Read time: 6 min

September 9, 2022

New here? Read up on our past Real Estate issues to get the most from this post.

TODAY’S HIGHLIGHTS:

- Is the American real estate market in trouble?

- Who will be the winners and losers if the market takes a tumble?

- A few compelling investment opportunities

Let’s go!

Table of Contents

Real Estate in 2022

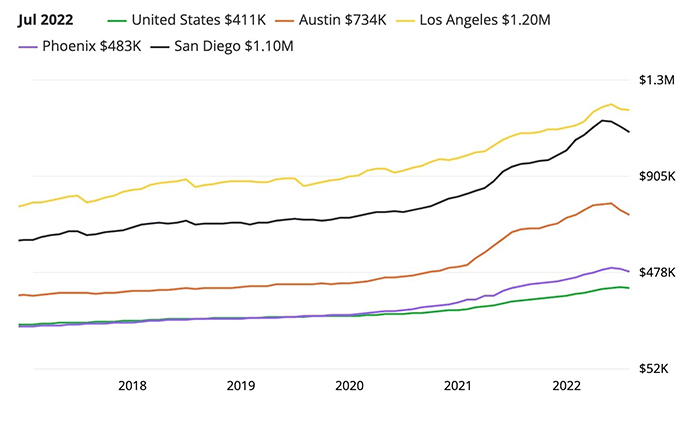

Residential real estate is still up big year over year, but it’s starting to turn around.

Similar patterns can be seen in metros like Reno, Boulder, and Las Vegas.

Inflation is the main culprit here. As interest rates rise, new buyers are now stuck with paying the highest average mortgage payment on record ($1,162 per month). This is an increase of 31% since 2021, the largest one-year increase in 22 years.

New buyers are being priced out of homes, inventory is rising, and prices are coming down.

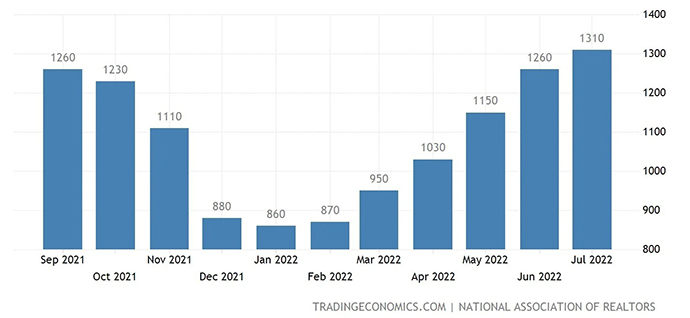

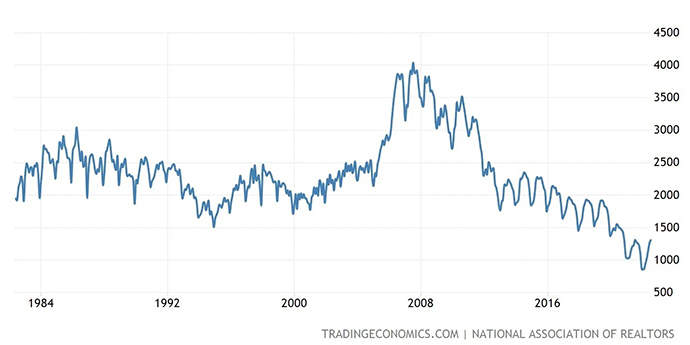

While that’s a sharp rise, it’s worth noting inventory levels are nowhere near 2008 figures, which saw up to 4m homes available.

In fact, inventory always spikes in the summer, so that’s certainly playing a part here. Another 1m homes need to come onto the market to reach historic averages of around 2m to 2.5m.

To get back to some semblance of normal market rates, we need to see a few things happen:

- Mortgage payments come down by perhaps 20% while interest rates continue to rise, which would require…

- Average sale price to come down by another 30% or so, while…

- Inventory increases by around 1m homes.

So if you’re making a bet based on that, I’d expect to see another 15% to 25% drop in average home prices before finding some stability.

All this is leading to a booming rental market in the US. Vacancy rates are the lowest they’ve been for 30 years despite rents increasing more than 10% year over year (👋 inflation).

But I think rent has another 10% to 20% to rise in the US.

The housing price-rent ratio, which compares home prices to rental rates is the highest it’s ever been and needs to come back down 30% to 40%. Some of that will come from home prices falling, but rent will have to increase as well.

Which creates sort of a weird dynamic for landlords. Cash on cash will increase due to rents going up (assuming fixed rate mortgage) while appreciation will slow or turn negative.

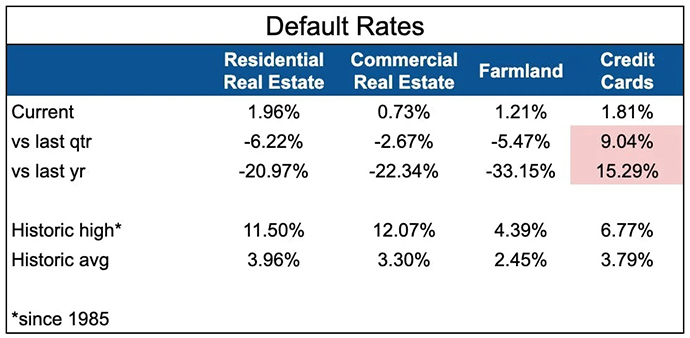

A few stats to keep an eye on, which I’ve helpfully consolidated and made (slightly) pretty for you.

Both residential and commercial real estate mortgage defaults are well below historic averages still and are actually declining against both last quarter and last year.

But keep an eye on those credit card defaults. They’re also near historic lows but are up significantly since last year, and the trend is accelerating.

People default on (in this order):

- Credit cards

- Car

- Home

So consumer lending defaults could be a leading indicator of mortgage defaults.

The winners & losers

There are going to be a lot of opportunities that come out of this. Below are just my guesses on who I think will be the winners and losers here (re-upped from July):

Winners:

- Rental units

- Self-storage

- Mobile home parks

Losers:

- Single-family homes

- Commercial real estate (except rentals)

- Student lets

- America

Opportunities this week

If you’re not scared off real estate, you may want to look at vacation rentals and farmland.

Vacation rentals

Vacation rentals are single-family homes that rely on cash more than their peers, which could make them a good bet. Here are a few opportunities you may want to consider.

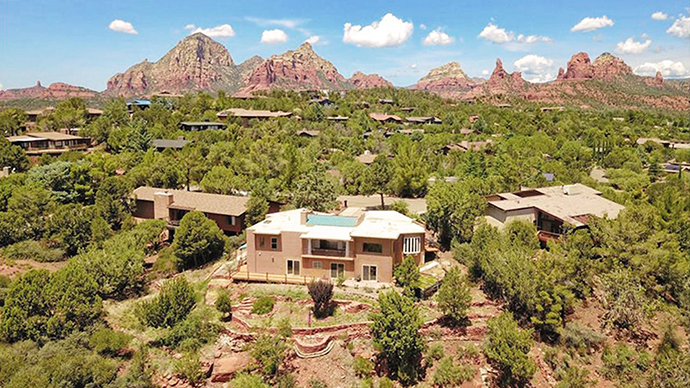

Sabino by Here.co

- Total offering: $883k

- Annual cash flow: $137k (based on averages provided by Here)

- Cash on cash net of fees: 11.5%

Terracotta by Here.co

- Total offering: $1.445m

- Annual cash flow: $371k (based on averages provided by Here

- Cash on cash (net of fees): 24.0%

Farmland

Unlike vacation rentals, I’m including historic average appreciation rates for farmland below. The market has been overheated the last couple of years, but I think it’s more likely to continue to appreciate at sensible (around 5%) rates over the near term.

Bucklake farm by Acretrader.com

- Total offering: $3.9m

- Annual cash flow: $90k (based on gross yield figures provided by Acretrader)

- Cash on cash (net of fees): 2.3%

- Total annual return (including potential appreciation): 8.2%

That’s all for this week.

Cheers,

Wyatt