(Note: This is Part 2 in our series on RAD Diversified. Here’s Part 1: Exploring REITs with RAD Diversified)

Today we’re looking at another alternative asset class that is critical to society: land

There’s a famous quote that I love:

The best time to plant a tree is yesterday. The second-best time is today.

You could say the same thing about investing in land. It’s the foundation of all humanity, it enjoys permanent demand, and they aren’t making any more of it.

In this issue, we’ll talk about land through the lens of RADD America, a company that has evolved from investing in traditional real estate to investing in American land.

We explore why investing in real estate can be a pain, how REITs make it easier, and look at RADD’s land strategy.

- If you’re accredited, step right up and invest here.

- If you’re not accredited, no problem. You can join the waitlist here

Let’s go 👇

Table of Contents

The problems with real estate investing

When you invest in a stock, all you have to do is buy the asset, sit back, and wait for its price to rise. (Err, hopefully)

But real estate is much more hands-on. In fact, it’s a bit of a pain.

- You need a down payment anywhere from 3% – 20% (If you live in Arizona, you may qualify for Zillow’s new 1% down mortgages)

- You need to scour areas for the right property

- You need to think about development

- You need to ensure compliance with all zoning and occupancy regulations

- You need to find tenants

- Finally, you need to either manage the property yourself, or pay someone to do it (which costs an average of 4 – 7%)

And that doesn’t even cover the complex nuances of real estate taxes, the navigation of which can make or break your performance.

(Note: Some tax laws, like the infamous 1031 exchange, are so important that they warrant their own issue. We’re exploring 1031s in this week’s Sunday Edition.)

For decades, these challenges kept many people from thinking about real estate investing beyond one’s own home (or perhaps a second holiday home).

When everyday people do invest in real estate, they typically rent out a single-family home in a neighborhood they know well.

But with the creation of a corporate structure known as the real estate investment trust (also known as REITs), the tide began to shift in favor of retail investors.

The rise of REITs

REITs are basically just companies that own and operate a portfolio of real estate assets. To buy these properties, REITs raise money from retail investors like you.

REITs were introduced in the 1960s as a tax-efficient way for individual investors to access better real estate opportunities.

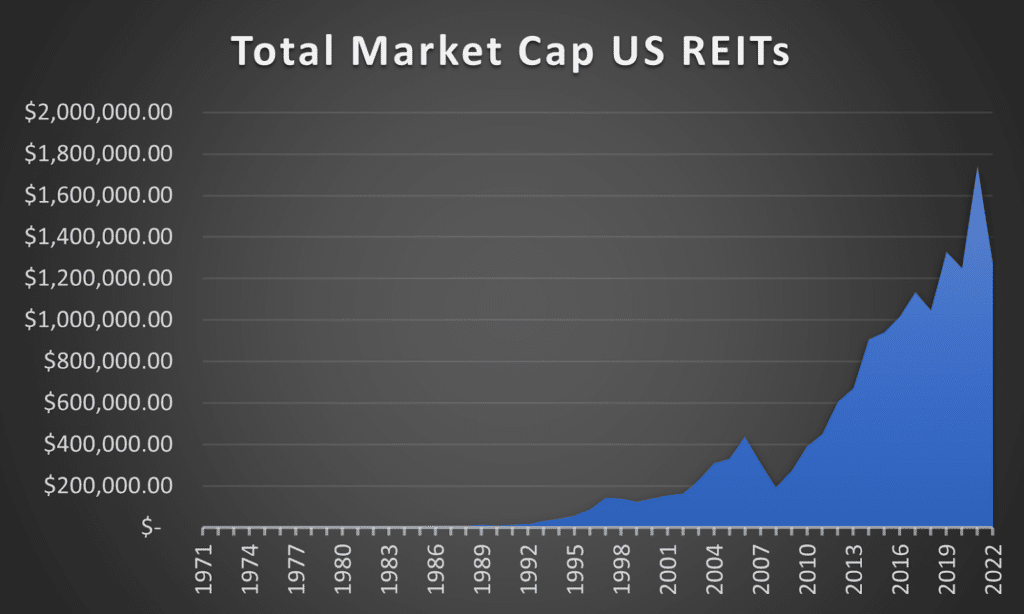

For the first few decades after its introduction, nothing much changed. But the law changed in 1986, and suddenly REITs were allowed to manage the properties they purchased themselves.

This unleashed the modern era of real estate investing.

There are now more than 200 REITs in the United States, with a total market cap of over $1.2 trillion. RADD America is one of them, and we’ll talk more about them below.

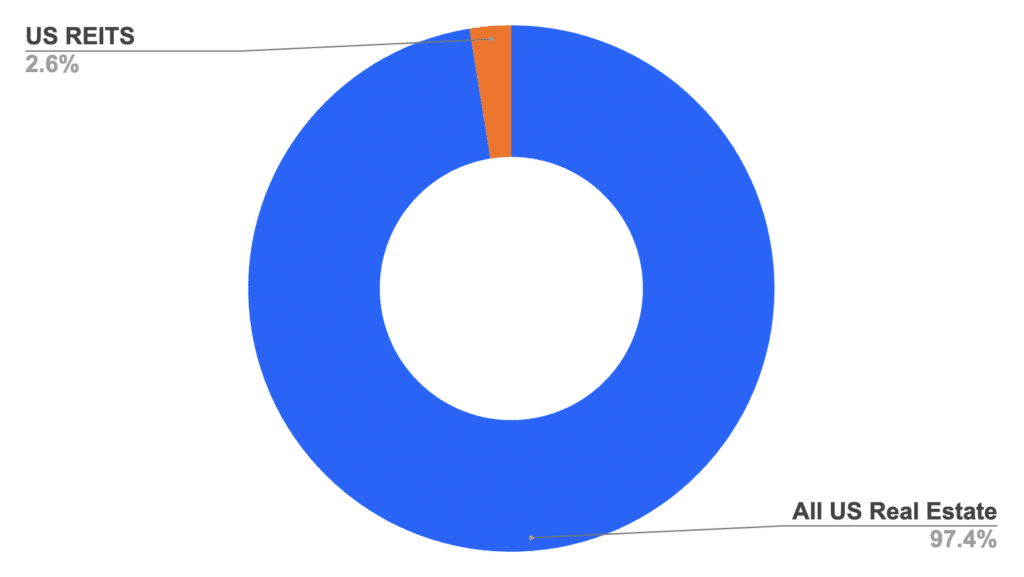

While REITs represent just a fraction of the total value of domestic real estate, it’s about the same size as the private credit market.

In exchange for providing financing, investors receive income generated by the REIT.

By law, REITs must pay out at least 90% of their taxable income as dividends to investors.

We’ve long been a believer in the importance of REITs – in fact, when we first founded Alts, the RAD Diversified REIT,, Inc was our second sponsor ever. They originally focused on buying fixer-upper properties, improving them, and finding new tenants.

Their track record has been terrific. In under four years, the RAD Diversified REIT share price climbed from $10 to $25.04.

Why are REITs so popular?

The biggest benefit of REITs is that it turns active real estate investing into passive investing.

Traditionally, real estate investing combined the two. There was essentially no difference between real estate investors and operators.

But with REITs, investors can outsource the operations to professional managers who do all of the hands-on work (sourcing properties, making repairs, managing tenants, etc.)

The passive part is far easier. Just invest capital and collect returns.

REITs also helped solve a few of the structural problems with the asset class:

Liquidity

Buildings and houses can be difficult to sell. After all, each property is unique, and finding the right buyer takes time.

But by assembling a portfolio of properties under a single corporate structure, investors can just trade shares on that portfolio, the same way they can trade shares of stock. In fact, many REITs are publicly traded, being listed on stock exchanges.

Now, RADD America is a private REIT, which means RADD America is not on a stock exchange.

But this can be a big advantage, because their stock price isn’t determined by the broader stock market! Private REITS do a better job reflecting reality, and won’t fluctuate as drastically.

Capital intensity

Real estate investing typically requires high upfront capital costs – after all, buying a house (or land) isn’t cheap.

But REITs are fractionalized shares of an entire real estate portfolio, which allows investors to get in for a low minimum investment.

Diversification

Real estate is treated as a single asset class, but it shouldn’t be, because there are tons of diverse sectors within real estate that each have their own attributes.

Residential real estate and commercial real estate are the two major groups. But each of these has its own subdivisions (single-family housing, multi-family housing, offices, storage, industrial, etc)

And that’s to say nothing of the truly diversified, alternative real estate REITs, like RAD Diversified (heck, it’s in their name)

What is RADD America?

RADD America is led by founder and CEO Dutch Mendenhall, who spent years consulting in the real estate industry.

The organization now has over 150 people and manages a $200 million real estate portfolio, operating residential and mixed-use properties across California, Texas, Florida, Pennsylvania, and New Jersey.

But the team is putting together a new fund that’s focused strictly on American land, including farmland, timberland, and undeveloped land.

Let’s get into their strategy.

RADD’s investment strategy

Investing in land is different from buying homes. Here’s how RADD America plans to leverage land’s unique features and create serious value.

Buying underutilized land

Too often, prime land is underutilized, not achieving its full potential. This is especially true for farmland, which can suffer dearly from bad management.

The RADD team has plenty of experience helping traditional real estate assets realize their full earning potential. Now, they’re taking that experience to the land itself.

All land that RADD America invests in has:

- Water rights, which we’ve covered before and is critical

- Access to good soil

- Potential for additional income. For instance, many farms have overlooked opportunities to generate revenue by selling gravel to a rock company, selling timber from the land, and applying for carbon credits. Stuff like that.

By improving the management of the farms and increasing their cash flow per acre, RADD America is ensuring their investments are realizing their full potential.

Developing the land

One of the drawbacks of investing in undeveloped land is that it’s, well, undeveloped. That means there’s limited potential to generate immediate income from the land.

On the other hand, it means that potential income is limited only by your imagination — and by your capacity to actually build what you want to build.

They have plans and zoning in place to develop the plots. They’re taking the blank canvas of raw land and painting a new picture – in this case, developing homes for everyday people to live in.

Scarcity

Land is the ultimate scarcity investment. After all, we can’t just make more land.

The scarcity of developed real estate is something of an illusion. A developer can easily 20x the units of available housing on a lot by converting a single-family home to a multi-floor apartment building.

But the scarcity of land is undeniable. That means increases in demand will almost inevitably flow through to an increase in price.

All in all, these key features have made land an exciting opportunity for investors in the past few years, an opportunity that RADD America is looking to capitalize on.

The best time to invest in land

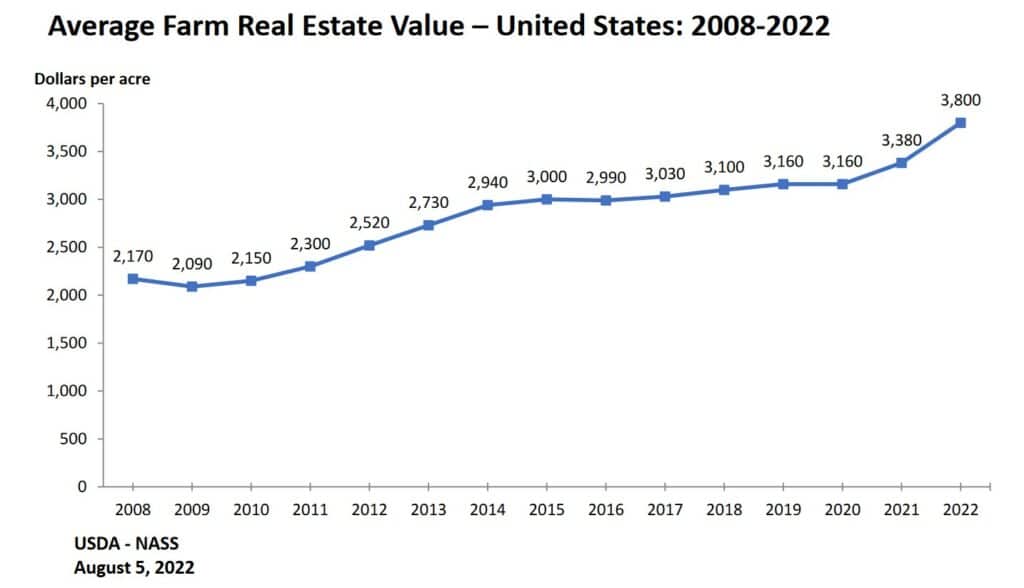

Over the past decade, land has seen a strong rise in value, as competition for this scarce resource heats up. To take one example, the average value of an acre of farmland in the US climbed from $2,520 in 2012 to $3,800 in 2022.

And that rise doesn’t factor in the income the land has generated. It’s like looking at the rise in a stock’s share price without also factoring in the dividends.

All told, the average annual return on farmland is 11.5% (In comparison, the S&P 500 has an average annual total return of about 12%)

Social benefits

In his recent appearance on the Alts podcast, Dutch acknowledged that part of the motivation for having a separate vehicle for land investments was making financing simpler for RADD’s overall real estate portfolio.

But he also emphasized the important social benefits of RADD America. In other words, this REIT is designed not just to achieve strong financial performance, but also to serve a higher purpose for America.

RADD America is being launched at a time when the importance of America’s land to her security is being increasingly emphasized.

Foreign ownership of US agricultural land doubled from 2009 to 2019. And recently, a Chinese company attempted to build a plant near a US Air Force base.

Highlighting these facts isn’t meant to demonize foreigners – after all, immigrants from an invaluable part of America’s history and cultural fabric. But for both food security and national security purposes, the importance of ensuring America’s land is overwhelmingly owned by her own citizens can’t be overstated.

RADD also sees tremendous value in stewarding America’s land for the next generation. That includes contributing to conservation efforts for environmental purposes, as well as ensuring support for farmers who still cultivate locally-grown, fresh produce.

The financial case for investing in RADD America is strong. But the social case could be a big draw for Americans who want to support their nation’s future by supporting its land.

How it works

Historical performance

RADD America is a new fund, so there’s not any performance history to access.

However, the original RAD Diversified fund’s performance is strong.

In three years, it grew its share price from $10 to $22.22 from 2019 to 2022, an annualized increase of about 30%. Today, the share price sits at $25.04.

Private REIT

RADD America is structured as a REIT, which means investors will get the same great income generation and tax treatment that all REITs get.

As a non-listed REIT, however, RADD America shares can’t be sold as easily as shares on a public exchange can. RADD does intend to have a semi-annual redemption program, though, similar to the structure of their RAD Diversified fund.

This also means the RADD America share price will update less frequently than public shares would. The share price will be updated once a quarter based on the firm’s current net asset value.

Transparency

Despite being non-listed, RADD does aim to be as transparent as possible with investors on the current status of their funds. Each month, CEO Dutch Mendenhall does a monthly Zoom call to update investors on potential returns and what new acquisitions are being worked on.

How to invest in RADD America

Accredited investors

RADD America is a Reg D fund, so only accredited investors can currently access the fund.

Non-accredited investors

If you’re not accredited, no problem.

The fund will roll out a Reg A offering in the future, in which case non-accredited investors can join in.

The company is submitting their Reg A offering to the SEC this month to start qualification process.

In the meantime, you can join the waitlist here

Join Non-Accredited waitlist →

Disclosures

- This issue was sponsored by RADD America

- This issue contains no affiliate links

- Neither me nor the ALTS 1 Fund has any investments with RADD America or RAD Diversified REIT

This issue is a sponsored deep dive, meaning Alts has been paid to write an independent analysis of RADD America. RADD America has agreed to offer an unconstrained look at its business & operations. RADD America is also a sponsor of Alts, but our research is neutral and unbiased. This should not be considered financial, legal, tax, or investment advice, but rather an independent analysis to help readers make their own investment decisions. All opinions expressed here are ours, and ours alone. We hope you find it informative and fair.

Read the Disclosure for RADD America land REIT Reg. D Fund and RAD Diversified