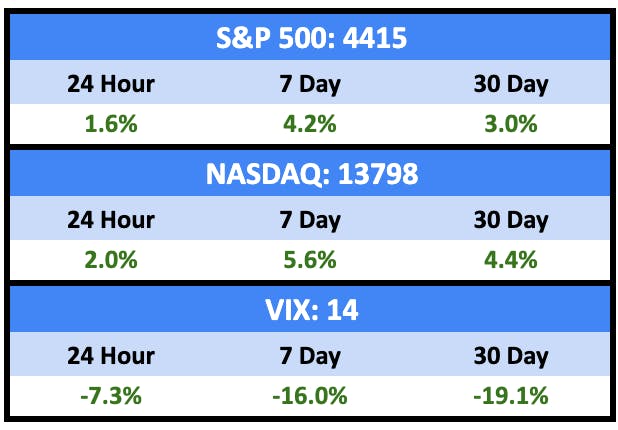

It was another big week for the markets, but some key prints are coming out over the next few days.

Bullish News

- Wall Street rose sharply Friday, keeping November on track to be one of its best months of the year, as companies continued to turn in better profits for the summer than expected.

- Big Numbers Dropping: The Consumer Price Index (CPI) and Producer Price Index (PPI) report this week, as will major retailers Walmart and Target.

- Analysts forecast a 3.3% CPI print while prediction market Kalshi is at 3.21%.

Bearish News

- Moody’s changed the US ratings outlook to negative while affirming the AAA rating.

- House Speaker Mike Johnson’s funding plan looks doomed by GOP lawmakers ‘hell-bent’ on shutdown.

- But prediction market Kalshi shows only a 24% chance of the gov’t shutting down.

Forecasts

Get $25 to play around with invest on Kalshi using this link.

📉

1%

Chance of Fed hikes rates in November

📈

91%

Chance credit card defaults will rise in Q3

📉

2.34%

National average house price increase in 2023

What are we doing?

ALTS 1 Fund news:

In the final stages of a major art acquisition.

Real Estate

Bullish News

- The largest commercial property brokerages are saying the market has hit a bottom. “We think we are at the bottom, and we think it’s only going to get better,” Newmark CEO Barry Gosin told shareholders during the New York-based company’s earnings call. “The question is how much better.”

- The most popular destination for people looking to move overseas was Canada, followed by Japan and Spain.

Bearish News

- Wells Fargo predicts a 1980s-style housing recession and persistent 8% mortgage rates.

- WeWork, which has gone WeBroke, canceled all its leases in Seattle, NYC, and the Bay Area.

- And the bankrupt company has $100 million unpaid rent.

- Workers will likely spend 20% to 25% less time in the office than before the pandemic, according to the head of CBRE.

- And “We thought values may come down 15%, 20%. We now think that may be another 10%,” Sulentic said.

- Briefcase comes with a sobering overview of real estate’s impact on climate change.

- And learn how climate change will impact real estate.

- Because climate concerns play a role in half of American home moves.

- And learn how climate change will impact real estate.

- American property taxes are going up.

- Britain’s buy to let bubble has burst.

How to invest in real estate right now:

Don’t

Startups

Bullish News

- A new breed of sort-of PE funds are raising cash to hoover up startups left bereft by VCs.

- OpenAI is much more vulnerable to challengers than most people think.

- BNPL companies Klarna and Affirm both had good weeks.

- Three different $100 million + crypto VC funds launched last week:

- LightSpeed Faction announced a new $285M crypto fund.

- Standard Chartered’s SC Venture and SBI Holdings announced they’re investing $100M into crypto startups.

- Maven announced it’s raising another $100M fund (and it’s already raised more than a third of the funds so far).

Bearish News

- The tech industry has seen nearly a quarter million layoffs in 2023.

How to invest in startups right now:

Buy distressed startups.

Private Equity and Private Credit

Bullish News

- PAI Partners has completed fundraising for its eighth main buyout vehicle, raising over $7 billion.

Bearish News

- Is a private credit bubble brewing? FT thinks so.

- But the WSJ think not.

- PE shops, struggling to retain junior talent, are showering them with pay rises and big perks.

- Private equity investors needing liquidity are being forced to get creative with an uncommon type of deal – midlife co-investments.

How to invest in PE and Private Credit right now:

Either go long or short private credit.

Crypto & NFTs

Here’s what you need to know:

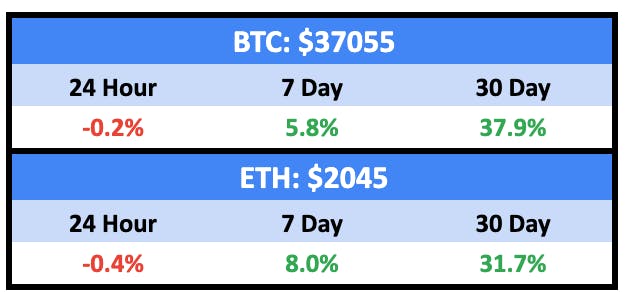

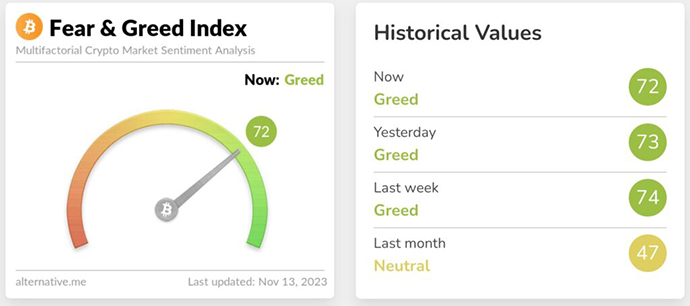

It’s getting frothy.

Wen moon? Now moon.

NFTs are now up 13% YTD.

Bullish News

- ETH hit $2k for the first time in ten months off the back of news BlackRock is launching an Ethereum ETF.

- Three different $100 million + crypto VC funds launched last week:

- LightSpeed Faction announced a new $285M crypto fund.

- Standard Chartered’s SC Venture and SBI Holdings announced they’re investing $100M into crypto startups.

- Maven announced it’s raising another $100M fund (and it’s already raised more than a third of the funds so far).

- Last week, “Gordon Goner,” co-founder of Yuga Labs, bought around $1.5 million worth of NFTs.

- Remember Sandbox? They’re launching a new cinematic-themed neighborhood where buyers of virtual land can build immersive experiences alongside famous Hollywood brands like “The Walking Dead,” “Black Mirror” and “Peaky Blinders.”

- Microstrategy is sitting on $1 Billion unrealised Bitcoin profit.

Bearish News

- Former FTX execs are launching a new crypto exchange.

How to invest in Crypto & NFTs right now:

It’s accumulation season.

That’s all for this week

Cheers,

Wyatt

Disclosures

- This issue of Alts Cafe was brought to you by our friends at Solenic Medical and Upwork.

- We hold BTC and ETH in our ALTS 1 Fund.

- There are a couple of affiliate links above. If you click them, we may get a couple of bucks.