Welcome to Sports Memorabilia Insider for Jan 27th, 2022 – FREE issue.

Each week we give you the scoop on undervalued, mispriced and hidden gems in Alternative Investing.

Table of Contents

Sports Memorabilia in 2022

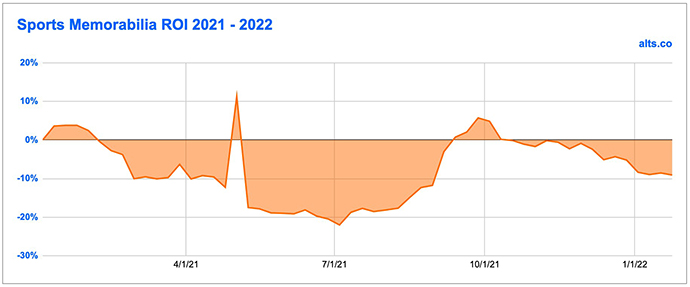

The sports memorabilia index remained flat for the second week in a row. This could be a potential consolidation of support and will be interesting to see if it breaks out higher or continues the recent downward slump.

The index is down 4% for 2022 YTD.

Last Week

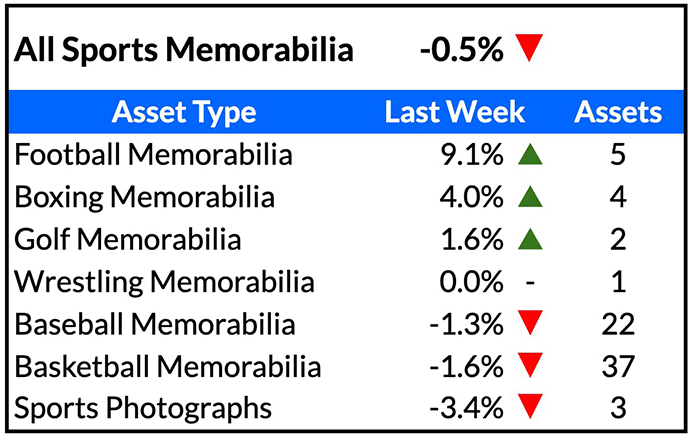

Fractional secondary markets

Baseball and basketball memorabilia, the two largest components of the index, were down for the week, but strong results from football and boxing memorabilia helped offset these losses.

The Chris Bosh Collectable sneaker gave up some of their prior week gains as they fell 37%.

The Rally ‘71 Willie Mays jersey has had a rough introduction to live trading as it fell another 29%.

With the NFL playoffs perhaps pushing football assets to the front of traders minds, the Manning helmet (up 24%), Emmitt Smith jersey (up 9.7%) and Johnny Unitas jersey (up 8.3%) all had strong gains on the week.

Buyouts

Shareholders of the 2014 Kobe Bryant Game-Worn Jersey on Rally accepted a $95,000 buyout offer ($90,382 net), returning 32.4% from last trade and 15.9% from IPO.

Auctions

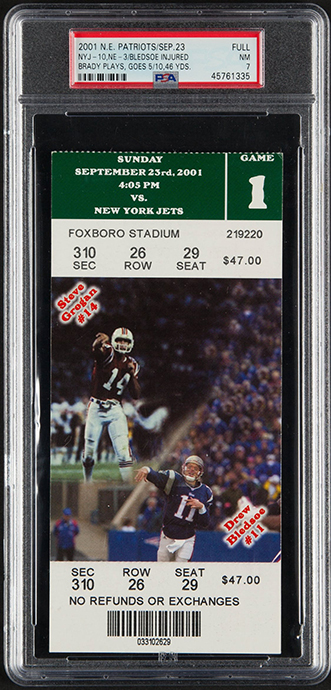

The weekly Heritage sports collectable auction wrapped up with ticket offerings for both the blue-chip and value collector.

A Tom Brady Foxboro debut PSA 7 ticket sold for $10,500, an increase over its last sale for $2,400 in August 2020. On the budget end of the spectrum, less than $500 got the winner a couple of 1936 World Series tickets from Game 4 and Game 6.

In my personal opinion, the tickets space is 🔥 right now, but it feels like a pump and dump to me. We’re still on the upswing, so there are opportunities if you’re brave.

The thing to do is to keep an eye on the major auction houses’ Twitter feeds. As soon as they stop extolling the virtues of tickets, that’s when you know the party’s over.

This Week and Next

Fractional Market IPOs

No new memorabilia IPOs this week on the fractional platforms; Collectable does open the Bobby Orr Bruins jersey to a full IPO.

Our recommendation? [INSIDERS ONLY]

Fractional Secondary Markets

Rally debuts three memorabilia assets for live trading, all of which are trading slightly above inferred values.

Note: Market cap data correct as of 1/25

Joe DiMaggio Rolex DateJust 16030

- Platform: Rally

- Market Cap: $15,500

- Inferred Value: $15,000 (maintaining inferred value; this Rolex model can be bought used for $5,000 – $6,000 and $10,000 premium for the DiMaggio provenance seems reasonable)

- Recommendation: [INSIDERS ONLY]

‘50-’51 Joe Dimaggio Game-Worn Jersey (Final Season)

- Platform: Rally

- Market Cap: $239,625

- Inferred Value: $200,000

- Recommendation: [INSIDERS ONLY]

‘75 Fight Worn Ali Boots

- Platform: Rally

- Market Cap: $46,000

- Inferred Value: $45,000

- Recommendation: [INSIDERS ONLY]

Auctions

The MINT25 auction at Lelands enters its final week. In addition to the assets highlighted in last week’s Insider issue, other offerings of note are:

- 1998 Michael Jordan Chicago Bulls Game Worn “Last Dance Buzzer Beater” Jersey – Current Bid = $197,991; this jersey has been photo-matched to one game in the 1998 season highlighted in the “Last Dance” 2020 documentary. There are several game-worn Jordan jerseys on the fractional platforms that the Lelands offering can be used as a comp for.

- Michael Jordan Game Worn Air Jordan 1 Sneakers from Broken Foot Game – Current Bid = $0.00 (Reserve = $250,000); believed to be the last pair of Air Jordan 1s that Jordan wore in an NBA game in which he suffered a broken foot.

- Tom Brady New England Patriots Signed Game-Worn Jersey (Photo-matched) Current Bid = $241,881; Brady game-worn memorabilia doesn’t surface in auctions frequently; will be interesting to see how the final sales price compares to a 2021 Brady Buccaneers game-worn jersey that sold for $480,000 on January 8.