Welcome to our very issue of Farmland Insider.

We analyze deals across FarmTogether, AcreTrader, FarmFolio, and other platforms.

This issue was written by our new analyst, Brian Jacques, who did a phenomenal job analyzing this offering.

(New here? Read our primer on farmland investing and our post all about farmland and rural opportunities)

Today, we look at the Willow Creek Farm — a corn and soybeans farm in Lee County, Illinois.

Table of Contents

Offering at a Glance

Willow Creek Farm

- Location Lee County, IL

- Platform: FarmTogether

- Available On: 12/15/2021 (First Time Investors)

- Permanent/Annual Annual Crops: Corn/Soybeans

- Capital Being Raised? $1,299,831

- Total Acres (includes non-farmable): 118.8

- Price per Acre? $10,941

- Price per Farmable Acre: $11,119

- Est. Ownership Duration: 9 years

- Min. Investment: $15,000

- Average Net Cash Yield (after Expenses): 2.10%

- Net Annual Return: 6.30%

About the farm

Crops

The Willow Creek Farm is located in Lee County, IL, 72 miles west of Chicago in north central Illinois. The farm rotates between corn and soybeans on an annual basis. This crop rotation augments yields, balances soil fertility, and reduces pest and disease pressure (pest and diseases specific to one crop do not have an extended time period to take root in the fields). Corn and soybeans are two of the most commonly rotated crops as they complement each other: soybeans deposit nitrogen in the soil, a critical component for corn growth, which helps to reduce the cost of added fertilizer.

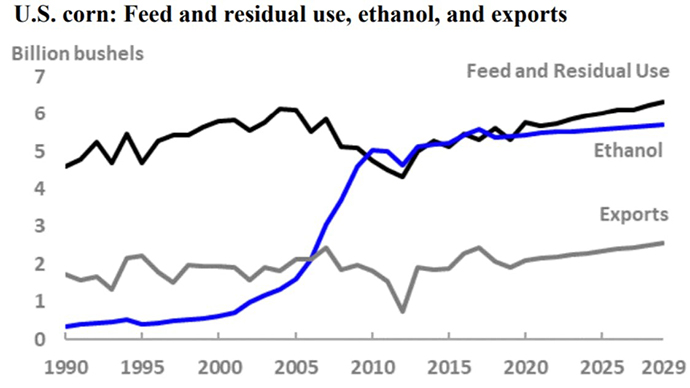

Both corn and soybeans are staple crops with several uses. The corn market is divided into three main uses with each comprising a third: feed for cattle/hogs/poultry, ethanol, and human/industrial uses. Both corn and soybeans have reputations on the global agricultural market as premium products. As a result, corn is one of the few crops where US exports are expected to increase over the next 10 years.

Soybeans have two main uses: livestock feed (corn acts as the carbs and soybeans as the protein) and soybean oil (human consumption; other products such as tofu, soy milk, and increasing use in adhesives, plastics, and construction materials). The current soybean export market is slightly depressed: China is the biggest consumer of soybeans (29% of global consumption) and has tariffs on American soybeans as a result of the recent trade war. Normalization of trade relations with China should spur increased soybean exports.

Summary: Corn and soybeans are annual crops which reduces the risk profile since they are harvested each year and the rotation between the two crops provides multiple benefits. With their varied uses and global demand, corn and soybean markets provide steady and predictable returns.

Geography

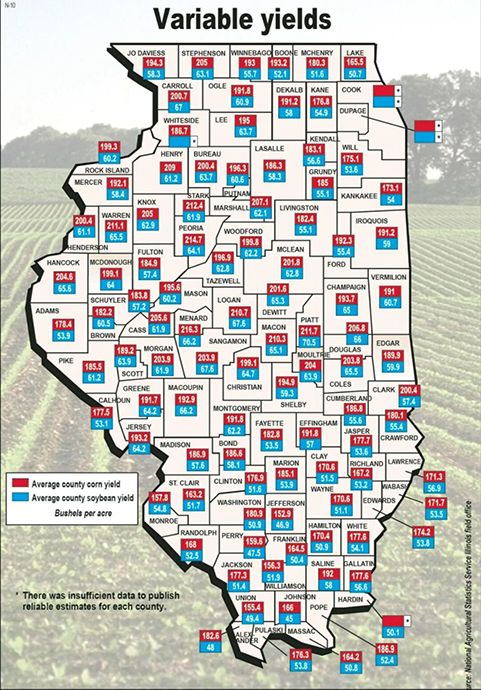

There are two soil quality indexes which can be used to evaluate soil profile for a corn/soybean farm: the Corn Yield Rating (CYR) and the Productivity Index. The CYR is on a scale of 190 and the Productivity Index is on a scale of 160. The Willow Creek Farm rates 165 and 121, respectively. Willow Creek’s CYR rating is below Lee County’s overall CYR rating of 195, which is among the highest in the state.

However, through the use of modern farming techniques, the Willow Creek Farm has a historic production of 211 bushels/acre for corn and 64 bushels/acre for soybeans. Both of these metrics are higher than the Lee County average of 195 and 63.7.

Summary: The ratings of the Willow Creek Farm soil is slightly below the county average, but actual historic corn/soybean production is above the county averages.

Water Rights

The farm itself is not irrigated and no well is present on the farm. A natural waterway runs through the middle of the farm which helps to prevent soil erosion. The Willow Creek Farm relies on precipitation for irrigation. Both corn and soybeans require 18 to 20 inches (40 – 50 cm) of rain during the growing season to generate high yields (or approximately 1 inch per growing week).

Lee County averages 34 inches of annual precipitation which is more than sufficient for corn/soybeans. The farm has installed drainage tiles to help remove the excess precipitation it receives.

Summary: There is some risk with no source of water present on the farm, but historical annual rainfall is more than adequate for corn/soybean growing purposes.

Access to Infrastructure/Capital Expenditures Required

Illinois is one of the leading corn and soybean producing states in the US. Corn and soybeans make up 90% of the crop acres in the state with corn (54%) and soybeans (27%) the two leading crops by revenue. Extensive infrastructure is present in Illinois to support the transportation and processing of corn/soybeans.

No capital expenditures are required at present for the Willow Creek Farm as it is currently producing the two crops.

Summary: The farm produces the two largest crops by dollars in Illinois, which in turn is one of the US’s leading producers of corn and soybeans. Infrastructure is present to support the farms’ crops and no current capital improvements are required.

Owners/Management

FarmTogether has subcontracted the management of the farm to Farmland Opportunity. Farmland Opportunity was established in 2009 and currently has $600 million of farmland under management with 128,000 acres in 10 states. FarmTogether is also investing their own capital in the project and has other corn/soybean farms in their investment portfolio.

The current tenant farmer will continue to operate the farm. This tenant has a long-standing relationship with Farmland Opportunity and has farmed several nearby properties. Replacement farmers would be able to be easily sourced due to Illinois’ large corn/soybean presence.

Summary: No red flags. Management and owners have prior experience in the corn/soybean markets.

Economics of the Deal

Purchase Price

The purchase price of the farm is $1.3 million USD. This equals $10,941 per farmable acre or $11,119 per acre. In their offering materials, FarmTogether states that the Willow Creek Farm was bought in an off-market transaction at a 11% discount to market rates. FarmTogether provided comps for recent sales in Lee County at $15,476/acre and $10,936/acre. Additional comps are shown below:

131.42 acres in Dixon, Lee County ($11,134/acre) 40 acres in Dixon, Lee County ($9,763/acre)

Summary: Purchase price per acre is in line with current farms for sale and at a slight discount to recently sold farms.

Cash Flows

The current tenant farmer will prepay annual rent. There is additional potential upside if corn/soybean prices exceed base cash assumptions. The added revenue would be distributed to investors at the end of the year. Investors can expect annual yields of 2.1% based solely on the tenant rent. This is net of FarmTogether’s annual management fee which is 20% of the farm’s annual gross revenue (this equates, roughly, to a .60 to .80 management fee, which is slightly below management fees seen on other fractional platforms).

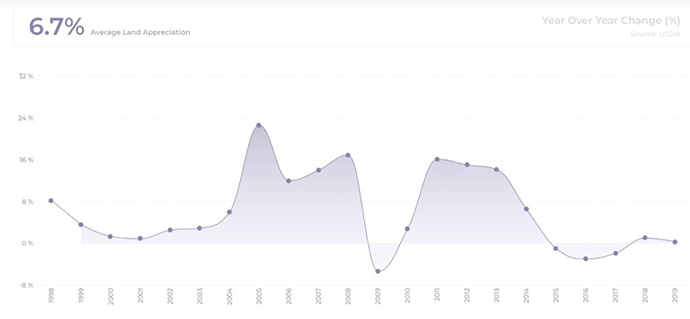

The 6.3% annual return projected by FarmTogether includes the projected sale of the farm in year 9. FarmTogether assumes that the land will increase 4% annually. Over the last 20 years, farmland values in Illinois have grown at 5.9% CAGR (compound annual growth rate). If the farmland values grow at this historical rate over the next 9 years, investors could expect an annual return closer to 7.98%.

Summary: Base case assumptions are for 2.1% yields in years 1 – 8 with potential additional upside if corn/soybean sales prices exceed certain limits. Assumptions used for growth of farmland value appear conservative and could lead to additional gains when/if the farm is sold in year 9.

Additional Financial Considerations

No debt is being assumed as part of the purchase. The depreciation of the drainage tiles will be passed to investors on the annual K-1 forms and can be used as a tax benefit (if investor has passive income to offset against depreciation) – this can potentially provide an additional .02% annual return.

Conclusions

The Willow Creek Farm isn’t the most “a-maize-ing” investment opportunity, but sometimes your portfolio can benefit from exposure to a low risk steady returns asset.

Pros

- Corn and soybean are two global commodities with multiple uses.

- Annual crops on a rotational basis reduces the risk profile and increases yields.

- Historical production of Willow Creek Farm is above average for Lee County.

- Annual precipitation in Northern Illinois is sufficient for high yield crop growth.

- No current capital expenditures required; continuity in current operator should minimise interruptions to operation.

- Off-market purchase of farm is at a slight discount to recent comps.

- Additional upside possible due to profit-sharing in corn/soybean sales above base rate and conservative farmland value growth rates used in model.

Cons

- No water source on the farm exposes crops to drought risk.

- Lower projected annual return compared to other fractional offerings would be less attractive in an inflationary environment; this risk is partially offset by expected increase in corn/soybean prices which investors would partially share in.

Would we invest?