Hola amigos, this week I’m coming at ya from sunny Jalisco, Mexico, where we’re going through the ins and outs of tequila investing with a lucky group of Alts members.

Want to come on the next trip? Check out Altea, our private community.

Today, we’ve got:

- Remember NFTs?

- Who got some Trump Sneakers?

- Why is rooftop solar dying?

- You’re probably paying too little for car insurance

- The unbearable responsibility of owning a smartwatch

Let’s go.

Wyatt

Table of Contents

Remember NFTs?

I sure do. I’m not afraid to say I was super bullish on blue-chip projects.

Ready for some eye-watering stats? Data from dappGambl:

- Of the 73,257 NFT collections we identified, an eye-watering 69,795 of them have a market cap of 0 Ether (ETH).

- Only 21% of NFT projects sold out. The vast majority didn’t.

So, it’s not been great for the most part.

But I wonder if NFTs are coming back in some form.

Before you start throwing rotten veg at me, let me lay out a few data points, and then you can decide for yourself.

Point the first:

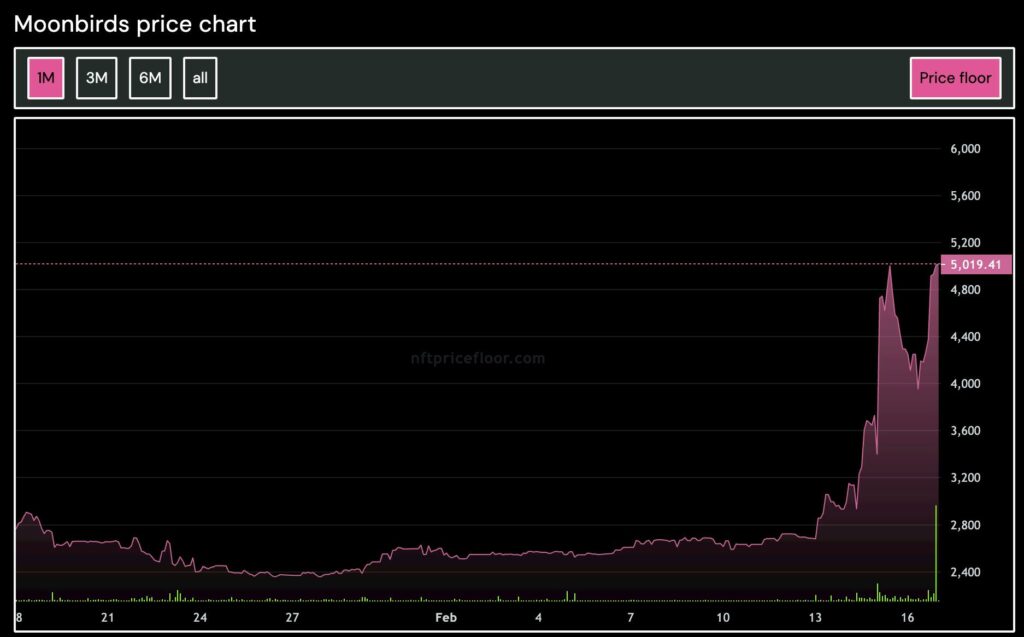

Last week, Yuga Labs — one of the last remaining big-time players — bought PROOF Collective, creator of Moonbirds, Oddities, and some other stuff [Dicslaimer, our Alts 1 fund owns a Proof Collective NFT].

Yuga Labs has acquired @PROOF_XYZ, which includes PROOF Collective, @Moonbirds, Mythics, @oddities_xyz, and @Grails exhibition series.

For more information, see the official Yuga News blog: https://t.co/ly3fTYxCBk pic.twitter.com/ouvIM4Hr4S

— Yuga Labs (@yugalabs) February 16, 2024

Members of the Yuga community aren’t completely on board with the acquisition, but it’s been great news for Moonbirds holders.

Point the second:

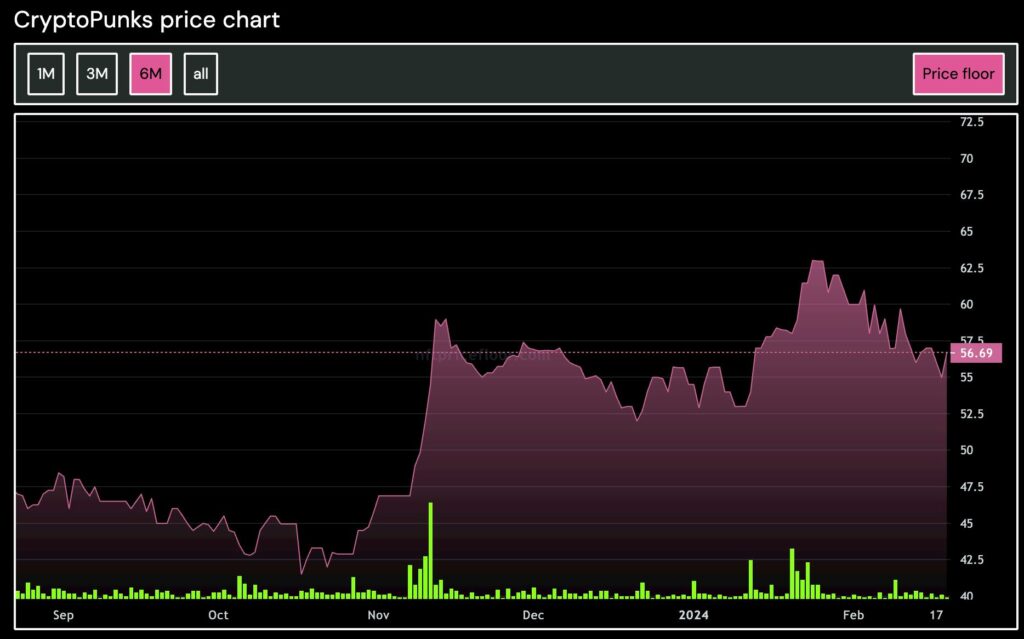

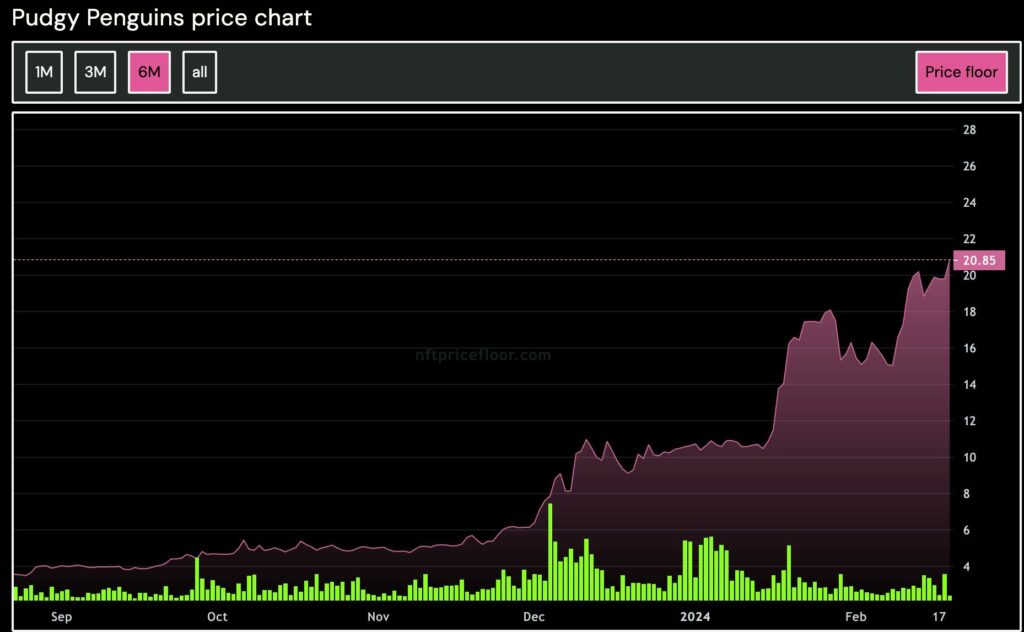

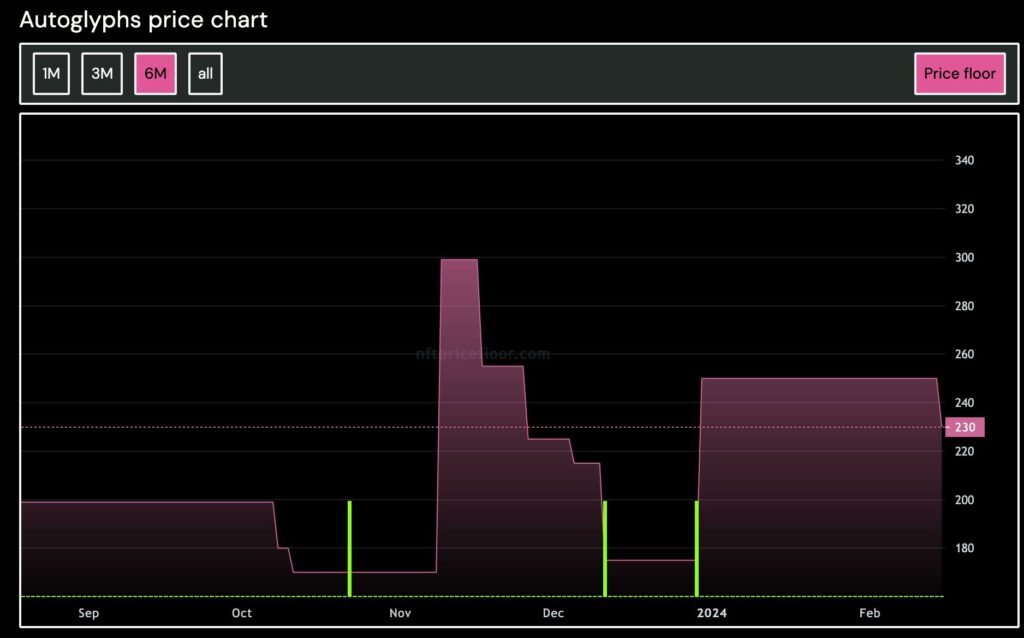

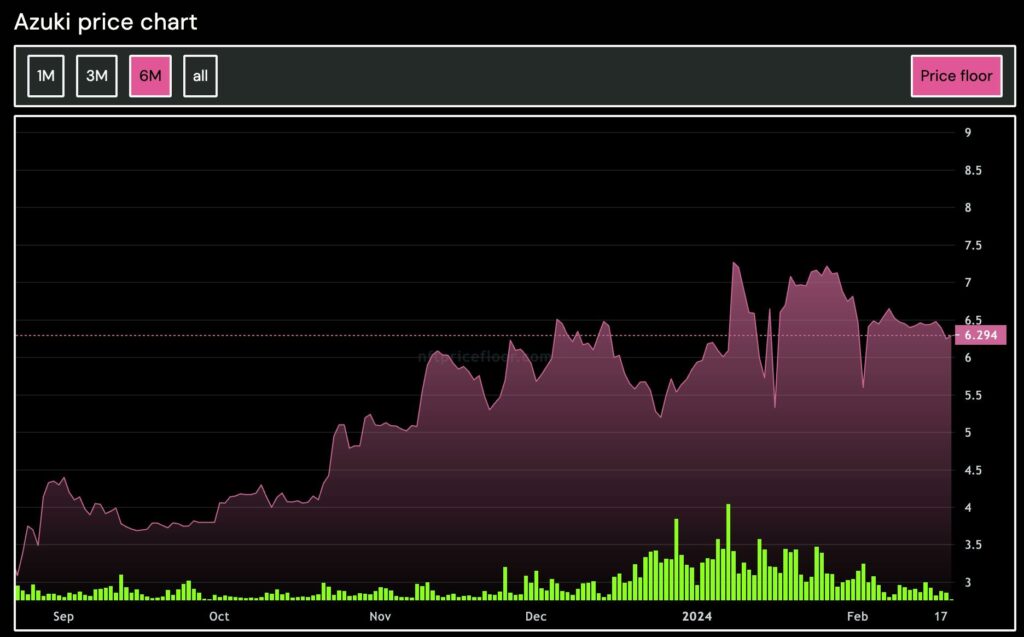

Have a look at the six-month charts for some of the biggest NFT projects:

CryptoPunks

Pudgy Penguins

Autoglyphs

Azuki

These charts are priced in ETH, so the pump isn’t just due to currency appreciation. The increase is more pronounced if you account for their values in USD.

Not all projects are thriving, of course. In fact, Yuga Labs NFTs are struggling in particular, possibly for the same reasons their community members aren’t over the moon(birds) about the PROOF acquisition.

Point the third

There are a number of projects going on behind the scenes right now that use NFTs and blockchain to very good effect. The future of NFTs may not be deformed apes, but the possibilities are wide open.

I'm pretty sure Wyoming is going to save America, or at minimum play a major part in her triumphant resurgence. pic.twitter.com/sy7EUGDEpA

— John Belitsky (🏢,🏢) (@JohnBelitsky) February 17, 2024

Point the fourth

We’re so back. 🚀 pic.twitter.com/26UUmF3Wux

— Wyatt Cavalier (@itiswyatt) February 18, 2024

OK, so this one is garbage.

Who got some Trump Sneakers?

Speaking of fantastic products that 100% won’t be made vicious fun of years from now…

As you may have heard (God bless you if not. Can we trade lives?), former President Donald Trump launched a limited edition shoe at SneakerCon over the weekend.

At $399, the 1,000 pairs sold out within nanoseconds.

Politics and fashion aside, this got me wondering about the investment potential of all the stuff Trump has come out with lately.

Remember the patch cards he gave away with NFT sales? And the Never Surrender mugshot t-shirts and mugs?

The Trump sneakers aren’t “worth” $399, but there have been no fewer than ten pieces of presidential memorabilia sold for more than $1 million at auction.

Given how quickly those kicks sold out, I’ll be shocked if they don’t 2x to 5x on the secondary market.

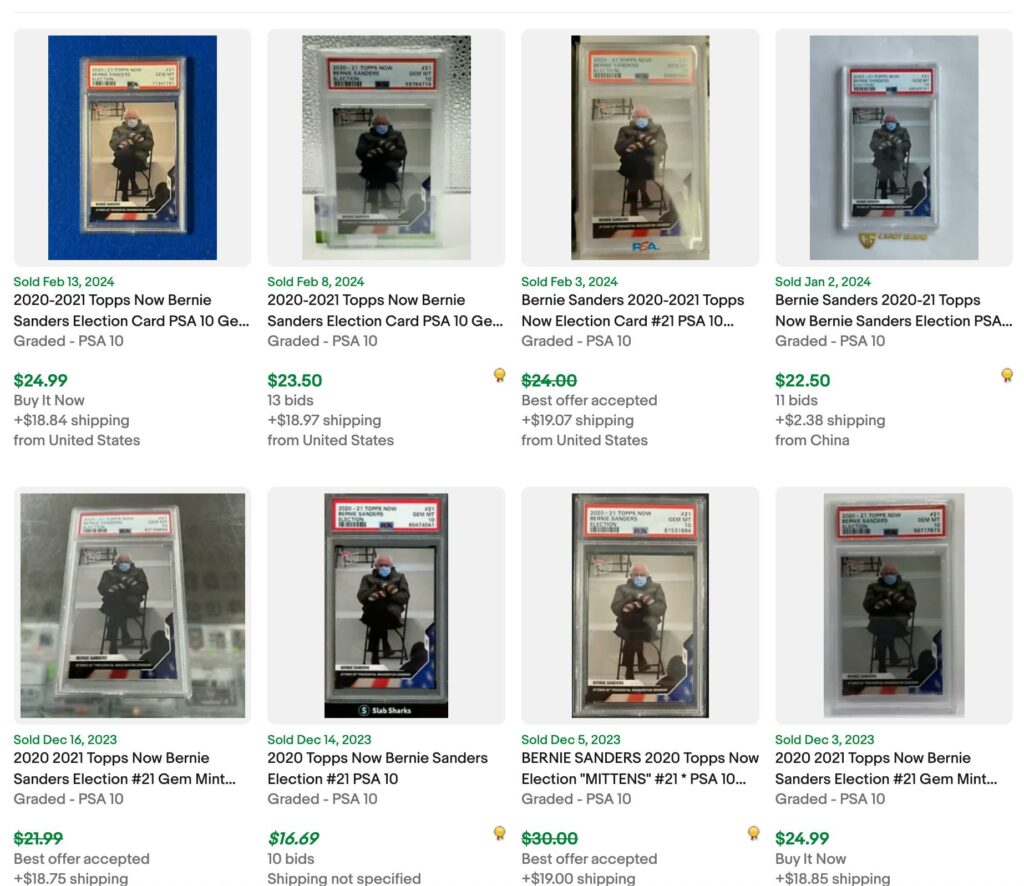

Or I could be wrong, and they’ll go the way of the Topps Now Bernie Sanders card.

Or Trump might realize 1,000 pairs of sneakers was thinking too small, and he’ll flood the market with 50,000 more sets next week.

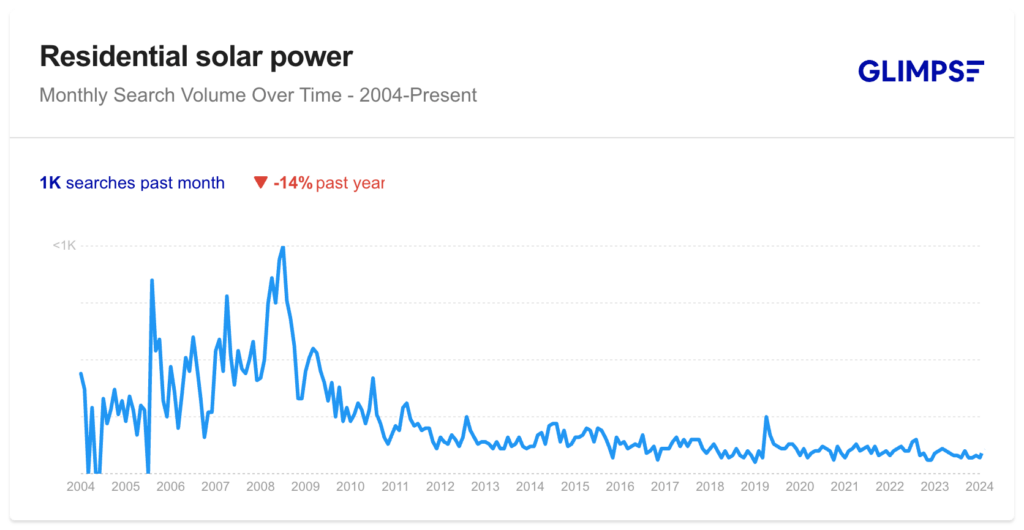

Why is rooftop solar dying?

In 2023, more than 100 different residential rooftop solar companies went out of business in the US. Broadly speaking, there are a few reasons why this happened:

- Inability to deliver high-quality work and operate profitably

- Reduced financial attractiveness of solar investments under California’s Net Energy Metering (NEM) 3 policy

- Higher interest rates make borrowing more expensive, discouraging consumer investment

- Decreased consumer sentiment and solar investments due to increased borrowing costs

This is an ugly chart for a technology that should be becoming more popular, not less.

Most smaller players felt compelled to compete on price, delivering a glut of poor solar installations.

Hilariously, there’s a Facebook group called Crap Solar with 45k members.

It’s rife with horror stories, including 100kw industrial installations abandoned when a company failed – and the photos. Well, they’re bad.

Jokes aside, many solar installation experts are just fraudsters tricking people into finance agreements they don’t understand and can’t afford.

One of the industry’s biggest players, “Sunnova, is … under the microscope for having received a $3 billion loan guarantee from the Department of Energy while facing numerous complaints about troubling sales practices that targeted low-income and elderly homeowners.”

In some cases, a $25k solar installation project costs the homeowner more than they paid for their home.

Statewide consumer projection bureaus have got wind of this and are shutting some of them down, but it’s obviously put a bad taste in peoples’ mouths.

I reckon another hundred or more companies will fail this year, and the next, and the industry will come back stronger as interest rates come down and the bad apples wash out. In the meantime, fill up the generator.

You’re probably paying too little for car insurance

Ducking from the tomatoes again on this one.

If you’re in the US, you’re probably not paying enough for your car insurance — but it’s not your fault.