This week, we’re back to normally scheduled programming.

Today, we’ve got:

Table of Contents

Caitlin Clark is Box Office

More than 13 million people watched last night’s matchup between UConn and LSU, a record for a women’s game.

As I’m writing this, more than 1.6m people have watched the highlights on YouTube.

Women’s sports, in general, have been getting more popular, but this is all down to generational talent Caitlin Clark.

A couple of comments from the highlights above:

“I have never in my life watched a women’s basketball game until Caitlin Clark came along. First time ever I said “what time is the game” when it came to women’s basketball. She has not only changed the game but brought so many new fans to the game.”

“I’m 33 years old and this is my first time actually watching any women’s basketball clip/video in it’s entirety. Caitlin Clark did that.”

According to analysts, a championship matchup between Iowa and unbeaten South Carolina could draw more than 16 million viewers. That would top last year’s men’s championship, which was watched by 14.7m people.

Big-time personalities are important to any sport that wants to evolve into must-see TV. Tiger Woods is perhaps the best example of the phenomenon.

Clark is declaring for the WNBA draft after this season and will be taken first by the Indiana Fever. The Fever had the second-lowest ratings in 2023, but that’s likely to change when the 2024 season kicks off in May.

How can you invest in this?

- Sports Memorabilia and Collectibles: Investing in autographed items, game-worn jerseys, and other sports memorabilia connected to Caitlin Clark could pay off.

- Trading Cards: Look into basketball trading cards featuring Caitlin Clark. Limited-edition cards, rookie cards, or those with autographs can become significantly more valuable over time.

- Endorsement Companies: Clark has already signed deals with Nike, Panini, Gatorade, State Farm, Buick, Hy-Vee, H&R Block, and Topps. She’ll boost sales there for sure.

- Sports Betting and Fantasy Leagues: ESPN Bet and others have markets for the WNBA.

Are you going to watch the Final Four matchup between Iowa and UConn?

College Admissions Consulting is Big Business

For $120,000 a year, Christopher Rim will get your kid into an Ivy League school. Or whatever school they want.

94% of his clients get into at least one of their top three choices.

His firm, Command Education, has 190 clients each paying an average of $500k per child (the process starts before 9th grade) to guarantee this sort of admissions success.

For kids (or parents) who blew it and didn’t get into their early admissions choice, families can pay “$250,000 for two weeks — just enough time to get their regular-decision applications in fighting shape by what, for some schools, is an early-January deadline.”

The peer mentors who guide the kids (and parents) make $50k to $70k plus up to $200k bonuses, which means Command is raking in something like $10m a year on $25 million+ in revenue. Absolutely printing money, and it’s only in NYC.

A quick google search of “college admission consulting + [City]” leads me to believe there’s a huge opportunity to replicate this service across America. You may not be able to charge $120k a year outside NYC, but it’s still a money factory.

The Horrific Economics of Modern Slavery

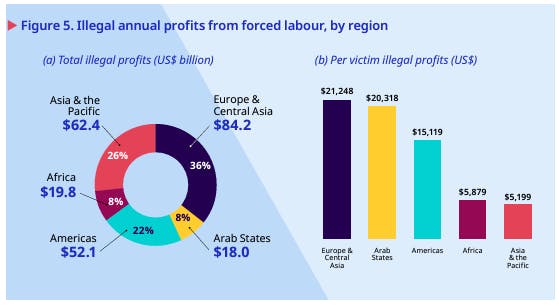

The International Labor Organization (ILO) recently published a report revealing startling figures: forced labor is projected to generate $236 billion in illegal profits in 2024 alone. These profits, averaging $9,995 per victim, represent wages unjustly withheld from workers through coercive practices. This estimate, however, is considered conservative by the ILO, as it doesn’t account for additional revenues from recruitment fees or tax evasion.

Forced labor, as outlined in the report, involves work performed under coercion or threat, negating any choice or consent on the part of the worker.

A significant portion of these profits, amounting to $172.6 billion globally in 2024, is attributed to sexual exploitation, highlighting the severity of this issue across all regions. Europe and Central Asia, Asia and the Pacific, the Americas, Africa, and the Arab States all face substantial impacts.

Despite constituting nearly three-quarters of the total illegal profits from forced labor, victims of sexual exploitation make up only 27% of all individuals in privately imposed forced labor conditions. The remaining profits stem from various sectors, including industrial work, services, agriculture, and domestic work.

Since 2014, illegal profits from forced labor have risen by $64 billion worldwide, driven by an increase in both the number of individuals subjected to forced labor and the profit per victim. This growth underscores the escalating challenge of combating forced labor globally.

Your Biggest Investment is Probably at Risk from Climate Change

A new study from Realtor.com found “roughly $22 trillion in residential properties are at risk of “severe or extreme damage” from flooding, high winds, wildfires, heat or poor air quality.”

The study, which bears a shocking resemblance to analysis I did on this very topic last year, paints an ugly picture for homeowners and real estate investors in a number of American markets.