Welcome to Deep Dives, where we explore interesting companies in the alt investment space.

You may have caught our recent Sunday Edition on Pre-IPO Secondaries (written by Alts community member Jack Richardson)

The ecosystem for investing in secondaries is developing rapidly, and one of the most disruptive companies is Sandhill Markets (formerly known as Stonks.com)

This issue goes deeper into the world of secondaries. We explore how we got here, why startups are taking longer to go public, and how you can invest in them.

Let’s go

Table of Contents

The private vs public divide

For everyday retail investors, investing in private companies is relatively new.

When you log on to Robinhood, Schwab, or whichever brokerage you use, you can buy thousands of different stocks.

But it’s easy to forget these are just a fraction of the equity investment universe. That’s because brokerages only support public companies, whose shares are traded openly after going through a lengthy regulatory process.

In contrast, there’s a whole host of private companies whose shares don’t trade on stock exchanges.

While most of the world’s attention is focused on public firms, private ones are far, far more numerous. The US is home to 6.14 million companies, of which only about 4,000 are public.

But it’s not just the number of private firms that make them important. Increasingly, private companies are having an outsize influence on our world and society.

Why startups are staying private longer

OpenAI, which developed the revolutionary ChatGPT AI, is private. So is Stripe, the payments company that processed a mere $800 billion of transactions last year.

And let’s not forget X (formerly known as Twitter) which recently went back to being private after Elon Musk too over.

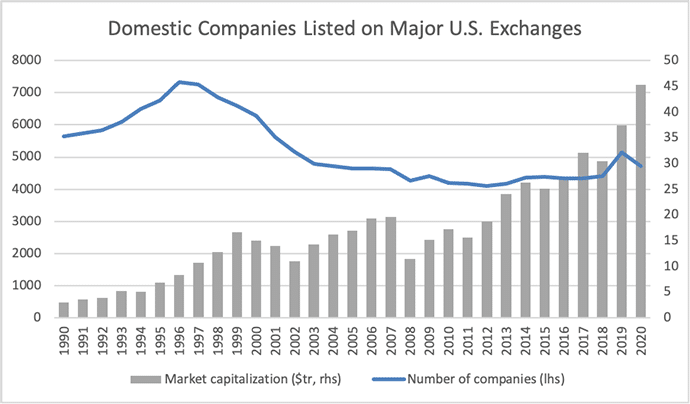

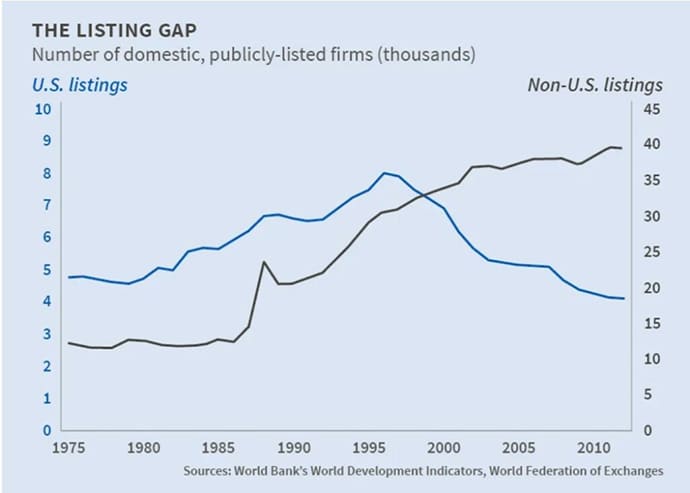

In fact, the influence of public firms in comparison to private firms has been declining for decades. Over the past 20 years, the number of public American companies has fallen by about half, even as the rest of the world saw an increase.

In the past, “going public” was seen as the only way to secure the amount of financing a large company needed to grow. No single investor (or small group of investors) could marshal enough money, so firms had to sell shares to the public to get large volumes of financing.

But in the past few decades, that’s completely changed. With the rise of venture capital funds in the 1990s and private equity funds in the 2000s, companies have access to essentially limitless amounts of capital in the private markets.

Pair this with increasingly strict disclosure requirements for public companies (especially since the passage of Dodd-Frank) and suddenly, firms have little motivation to go public.

The fact that private firms don’t have to file public financial statements is also beneficial, since they can worry less about how short-term performance looks to competitors or the media (which can often have an anti-startup bias)

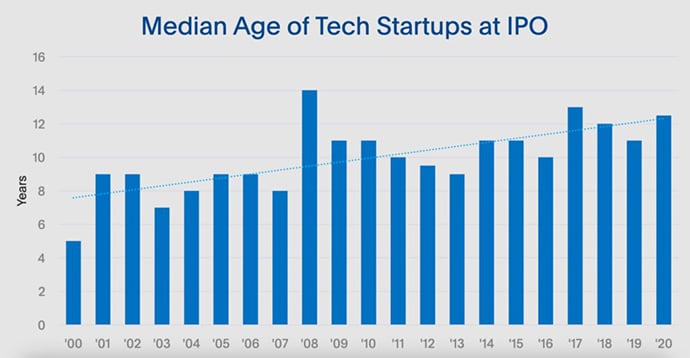

When firms do choose to go public these days, it’s at a later stage. Since 2001, the median age of a US company during its IPO jumped from 8 years to 11 years.

Now, the rise of private markets might be great for firms, who can access the capital they need without undergoing expensive regulatory requirements.

But it has been a disaster for everyday investors, who are increasingly unable to invest in the companies defining our modern world.

The problem with private markets

As it stands, everyday investors are essentially shut out from investing in the most influential private companies. Lack of access is the main issue plaguing private markets today.

Now, before you blame private firms too heavily for not giving average people a seat at the table, understand that there are real economic challenges to raising capital from individual investors.

- Negotiating difficulty – Private firms (especially startups) may need unique financing arrangements to suit their situation. It’s far more difficult to individually negotiate these arrangements with thousands of investors than to do so with a single large investor.

- Administrative complexity – Trying to keep track of all those individual investors is challenging and expensive. When it comes time to raise further financing, such a complicated cap table could turn off future investors.

- Regulatory restrictions – For better or for worse, institutions like the SEC are generally suspicious of private firms trying to raise capital from average people due to historical instances of fraud. The SEC therefore makes it more challenging to raise funds from individual investors than “sophisticated” institutions.

Solving these problems is the raison d’être for public stock exchanges. But, for reasons we described, going public is unattractive for many firms.

The end result is a private market designed almost solely for institutional investors.

For individual investors trying to get the access they deserve, problems start stacking up immediately.

Retail investors are left with “scraps”

It’s much easier for firms to raise substantial capital through institutional firms. That means the private deals left for individual investors are of lower quality than they otherwise would be.

This is a significant problem for equity crowdfunding platforms, which have seen strong growth in recent years.

Crowdfunding is one of the main ways individual investors can get access to startups – but resorting to crowdfunding is also a sign that such startups might not be very good. (After all, the thinking goes that if they could attract easier financing through institutions, why would these firms turn to average investors?)

Lack of liquidity

If you wake up one morning and decide that Apple is no longer a good investment, dumping the stock takes just a couple clicks on your computer. Public companies trade on highly liquid exchanges, making it easy to sell your shares.

For private markets, though, there’s no centralized exchange to trade on. That means you’ll need to either search for another investor to sell your shares to, or wait years for the firm to go public (if that even occurs).

Lack of transparent pricing

It’s hard to tell what a share of a private company is worth. Public companies have a share price – but private companies don’t trade, resulting in unreliable (or nonexistent) pricing.

Institutions get around this constraint by building complicated financial models to come up with a number for how much their current and prospective investments are worth. But for everyday investors, who lack access to the same info & expertise, valuing private firms is far more difficult.

Very high minimums

Finally, even if individual investors get access to a private investment opportunity, they often face astronomical investment minimums. In many cases, the minimum investment for a private company can exceed $100k.

Firms have to set high minimums to keep their cap tables simple, minimize dilution, and satisfy regulatory constraints.

But the side effect is that the minimums are often too high for average investors to realistically commit to a single investment.

Individual investors are left out

In short, since firms struggle to raise money from individuals, the private market is essentially built for institutions, leading to the problems described when individuals try to access it.

Now, stock exchanges have solved all these problems for public companies. But how close can we get to doing the same for private ones?

To find out, let’s turn to Sandhill Markets, who is solving each and every one of these problems.

What is Sandhill Markets?

Sandhill is on a mission to give everyday investors access to the world of blue-chip private company investments.

Sandhill is led by CEO and founder Ali Moiz, a successful entrepreneur who previously founded Streamlabs (which was acquired by Logitech for $160 million) and Peanut Labs (acquired by Dynata for $30 million). He knows a thing or two about building companies.

As it turns out, Sandhill had to go through several iterations before finding that vision. Originally, the firm was named Stonks, capturing the spirit of the WallStreetBets subreddit which campaigned against big hedge funds.

The team discovered that they could better serve investors by focusing on helping people access established startups. In line with this establishment shift, the firm rebranded to become Sandhill Markets, named after the famous road in Silicon Valley dotted with illustrious venture capital firms.

The company lost the old logo, but is keeping their cheeky attitude. In the announcement email, CEO Ali Moiz mentioned he hoped the name change might result in some of the mail meant for Silicon Valley’s biggest firms getting sent their way 😉

Now, successful startups aren’t exactly begging individual investors for their money. Sandhill is taking an innovative approach to solve this challenge through the use of pre-IPO secondaries.

Secondaries

Secondaries let people sell shares of a company before that company goes public (via IPO).

As we discussed last Sunday, when firms take longer to IPO, many private company founders, employees, and investors have locked-up shares that they want to liquidate.

Selling these shares to another investor is a win-win for both parties, providing liquidity for one side and a new investment opportunity for the other.

These sales are known as “secondary” transactions since the firm itself is not receiving the proceeds of the sale.

By sourcing secondaries from people who own private company shares they want to liquidate, Sandhill is taking a big step toward solving the adverse selection issue of private markets. With secondaries, average people don’t have to compete for the best investments with institutional investors – instead, they can step in and invest alongside them.

SPVs

But investment minimums still prove a challenge when it comes to secondaries. Secondary deals can involve the liquidation of sizable amounts of stock, which may vastly exceed what an individual investor can purchase.

To get around this, Sandhill employs special purpose vehicles (or SPVs). SPVs are basically blank companies set up to achieve a specific purpose. In this case, Sandhill’s SPVs are designed to purchase private company secondaries – then, investors purchase an equivalent number of shares in the SPV, rather than the secondaries themselves.

This might sound complicated, but the underlying mechanics are fairly simple.

Think of it like this: if you set up a company whose sole purpose was to purchase and hold 100 shares of Tesla stock, then selling 1% of your company to someone else would be the equivalent of them owning 1 Tesla share.

With the SPV layer sitting between the secondaries and investors, Sandhill can offer minimums as low as $5k – a fraction of the standard $50k – $100k minimum.

Exchange (upcoming!)

Finally, Sandhill has teased an upcoming solution to the final set of problems plaguing private markets – liquidity and pricing.

That solution will come in the form of an aftermarket exchange for users to trade shares they’ve bought on Sandhill. (NOTE: This exchange is pending regulatory approval, Sandhill expects it to be launched in the first half of 2024.)

If Sandhill gets their exchange up and running, the impact on investors could be massive. As it stands, investors have no ability to sell the shares they purchase on Sandhill. Moreover, share prices are determined at the closing of each investment opportunity, and updated by independent valuation analysis.

Sandhill’s investment opportunities

Sandhill is true to their word – the investment opportunities on offer are truly the blue-chip private companies that investors will be familiar with.

One exciting aspect of Sandhill is the flat membership fee model they operate. The price is currently $149/month with a 12-month commitment. This stands in contrast with the percentage-based model most investment firms operate, which often includes a management fee and a performance fee.

The upshot of the percentage model is that you spend more money as you earn more money, perversely punishing you for doing well. Sandhill’s model is a breath of fresh air and evidence of their commitment to serving investors.

Opportunities on Sandhill don’t last forever. Investments in SpaceX and OpenAI, for instance, recently closed. But let’s take a look at what’s available now:

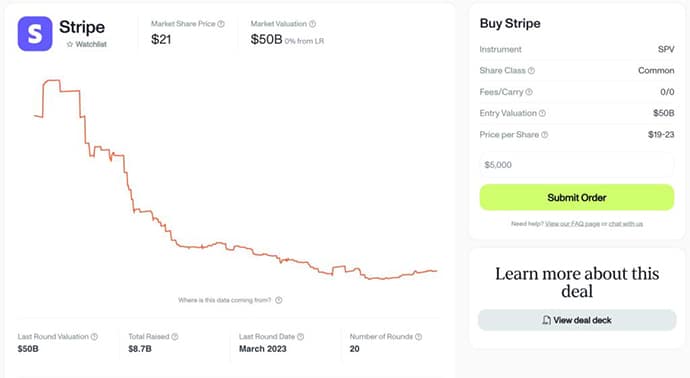

Stripe

Stripe is one of the most influential private companies shaping the world today. Their payment infrastructure is extremely popular and helps power the digital economy.

Epic Games

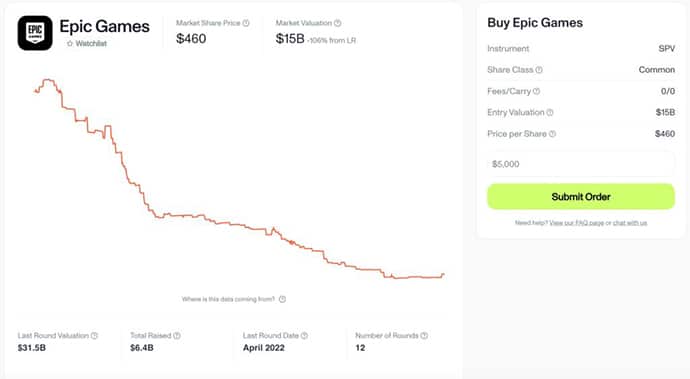

Epic Games is a video game developer that created the hugely popular battle royale shooter Fortnite. They also manage and license the Unreal Engine, one of the most popular video game engines of all time.

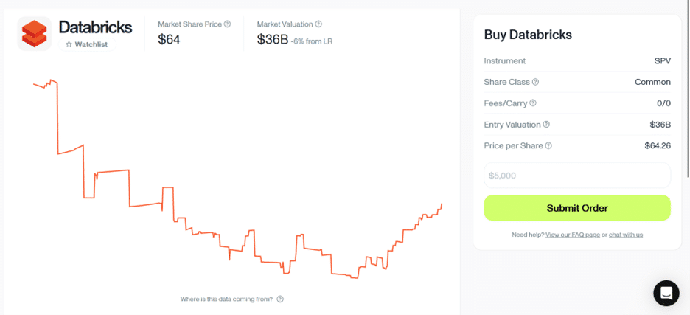

Databricks

Since they operate a B2B model, investors may be less familiar with Databricks, but the firm runs a very successful business offering data analysis and data architecture solutions.

Note: All these companies seem to have been victims of the great tech pullback of 2022 – but past performance is no guarantee of future results, and the future does look exciting for these firms!

The performance of upcoming IPOs like Klaviyo and Instacart will provide meaningful signals on the state of the current venture-backed market.

Q&A

We did a Q&A with CEO Ali Moiz:

How did your company start out? Why was the company founded?

We were doing a related project (Stonks) around early-stage demo days and fundraising. But we noticed that LPs and our angels were writing more late-stage checks more easily. $25 million was invested into Pre-IPO deals as a side project without us building anything.

That’s when Sandhill Markets was born. Me and Olivier worked together at Stonks, and carried that momentum over into founding Sandhill.

What is the problem you’re solving? Who is your target audience?

Startups are staying private longer and longer. 20 years ago, Google went public 4 years after starting. These days the average is 12 – 15 years.

Instacart, Klaviyo and ARM between them created over $100 billion of value in the private markets, and only recently announced their IPO.

Getting access to invest in late-stage category winners pre-IPO like Stripe, SpaceX, OpenAI, Databricks is virtually impossible unless you have deep relationships and are writing seven or eight-figure checks. These companies are obvious winners creating all their value in the private markets, and virtually inaccessible to individual investors

That’s the problem we’re solving. Democratizing access to the best blue-chip, category-winning startups. The target audience are those who understand the key role private markets and startups play in wealth creation.

They want access to the best blue-chip startups before an IPO, but don’t have access and can’t write checks in the millions.

What is the biggest value you provide for your customers? Why do they pick you over another company?

We solve these key problems:

(a) Access – getting into the top names is very, very hard

(b) Minimums – lowering what are typically $250k+ minimums (for top names) to $5k

(c) Fees – Our flat-fee membership model gives everyone 0% carry and 0% fees. It’s like Robinhood, but for Private Markets.

(d) Future Liquidity – No forced buy-and-hold to IPO. Investors can sell their holdings on our upcoming regulated securities marketplace and get liquid at any time.

What do you offer that nobody else does? What are a few things that differentiate you from your competitors?

(a) The lowest $5k minimums in the industry. Makes investing incredibly accessible to all. Others typically charge $100k+ minimums for blue-chip names like Stripe or OpenAI.

(b) Consistent access to the Top 25 blue chip names, that are generally unavailable on other platforms (or only very sporadically available). In the past 90 days we’ve featured SpaceX, Stripe, OpenAI, Anthropic, Databricks, Hugging Face, Cohere, Anduril, Epic Games, and the S23 YCombinator Access Fund.

Find me another secondaries platform, broker or bank that has done this quality of inventory in this period of time.

What was the tipping point in your success? When did you know you were onto something special?

When our users on Stonks invested $25m into pre-IPO secondaries with us, without a product, team, or plan. Access to the best late-stage deals was even harder than early-stage.

Closing thoughts

For decades, investing in private companies before they went public was only available to institutions. It was basically impossible for everyday investors to get a slice.

As comedian George Carlin famously quipped, “It’s a big club, and you ain’t in it.”

What Sandhill is doing is commendable.

By building a “Robinhood for Private Markets” for companies that are staying private longer and longer, they’re solving the transparency and liquidity problem that is at the core of any functioning market.

Making secondaries more liquid will make startup investing more accessible and open up this engine of wealth creation to more people.

I’m particularly excited about this potential aftermarket exchange (hopefully launching in 2024). By letting investors trade their startup shares on a liquid market, Sandhill could kill two birds with one stone — making a huge leap towards offering a comprehensive solution for the problems plaguing individual investors in private markets.

But ensuring there’s sufficient liquidity on the exchange is critical. As it stands, Sandhill has offered no information about partnering with a market maker. That means achieving a critical mass of users is the only way to guarantee a truly liquid, well-functioning market.

Investors should also be aware that some of Sandhill’s fees aren’t obvious upfront. While the firm says they don’t collect a markup when they sell shares, investment costs (except SPV setup fees) are bundled into the price you pay. In addition, sellers will be charged a percentage-based fee on completed trades when Sandhill’s exchange gets up and running.

That said, Sandhill is still definitely a company you want to sign up for.

We’ll be watching them closely and look forward to seeing them bring this platform to life.

- Are you an accredited investor? Start here.

- Not accredited? Click here and we’ll keep you in the loop.

If you’re interested in connecting with the Sandhill Markets team, reply to this email and I’ll make a personal introduction.

Disclosures

- This was a paid deep dive by Sandhill Markets

- Our ALTS 1 Fund has not yet invested in any startup secondaries through Sandhill Markets

- I have not yet personally invested in any companies on the Sandhill Markets, but I have signed up for their Databricks waitlist.

- This issue contains no affiliate links.

This issue is a sponsored deep dive, meaning Alts has been paid to write an independent analysis of Sandhill Markets. Sandhill Markets has agreed to offer an unconstrained look at its business & operations. Sandhill is also a sponsor of Alts, but our research is neutral and unbiased. This should not be considered financial, legal, tax, or investment advice, but rather an independent analysis to help readers make their own investment decisions. All opinions expressed here are ours, and ours alone. We hope you find it informative and fair.