Hundreds of investing and finance newsletters hit my (and maybe your) inbox every week. This is the best of the best.

This week, we bring you

- Chuck E. Cheese… A $1B Company?

- AI in 2024—What Bill Gates Expects

- The Art of Waiting: UVA’s 25-Year Investment Experiment

- Researcher vs. Hedge Fund, A $170M Battle

- The Bursting of the Apartment Bubble

- AI Cannot Claim Patents—UK Court Rules

- Inflation—Back to Pre-COVID Levels?

- The Conclusion of a 12-Year Clean Energy Legal Battle

- 3 Stocks To Consider

Table of Contents

Chuck E. Cheese… A $1 Billion Sale?

After a rough pandemic-induced bankruptcy, Chuck E. Cheese is bouncing back, potentially heading towards a sale.

Goldman Sachs is guiding this possible acquisition, hinting at a value above $1 billion for the family-friendly entertainment venue.

More from Nation’s Restaurant News.

AI in 2024—What Bill Gates Expects

From personalized education to accelerating the pace of innovation in medicine and global health, Bill Gates expresses a strongly optimistic view for what AI will help humanity achieve in 2024.

Read the full predictions here.

The Art of Waiting: UVA’s 25-Year Experiment

Through a unique donation from the Gayner Family, UVA students are learning investment patience through a creative challenge: manage a stock portfolio that’s untouchable for 25 years.

It might sound crazy, but Gayner is trying to teach the principle of Coffee Can Investing, where you let your winners run.

Read the full story from Market Sentiment.

Researcher vs. Hedge Fund, A $170M Battle

Two Sigma’s narrative of a rogue researcher causing massive losses is facing pushback by none other than the “rogue researcher” himself, Jian Wu.

Claiming damages to his professional reputation, Wu is countering with a defamation lawsuit, arguing the hedge fund’s internal issues and lack of policy led to the losses, not his actions.

The Bursting of the Apartment Bubble

Years of the Federal Reserve’s ‘easy money’ policies led to rampant carelessness when it came to investing in the apartment industry.

This bubble, fueled by inexperienced investors and loose credit standards, is now deflating due to rising interest rates.

AI Cannot Be Patent Inventor—UK Court Rules

The UK Supreme Court ruled that AI cannot be an inventor for patents, unanimously rejecting a U.S. computer scientist’s appeal to register patents for inventions created by his AI system, DABUS.

This reaffirms that under UK patent law, a natural person, not a machine, must be the inventor.

Inflation—Back to Pre-COVID Levels?

While shelter inflation remains high, overall inflation is returning to normalized pre-Covid levels, with private indicators even suggesting potential deflation.

But considering the difficulty of measuring something as complex as inflation, how much trust should be put into any short time inflation data?

A Landmark Ruling In The American Clean Energy Debate

Since 2015, “clean energy leader” Enel, has been collecting about $10 million per year in federal tax credits from their controversial wind project on the Osage Nation’s lands.

After 12 years of litigation, Enel has been ordered to remove 84 wind turbines by a federal judge.

What does this case say about the future of wind energy investing?

What I’m reading

I get a lot of mail asking where I find all this good stuff. Here are a few of my favorite newsletters, all of which are free to subscribe to:

Stay up to date on disruptive trends, the most exciting early stage companies, and groundbreaking entrepreneurs.

Free daily hot stock trading ideas, and market insights from a 20-year trading veteran.

The “IKEA instructions for investing” to help you become a better investor.

Stock ideas

Inspired by the potential $1B Chuck E. Cheese sale, let’s take a look at some other companies in live entertainment.

Here are three of my favourites from this past week.

Powered by insights from public.com

Remember to always DYOR.

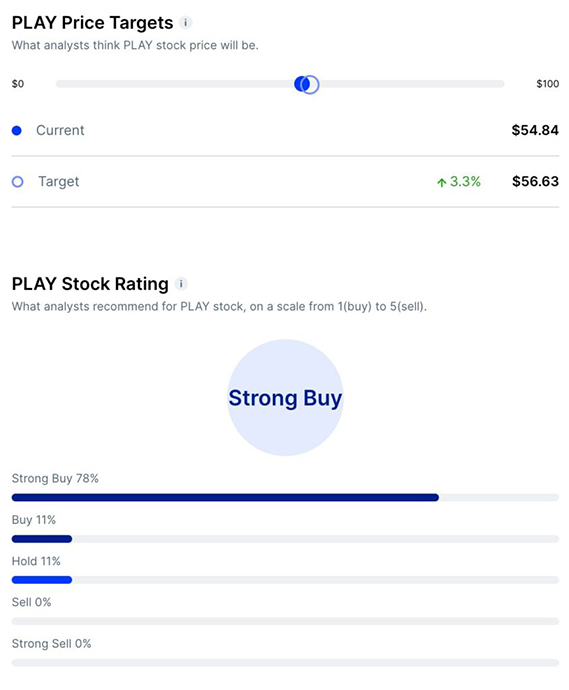

Dave & Buster’s ($PLAY)

Bull Case:

- New Leadership Initiatives: Under CEO Chris Morris, PLAY is adopting new marketing strategies and leveraging sporting events to drive traffic.

- Acquisition Growth: The acquisition of a smaller competitor could provide new growth opportunities.

- Low P/E Ratio: PLAY’s forward price/earnings ratio of 11.6 indicates potential undervaluation,

Bear Case:

- Revenue Decline: A recent 3% fall in revenue indicates potential challenges in the business model.

- Economic Uncertainties: Widespread economic uncertainties could affect consumer discretionary spending.

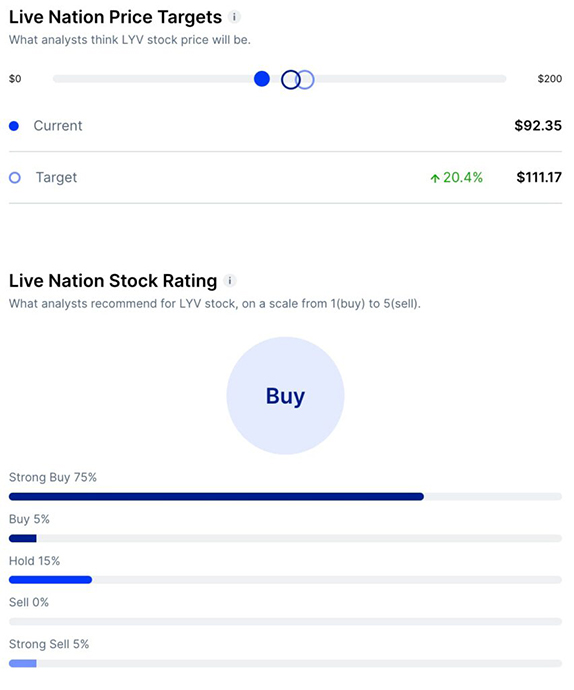

Live Nation ($LYV)

Bull Case:

- Expanding Global Live Music Opportunity: Morgan Stanley noted LYV’s unique ability to capture the expanding global live music market, which is showing strong post-pandemic growth

- Strong Analyst Price Target: Live Nation has a “Strong Buy” average rating from analysts, with a 12-month stock price forecast of $107.50, indicating a potential increase of 16.41% from the latest price.

- Impressive Financial Performance: The company’s operating income surged 22% year-over-year last quarter, with $762 million in operating cash flow generated in the first nine months of the year.

Bear Case:

- Potential Future Lockdowns: If future lockdowns occur, they could severely impact Live Nation’s business, which heavily depends on live events.

- High Price/Book Ratio: LYV has a high price/book ratio of 224.29, which might suggest overvaluation relative to its book value.

- Regulatory and Legal Concerns: The company faces investigations and potential legal challenges related to its ticketing practices, which could impact its operations and reputation.

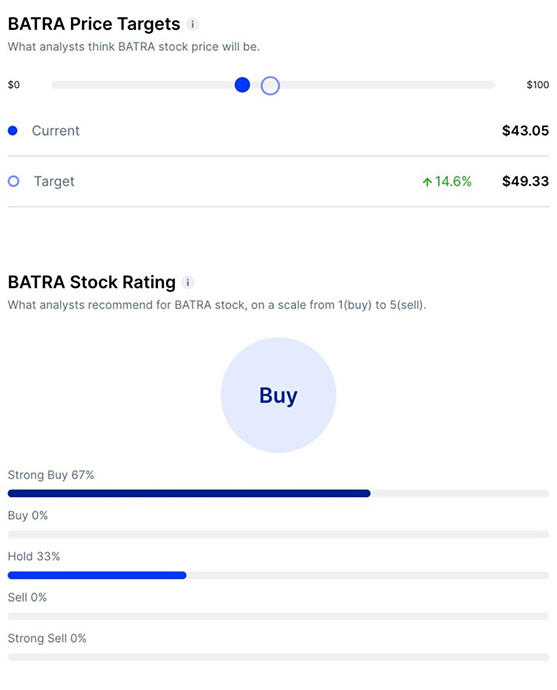

Atlanta Braves Holdings Inc ($BATRA)

Bull Case:

- Attractive Valuation: BATRA is trading at a lower price than the estimated value of the Braves franchise by Forbes, suggesting the stock is undervalued compared to the team’s value.

- Historical Growth in Franchise Value: Since the Braves were acquired for $400 million in 2007 and are now worth $2.6 billion, there’s a historical precedent for significant long-term value growth.

- Potential Sale Boost: There’s an expectation that the Braves could be sold in the future, which could lead to a substantial return for BATRA stockholders.

Bear Case:

- Market Dynamics: The stock’s performance may be subject to unique market factors and lacks guarantees of a liquidity event.

- High Forward P/E Ratio: BATRA’s forward P/E ratio is high at 417.96, indicating potential overvaluation based on future earnings expectations.

- Negative Financial Metrics: BATRA has shown negative ROE (-42.10%), ROA (-9.10%), and ROIC (-1.74%), indicating current inefficiencies in generating profits from assets and investments

That’s it for this week.

If you write amazing content and want to be featured, please send it through for consideration.

Cheers,

Wyatt

Disclosures

- There are affiliate links above; we’ll get a couple of bucks if you take action after you click.

- This newsletter was brought to you by our friends at pdfFiller.

- Nothing above is financial advice. DYOR, you filthy animal.