Hundreds of investing and finance newsletters hit my (and maybe your) inbox every week. This is the best of the best.

This week, we bring you

- The Surging Trend of High-Income Renters

- The Attention Economy: Is It Worth It?

- ESG Investing Versus Political Pushback

- Wages Outpace Inflation: The First Time in Two Years

- CEO Pay Skyrockets in Canada

- Tax Loopholes For NIL?

- NCAA Secures a $920M Deal with ESPN

- 3 Stocks To Consider

Thanks for reading.

Wyatt

Table of Contents

The Surging Trend of High-Income Renters

Affluent individuals are increasingly opting to rent rather than buy. The number of renters earning over $200,000 annually has quadrupled since 2010.

Soaring home prices and high mortgage rates might explain this, but is there more to the story?

The Attention Economy: Is It Worth It?

Seven out of the ten most valuable companies are in the advertising business. This puts advertising as a $650B a year industry (which is almost as much as the entire US defense budget).

On the flip side, the average 6-year-old in America sees 40,000 ads a year, and ADHD diagnoses are rapidly growing.

Are the economic gains worth the social and cultural costs?

ESG Investing Withstands Political Pushback

Despite political resistance branding ESG investing as “woke capitalism,” a recent survey indicates that investors and executives are doubling down on their ESG commitments.

Over half of the investors surveyed are increasing their focus on ESG, and many companies plan to boost their ESG budgets significantly in the next two years.

Wages Outpace Inflation: The First Time in Two Years

Overall inflation outstripped pay rises in every month from April 2021 to early 2023, but the trend is finally starting to reverse.

Likewise, with the unemployment rate steady at 3.7%, the job market is starting to look healthier than many had predicted.

Does this mean the US economy doesn’t need more stimulus anytime soon?

CEO Pay Skyrockets in Canada

Top Canadian CEOs earn an hourly wage of $7,162. This means that in just over eight hours, these CEOs earn what the average Canadian worker makes in an entire year, $60,607.

The gap has widened significantly over the years, with the top CEOs now earning 246 times the average worker’s pay, a stark increase from 105 times in 1998.

How did this happen, and is this sustainable?

NIL Collectives Navigate Tax Laws with Nonprofit Strategies

For-profit NIL collectives, such as Blueprint Sports, are creating nonprofit arms to provide tax benefits for donations made towards NIL payments to athletes.

The BPS Foundation, Blueprint’s nonprofit, is a tax-exempt channel for boosters to financially support athletes, sparking debate over the exploitation of tax codes.

Is this a game-changer for athlete endorsements or a loophole that needs closing?

NCAA Secures a Lucrative $920M Media Rights Extension with ESPN

The NCAA has inked an impressive eight-year, $920 million media rights extension with ESPN, covering a record 40 championships.

Despite many calling for unbundling, women’s March Madness remains part of the package.

The deal, brokered by Endeavor’s IMG and WME Sports, kicks off this September, averaging an annual payout of $115 million.

What I’m reading

I get a lot of mail asking where I find all this good stuff. Here are a few of my favorite newsletters, all of which are free to subscribe to:

The latest news, tools, and step-by-step tutorials of all the latest in AI.

The world’s biggest ideas, disruptive trends, most exciting early-stage companies, and groundbreaking entrepreneurs.

Free daily hot stock trading ideas, and market insights from a 20-year trading veteran.

Stock ideas

Here are my three favourites from this past week from Yellowbrick Road.

Analysis provided by public.com.

Remember to always DYOR.

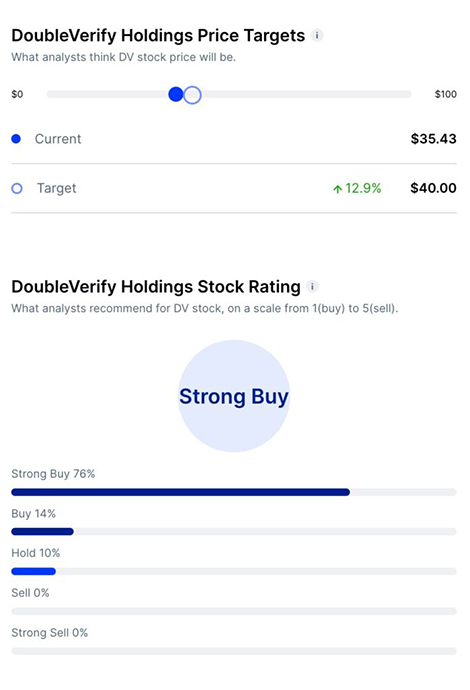

DoubleVerify Holdings ($DV)

Bull Case:

- Revenue Growth: DoubleVerify has demonstrated superior revenue growth, with a 139% increase over three years, outperforming industry growth rates.

- Market Cap Growth: The company’s market cap has increased by 66.64% in one year, indicating strong investor confidence.

- High Analyst Ratings: 19 Wall Street analysts have given price targets ranging from $30.00 to $50.00, suggesting a potential upside of 15.7% from the current price.

Bear Case:

- High Price-to-Sales Ratio: DoubleVerify’s high P/S ratio compared to the industry could be a concern if the company’s growth does not continue.

- Moderate Return on Equity (ROE): The company’s ROE of 5.6% doesn’t compare favorably to the industry average of 9.7%, which could be a sign of less efficient capital utilization.

- Future Earnings Growth Slowdown: Forecasts suggest a slowdown in future earnings growth, which might impact the long-term potential.

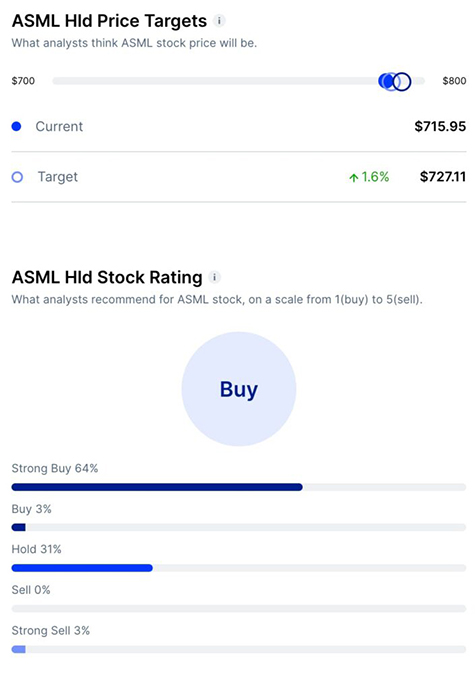

ASML ($ASML)

Bull Case:

- Robust Financials: ASML showed significant growth in revenue and EPS last year, reflecting its strong financial health.

- Significant Market Position: Dominating the lithography system market, ASML holds a key role in semiconductor production with considerable market demand.

Bear Case:

- Geopolitical Risks: ASML’s shares dropped following the Netherlands’ export restrictions to China, potentially impacting growth.

- Export Policy Impact: New export policies could jeopardize ASML’s market share in China, a crucial market for growth.

- Vulnerability to Semiconductor Sector Volatility: The sector’s recent selloff highlights ASML’s susceptibility to industry volatility and market shifts.

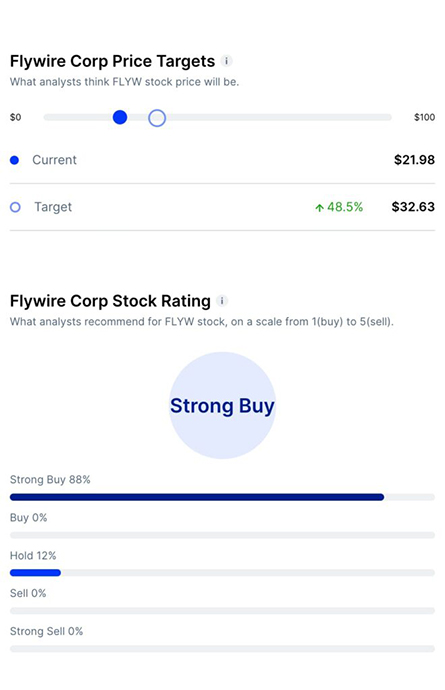

Flywire Corp ($FLYW)

Bull Case:

- Rapid Expansion: Flywire exhibits rapid growth as a small-cap stock, with increasing revenue and a shift to internet income.

- Strong Market Position: Operating across various industries like education and healthcare, Flywire’s diverse customer base suggests resilience and stability.

- Positive Analyst Ratings: With a “Strong Buy” consensus and a forecasted 60.28% price increase, analysts support Flywire’s growth potential.

Bear Case:

- Recent Price Drop: Recent disappointing quarters raise concerns about Flywire’s future performance.

- Market Volatility: Flywire faces risks like foreign exchange headwinds and market-specific challenges, affecting its growth.

- Dependency on Specific Industry Trends: Flywire’s reliance on sectors like education and travel could impact its revenue in case of industry downturns.

That’s it for this week.

If you write amazing content and want to be featured, please send it through for consideration.

Cheers,

Wyatt

Disclosures

- There are affiliate links above; we’ll get a couple of bucks if you take action after you click.

- This newsletter was brought to you by our friends at Alto and pdfFiller.

- Nothing above is financial advice. DYOR, you filthy animal.