Welcome to The WC — your weekly shot of awesome.

Today, we’ve got:

- What’s going on with Venezuela and Guyana?

- Sunken Treasure

- Why are pharmaceuticals so expensive in America?

- What’s the Bohemian Grove?

- Carbon farming

- Bonus links

Table of Contents

What’s going on with Venezuela and Guyana?

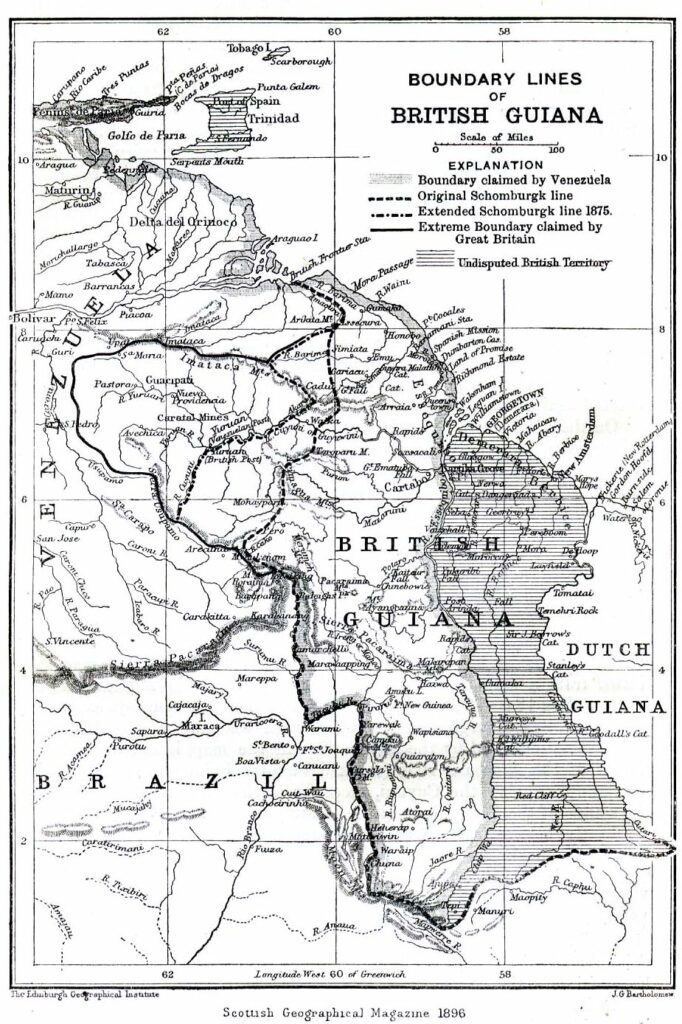

128 years ago, the US and UK faced off in a border dispute over a lot of useless jungle in Venezuela and Guyana and an important river mouth.

Because the region between British Guyana and Venezuela was literally 31,000 square miles of uninhabited jungle, the border itself was fuzzy at best.

At the time, Guyana was a British colony, and the crown was trying to extend its borders west into independent Venezuela to take advantage of newly discovered gold and gain control of the mouth of the Orinoco River.

Venezuela thought it had rights to 2/3 of British Guyana beyond existing borders because…vibes.

The US, flush with Monroe Doctrine zeal, stood for Venezuela and commissioned a tribunal mediated by an independent advisor from Russia (who may have been bribed).

In the end, no one really got what they wanted, and both Britain and Venezuela left feeling like they’d been robbed of territory.

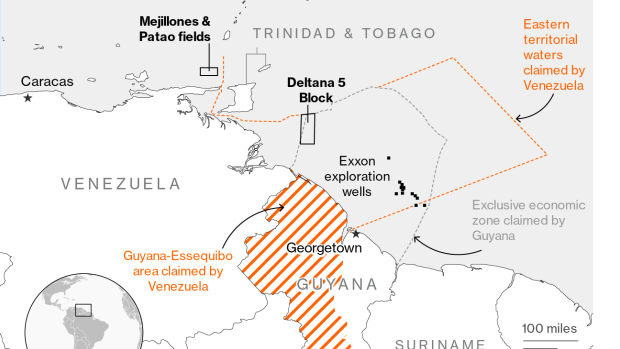

Flash forward to today, and it turns out there are eleven billion barrels of oil worth around $1 trillion off the shore of Guyana, and Venezuela wants it.

So Venezuela’s President Maduro held a vote asking his people if the country should forcibly take back the 2/3 of Guyana it lost out on 125 years ago. 95% of the country said yes.

Maduro has ordered the state-owned gas and oil companies to “immediately” begin to explore and exploit the oil, gas, and mines in Guyana’s Essequibo region.

How will they do it? Who knows. How will an army mostly known for bungled cocaine smuggling enforce it? Who cares?

Things aren’t great in Venezuela, and Maduro is looking for a win. I don’t know how this translates into that for the dictator, but it’s got the potential to blow up quickly.

Sunken Treasure

On a cloudy June day in 1708, a British squadron of four ships encountered a Spanish treasure fleet comprising three galleons, one hulk, and 14 merchant ships off the coast of what’s now Colombia.

The Spanish ships were ferrying gold from the American colonies back to Spain, where it was to be used to fund the War of the Spanish Succession.

This, roughly, is how things went for the Spanish fleet.

Among the ships sunk that day was the flagship San Jose, which lost 589 of its 600 crewmembers when its powder magazines exploded. Also aboard the ship? Some 200 tons of gold, silver, and emeralds.

Which is why the San Jose is now known by another name – the “Holy Grail of Shipwrecks.”

The bounty aboard the San Jose is worth somewhere between $15 billion and $20 billion in 2023 money, and there’s a four-way fight for the booty.

Both Spain and Colombia have made claims, naturally. But a US salvage consortium called Sea Search also claims the wreck – they say they found the treasure in 1981 and have first dibs.

Finally, Bolivia’s indigenous Qhara Qhara nation has a right to the cash because the Spanish extracted the wealth from its people.

Between this shipwreck and the oil off Guyana’s coast, there’s a lot of money to be snatched up off the coast of South America.

Why are pharmaceuticals so expensive in America?

We’re introducing a premium subscription option for our most rabid interested readers, and I’d like to explain why by talking about the price of prescription medicine in the US.

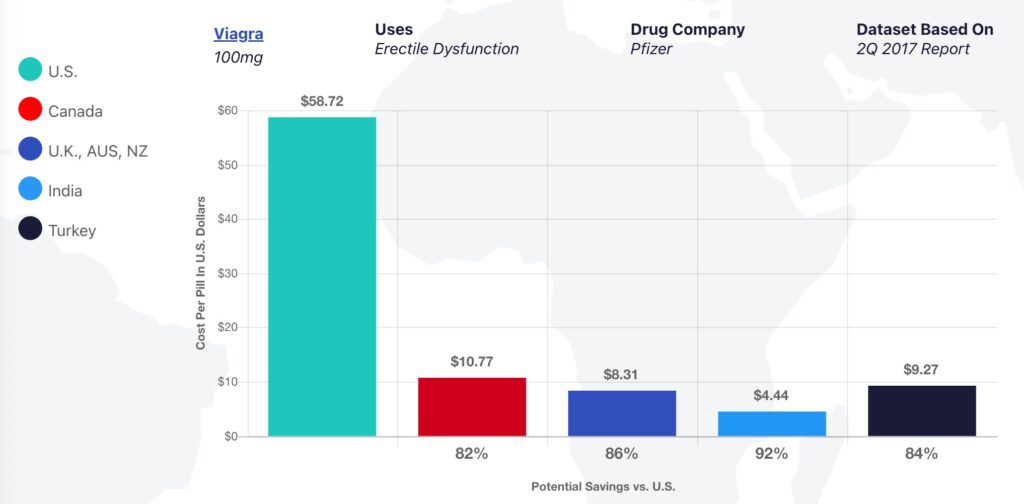

On average, Americans pay 127% more for prescription drugs than the rest of the world.

In specific, Americans pay:

- 252% more than Britons and Australians.

- 21x more than Indians and Turks.

It gets worse. This is what you pay for Viagra in the US relative to other countries.

There are a lot of reasons for this:

- Medicare isn’t allowed to negotiate prices.

- Prices aren’t regulated in the US.

- Private insurers all work out their own opaque deals.

But this is the reason that matters to you (and why I hope you’ll pay for our premium membership):

The US is one of only two countries in the world where pharmaceutical companies are allowed to advertise directly to consumers. All those Viagra adverts you see on TV don’t exist in other countries.

These ads drive demand, which is a factor in high prices, but they also ensure the media doesn’t report on the problem or hold politicians accountable.

Over 90% of media in the US is controlled by six publicly traded corporations, and pharma companies collectively spend over $8 billion per year on direct-to-consumer marketing with them.

Pharma companies aren’t super motivated to slaughter their cash cow.

And because of that, Americans get a raw deal.

So long as we rely on sponsors to pay the bills, you (the reader) are the product, and I can’t say something like “gold is stupid” when we have a precious metals platform sponsoring an issue.

Our insights, analysis and undeniable charm should be the product, and if you find it valuable, I hope you’ll pay for it.

Non-paying members will still get most of our writing, but paying members will get the best stuff, including:

- All Sunday editions

- Full issues of the WC (look below for a paywall!)

- Deep dives like this one

- Probably be more stuff in the future, like chat groups, etc