Welcome to The WC — your weekly shot of awesome.

Today we’ve got:

- More pickleball nonsense

- Good news for renewables

- The reason you’re losing money betting against the Fed

- Saudi Arabia and India keep crushing it

- Junk bonds are back (and why you care)

Table of Contents

The pickleball train wreck gains steam

This week, Major League Pickleball (MLP) announced it’s hired a new CEO and COO. Sounds impressive!

The COO hire seems like a coup. Bruce Popko has a long and distinguished history of running the operations of several high profile NFL teams. He’s also a partner at Forma Capital, which has made a pickleball investment.

The CEO, Julio DePietro, is a bit of a head scratcher, though. He worked in finance for awhile then moved into the independent film industry. As far as I can tell, he was pretty terrible at it.

Most of the films he directed and produced got mediocre reviews, and he’s not done anything professionally since 2016 (EP credits don’t count). I could only find box office stats for one of his films — The Good Guy.

The $10 million budgeted film made $106,000.

His only qualification seems to be that he’s part owner of one of the league’s franchises.

My thesis on pickleball remains unchanged — it’s the new bowling.

Everyone likes bowling. You can do it with friends; you don’t need to be athletic; you can do it drunk.

It’s a super popular sport to participate in. The second-most popular in America, actually, after corn hole.

You’ve probably bowled recently.

But have you watched someone else do it? No? No. Because it’s boring.

Hooray for metals

Some good news on the renewables front.

First, Goldman thinks the west can develop a rare earths supply chain independent of China and Russia for $25 billion. Sounds like a lot, but consider the size of the problem.

From FP:

“If the global scramble for rare earths—the elements behind F-35 fighter jets and missile guidance systems—were a relay race, China grabbed the baton in the 1980s and bolted. The United States, once an industry leader, was left in the dust, along with the rest of the world.”

From National Defense Magazine:

“From the smartphone in your pocket to magnets powering a growing number of electric vehicles on the road, rare earth elements are the foundational components for some of the most commonly used technologies today.”

It’s a big big problem, and the US needs to solve it. $25 billion feels cheap.

Second, Norway has made a significant discovery — a phosphate vein so rich it’ll power solar panel and battery production for a century. The 70 billion tonne vein dwarfs the current leading producer’s — China’s — annual output of around 85 million tonnes.

There’s work to be done, but an independent western supply of rare earth metals and phosphate is achievable.

Believe the Fed

“When people show you who they are, believe them the first time.” It’s a lesson no one seems to learn. Politics, celebrities, business, and Fed minutes. We’ve all got our biases, and often where you stand depends on where you sit.

It’s something I’ve seen over and over again over the last year of rate hikes. It goes something like this:

- Fed says it’s going to hike rates

- Markets don’t believe the Fed

- Fed hikes rates

- Market is surprised

It’s happening again.

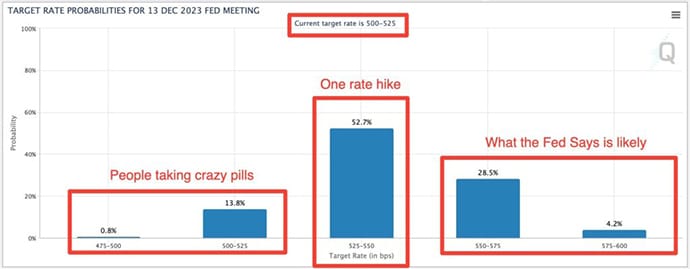

The Fed has just told us it’s going to hike rates twice more this year. 16 of the 18 participants say there will be at least one, and 12 say there will be at two (or more).

But what does the market think is going to happen? Not that!

Only 33% of people believe the Fed has the stones to hike rates twice even though 2/3 of the participants say they’re going to hike rates two (or more!) times before the end of the year.

The majority — 52.7% — think the Fed will go once then take their ball home.

And a solid 14.6% think the Fed is going on holiday until January.

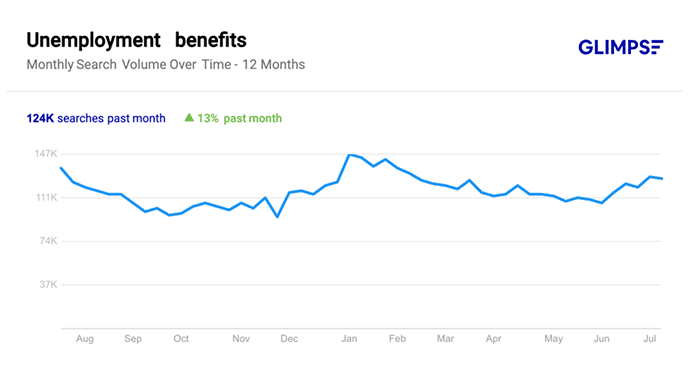

People. Rates won’t go 📉📉📉 until this chart goes 📈📈📈.

Get a grip on reality.

This platform lets you flip hotel rooms

Hoken is a marketplace where you bid on, flip, and trade hotel room bookings.

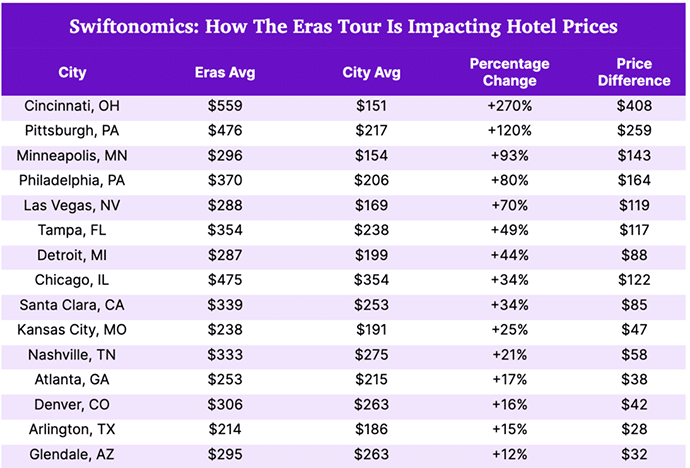

The platform mainly revolves around events, because that’s when demand for hotels skyrockets.

Think about Taylor Swift comes to town. We know getting tickets is nearly impossible, but finding a decent hotel room isn’t much easier. So Hoken partners with hotel chains to offer hotel rooms to travellers.

As an investor, you can bid on these hotel rooms, and resell them to others. (Whoa…!)

How Hoken works:

- Hoken uploads hotel rooms to its platform. Pick your city and dates.

- You bid on rooms (or you can “buy it now”)

- Buyers visit Hoken and rent the room from other sellers on the marketplace – whether they’re Hoken investors or hotel partners forward-selling their inventory.

- If a room can’t be used or sold, Hoken buys it back from you at its original price (within 96 hours)

This is an innovative and unique company. It’s like the StockX of hotel rooms. We’ll be doing a Deep Dive on them tomorrow.

In the meantime, sign up for Hoken here.

Saudi Arabia and India roll on

More prognostication!

In May, I said Saudi Arabia and India are the countries to watch for the next fifteen years.

Time for an update.

Saudi Arabia

The House of Saud isn’t stupid. It knows it’s got 10 – 20 years to wean itself off oil before demand collapses.

From the IMF last month:

Saudi Arabia was the fastest growing G20 economy in 2022.

Overall growth reached 8.7 percent, reflecting both strong oil production and a 4.8 percent non-oil GDP growth driven by robust private consumption and non-oil private investment, including giga projects.

More than half the Kingdom’s growth last year was from non-oil sources. In fact, GDP growth from non-oil sources has been around 5% per year for the last two years.

If it wants to continue this growth — and become a global powerhouse — it needs to become a legitimate player in industries outside oil. That requires international legitimacy.

And sportswashing is Saudi Arabia’s preferred path forward. How’s that going for them?

Pretty well! Just in the last couple months, Saudi Arabia has:

- Launched a state-owned multi-billion dollar sports investment fund.

- Lured a wide variety of household name football (soccer) players to their domestic professional league including:

- Roberto Firminho

- Steven Gerrard

- Karim Benzema

- N’Golo Kante

- Ruben Neves

- Kalidou Koulibaly

- Edouard Mendy

- Marcelo Brozovic

- Jota

- Acquired the PGA

Photos like these go a long way.

India

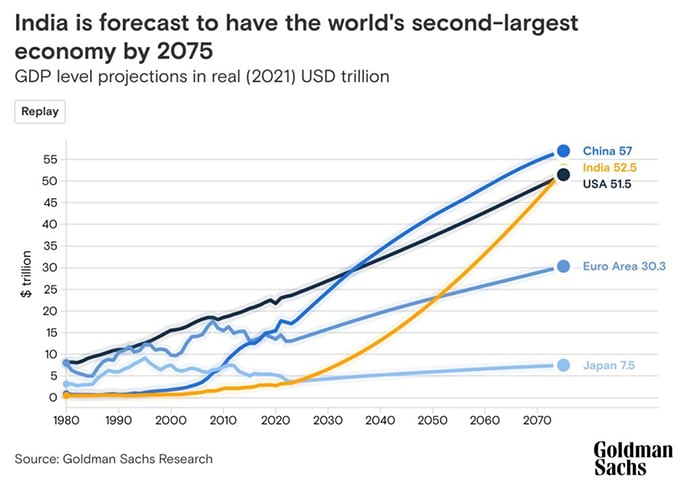

Goldman Sachs has forecast India will be the world’s second largest economy by 2075. Sounds far off, but it’s within many of your lifetimes.

Perhaps it’s time to go east, young man.

Game on

The junk bond market is an excellent proxy for investor risk appetite. When investors put money there, it means they think things are getting better. When they pull money out in a flight to safety, it means they’re looking for more conservative (safer) options.

Junk bonds are back, baby!

One swallow doesn’t make a summer, but it looks like investors are bored of safe stuff that yields less than the CPI.

Could mean alternatives are coming back as well.

Bonus!

What I’m reading

With the women’s World Cup kicking off in eight days, I’m checking in with The Gist to get my fix. The US are slight favourites, but England are a close second.

What I’m listening to

Invest like the best with Jeremy Giffon – everything you’ve ever wanted to know about investing in private markets.

What I’m writing

I’m on holiday a couple weeks in August, so you’ll get some long-form stuff about (a) a long view of the US real estate market and (b) a comprehensive update of where the Alts market is.

What else should I be watching, reading, thinking about, or listening to?

That’s all for this week; I hope you enjoyed it.

Cheers,

Wyatt

Disclosures

- This issue was sponsored by Webstreet and Hoken. If you subscribe to the Gist via our link above, we get a couple bucks.

- Our ALTS 1 Fund has invested in one of WebStreet’s funds.

- Who wants to give me a job in Saudi Arabia?