Welcome to The WC — your weekly shot of awesome.

Today we’ve got:

- PE is coming for your local sportsball team

- Can weed save Texas?

- Wealthy Americans building their own cities

- The 117k years where humans almost went extinct

- The economy is crumbling

If you like what we’re doing here, please support our sponsors and tell a friend.

Wyatt

Table of Contents

Where have you gone, Joe DiMaggio?

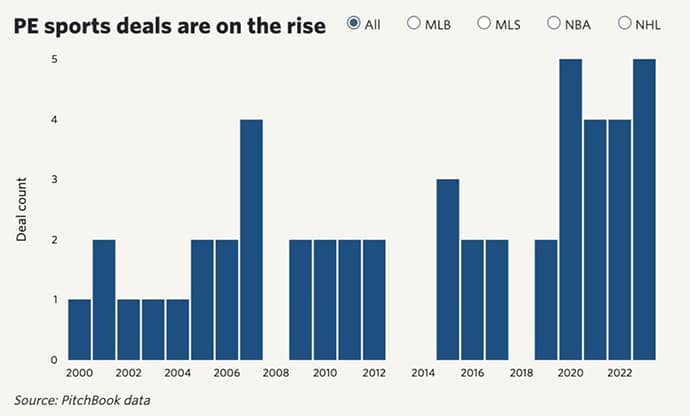

The frequency and number of pro sport team takeovers by private equity firms is on the rise. And while owning an MLS, NBA, NHL, or MLB team has never really been a mom-and-pop organisation, it does give a feeling that sports are becoming more commercialised than ever.

PitchBook cobbled together a nice report on just how deeply PE is involved in the four leagues, and it turns out they’ve got their fingers in more than 50% (63) of teams.

The NFL is a different story, because it has different ownership rules. The league “forbids corporations, religious groups, governments, and non-profit organizations owning a team.”

Smaller / emerging leagues tend to have more private ownership. The North American Soccer League, for example, is owned mostly by private individuals, though one of the two upcoming expansion teams is backed by a fund.

The WNBA is a bit of a mess.

Dig deeper

- Check out who owns your team.

- Future NWSL expansion opportunities. And MLS. And WNBA.

- How have sporting investments performed compared to the S&P 500?

High times in Texas

From the always-excellent High Times, this week we learn that the marijuana industry in Texas is overtaking wine.

While recreational marijuana use is illegal in Texas, “businesses involved in hemp-derived CBD, from the manufacturing to the storefront, employed more than 50,000 Texans, generating between $19.1 billion to $22.4 billion in economic growth.”

Wine generates around $20 billion.

To unlock the real revenue potential behind THC, of course, Texas will need to legalise recreational use. While the state’s lower house took steps toward this earlier in 2023, the senate rejected the bill.

Nationwide, legal weed has delivered a $100 billion economic uplift across the states that have legalised the drug.

Dive deeper

- The Economic Benefits of Legalizing Marijuana

- America has spent over a trillion dollars fighting the war on drugs

- Long-term effects of cannabis

Paradise Found?

In 2013, Elliott Bisnow, Brett Leve, Jeff Rosenthal, Jeremy Schwartz, and Greg Mauro bought a Utah ski resort for $40 million, saving it from foreclosure.

They’re the guys behind the Summit Series, which is sort of like Davos for tech bros.

Their audacious plan for the resort was to create a master planned community for people like them.

To be honest, it sounds like a lovely place, but the chaps bit off more than they could chew, and it’s not really worked out.

Building 500 homes on top of a mountain that’s covered in snow six months a year is hard — plus they pissed off the locals.

None of this is new, of course. Rich people have been buying up towns for decades. Larry Ellison owns the sixth largest island in Hawaii, complete with a town, two resorts, and three golf courses.

It does feel like this sort of thing is becoming more common, though. It’s sort of a natural extension of all the rich guys buying bunkers in New Zealand. People — especially wealthy Americans — are sort of dissatisfied with how the world is shaping up, and they think they can create something better.

Sim City brought to life.

The New York Times broke the story that a who’s who amongst Silicon Valley types has bought up $800 million worth of land near the Bay Area, but it’s unclear what the plan is or how far along they are. The intent seems to be building a new city and making a lot of money.

Perhaps the most credible innovator in this space is Dryden Brown, who is trying to build a new city somewhere in southern Europe. The city, called Praxis, is well-thought-out, and just last week, the company received a “term sheet” from a local government to acquire the land.

Doing something like this requires an astounding level of arrogance, and these initiatives smack of all the worst elements of late stage capitalism.

But what if they pull it off, and this is the new model?

Does society further diverge between the haves and have nots? Will the Eloi thrive in these utopias while the Morlocks waste away on the government dime?

Or can we figure out how to thrive?

Dig deeper

- How to Buy a Private Island

- An Introduction to Charter Cities

- How to create a city

Humanity on a knife’s edge

Sticking with doomsday scenarios, scientists recently discovered that humanity was nearly wiped out 900,000 years ago. This event, called the “bottleneck,” reduced the number of humans from around 100k to 1,280, and the population didn’t bounce back for some 117,000 years.

For over a thousand centuries, humanity balanced on a knife’s edge. Every human being on earth could have fit comfortably in one NFL end zone, and any number of mild catastrophes would have been game over.

The cause may sound familiar.

The population bottleneck coincided with dramatic changes in climate during what’s known as the mid-Pleistocene transition, the research team suggested. Glacial periods became longer and more intense, leading to a drop in temperature and very dry climatic conditions.

And what saved humanity? Fire and a shift toward a more hospitable climate.

There’s a lesson in here somewhere.

An economy built on quicksand

This one gets a bit wonky. Tl;Dr: poor Americans are in real trouble.

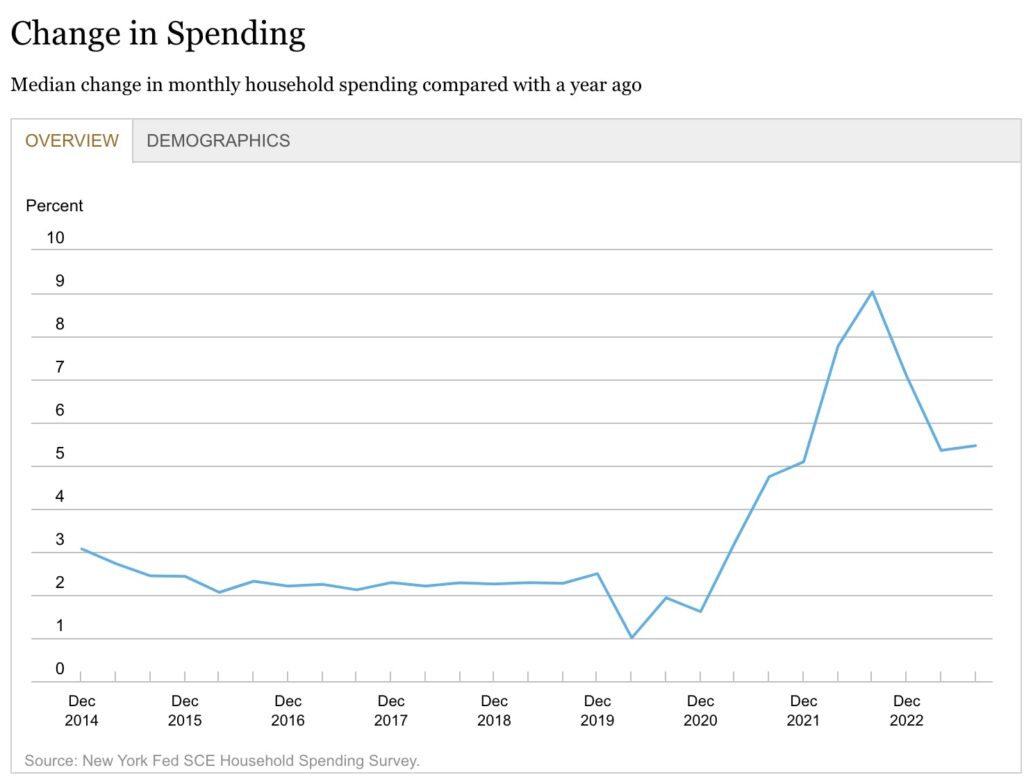

Last week, the Fed released its household spending survey, and while the broad data is good, it points to specific cracks forming under the surface.

Historically, annual spending growth corresponds to inflation, which makes sense. And most demographics are aligned with that.

But a few key demos are YOLO’ing in 2023, refusing (or unable) to save their pennies. And it’s a weird mix.

- Over 60s

- High school or less education

- < $50k annual income

All three of those demos are actually spending more as we come into the end of 2023.

Which might be great. But it’s not.

Because also:

- Those demos have seen their income variance increase by 50% over the last year.

- And while historic surveys suggest those folks intended to spend less this year, they didn’t.

Which tells me the poorest and most vulnerable Americans are getting hit with unexpected expenses at the same time credit card debt is setting new records and job security is declining.

That’s bad.

That’s all for this week; I hope you enjoyed it.

Cheers,

Wyatt

Disclosures

- This issue was sponsored by our friends at RADD.

- Our ALTS 1 Fund doesn’t have a stake in anything here.