Welcome to The WC — your weekly shot of awesome.

Today, we’ve got:

- Investing in private islands

- A houseplant bubble

- Short-term thinking

- An important announcement

- Trouble for the addiction economy

Table of Contents

Private islands

We’re working on something special at Alts, and it sent me down the archives rabbit hole. How to Buy a Private Island, a piece Stefan wrote three years ago, has always been one of my favorites.

It sent me down another rabbit hole — looking at private islands currently for sale.

Some of the best…

Most expensive – Rangyai

110 acres | $160 million

A popular tourist island near Phuket, Thailand.

A Fixer Upper – Haapiti Rahi

2.4 acres | POR

Set in French Polynesia, this island is exactly what most people think of when they consider buying their own private island.

But beware, “Whilst considerable repairs and renovation work are needed, the two houses nevertheless form a great basis for luxurious island living.”

Best value – Ile Fraser

0.5 acres | $415,000

Rustic, off-grid, and set in the middle of a river. The zombies won’t get you here.

Better than tulips

Did you know some houseplants sell for more than $50,000?

[There’s} a houseplant bubble that has seen the growth of those most human of off-shoots: plant speculation, plant swindling and outright plant crime. Pot plant collections have been raided at gunpoint. Botanical gardens have been trimmed at scissor-point. Some unscrupulous sellers have even taken to painting the leaves white.

I think I’ve found my new hobby.

As ever, Stefan was on the case a year and a half ago.

Short-term thinking

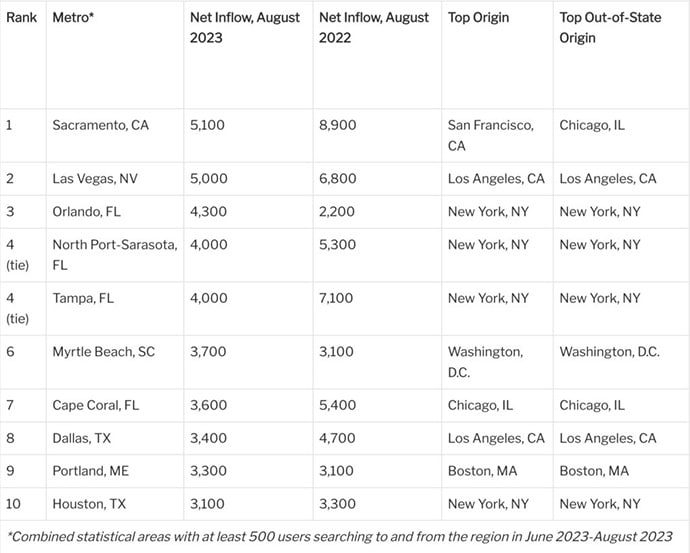

From Redfin: “A record 26% of homebuyers are looking to move to a different part of the country, up from 24% a year ago and roughly 19% before the pandemic began.”

Makes sense:

- Covid and remote work made it more desirable and possible to leave big cities

- The number of Americans retiring every year is increasing

- Lack of housing inventory and decreased affordability have prevented people from moving for the last year

So, increased demand + pent-up demand.

But what’s worrying is where people want to go.

Nine of the top ten locations are set to be significantly impacted by climate change over the next few decades.

Florida and California, five of the top seven, are already uninsurable.

Long term, Texas, coming in at eight and tenth, is looking at crop failures, wildfires, flooding, unbearable temperatures and humidity, and a devastated economy. Oh, and it’s second in hurricanes only to Florida.

Maine should be ok, though.

Check in on those around you

Startling stats:

- The rate of suicide is highest in middle-aged white men.

- In 2021, men died by suicide 3.90x more than women.

Over the last couple years, three men I know — all dads — have attempted suicide. A fourth, out on his stag do, drowned himself in the ocean.

Each was, on the surface, absolutely fine.

Watch this, and check in on your mates.

𝗔𝘁 𝘁𝗶𝗺𝗲𝘀, 𝗶𝘁 𝗰𝗮𝗻 𝗯𝗲 𝗼𝗯𝘃𝗶𝗼𝘂𝘀 𝘄𝗵𝗲𝗻 𝘀𝗼𝗺𝗲𝗼𝗻𝗲 𝗶𝘀 𝘀𝘁𝗿𝘂𝗴𝗴𝗹𝗶𝗻𝗴 𝘁𝗼 𝗰𝗼𝗽𝗲, 𝗯𝘂𝘁 𝘀𝗼𝗺𝗲𝘁𝗶𝗺𝗲𝘀 𝘁𝗵𝗲 𝘀𝗶𝗴𝗻𝘀 𝗮𝗿𝗲 𝗵𝗮𝗿𝗱𝗲𝗿 𝘁𝗼 𝘀𝗽𝗼𝘁.

— Norwich City FC (@NorwichCityFC) October 10, 2023

Check in on those around you.#WorldMentalHealthDay | #YouAreNotAlone | @samaritans pic.twitter.com/ZC50AH5thl

Is the addiction economy in trouble?

Power law says that a tiny percent of the population generates the vast majority of results. In video games, something like 50% of revenue comes from 1% to 5% of players.

The effect is common across a number of addictive industries, including sugar, gambling, alcohol, coffee, cigarettes, and even ice cream.

So what happens if science develops a therapeutic that mutes addictive behavior?

1/ Just caught up with a few investor friends in the consumer space last week about Ozempic and GLP1s

— Corry Wang (@corry_wang) October 11, 2023

As far as I can tell, everything basically hinges on: how much does it matter that every consumer product in the world depends on a tiny cohort of super consumers?

The impacts will be wide-ranging. First, consumption of these products will fall off a cliff. Companies–and perhaps industries–will collapse. Marketing and branding will have to change.

And if all addicts take the drug, what about their so-called positive addictions? Working out. Working long hours. Painting.

Does humanity lose its long tail? Do we ever get another Hemmingway or Van Gogh? Michael Jordan? Thomas Edison?

Bonus

What I’m reading

Happy Returns: Your complete guide to option trading for beginners

Written by a friend of mine in Spain, this is a super accessible guide to how options and other derivatives work.

That’s all for this week; I hope you enjoyed it.

Cheers,

Wyatt

Disclosures