Today I’ve got a short and sweet issue on student housing — the silent winner in today’s real estate market.

I look at the strongest university markets in the US, and weave that into a cool hedging strategy for combating seasonality.

Let’s go 👇

Table of Contents

Demand for student housing is roaring back

Good news: Universities are back on track following the pandemic.

During the 2010s, universities got used to a steadily increasing flow international students. In 2020 Covid shut off the faucet, leaving universities scrambling to adjust and fill budget gaps.

Since 2022, international student enrollment has begun bouncing back, counteracting the broader decline in US college enrollment (which is a whole other issue). In the US, international registrations are up 80% over pre-pandemic levels.

But now we have a new problem.

As the number of students studying abroad continues to roar back, they face a massive shortfall in student accommodation.

The rental market students face as they flock back to class across the US, the UK, and Australia can only be described as hellish:

- Across the US, 20% of college students struggle to find housing

- Some campuses and students have turned to short-term solutions for relief, from living in vans near campus to allowing students to sleep in their cars in campus parking lots. A UC survey found that almost 9% of Santa Cruz students are homeless.

- California is pouring money into buying adjacent land and building new university housing. Senate Bill 886 would exempt student housing projects from the California Environmental Quality Act.

Building new housing, though, will take years to make an impact and does nothing for current students.

And in the meantime, the problem is even worse for international students. While local students can live at home, international students don’t have that luxury. They need a place to live, and will generally pay whatever it costs.

Australia is one of the world’s most popular destinations for international studies (and the 2nd most sought-after destination behind Canada).

Last year, the country experienced its biggest annual increase ever in international students, jumping 44% to 456,970 students (now 1.7% of the entire population). Aussie universities are receiving up to seven applications per bed.

The UK’s largest rental service, StuRents, predicts a shortfall of 450,000 student beds by 2025.

As foreign student numbers rise worldwide, real estate investors are taking note of their need for housing.

The benefits of investing in student housing

Wyatt and I often chat about the benefits of student housing:

- High demand from international students drives rental prices up and reduces vacancy rates. Yes, covid was the exception. But in normal times, each year before the first semester starts, an influx of new potential tenants fly in looking for a place to live. You rarely need to be concerned about vacancies.

- Year-long leases are the norm. This isn’t a world of month-to-month, and some landlords even require students to pay the full-year rent before they move in. At a minimum, students tend to not move out in the middle of a semester, which lets you plan ahead with confidence each year.

- Rate increases. After adjusting for inflation, average university tuition actually fell in the US in 2022. But over the past decade, it’s risen by an average of 4.63% annually. It’s logical to think student housing rent prices will follow suit. (Also, since long-term leases mean you can make longer-term plans, you can build in these rate increases each year.)

- Backed by parents. Since rental payments are often backed by parents, theoretically they’re less likely to break a lease, or have late/unpaid rent, compared to standard tenants. (Admittedly, I cannot find any hard data on this, but it makes sense. If you have anecdotes or data on this, let me know!)

- Low maintenance. Students don’t need fancy amenities; a simple comfy pad will do. Speedy WiFi is a must. But a gym with a view? Not so much. Students mainly just need a safe place to eat, sleep, and study.

What are the best student housing markets?

According to JLL, investment in purpose-built student accommodation reached $17.7 billion globally in 2022 — about 0.5% of the global real estate market.

I thought it’d be interesting to analyze the top student housing markets from an investment standpoint. Basically, from an investor’s point of view, which markets offer the best long-term buying opportunities?

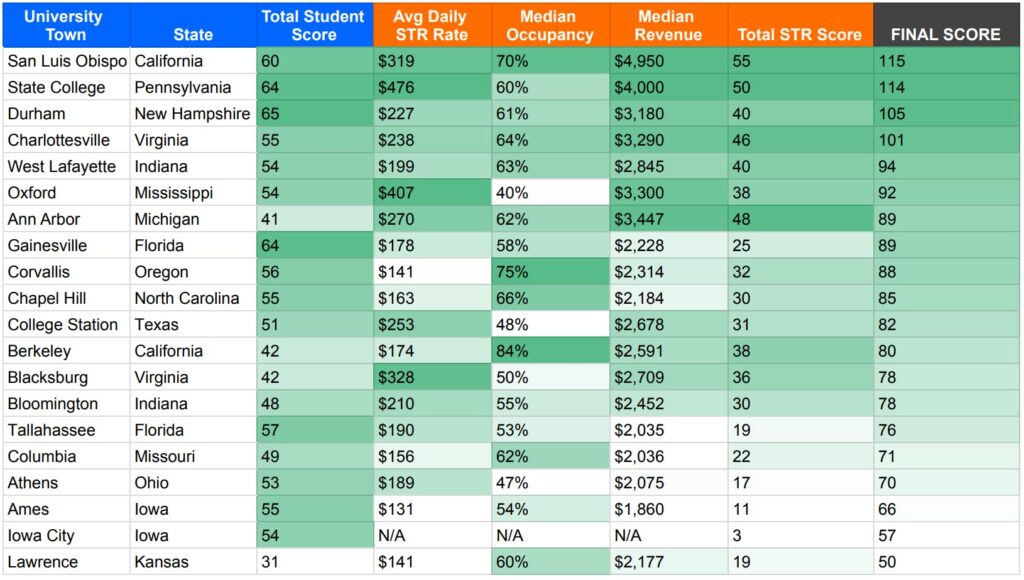

For simplicity, I stuck with college towns in the US (though I’d love to do a global version of this someday). I decided to find the top 20 towns by total student population, and analyze them across the following metrics:

- Students per capita. Since only about 25% of students live at home while attending university, this is really a measure of the “number of students vs total housing supply”

- Annual population growth. What’s the annual rate of change over the past 10 years?

- Avg rent price. How much does it cost to rent a 1br/1ba apartment? (Note: This is my weakest assumption, as students have many different living arrangements. However, when evaluating real estate, the price of a 1br/1ba acts as a “baseline benchmark.” So I think it’s safe to start here.)

- Annual rent growth. How fast are rent prices rising in each town? (All rents, not just 1br/1ba)

- Average sale price. What is the average sale price of a 1br/1ba apartment over the past year?

Using data from the US Census Bureau and RentCafe, and with the help of GPT-4, I created a table and stack-ranked each city based on each metric. I then tallied up all the points and gave each city a total score.

It’s a fairly simple analysis, but it’s a good start.

You can view the Google Doc here.

According to the table, the top 5 student housing markets for investors are:

- Durham, NH (Home to the University of New Hampshire)

- State College, PA (Home to Penn State University and 8 other colleges)

- Gainesville, FL (Home to the University of Florida)

- San Luis Obispo, CA (Home to Cal Poly SLO, and a gorgeous neck of the woods to boot)

- Tallahassee, FL (Home to Florida State, but much less of a pure college town than others on this list)

Like so much in real estate right now, some of the best opportunities are in Florida (err, so long as you ignore the massive risk a changing climate poses.) As we mentioned in our recent review of Nada’s Cityfunds, a full half of America’s top 20 fastest-growing cities are all in Florida, and Miami is the 2nd fastest-growing large city in America (behind Austin.)

Problems with investing in student housing

There are a few problems with student housing:

- Finding high-quality tenants. Student housing isn’t for everyone. Expect persistent smells and stains that never come out. The bar is low, and your property will likely get trashed at some point. If you’re looking for high-quality tenants, student housing isn’t your best bet.

- Short Lease Length. While 1-year leases are the norm, they are often the max. Students rarely stay in the same place all 4 years. This means more turnover.

- High pressure to rent quickly. Yes, students arrive in waves each semester. But once classes begin, rental demand sinks like a stone. You have a limited window of time, and if you miss the boat, you may have to wait a whole semester to find a new tenant.

- Tight Regulations. Student housing is heavily regulated in many areas. Definitely something to keep top of mind when researching potential regions.

One of the more interesting problems though is seasonality.

Students don’t usually need (or want) to live near campus during the summer. This means they’re either overpaying for months they aren’t using, or specifically looking for 10-month leases.

While students form the tenant base in college towns, locals help shield against the usual summertime lulls. Yet those extra two months can be a pesky, unnecessary, inefficient waste for both sides.

But what if you could combat that?

How to combat student housing seasonality

In one of our recent chats, Wyatt made a fantastic point: Demand for student housing is higher during winter than the summer, but demand for vacation rentals is the opposite.

Therefore, why not invest in locations with high demand for students during the school year, and high demand for tourists when classes are finished?

STRs half the year, student housing the other half. It could be the best way to combat seasonality!

I wanted to add a new column to the table for tourists per capita. This way I could determine which areas present the best combination of student housing & STR destinations.

However, it turns out not every city on the list reports on tourism numbers. Lame.

So instead, I used AirDNA to get some critical short-term rental info:

- Average Daily Rate. The avg price charged across Airbnb and VRBO over the past 12 months.

- Median Occupancy Rate. The number of booked days divided by the total number of days available for rent over the past 12 months.

- Median Revenue. The median monthly revenue earned over the past 12 months, not including taxes, service fees, or additional guest fees.

What I found was interesting: San Luis Obispo scored the highest in both the STR Score, and this was enough to give it the highest Final Score. (On a personal level, this makes me happy. SLO is an outstanding part of the world)

Closing thoughts

Student housing is a valuable asset class, and thanks to the post-pandemic rush of international students, it’s only getting bigger.

Few real estate markets offer the consistent returns, low maintenance, and permanent recurring demand that student housing offers. If you’re looking to diversify your real estate portfolio, student housing is a great place to start.

There are more scientific ways to perform an analysis of the best student housing opportunities. Using weighted averages, including more cities, focusing on markets outside the US, or starting from an STR point of view and working backward from that (instead of vice-versa). Consider this more of a starting point than a serious investment tool.

But you have to start somewhere. And frankly, investing in student housing can do some good. It’s much-needed accommodation for some of the most valuable members of society. It’s easy to see why student housing has become the silent winner in today’s real estate market.

It’s a great way to get involved in real estate, positively impact the world, and make some good returns at the same time. 🎓

Further Reading

- The biggest risk to future student housing returns is college enrollment, which is falling

- Macau University leads the list of universities with the highest percentage of international students

- In the US, the university with the highest international enrollment is NYU

- Invest With Roots wants to disrupt the tenant-landlord relationship

- Play around with my student housing/STR table

- VICE just had a good piece on what it’s like to be homeless while studying

Disclosures

- We have no ALTS 1 or personal investments in any companies mentioned in this issue. But I’m tempted to pull the trigger on a studio apartment in San Luis Obispo (if I can convince Wyatt not to hate southern California!) 😂

- This issue may contain affiliate links. AirDNA isn’t one of them, but should be, because it’s a great service.