Welcome to The WC — your weekly shot of awesome.

Today we’ve got:

- Tom Brady’s buying up third tier sports teams

- Is everything bigger in Texas? Or just a bit crooked?

- I don’t want to hear your burning insights

- Power law in the media

- How to make money selling art

Table of Contents

Tom Brady’s shopping spree

Legendary American football quarterback Tom Brady hasn’t let a $45 million class action lawsuit, divorce, or a second retirement slow him down.

Brady has always been active in business outside football, but his endeavors have all started to look alike recently.

Over the last couple years he’s:

- acquired a minority stake in the WNBA’s Las Vegas Aces

- become minority owner of and Chairman of the Advisory board for English football (soccer) team Birmingham City FC

- bought a pickleball tam

- bought a race boat (??) team

The latter three positions were via his stake in a company called Knighthead Capital Management, which looks like a dreadfully straightforward investment firm but obviously isn’t.

Something shady in Texas

Speaking of potentially dubious sporting investments, a few weeks ago the new high school football stadium in Melissa, Texas, went a bit viral.

Melissa HS in Texas has just over 1300 students — this is their new 10,000 seat, $35 million football stadium #txhsfb

— Texas Football Life (@txfblife) August 16, 2023

Everything is bigger in Texas 🤠 pic.twitter.com/PPzceXtP0L

Most people said a lot of things about how everything’s bigger in Texas etc etc, but the whole thing smells funny to me.

No one has said who paid for it or how they justified the spend.

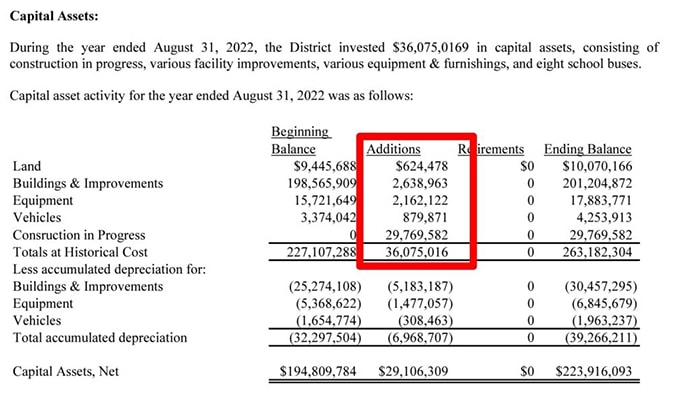

The school district issued a $400 million bond in 2021 that was meant to cover “the new construction of an elementary school, middle school (with land purchased from the 2016 bond), and the final phase of Melissa High School including Career and Technical Education (CTE). The bond will also include future projects as growth allows.”

Nothing in there or any of the breathless videos pushing the bond that mentions a stadium.

But looking at the district’s audited financial reports for 2022, it looks (looks) like the $35 million stadium came out of the bond raise.

It’s tough to be sure what’s going on with the bond spend, because the site promoting the bond has been taken down, and I can’t find any reference to the initiative justifying the bond’s passing – “Vision 2034.”

School board minutes only reference the stadium in passing, saying construction is going well.

A bit (ok a lot) of digging through the school board minutes revealed Melissa has also spent $23 million on a new basketball gym.

I don’t have the time to dig too much deeper into this (unless y’all really want to hear about it for next week), but it all feels a bit shady and ridiculous to me. I say this as an admittedly slightly bitter ex non-revenue high school athlete, but the even the revenue side doesn’t make sense.

- The football stadium cost $35 million to build.

- It’s got 10,000 seats

- Seniors and student athletes get free tickets — maybe 1,000 per game ($0)

- Reserved seating — 1,000 at $100 each ($100,000)

- Other students pay $4 each — maybe 1000 per game ($4,000)

- Adults pay $6 each — 7,000 seats left ($42,000)

- So they can generate maybe $150k per game plus concessions. A total of perhaps $200k.

- They play a maximum seven games per season

- The stadium will generate revenue (not profit) of maybe $1.5 million per year.

I’m sure there are other revenue sources, but I’m also not including any costs. This thing will never pay for itself, so it can’t be justified on that basis. The basketball court will make even less money.

And fine, whatever, football is big in Texas, and it’s a matter of civic pride to have a whacking stadium, but perhaps consider teaching students to read first.

And don’t lie about how you’re going to spend $400 million.

No essays, please

I guess everyone is back from Burning Man, right? You all learned what hundreds of thousands of British kids have learned over decades of Glastonbury — sometimes it rains.

Congrats — I’m glad you’re home safe. I bet you’ll have a lifetime of memories and stories to tell your kids.

Just one request for all you VC and founder type who were there.

No essays.

The first time I see “how my week of Burning Man terror changed my life” I’m going to drown myself in silty playa mud.

Can’t see the forest for the trees

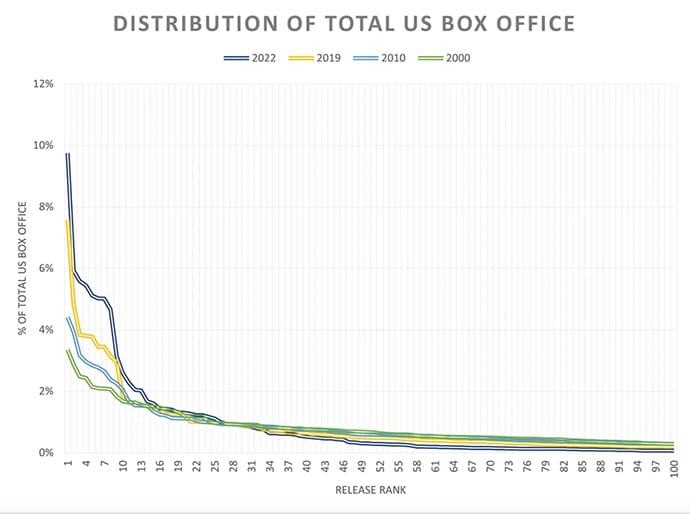

As infinite access to (nearly) media proliferated (Spotify, Twitter, Instagram, newsletters like this one), many expected to see the democratisation of hits. Infinite supply + frictionless demand should create lots more stars.

But it doesn’t.

That the internet would yield more choice and, therefore, more fragmentation was intuitive then and is indisputable now. But it only tells half the story. Though it seems contradictory, the internet both fragments and concentrates attention.

In fact, it’s going the opposite direction.

Because while supply is now infinite, and we’re less subject to the whim of a handful of distribution channels (record labels, newspapers, film studios), we’re still slaves to our network.

Concisely, “people are more likely to be influenced by what other people do when: 1) there are a lot of choices; and 2) it is easy to observe what other people do.”

I don’t know how many times I’ve had conversations with friends about what’s good on Netflix now. Too much to choose from, and I trust their opinion. So I become the billionth person to watch Stranger Things.

Recommendation algorithms make the problem worse, of course. Unless specifically designed to surface new content, you’re going to see more of what everyone else seems to like.

Anyway, if you like this newsletter, tell a friend.

Want to make money as an art dealer?

Read this profile of Larry Gagosian. It’s excellent.

Bonus!

What I’m listening to

The Economics of Girl Scout Cookies — silly and easy

What I’m reading next

Outsourcing Empire: How Company-States Made the Modern World – How chartered company-states spearheaded European expansion and helped create the world’s first genuinely global order.

That’s all for this week; I hope you enjoyed it.

Cheers,

Wyatt

Disclosures

- This issue was sponsored by our friends at JKBX and BabyQuip

- Our ALTS 1 Fund doesn’t have a stake in anything here.