When we discuss investment opportunities, we’re usually talking about an intriguing new strategy or alternative asset class.

But if history shows us anything, it’s that the financial infrastructure that powers these opportunities is arguably just as important.

Today, we’re taking a look at Sweater, a financial infrastructure startup unlocking venture capital for everyone (including non-accredited investors).

Sweater has an interesting story:

- They started out by enabling non-accredited folks to invest in venture capital for the first time, through their Cashmere Fund (the world’s first public VC fund)

- Now, they’ve built something even cooler: a Funds-as-a-Service business, using a massively underutilized type of fund called an interval fund.

It’s a bit complex, but we’ll break it down and simplify it for you, as always.

To help tell this story, our CEO Stefan recorded a podcast with Jesse Randall, Sweater’s co-founder and CEO. (Jesse is a brain – this guy has learned and forgotten more about funds than I’ll ever know.)

Note: This issue is sponsored by our friends at Sweater Ventures. As always we think you’ll find it very informative and fair.

Let’s go 👇

Table of Contents

Why financial infrastructure is so important

To understand Sweater’s role in building new financial markets, you absolutely need to understand what financial markets looked like in the past.

In the modern world, we’re spoiled by how easy it is to invest in public markets.

If you have an internet connection, a computer, and a bank account, you’re already 99% of the way to being an investor in some of the most important companies of the world.

But it wasn’t always this way!

Let’s think back to the 1950s. At the time, buying shares was an uphill (and expensive) battle:

- For market prices and trading, you had to call up an actual stockbroker, which came with major information asymmetry and conflicts of interest.

- You’d get charged a huge commission by the broker, courtesy of Wall Street price fixing.

- And the requirement to purchase stock in round lots of 100 shares translated into high minimum investments.

Unsurprisingly, this meant that stock investing was out of reach for ordinary people.

In fact, a 1959 census conducted by the NYSE found that just 12% of Americans owned stock at the time (a far cry from 58%+ in America today, and 90%+ here in Australia.)

For a big chunk of the 20th century, “public” markets were only public as a regulatory matter. Actual access to the markets wasn’t very public at all.

But that all changed with the mutual fund revolution.

Mutual funds changed stock ownership forever..

While mutual funds were first unveiled in 1924, they didn’t catch on in their modern form until 50 years later:

- The first money market fund was introduced in 1971, allowing investors to earn far higher yields than they could in a bank account,

- the first index fund was launched by John Bogle in 1976, an idea initially deemed so ludicrous it was nicknamed “Bogle’s Folly,”

- and no-load funds (which don’t charge commissions) started to grow in popularity during this decade, helping slash costs for average investors.

These changes laid the groundwork for spectacular growth in the 80s and 90s, with the modern mutual fund industry taking shape and assets under management steadily increasing.

By 2000, mutual funds had gone from a relatively unimportant part of the market to holding over $10 trillion in inflation-adjusted assets, equivalent to one-third of the entire US stock market capitalization at the time.

The mutual fund isn’t the only factor responsible for democratizing financial markets. Better technology and revised regulations played a role as well.

But the mutual fund structure made it possible for the average investor to get low-cost, diversified exposure to a pool of public stocks for the first time – without the high fees and conflicts that came with individual securities.

..and they have lessons for private markets

Mutual funds quickly became an integral part of financial infrastructure – the behind-the-scenes system of exchanges, funds, and payment rails that power investment markets.

And as the mutual fund revolution shows, infrastructure improvements can be a powerful tool to make markets more equitable and accessible.

Here’s why we’re talking about mutual funds: public markets in the 1950s look a lot like private markets today.

While the situation is starting to improve, trying to buy shares of private startups is still a fee-heavy process with high minimums and opaque information, just like buying public stocks 70 years ago.

And the situation is made worse by accreditation requirements, which make it illegal for the average investor to even buy private shares in the first place.

If mutual funds helped solve public markets, can new pieces of financial infrastructure help solve private markets?

We’ve seen some intriguing infrastructure experiments so far, like the launch of listed private share funds and private share exchanges.

But there’s one piece of financial infrastructure that’s been surprisingly overlooked – the interval fund.

Interval funds: New(ish) and exciting

Interval funds are a relatively new type of fund structure, only having been blessed with SEC approval back in 1992.

Ever since, they’ve had a turbulent journey.

In 2007, total assets held in interval funds finally eclipsed $5 billion – but the ensuing global financial crisis knocked that back down to less than $3 billion.

Around 2013, though, the interval fund industry started to slowly gain steam, with total assets climbing to $85 billion in 2023 (for comparison, US ETFs hold about 80x more assets).

How do interval funds work?

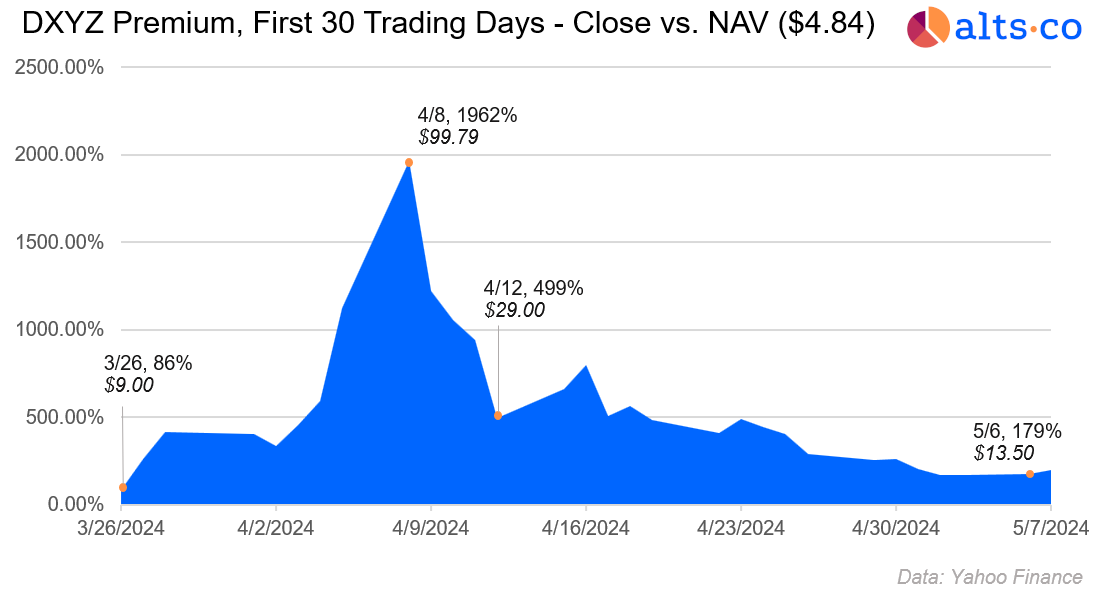

Interval funds are a form of closed-end fund (CEF), which might set off alarm bells if you remember our recent piece on DXYZ.

But there’s a key difference here – interval funds are unlisted, which means they don’t trade on an exchange the way listed CEFs like DXYZ do.

The price of listed CEFs can swing wildly, disconnected from the underlying portfolio – but unlisted CEFs don’t really have a “trading price” to speak of.

Instead, investors transact directly with the interval fund itself to purchase or redeem shares at net asset value (NAV).

So far, that probably sounds pretty similar to a mutual fund – but there’s a key difference.

Mutual funds are legally bound to offer share redemption daily.

Interval funds face no such requirement. Instead, they offer redemption at predetermined “intervals,” usually quarterly or semi-annually.

Because interval funds don’t face the same continuous redemption requirements that mutual funds do, they have the freedom to hold more illiquid assets – including alternatives trading in private markets.

But just like a mutual fund, interval funds are publicly registered with the SEC. As a result, they have no accreditation requirements — anyone can invest.

Interval funds are massively underutilized

Despite the power of interval funds to take private markets public, they haven’t gone mainstream – in large part because they’re still a new and unfamiliar tool for fund managers.

Just look at the numbers: there are fewer than 100 total active interval funds on the market right now. In comparison, 170 new mutual funds opened in 2023 alone.

And of the total assets in those active interval funds, over 93% are held in:

- Credit funds (both public and private credit)

- Real estate funds (the “original” alternative)

- And the ACAP Strategic Fund (which invests in public equities and accounts for almost 10% of all interval fund assets, yet doesn’t have a website)

Clearly, this is still an immature market with a lot of room for growth.

And one company is doing more to power that growth than almost anyone else — Sweater.

What is Sweater Ventures?

Launched in 2018, Sweater is a financial infrastructure startup aiming to unlock private markets for every investor, not just the wealthy and accredited.

The Sweater team was one of the first to identify the untapped potential of interval funds to bring private markets to the masses.

But they also realized that the web of financial regulations surrounding interval funds was complicated and untested, leaving many investment managers wary.

So, instead of waiting around for someone else to fix the situation, they decided to do it themselves by creating the world’s first public venture capital fund.

The Cashmere Fund

Sweater’s Cashmere Fund is the clearest proof of concept for the idea that interval funds can be used to take private markets public.

The fund operates like a true VC firm, investing in early and seed-stage startups – but features no accreditation requirements, a $500 minimum investment, and semi-annual redemption windows.

While being the first company to launch a public VC fund is a big milestone, Sweater’s greatest competitive advantage isn’t actually the Cashmere Fund itself.

Instead, it’s the fact that they focused on making the fund’s registration process repeatable.

By making long-term investments into compliance and technology, Sweater built an efficient framework to launch future funds using the same mechanisms as the Cashmere Fund.

But their plan isn’t to start launching a bunch of Sweater-branded funds.

Instead, they’re going to play an even more valuable role – operating a fund-as-a-service for independent investment managers.

Sweater’s newest venture: Funds-as-a-Service

To facilitate the growth of public VC, Sweater is opening up their platform and tech stack to qualified partners to run their own funds on the back of Sweater’s infrastructure.

These qualified partners:

- Need to have an existing audience or community they can target for fundraising. Think fintech companies, investment professionals, financial influencers, or even celebrities (like say, Kim Kardashian, who launched a VC fund in 2022).

- Will be responsible for fundraising and deployment (i.e., raising the cash and picking which investments to make). Sweater takes care of the rest, including registration, technology, and valuation.

- And will split the fund management fee with Sweater in exchange for utilizing the company’s platform.

In addition to the interval fund structure, Sweater is also going to facilitate the creation of tender offer funds.

These are a close relative of interval funds, with the main difference being that tender offer funds have redemption windows at the discretion of the fund manager, rather than during fixed intervals.

For that reason, tender offer funds are a bit less investor-friendly – but also offer more flexibility in case a fund needs to halt withdrawals for liquidity reasons.

Recently, we spoke with Jesse Randall, CEO and founder of Sweater.

Jesse estimated that fewer than 20% of the funds on Sweater would end up being tender offer funds – and also gave us a lot more insight into what the company can offer both managers and investors.

Jesse likened the current state of the investment fund industry to an orchestra where fund managers are expected to play every single instrument themselves.

If you want to launch a fund, it’s not enough to simply be a great investor.

You also need to know how to navigate the SEC registration process, understand the intricacies of fund auditing, build a modern technology stack, and do everything else that comes with fund operation.

This structure is a holdover from the days when only big institutional firms (with lots of in-house capabilities) launched new funds – but it doesn’t really make economic sense today.

Instead, fund managers should just focus on what they do best (raising money and picking good investments), while letting specialists take care of the rest.

With this context, Sweater’s focus on venture capital makes complete sense, as it’s the asset class in which their FaaS model could arguably have the greatest positive impact:

- By improving the division of labor within the VC world, Sweater aims to help get more funds off the ground…

- which translates into more investment opportunities for everyday investors…

- and helps funnel more capital into companies with world-changing potential.

Sweater’s journey is already well underway. They’ve already signed two major contracts (funds with an estimated $500 million and $1 billion in assets, respectively) and are in the final stages of another.

If you want to be part of this journey, Sweater is currently raising an equity round – which, in line with their overarching mission, is open to all investors.

Investing in Sweater

Sweater has already raised over $19 million in VC financing from prestigious firms like Motivate and Akuna Capital.

But now, they’re raising a community round to invite everyday investors to share in their growth. Here are the details:

- Type: Equity (Preferred Stock)

- Valuation: $48.49m (the same valuation that professional VCs invested in Sweater at)

- Format: Reg CF through StartEngine

- Min. investment: $177.50

- Funding target: $1.09MM

- Accreditation restrictions: None, although non-accredited investors have SEC-imposed limits

- Raised so far: $350K+

- End date: July 2nd, 2024

For the time being, Sweater is focused on venture – but we believe their model can quickly be expanded to other private markets.

Today, Sweater is taking VC public. But why not take assets like private credit, collectibles, and art public too? In other words, why not take alternatives public?

VC is a $3 trillion AUM industry, but private markets as a whole are at least ten times as large (and continue to grow).

That creates a near-limitless opportunity for Sweater to expand their qualified partner interval fund model.

We’re excited to see what the future holds for Sweater – and for the public alternative future they could help power.

That’s it for today.

See you next time,

Brian

Disclosures

- This issue was sponsored by Sweater Ventures

- Neither the author, nor the ALTS 1 Fund, nor Altea holds any interest in Sweater or the Cashmere Fund

- This issue contains no affiliate links

This issue is a sponsored deep dive, meaning Alts has been paid to write an independent analysis of Sweater. Sweater has agreed to offer an unconstrained look at its business, offerings, and operations. Sweater is also a sponsor of Alts, but our research is neutral and unbiased. This should not be considered financial, legal, tax, or investment advice, but rather an independent analysis to help readers make their own investment decisions. All opinions expressed here are ours, and ours alone. We hope you find it informative and fair.