Today’s issue is about the world of fractional real estate investing — including both residential and commercial opportunities.

Let’s explore!

Table of Contents

What is real estate crowdfunding?

Real estate has always been one of the most popular and attractive investment opportunities known to man.

As the famous Will Rogers saying goes:

Buy land, they ain’t making any more of it.

-Will Rogers

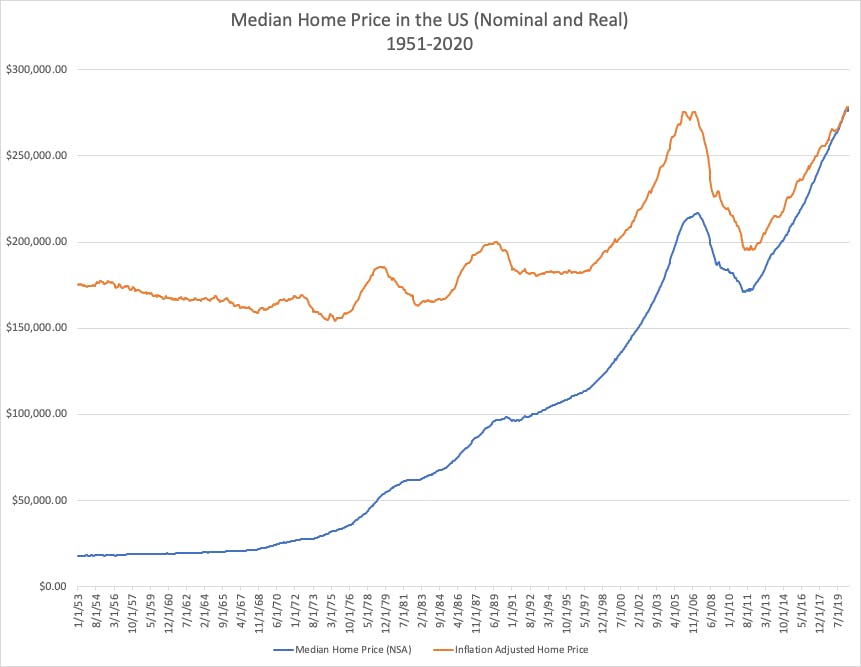

However, with median home prices at new all-time highs, homeownership is out of reach for far too many people. Low-income families, single-earner households, heck even high-earning households without a down payment are effectively shut out of the market.

We’ve all seen the upward-trending home price charts a million times, but here’s another one anyway. Even adjusting for inflation, real estate prices are bonkers.

Real estate crowdfunding uses innovations in technology & finance to bridge the affordability gap, and let those with lesser means share a slice of the pie — without the big down payment.

The concept of crowdfunding is simple: A project (be it artistic, business-oriented, or altruistic) pools funds from a group of interested supporters. The most well-recognized crowdfunding platform is Kickstarter, which has thousands of listings, and has hosted many of the world’s highest-funded crowdfunding projects.

Yet while many are familiar with crowdfunding, real estate crowdfunding is not quite as popular or well-understood. Real estate crowdfunding is when a collection of investors pool funds to purchase and/or develop an investment property. Purchases take the form of equity or debt, and ROI is generated through (typically high) dividends, and a proportional profit margin if and when the property is flipped.

How does real estate crowdfunding differ from other RE investments?

In some ways, real estate crowdfunding is an old concept. After all, families, friends, and communities have been pooling funds to buy investment properties for decades.

So what makes real estate crowdfunding different now?

Two things:

- The entry point is far lower. Investors can now get involved in real estate investing for very modest sums — as low as $250 with some platform. Traditional real estate investment has become more and more unaffordable as of late, with the average house price up 8% in the last year alone. This gives those that can’t typically afford an investment property a way to diversify into real estate.

- You invest with strangers. The platforms are almost entirely online. involving a third party that handles the transactions which occur not among acquaintances, but a wide variety of complete strangers. (And lots of them.)

Okay, so it’s a modern take on community investing. Got it.

But how is it different to another popular form of real estate investment — REITs (Real Estate Investment Trusts)?

Real estate crowdfunding vs REITs

At face value, real estate crowdfunding seems similar to investing in a REIT.

REITs are publicly traded funds that operate similar to ETFs. Investors can invest in REITs like any other stock. They earn a dividend and can resell their stake at a later date. REITs provide those without the means to get on the property ladder, without worrying about lump sum down payments, mortgages, or interest rates (at least not directly.)

The primary and most significant difference has to do with where your investment money goes. With REITs, your cash goes into the hands of a corporate management team who will choose the investment properties for you, with shares often comprising of hundreds to thousands of properties, usually commercial properties.

This provides a safe, liquid option for those that have minimal knowledge of the real estate market. But unless you are a major shareholder, you have essentially no control over what particular properties the REIT invests in. It’s essentially a highly targeted investment fund.

Conversely, real estate crowdfunding provides you with the freedom and clarity to choose specific assets to invest in. While these assets are much less liquid than REITs, it may be a worthy trade-off for the sheer customization it allows.

REITs provide access to investing themes, whereas real estate crowdfunding lets you get much more specific. Want a piece of the Australian or New Zealand housing market, but live overseas? Sure, a REIT can give you exposure to that. But if you want to place a proxy bet on a commercial real estate project in say, Bend, Oregon? You’ll need something much more specific.

Real estate is all about location, location, location. And real estate crowdfunding is a location due diligence dream come true.

Pros & cons of fractional real estate investing

Pros

For those who don’t have the time, energy, or financing for a traditional property purchase, real estate crowdfunding can be a great alternative way to climb the property ladder.

- More granular control. As discussed above, this investment gives you better control over your portfolio than a simple REIT. Rather than living at the mercy of a fund manager, you can target specific geographies or invest based on specific styles, quality levels, and other property attributes you are familiar with.

- Residential opportunities. Many (but not all) REITs invest solely in commercial/industrial property Through residential crowdfunding platforms, you can access the residential market. More on these later.

- Ultra-low minimums. This one of the best aspects of fractional investing, period. And it’s no different with real estate. With investment opportunities starting from as little as $10, the entry point for real estate crowdfunding is extremely palatable.

- No down payments. Real estate investing has played a role in helping to create 90% of the world’s millionaires. The vast majority of American (not to mention European and Australian) wealth is stored in real estate. You can join the club without forking over a year’s salary as a down payment.

- No tenants, no maintenance. This is arguably one of the biggest pros. Landlords know that tenants can be irritating or even downright malevolent. You don’t have to worry about leaky faucets, fees, broken windows or Project X style parties — all while reaping the benefits of passive income.

- Short investment periods. The investment periods for crowdfunded real estate are usually brief. You can start seeing dividends often within a year, though your money will generally remain tied up for a while after if the property needs a long-term renovation, or if it has a target investment period of multiple years. The investing timeframe will also depend on whether you invest in debt (typically shorter periods) or equity (typically longer periods).

- Good returns. Perhaps the most attractive benefit of real estate crowdfunding is the average return, which platforms claim can significantly outperform ETFs. In fact, one of the biggest crowdfunding platforms, Fundrise, boasted yields of 12% between 2014 and 2019.

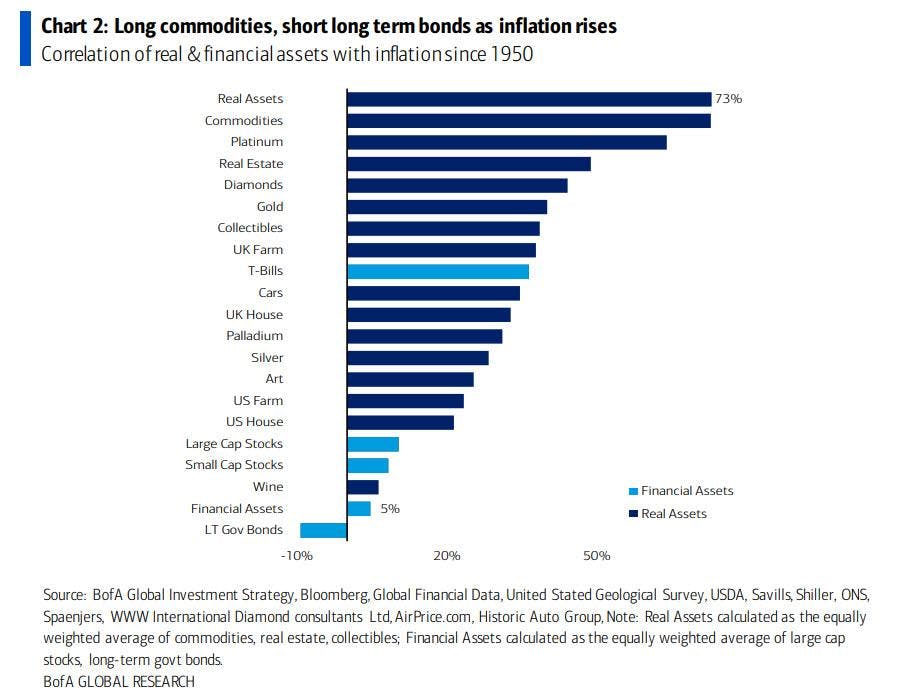

- Inflation hedge. While the housing market is somewhat correlated with the stock market, there is no direct relationship between stocks and real estate. So RE crowdfunding gives you the potential to diversify your portfolio during periods of turmoil (or heck, inflation)

Cons

I know, I know. In an ideal world, this section would be empty and everyone would be smoking expensive cigars and sleeping in stacks of cash from their investment returns. But as we all know, risk profiling comes with the territory.

- You can lose money (duh). The most obvious con (which probably needs no announcement) is that you can lose money. Not all investment properties succeed. The real estate market could crash. Past performance isn’t a reliable indicator of the future. Blah blah blah. Let’s move on from that.

- Illiquidity. Real estate crowdfunding tends to mirror actual property investment in that your assets are illiquid. If you need money in a bind, it’s best to look towards other elements of your portfolio, as you can expect a 5+ year commitment before your investment becomes fungible.

- Higher risk than managed indexes. The risk of real estate crowdfunding is typically greater than that of other managed indexes. Issues with construction, or an inability to find tenants can all result in delayed or significantly reduced yields. And large catastrophes can completely rob you of any return.

- Due diligence is your responsibility. Due diligence is extremely important when it comes to crowdfunded investments. You have greater control, but that means you have to make expert decisions. A lack of market understanding can burn you. On the other hand, REITs are typically handled by market experts.

- No control over development or property management. While you get to determine the exact property you wish to invest in, you still have minimal control over development and property management.

- Platform dependency. The specific platform you use to invest in crowdfunded real estate plays a major role in the overall success of your investment. While platforms usually have a unique process to assess each project, some will provide a far superior level of detail, market trends and access to the developer than others. It’s important to ensure you’re all over the vetting procedure, the sponsor’s business history and the overall quality of the property.

Which brings us to the next section…

Top real estate crowdfunding platforms

There are two primary types of RE crowdfunding platforms (though some dip their toes into both) — commercial platforms, and residential platforms.

Commercial crowdfunding platforms

Commercial real estate (CRE) is comprised of office buildings, apartment complexes, shopping centers, etc. Commercial investments are associated with higher long-term returns, but require more due diligence and upfront investment than residential properties.

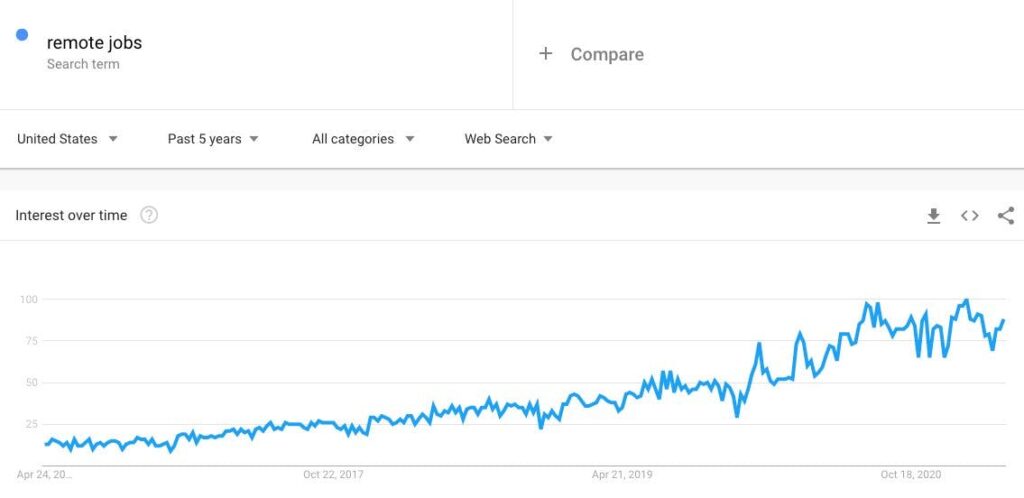

Covid has affected the commercial real estate market drastically. Rental growth, market demand and overall usage of office space has faltered as a result of social distancing and work-from-home measures. Of course many companies were forced business as a result of global lockdowns, which has also impacted CRE yields. Within a month of the pandemic, hotel and retail real estate was down 50%, and is recovering modestly.

But even as the world gets back to normal, working from home is here to stay, and the rebound of commercial real estate is dependent on its ability to adapt. Whether that be through adjusting rent prices, in-office overheads and creating a sound technological roadmap forward, for CRE to thrive many businesses will need to embrace an economic and digital transformation.

CrowdStreet

With an impressive IRR of 18.2%, CrowdStreet lets users to take crowdfunded real estate investments into their own hands, while handholding users through the process.

Crowdstreet offers 4 types of deals, listed here by least to most risky:

- Core deals offer stable, predictable cash flow. They are usually occupied, need no major improvements, and are in big markets. These are considered the least risky opportunities.

- Core-plus deals are high-quality properties that are mostly occupied, but have low cash flow. They conservatively set aside some of the monthly income for future maintenance and upgrades.

- Value-add deals are projects that aim to significantly increase cash flow and the value by making dramatic improvements to the property.

- Opportunistic deals are low-cash flow, complicated development deals with the highest returns but the highest risk.

Unlike other crowdsourcing platforms, CrowdStreet actually ventures into REITS, providing investors who don’t want to choose a specific property with an internally managed index fund by CrowdStreet’s team of pros.

Cadre

Cadre is a well-established crowdfunding real estate platform for commercial investment opportunities.

Their major selling point seems to be the experience of their fiduciaries. Cadre employs an investment committee boasting 25+ years of investing experience. This asset class requires due diligence, and Cadre’s team instils confidence that you’ll be provided with all the relevant information to make intelligent decisions.

Cadre has also identified the issues with illiquidity in real estate crowdfunding investments, and have created a secondary market which provides an early exit point for users looking to sell.

As an added bonus, Cadre lets you invest in opportunity zones, which are are a US Government incentive designed to provide an economic boost to lower socio-economic areas, and provide accredited investors a way to reduce their tax burden.

LEX Markets

LEX Markets is a growing crowdfunding platform focused on commercial real estate. They provide users with the opportunity to invest in fractional shares of already-developed commercial properties, including office buildings, train stations, warehouses, and more.

It has an absurdly low entry point for acquiring a property stake (only $250!) which is obviously very appealing to beginners and those with a lower funds to spare.

One of the key benefits of the LEX’s share-based system is that users are able to trade and sell shares unrestricted, avoiding holding periods and lengthy development waits; and thereby circumventing common illiquidity issues you face on other platforms.

If you’re a beginner looking for a modern, highly detailed and easy-to-use platform, LEX Markets seems like a great starting point.

Residential real estate

While commercial real estate platforms are more popular, residential platforms are growing. The reality is, while businesses come and go, everyone will always need a home. This has proven particularly true lately, as the popularity of residential real estate has soared despite the pandemic. The relative drawbacks compared to CRE (lower growth and higher taxes), are offset by lower volatility in recent years.

HoneyBricks

HoneyBricks focuses on a category of US real estate it calls Core Plus multifamily buildings.

Core Plus properties are “high-quality, stable assets in good locations” that offer a moderate rate of return ranging from 8 to 12%.

The onboarding process is relatively straightforward; create an account, connect your digital wallet, and buy tokens representing fractional ownership of an asset. Through this arrangement, HoneyBricks can deliver rent payments back to your wallet in your choice of cryptocurrency.

HoneyBricks token holders can also take out loans

RealT

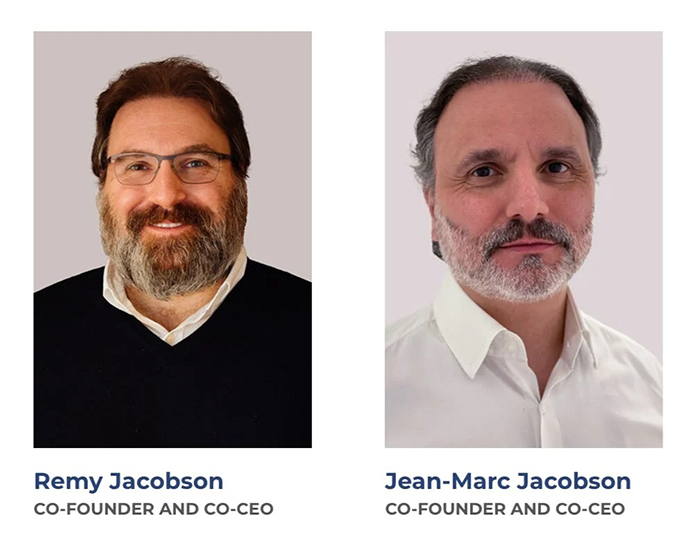

RealT was founded in 2019 by Remy and Jean-Marc Jacobson. It’s a first-of-its-kind company specializing in fractionalized real estate. Investors can buy tokens on the Ethereum blockchain that represent fractional ownership of a property.

In less than three years of operation, RealT has seen serious growth. The team has tokenized over 200 homes in the US. These tokens have gained traction all around the world, servicing more than 10,000 investors in 130+ countries.

Each property is divided into a finite supply of RealTokens. Holding a RealToken gives you a stake in a Limited Liability Company (LLC), which legally owns the property. Then, every week, you receive a distribution (rent), depending on how many RealTokens you own.

Another awesome part of RealT is its integration into the decentralized finance world. Instead of owning illiquid shares that can only be redeemed upon a sale event, RealTokens can be traded on a secondary marketplace supported by RealT.

For more information on HoneyBricks and RealT, check out our issue on real estate tokenization.

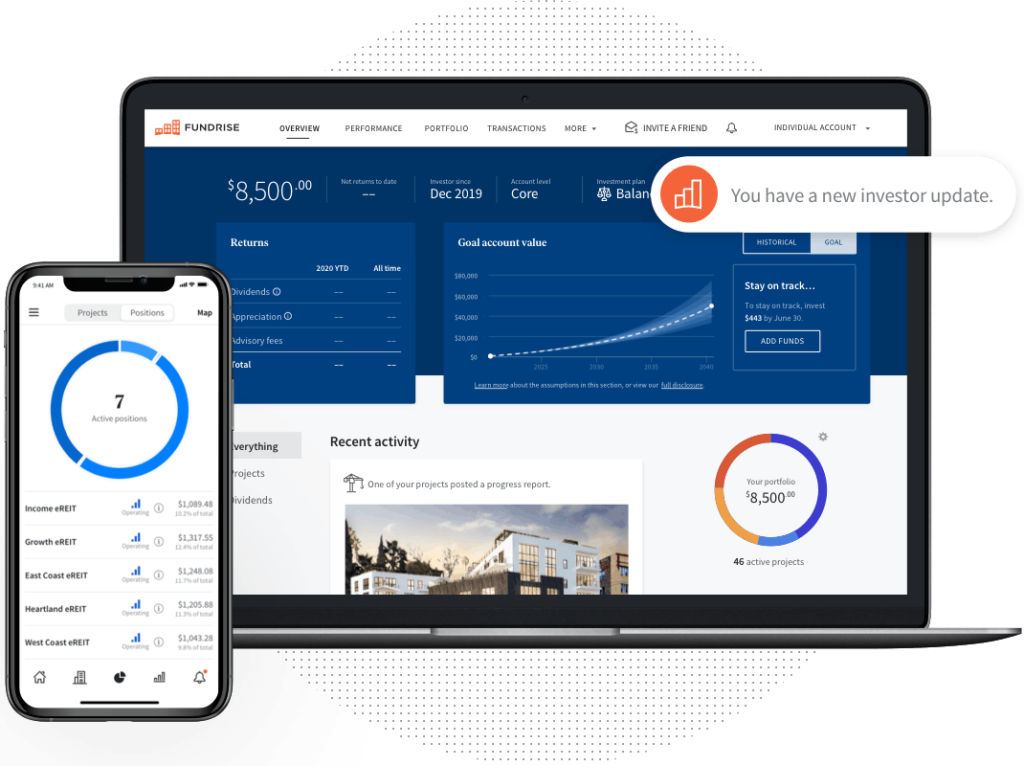

Fundrise

Founded in 2012, Fundrise is one of the longest-running and well-respected real estate investment platforms. They currently manage over $1 billion of equity across the United States.

With a minimum investment of $1,000, Fundrise’s portfolio of high-quality, strictly assessed real estate is easy to access no matter your financial situation.

As we mentioned previously, residential real estate is better equipped to stand up to periods of high volatility, and this is something that Fundrise recognizes and strives to achieve. While you are ultimately responsible for the risk assessment of your investments, Fundrise’s portfolio is ‘well-positioned to sustain a severe economic downturn’ due to an extensive underwriting process and conservative investments.

Though they are intended to be long-term investments, Fundrise also has methods in place to assist with the liquidity of certain assets, giving users the ability to prematurely liquidate their shares (though the success of this will depend on the economic climate.)

EquityMultiple

With an initial investment of 5 – 10k, EquityMultiple prides themselves on customer service, their track record, and a promise of low volatility.

Like Cadre, EquityMultiple also gives users the ability to invest in opportunity zones, and provides access to a team of investors with $75 billion worth of transaction history.

Whether you’re interested in institutional commercial properties or residential housing, EquityMultiple is a great platform for accredited investors.

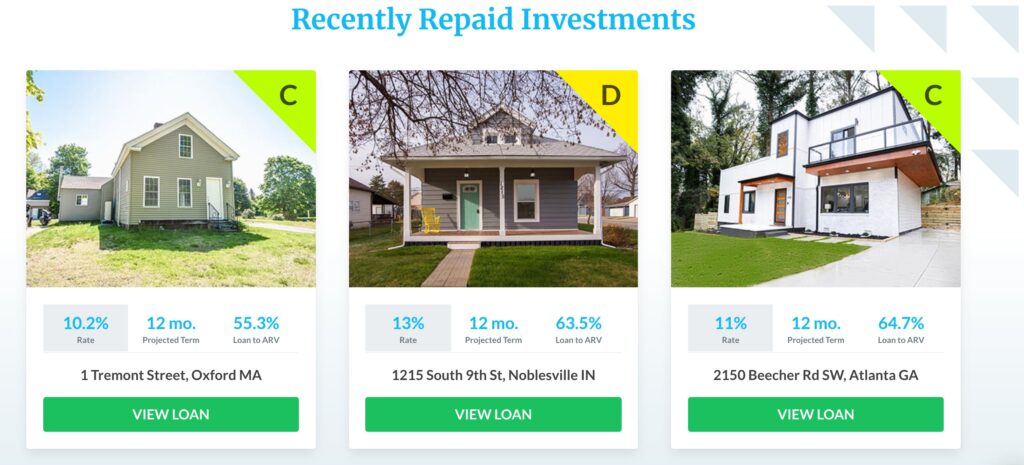

GroundFloor

GroundFloor is unique for a number of reasons, but its business model really stands out when you see its entry point. Initial investments can start as low as $10 dollars. That’s right. Ten bucks.

With a minimum like that, GroundFloor is clearly intended for beginning and younger investors looking to diversify their portfolio, and their overall asset and clientele numbers reflect that ($4 million raised among approx. 2,000 investors).

Their business model operates on a short-term basis, where investors essentially fund the ‘flipping’ of a run-down property, either for sale or renting out. This short-term nature is both a good and bad thing — you get your ROI quickly, but it also limits the profit potential. Yields can also be more volatile than on other platforms (especially if a property is foreclosed or a renovation proves more costly than expected).

That said, GroundFloor still gives their clients ultimate control over their investment as they provide intimate detail regarding each property they list. GroundFloor is one of the trailblazers in making real estate investment accessible for everyone. Investments are open to both accredited and non-accredited investors, which really pushes the ‘open-to-all’ philosophy.

Conclusion

Real estate crowdfunding is a concept that is gaining traction for good reason. As the real estate market continues to rise, it can be difficult for just anybody to get involved, which is why crowdfunding’s accessibility is so important for humanity.

In the long run, real estate only goes up. It’s arguably a must for any diverse and successful portfolio. And real estate crowdfunding platforms provide an appealing entry point for anyone, without the burden of down payments or the hassle of tenants.

As for the future? Expect more fractional real estate platforms to continue popping up. They may not be making any more land, but a new fractional real estate platform seems to surface every few months.

Notes and Links

- We just finalized the purchase of a website called ThePoorInvestor.eu. The owner, Jonas, has done a terrific job reviewing various P2P lending programs, and the site had a nice social presence as well. Welcome to all the new subscribers!

- Two companies living on the edge of alts, DriveWealth and Templum, have joined forces to create a digital fractional trading platform. (As you know here at Alternative Assets we are big fans of joining forces)

- Wall Street is starting to scoop up trailer parks. Hooray.

- Finally, our partner Jakob Greenfeld has a new project called Opportunities.so, and in their most recent issue did a great job exploring opportunities in real estate.