Hello and welcome to Alts Cafe

This is an all-killer, no-filler email–your bulletin of everything to do with alternative investing.

As always, I ask one favor – if you find this useful, interesting… Please spread the word for us. It helps support our work more than you know.

Today’s spoiler alert: Real estate still shaky, crypto strong, beware AI investing (but also look into it), and if you want something really left-field, think about lithium commodities — essential for making electric cars.

Caffeine up, and let’s go, my savvy Alts friends.

Table of Contents

Macro View

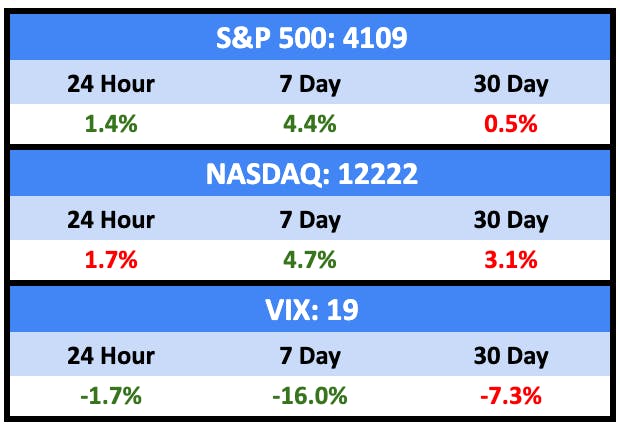

The equities market finished Q1 strong.

Bullish News

- Jobless claims rose 7,000 last week.

- U.S. consumer confidence unexpectedly increased in March.

- Wall Street banks are looking to start trading private credit loans.

Bearish News

- Q4 US GDP estimates were revised down slightly from 2.7% to 2.6% on weaker consumer spending.

- Investors pulled $286B out of bank deposit accounts over the last fortnight.

- No companies with investment-grade credit ratings sold new bonds last week for the first time since 2013. Credit is tight.

- Private equity deals in Asia plunged 44% in 2022.

What are we doing?

ALTS 1 fund news:

Our Q1 report will be out to investors next week. Stay tuned.

Real Estate

Bullish News

- While housing prices keep declining in the western US, prices east of Texas continue to rise.

- US pending home sales rose for the third straight month.

Bearish News

- US apartment rents only rose 2.6% year over year in March, well below inflation. That’s below the pre-pandemic average of 2.8%.

- The Briefcase newsletter had a solid breakdown of why CRE is in big trouble this year.

- Fundraising among non-traded REITs in February 2023 sunk to just $489 million, a low not seen since August 2020, while reported monthly redemptions have exceeded $1.7 billion.

- Opportunity zone fundraising is set to be down nearly 50% in 2023.

- Home prices have been falling for seven straight months.

- Tech hubs are seeing residential real estate prices cool faster than other geographies.

- Arizona keeps getting whacked: Electric vehicle maker Lucid announced plans to lay off nearly 1,000 in Casa Grande last week.

How to invest in real estate right now:

I’m still out of the real estate market [no change].

Crypto & NFTs

Here’s what you need to know:

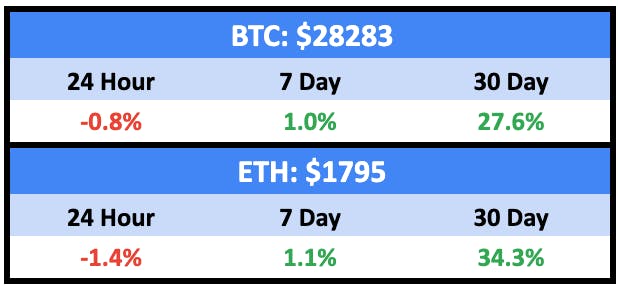

It was a fantastic Q1 for crypto. Bitcoin surged 71%, Ether was up 51%, and Solana smashed through at 112%.

And that’s reflected in the end of quarter fear and greed index.

While crypto has pumped this year, NFTs were left behind a bit in the first quarter. I suppose 33% is nothing to sneeze at, but it’s all relative.

Bullish News

- Ticketmaster has introduced NFTs to its ticket-sale process.

- SEC Chairman Gary Gensler said that rules for the cryptocurrency market already exist—but that the industry is still “rife with noncompliance.”

- Crypto wallet company Ledger raised another $108 million.

- NASDAQ is launching a crypto custody service in Q2.

- Otherdeed land sales topped $120m in Q1, though there are concerns over wash trading.

Bearish News

- Investors withdrew $1.6 billion of cryptocurrency from Binance since it was sued by the U.S. CFTC on Monday.

- Both Disney and Microsoft shuttered their metaverse projects in March.

- DAO governance tokens might come with legal liability, according to a US judge.

- Denmark’s supreme court says crypto profits are taxable income.

- MoonPay has dismissed dozens of staff, but it denies those cuts are layoffs.

- March NFT trading volume was off around 50% from February.

- BLUR has pushed back its launch by a month.

How to invest in Crypto & NFTs right now:

The NFT market is feeling increasingly wobbly to me while crypto makes steady gains.

Startups

Short and sweet. The AI investment bubble is here.

In December and January, several venture capitalists from the U.S. and Britain raced to Paris to vie for a stake in a new artificial intelligence company that could reshape how people work.

The startup they courted, Dust, consisted of just two people. It had not been incorporated yet.

Sequoia Capital won, leading a sizable “seed” fundraising round of $5 million.

I mean, can you imagine?

Companies like Anthropic, a Google-backed startup, are advertising salaries up to $335,000 for a “Prompt Engineer and Librarian.” A “Research Engineer“ at the same company makes up to $445k.

My take? There’s a lot of substance to AI in general, and generative AI in particular, but this is going to end in tears for a lot of people. And for what it’s worth, I’m not the only one saying this.

Samir Kaul, a founding partner at Khosla Ventures, itself an early backer of OpenAI, said the firm is receiving way more generative AI pitches than just six months ago.

“Now you are getting this herd mentality” among venture capitalists, said Kaul. That means lackluster companies “will get funded,” then “fail and give the entire sector, which is very promising, a black eye.“

As ever, the trick is backing the right horse, because there will be a few huge hits here, but yeah, a lot of flops.

Bullish News

- The Pentagon is looking to Silicon Valley to help develop the next generation of advanced weapons tech.

Bearish News

- Virgin Orbit is ceasing operations “for the foreseeable future” after failing to secure a funding lifeline.

How to invest in startups right now:

I said in late Dec/early Jan that if you want to invest in AI startups, the time was now. The bubble was coming, and your best play was to invest early and aim to exit at the next round.

If you’ve invested in a generative AI company, and they’re raising a round now, consider selling on your shares if possible.

Quick Hits

Rare Gems

An extraordinary purplish-pink diamond classified as “fancy vivid” is up at auction at Sotheby’s soon, and the 10.57 carat specimen is expected to pull in over $30m — the most ever for a diamond of its shade.

The auction house’s head of jewellery for the Americas (and probably all-round fun guy), Quig Bruning had this to say about the gem:

“This color is the most beautiful and concentrated shade of pink in diamonds that I have ever seen or has ever come to market. The Eternal Pink’s immense presence and great rarity make it comparable to ultimate masterpieces of art — far rarer than a Magritte or a Warhol.”

What’s most interesting to me — and probably no one else — is that the original rough stone was 23.87 carats. So the cutting process produced 13.3 carats of excess, or more than the finished product.

There’s an entire industry around putting excess to use. The bigger chunks are cut into smaller diamonds, and the “dust” is used for everything from nail files to jewellery to diamond blades.

Commodities

Commodities are taking a beating this year, but there’s a price spike forming:

We love this chart.

— Katusa Research (@KatusaResearch) March 29, 2023

Relatively speaking, commodities are the cheapest they have ever been compared to the S&P 500.

Notice the steep, sharp, rise… pic.twitter.com/tzjMX6pZqE

One element to look at is lithium, an essential component in electric vehicle batteries.

One such example…

— Katusa Research (@KatusaResearch) March 30, 2023

Lithium Prices corrected HARD. Maybe too hard based on the expected demand.

The price forecast curve looks interesting. pic.twitter.com/C6IjMmkoxN

Impossible to say when or how much commodities will pump, bit it looks like it’s inevitable at some point.

Fish Private Equity

I don’t know why this feels both hilarious and important, but Iceland is setting up its first ever seafood-focussed private equity fund. It recently closed at $71m (10 billion Icelandic Kroners).

As reported by the always-excellent IntraFish, which also reported this gem last week:

What a world.

That’s all for this week. I hope you enjoyed your coffee and this edition of Alts Cafe.

If you have any comments, questions, or concerns – let us know.

And, at the risk of boring you, please share this wherever you have a platform. Twitter, LinkedIn, the pub… I’m not fussy.

Cheers,

Wyatt

Disclosures

- This issue was sponsored by our super smart friends at Otherweb and Everbloom.

- We are holding BTC and ETC in our ALTS 1 Fund. Apart from those, we don’t own any other assets or vested interests in the companies mentioned in this email.

- I actually quite admire Mr. Beast. And I have a bit of a soft spot for Lankybox.