Hundreds of investing and finance newsletters hit my (and maybe your) inbox every week. This is the best of the best.

This week, we bring you

Table of Contents

A Record Low for Home Loan Delinquencies

US home loan delinquencies dropped to a 17+ year low, with only 1.72% of single-family mortgagees falling behind.

This is largely due to a strong labor market, rising wages, and stringent bank underwriting standards established post-Great Recession

Additionally, pandemic-era assistance programs played a crucial role in supporting homeowners through turbulent times.

Breakdown: Warren Buffett’s 47th Annual Letter

In his latest annual letter, Warren Buffett pays tribute to the late Charlie Munger, reflecting on their shift from seeking fair businesses at wonderful prices to acquiring wonderful businesses at fair prices.

This year’s edition covers the underestimated importance of incentives, the benefits of long-term market participation, and the value of investing in companies with strong reinvestment opportunities.

Milei Achieves A Historic Budget Surplus

Argentina’s Javier Milei has achieved the country’s first monthly budget surplus in 12 years, flipping a projected 5% GDP deficit into a $400 billion surplus in just over nine weeks.

Through drastic cuts to central government agency budgets and the elimination of crony contracts and activist handouts, Milei has set a precedent for radical government downsizing.

Could this become a blueprint for other nations grappling with similar challenges?

NFL Salary Caps Soar

The NFL set a new record with its salary cap for the upcoming season, allowing teams to allocate over $255 million each, culminating in a staggering $10.5 billion across the league.

With a 13.6% jump, the largest since the salary cap’s introduction 30 years ago, the NFL continues to demonstrate its dominance.

A Revolution In Loyalty Programs?

via Simon Taylor’s Fintech Brain Food

Bilt Rewards has made headlines by securing over $200 million in funding and reaching a valuation of $3.1 billion.

By rewarding rent payments, Bilt has carved out a niche in a market ripe with high earners in metropolitan areas, offering tangible benefits to both renters and property owners.

Is this a genuine innovation, or just hype?

Social Media Moderation: The Supreme Court Weighs In

The Supreme Court is currently considering pivotal content moderation laws from Texas and Florida.

These laws, if upheld, might compel platforms like Facebook and YouTube to host all user-generated content, regardless of its nature, including “misinformation or hate speech.”

More details from The Publish Press.

What I’m reading

I get a lot of mail asking where I find all this good stuff. Here are a few of my favorite newsletters, all of which are free to subscribe to:

Become a better dealmaker. Get the latest trends and transactions with the Street’s most informative M&A update.

The “IKEA instructions for investing” to help you become a better investor

Get Smarter About Crypto in 5 minutes a day 🥜

Stock ideas

Let’s check back in with Yellowbrick Road, which highlights 15 stocks every week. Here are three of my favourites from this past week.

Analysis provided by public.com. Remember to always DYOR

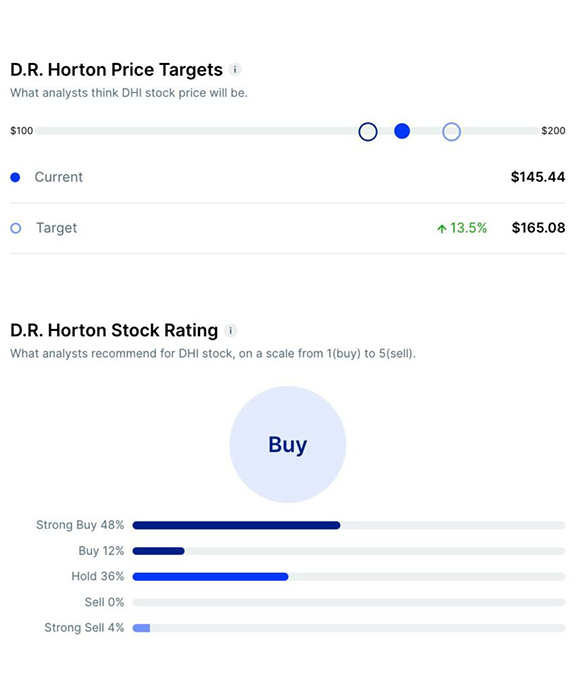

D.R. Horton, Inc. ($DHI)

Bull Case:

- Sales Growth: DHI’s sales are projected to grow from $36.75 billion in 2024 to $39.24 billion in 2025, with net income also expected to increase.

- Attractive Financials: Forward P/E is expected to decrease from 10.2 in 2024 to 9.2 in 2025, and the net debt forecast to remain under $700 million through 2025.

- Analyst Confidence: A recent outperform rating by Raymond James signals confidence.

Bear Case:

- Market Volatility: Homebuilding is highly sensitive to economic cycles, interest rate changes, and consumer confidence.

- Regulatory and Supply Chain Risks: Homebuilders face risks related to land development and construction regulation. Additionally, supply chain disruptions could impact the cost of materials and timelines.

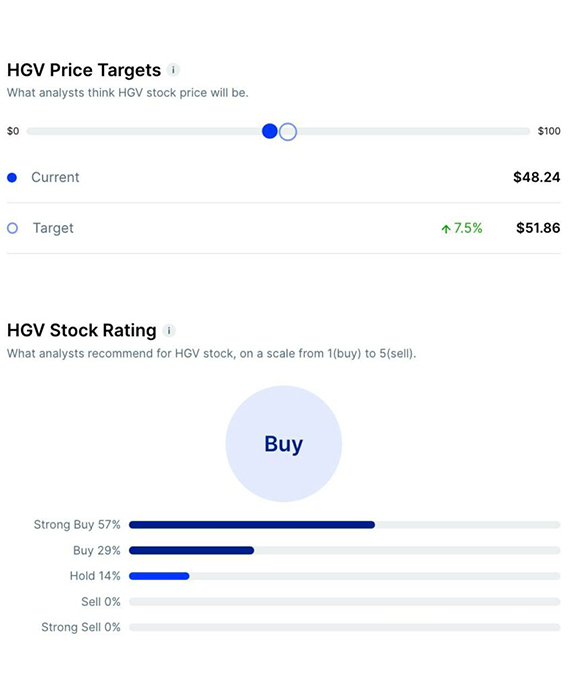

Hilton Grand Vacations ($HGV)

Bull Case:

- Attractive Valuation: HGV holds a P/E ratio of 10.84, significantly lower than its industry average of 22.60. Additionally, its Price-to-Sales ratio stands at 1.13, compared to the industry average of 1.63.

- Analyst Sentiment: The consensus suggests a potential upside of 25.5% from its current price.

- Impressive Financials: HGVs reported substantial annual sales of $3.84 billion. The company’s debt-to-equity ratio stands at 1.75, which, while indicative of leveraging, is not uncommon in the industry.

Bear Case:

- High Beta Value: The stock’s beta value is 1.93, indicating higher volatility compared to the market.

- Concerns over Insider and Institutional Selling: Recent transactions show instances of selling by entities such as Price T Rowe Associates Inc. MD and Winslow Asset Management Inc.

- Market Uncertainty: The timeshare industry faces stiff competition and market sensitivity.

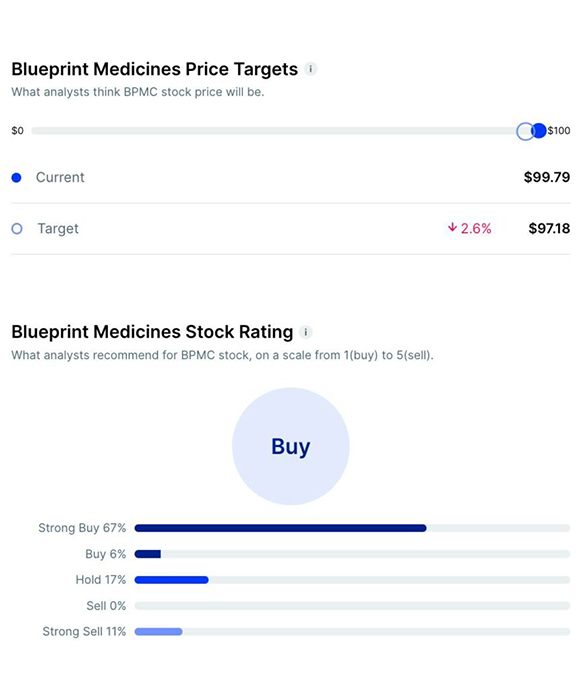

Blueprint Medicines ($BPMC)

Bull Case:

- Product Performance: BPMC’s flagship product, Ayvakit, has shown impressive performance in the indolent systemic mastocytosis (ISM) market.

- Sales Growth: BMPC expects Ayvakit to generate $360 million in product sales in 2024. In the future, the drug could reach peak sales of around $2 billion.

- Stable Finances: BPMC holds a strong balance sheet worth $767.2 million as of the end of 2023. They also anticipate a decline in operating expenses and cash burn in 2024.

Bear Case:

- Dependence on Ayvakit: While Ayvakit has demonstrated significant year-over-year growth, there have been concerns about a slowdown in its momentum.

- Challenges in the Broader Portfolio: BPMC is managing a range of early-stage programs that have yet to be prioritized.

- Valuation Concerns: BPMC’s market cap may have already priced in Ayvakit’s blockbuster potential.

That’s it for this week.

If you write amazing content and want to be featured, please send it through for consideration.

Cheers,

Wyatt

Disclosures

- There are affiliate links above; we’ll get a couple of bucks if you take action after you click.

- Nothing above is financial advice. DYOR, you filthy animal.