Welcome to The WC — your weekly shot of awesome.

Something special for you guys over the festive period to give you something to read while you’re hiding from the in-laws and kids.

This week:

- The best investments of 2023

- The worst investments of 2023

- The best ideas for 2024 (ish)

Make sure to grab your all-access pass to see the stuff our sponsors won’t let me say.

Today, we’ve got:

- Wen crypto moon? Now moon.

- AI, of course.

- BNPL seizes the day.

- Power Laws in Private Equity

- What do all these commodities have in common?

- Honorable mentions

Table of Contents

Crypto

CZ and SBF will disagree, but it’s been a fantastic twelve months for crypto investors.

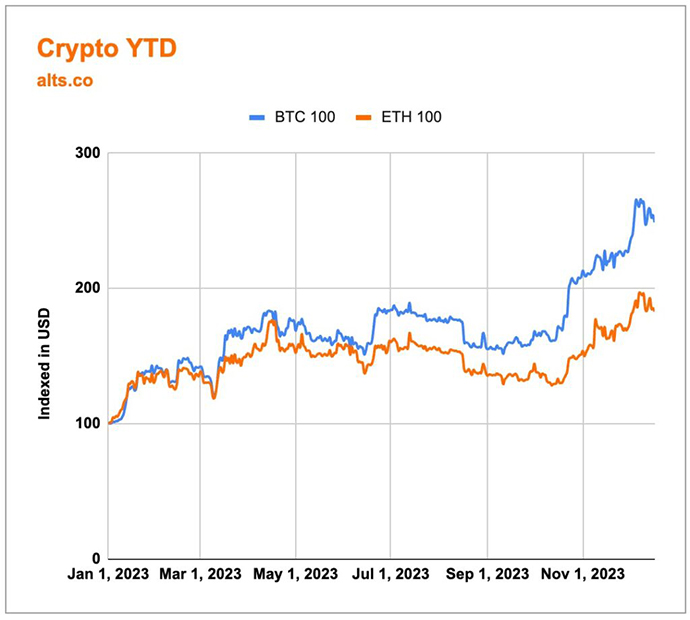

BTC is up 158% on the year, while ETH lags behind at a more pedestrian 85% ROI.

They’re both well off their 2021 highs, but there are a lot of forecasts coming out for 2024 that show BTC hitting $75k, $100k, and more as rates come down and the risk trade is back on.

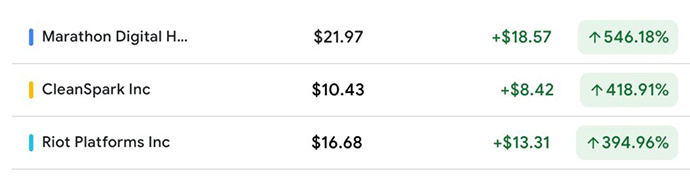

It’s not just the currencies that have done well. Marathon, a Bitcoin mining company, acquired two smaller competitors for nearly $180 million yesterday.

You think BTC has been doing well? Check out the picks and shovels.

Speaking of outperformers…let’s check in on the altcoins. No, not the stupid dog one.

YTD returns for:

- Solana: 527%

- Cardano: 129%

- Avalanche: 257%

Ok, the dog one too. DOGE is up 22% YTD.

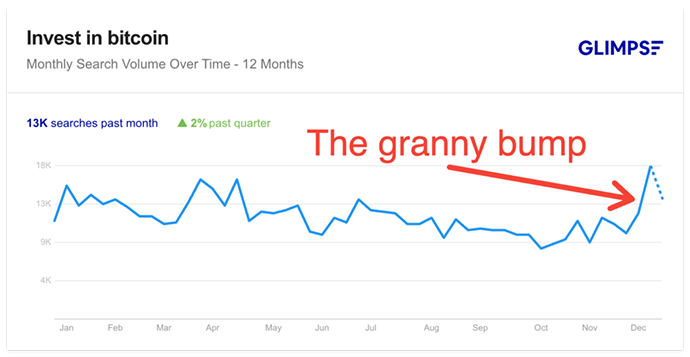

And Thanksgiving did its job. The degenerates told Granny all about how BTC is mooning.

As for CZ, SBF, and all their buddies?

AI

We can’t talk about 2023’s big winners without digging into AI a bit.

Nvidia is up 246% on the year with a market cap of $1.23 trillion. 25% of startup funding went to AI companies, and 20% of new unicorns are in AI.

Lesser known companies like Symbotic, which deals in warehouse automation, are up 3x to 4x with deca-billion dollar market caps.

Even the pretend-sounding Sanlam Global AI Fund is up 36% on the year.

It’s been a wild year for AI.

We all knew AI was going to be big in 2023. Even I predicted it.

But AI will be a lot like the mobile phone or the internet in the long run. Not really a thing you invest in directly very often but more of an enabling technology we all use.

Picking the companies that make the best use of the tech and do it first is where the real money will be made.

For now, enjoy an eight-bit pixilated image of me in a Christmas jumper.

BNPL

After a horrific 2022, Affirm has had a ridiculous 2023. The Buy Now Pay Later (BNPL) leader is up 454% YTD.

- Through December, consumers spent $65 billion via BNPL.

- BNPL purchases on Black Friday increased 42.5% YoY to nearly $1 billion.

- Yesterday, Affirm and Walmart announced a partnership that will let customers use Affirm at self-checkout stations.

The BNPL segment only accounts for a little over 2% of customer spend, but it’s helping prop up the American retail sector, which many feared would have a nasty holiday season.

It’s an attractive model for consumers, who don’t usually pay any interest on deferred purchases, and the debt is kept off credit reports.

In fact, nearly 25% of Gen Z won’t consider a purchase if BNPL isn’t offered.