Table of Contents

What’s Institutional-Grade Options?

We’ve recruited Benedict Maynard, the guy who literally wrote the book on options trade, to produce a fortnightly newsletter that shows you how to trade options intelligently.

No stupid scams. No naked shorts. He’s going to teach you the techniques he refined over 20 years on the trading desk in London.

Each issue will focus on a specific investment thesis and then show you how to build a trade around it.

Today, it’s a split issue:

Analysis, if you can call it that, by Wyatt

Execution by Ben

The idea is mine (not financial advice, DYOR), and Ben’s telling us how to execute the thesis.

What’s today’s idea? By Wyatt

After a raft of holiday calamities, Boeing is at risk of becoming a meme stock only taken seriously by the Wall St Bets crew lurking on Reddit.

And maybe a “raft of calamities” is underselling things a bit.

And while Boeing’s order backlog looks good, and the commercials are actually fairly sound, fundamentals and “analysis” don’t necessarily drive share prices in this economy.

Like the Titanic, Boeing shares will be slow to move based on indicators like “orders, costs, or revenue,” but sentiment can be a cruel mistress, and for Boeing right now, all news is bad news.

And while it looks like sentiment is turning around, it’s only because nothing has fallen out of the sky in a few days. Shares are still sliding.

At $206, shares are off 25% since All the Bad Things began in earnest January 5, 2024, but they’re still well above the company’s six month lows ($177), which were achieved in October 2023.

There’s more room to fall, and it’s reasonable to expect any kind of bad news will pull the floor out from share prices, sending them down 20% or more.

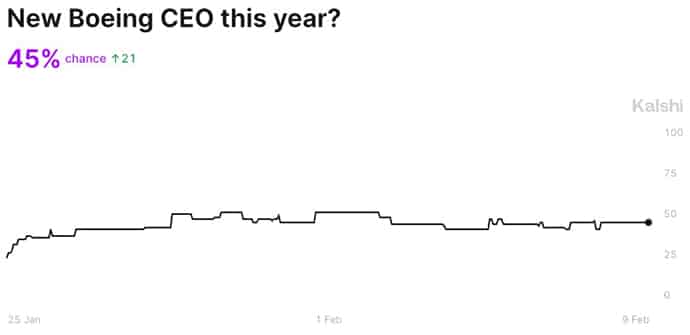

Besides more planes falling out of the sky, the next two most likely catalysts are (a) Boeing’s earnings call on/around April 24, 2024 and (b) the company sacking CEO Dave Calhoun.

Predictions market Kalshi puts the latter at 45% likelihood.

Beyond those specific events, I think it’s likely Boeing could continue to bleed down over the course of the next two or three months.