In today’s delicious issue, Brian Flaherty explores the economics of Girl Scout Cookies.

Who are the bakers behind the operation? How much profit is made per box? Who’s profiting? And how does the cookie money flow?

Unlike Girl Scout Cookies (which cost up to $7/box now) this well-researched issue is free for everyone. ✅

Let’s go 👇

Table of Contents

Tradition, transformation, and treats

The Girl Scouts are an American icon.

Since its inception in 1912, the organization has empowered millions of young women through courage, confidence, and character.

50 million American women have passed through the organization’s ranks, including my sister, mom, grandma, and great-grandma. (I figured I’d disclose this conflict of interest early!)

Over the years, the organization has branched away from its camping/hiking roots, and become more focused on economic empowerment and financial literacy.

But nowhere is this focus more evident than in the Girl Scouts’ famous cookie business.

What started as a small, home-grown way to raise funds for troops has ballooned into a gigantic sales operation, supported by a massive national marketing campaign.

- The Girl Scouts now sell an astounding 200 million boxes every year. (Incredible when you consider there are only 258 million American adults!)

- The high price point ($5 – $7 box) translates into over a billion dollars per year (more than Oreo makes in the US!)

- It’s even more impressive given that Girl Scout cookie “season” only lasts three months. (Though the scarcity probably helps sales)

This actually raises some awkward questions: Where does all this cookie money go? Is it ethical to depend on child and volunteer labor for such a massive sales operation? And how have they changed tactics in the digital age?

We’ll discuss these questions below.

But first we need to discuss a subtle fact with some surprising consequences…

Girl Scout Cookies aren’t the same nationwide

Every American knows the classic flavors, right?

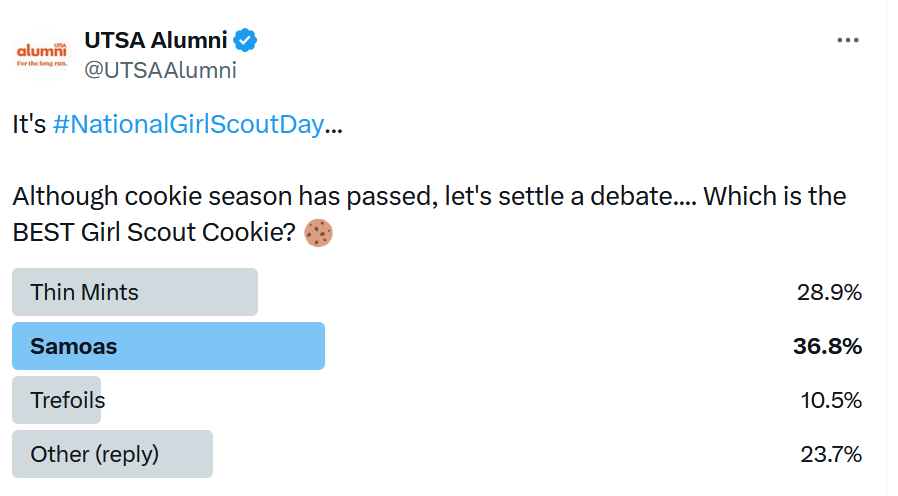

Two of the most popular are Samoas and Tagalongs — err, that is, if you live in New York, Miami, or Dallas.

But if you live in Houston, Orlando, or Philadelphia, you probably know these flavors as Caramel deLites or Peanut Butter Patties.

And it’s not just the names of certain cookies that differ regionally — recipes do too. While Samoas and Caramel deLites are similar, they’re not identical.

In fact, even consistent nationwide names like Thin Mint can hide subtle differences. There are actually two official Thin Mint recipes; one is more chocolatey, and the other is more minty.

And there’s no rhyme or reason to the geographic distribution of these flavors. Which cookie you end up with is kind random.

There’s an interesting reason for this…

Girl Scout cookies are made by two different bakers

To really understand Girl Scout cookies, we need to start at the source: the companies that actually bake them.

When the Girl Scouts began selling cookies as a fundraiser back in 1917, they were just regular, home-baked sugar cookies.

As they grew, the Girl Scouts started licensing commercial bakers to produce them instead. By 1948, there were 29 officially licensed bakers.

Over the years, though, the number of bakers has rapidly dwindled, largely to ensure uniform packaging & quality.

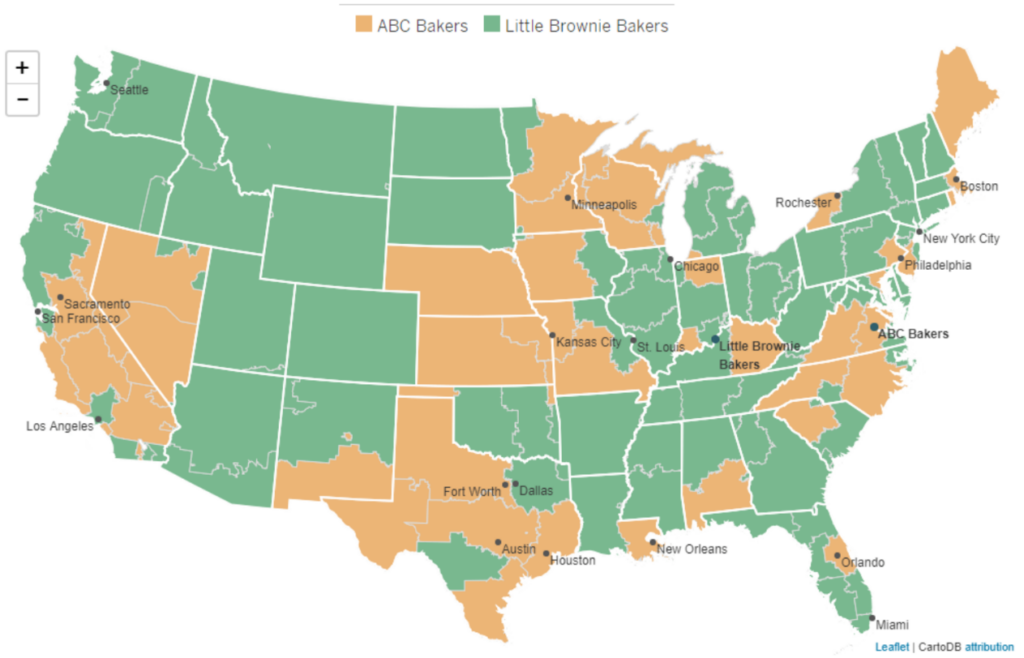

In the 1960s there were still 14 bakers. By the 80s that had shrunk to four. Today, just two remain:

- ABC Bakers, headquartered in Illinois and owned by Hearthside Foods (a major American contract food manufacturer that produces products for companies like Kellogg and Pepsi).

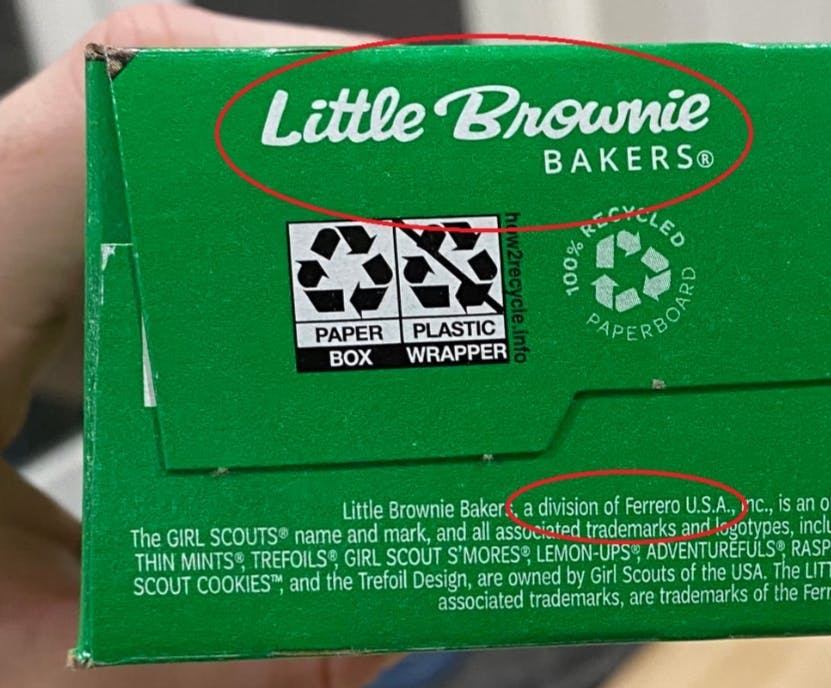

- Little Brownie Bakers, headquartered in Kentucky and owned by the Ferrero Group (an Italian company that also operates brands like Crunch and Baby Ruth).

Both bakers offer Thin Mints, Trefoils, and Adventurefuls.

But only ABC Bakers makes:

- Caramel Chocolate Chip

- Caramel deLites

- Lemonades

- Peanut Butter Patties

- Peanut Butter Sandwich

- Toast-Yay

- Raspberry Rally

Little Brownie Bakers exclusively produces:

- Do-Si-Dos

- Lemon-Ups

- Samoas

- S’Mores

- Tagalongs

- Toffee-Tastic

There are five players in this cookie racket:

- Individual Girl Scouts, who do the actual selling

- Troops, which all scouts are a part of

- Councils oversee the troops

- National organization oversee the councils

- Bakers actually make the cookies

Councils sit in the middle of the Girl Scout organizational hierarchy. But interestingly, councils choose which baker they want to use.

Since councils independently choose which baker they want to work with, cookie selection varies like crazy — not just from state to state, but even within states.

Considering that each baker offers a different collection of cookies, this is a pretty consequential decision!

And it’s not just a matter of going with the lowest price. The Girl Scouts of New Mexico Trails opted to switch to ABC for 2024, largely due to ongoing supply and production issues at Little Brownie.

Regardless of which baker councils choose, it’s the council who pays for all those cookies — not the national organization.

Let’s explore the financial relationship between councils and bakers and find out who’s making money off all these cookies.

How the Cookie cash crumbles

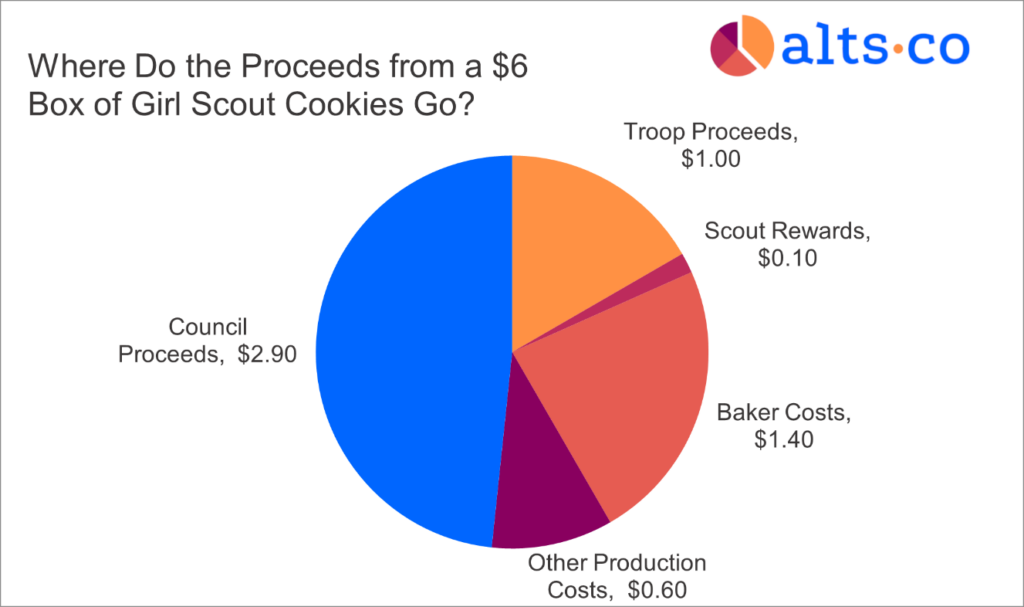

Girl Scout councils are at the center of it all.

As discussed, councils buy the cookies from the bakers upfront. Troops and scouts make sales, but the money flows back up to the council.

Girl Scout Councils make $4 – $5 per box

Councils don’t report precise figures, so it’s tough to figure out the exact unit production costs.

But by cross-referencing some financial statements, we’ve come up with some good estimates.

- Girl Scouts of Arizona Cactus-Pine distributed 2.7 million boxes in 2022. With a cost of product program sales (COGS) of $3.3 million, we come up with a production cost estimate of $1.22 per box.

- Girl Scouts of Nation’s Capital sold 4.4 million boxes on $9.8 million in cookie costs. This gives us an implied production cost of $2.24 (Note: Cost of sales here may include transportation costs).

- Finally, Girl Scouts of San Diego and Girl Scouts of Greater Iowa both show that $1.96 and $1.40 go toward “program expenses” (including production and distribution).

Overall, we estimate that Girl scout cookies cost between $1.50 – $2.00 per box.

At a sale price of $6 per box (in some areas, prices are now up to $7), Councils earn around $4 – $5 profit per box (or about 70% margins).

What about the rest?

Troops get their cut ($1.10 per box)

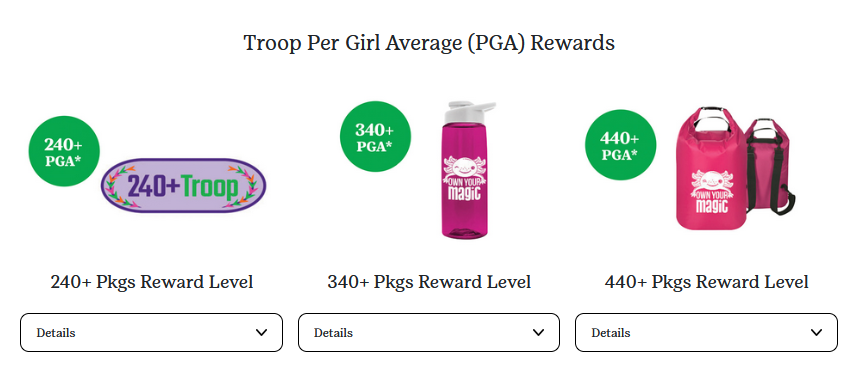

Troops and individual scouts both participate in the cookie profits. But the extent to which they reap the rewards varies by council.

Using the same financial statements above, we’d estimate troops retain an average of around 18%, or $1.10 per box. (This is roughly in line with breakdowns published by individual councils.)

Scouts pick up the crumbs ($0.09 per box)

While most of the revenue goes to the troop itself to pay for activities and experiences, a small amount goes to individual scouts in the form of rewards.

By comparing published troop proceeds with our $1.10 estimate (along with extra per-box troop proceeds for older scouts who opt out of rewards) we can estimate that around $0.09 per box goes toward individual scout rewards.

The rest of the money is sent back to the council itself.

After accounting for production costs, council funds are used to pay for organizational expenses and valuable programming and experiences for the scouts.

For their part, the national organization says that they don’t actually get any of the money from the cookie sales — it all stays local.

While that’s technically accurate, there’s an important detail often left out of the conversation.

While councils pay bakers to manufacture the cookies, the bakers pay Girl Scouts national a royalty fee for the right to use the Girl Scout logo and name on all the packages.

In 2023, this royalty income amounted to $9.3 million; which makes up just 9.1% of Girl Scout National’s revenue. (The national organization earns $60m/year from membership dues and merchandise sales.)

So it’s a nice bonus for the national organization. But for the councils, cookie revenue is a essential to their financing.

Who else is profiting?

Obviously, the Girl Scout cookie program is a valuable fundraiser that helps secure the money needed for councils and troops to pay for activities throughout the year.

Plus, it’s a great way for young women to learn business and entrepreneurial skills.

But it’s always fascinating to follow the money and understand the breakdown.

The big bakers

ABC Bakers and Little Brownie Bakers are the most obvious profiteers from the Girl Scout cookie program.

Even after accounting for royalty costs, the scale of Girl Scout cookie contracts is massive.

200 million boxes are sold each year. If our $1.40 baker estimate per box is accurate, that’d amount to $280 million in annual revenue between the two bakers. Not bad at all.

Council/national executives

When it comes to the beneficiaries of the cookie program, one party is surprisingly overlooked — the often well-paid council employees dotting the country (along with the national execs).

Now, cookies are just one component of the revenue stream that supports these employees. But it’s a major one for the councils.

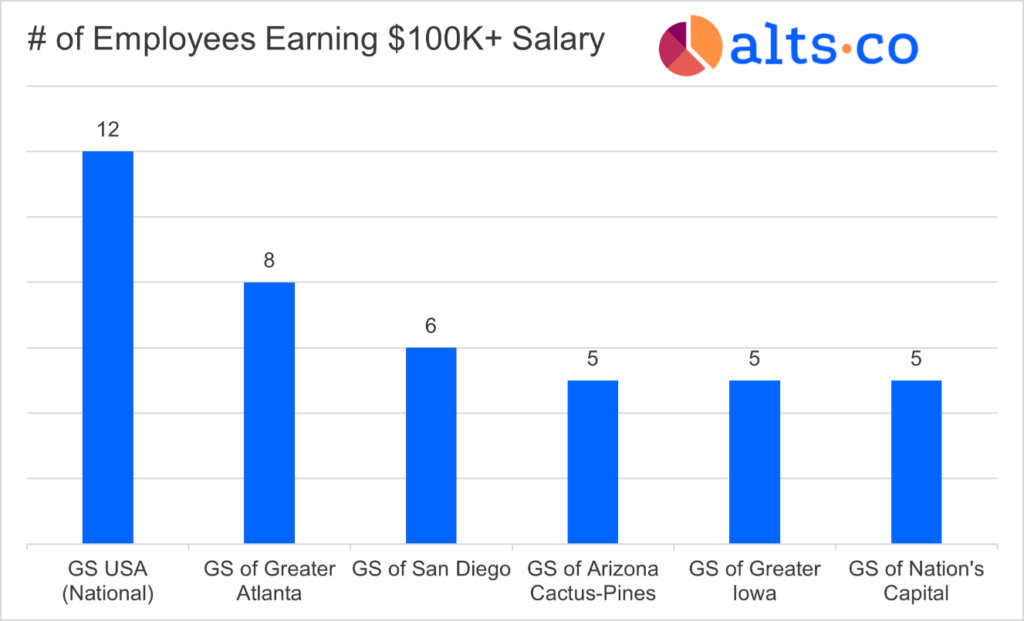

We’ve looked through tax filings to find out how many employees earn at least $100,000/year for some of the orgs we mentioned above:

To be clear, we’re not saying these employees aren’t earning their money. Managing these organizations is hard work, and all of this contributes to valuable skill development for scouts!

This isn’t a matter of exploitation. Scouts love selling cookies, and parents are happy to volunteer to help.

But it does perhaps seem just a bit crazy that scouts’ only direct compensation from all this is a few very, very cheap rewards.

The open secret about Girl Scout Cookies

Clearly selling Girl Scout cookies at a 200% markup is lucrative.

Given these economics, you might think the Girl Scouts have some super-secret, patented recipe that only they know. But this isn’t the case at all.

Girl Scout cookie knock-offs are incredibly similar

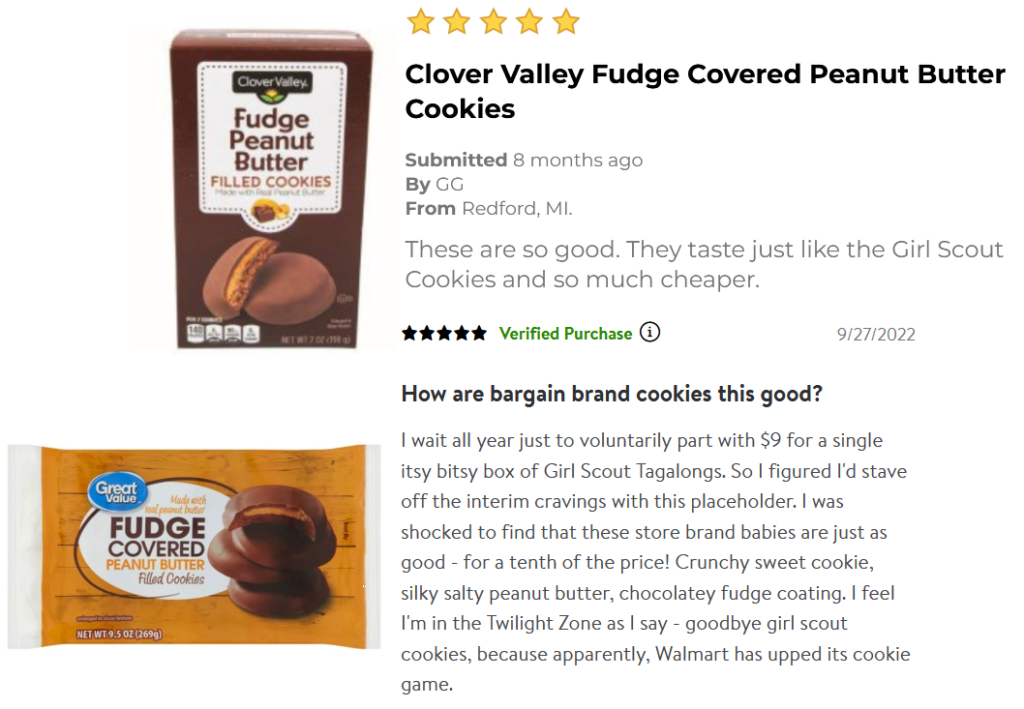

Both Walmart and Dollar General carry “Fudge-covered peanut butter cookies” that look curiously like Tagalongs.

Judging by reviews, they taste identical too…

What’s more, they’re both priced at just over $2 a box – a third the cost of the Girl Scout version.

Similarly, Keebler Grasshopper and Coconut Dream cookies have long been known as Thin Mint and Samoa alternatives, respectively:

But hang on a minute — Keebler is a subsidiary of the Ferrero Group, the same company that owns Little Brownie Bakers!

Now, we’re not saying these cookie variants are necessarily coming from the same exact factories as Girl Scout cookies.

But c’mon. These “knock-offs” are so incredibly similar that the term feels almost…inadequate.

Real scarcity vs manufactured scarcity

Obviously, people aren’t just buying Girl Scout cookies for the cookies – it’s also about supporting the organization and its mission.

But the fact that the Girl Scouts are so successful at selling their cookies despite lower-priced and near-identical competitors being available year-round is a testament to the power of scarcity marketing.

It’s like the McRib or Pumpkin Spice Latte. Part of the appeal of Girl Scout cookies is precisely that they’re not available all the time.

In fact, this is a tactic the Girl Scouts seem to be leaning into even more, pulling the fan-favorite Raspberry Rally flavor this year after a hugely successful roll-out in 2023.

So with cookie season wrapping up soon, go stock up on your favorite flavors. Because who knows if they’ll be around next year.

(But if they aren’t, just check Walmart or Dollar General)

See you next time, Brian

Disclosures

- This issue was sponsored by Sonic Power

- Neither the author nor the ALTS 1 Fund has any holdings in any companies mentioned in this issue

- This issue contains no affiliate links