Welcome to Deep Dives, where we explore interesting companies in the alt investment space.

Today, we’re looking at Onfolio, a Nasdaq-listed company that acquires and manages profitable, cashflowing online businesses.

Think of it like micro private equity. While much of the tech world focuses on moonshot startups that may never reach profitability, these guys are acquiring a portfolio of under-the-radar, revenue-generating businesses, and amplifying their profitability.

Note: This is a paid deep dive, but I’m excited to tell you their story. I have been invested in Onfolio since the very beginning. CEO Dom Wells is a personal friend, and it’s been exciting to watch them grow, go public, and become a world-class company.

Let’s go 👇

Table of Contents

Entrepreneurs vs operators

The business world may be built by entrepreneurs, but it’s run by operators.

Entrepreneurs are passionate, risk-taking visionaries who build ambitious businesses from the ground up. Everyone knows Walt Disney, because he defined American culture. But you may not have heard of of Roy Disney, Walt’s brother, who served as Disney’s first CEO and ensured the business stayed on track.

Operators, on the other hand, aren’t usually in the limelight. They’re inconspicuous; focusing on scaling and optimizing existing businesses to run as efficiently as possible.

This entrepreneur/operator framework should help you understand why acquisitions are so lucrative.

When operators buy businesses from entrepreneurs, they can add tremendous value by focusing on profitability and growth. We see this in verticals like real estate and private equity.

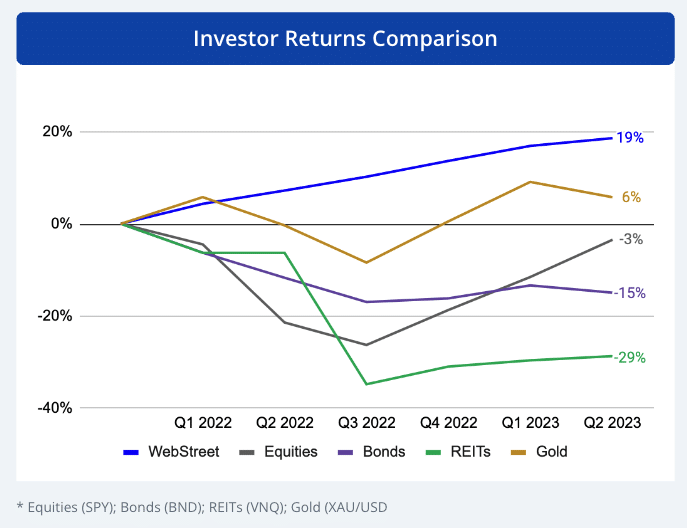

But in today’s day and age, digital acquisitions are looking like a particularly attractive opportunity.

Why digital acquisitions?

“Digital acquisitions” means buying websites and online businesses.

This world has significant advantages over purchasing other types of businesses 👇

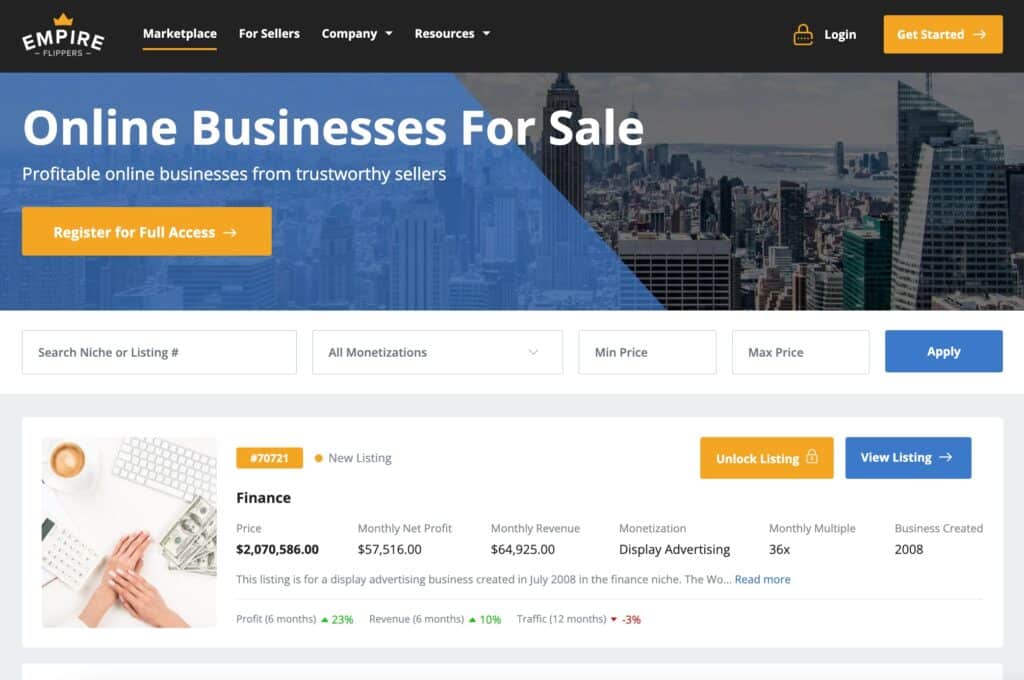

- Under-the-radar market. There are literally thousands of online businesses you could acquire, and new ones are popping up every day. (5,500+ listings between Empire Flippers and Flippa. Hundreds more on Acquire.com and other brokers)

- Highly scalable. Few online businesses have geographic restrictions. This means you can operate them from anywhere, and there’s no physical limit to how far a business can scale.

- Asset-light. Some online businesses are just a website pushing out digital content, monetized through ads & affiliate offers. This world is changing rapidly, but it does mean solid margins and low overhead.

- Recurring revenue. More and more businesses are utilizing a subscription (SaaS) model, which can be far more stable than one-off sales.

Where the digital acquisition market stands today

Before we dig into Onfolio, the subject of our deep dive, let’s get up to speed with where the market is today.

New businesses emerging: Courses and AI content

In the past several years, the composition of new entrepreneurial digital ventures has shifted to emphasize courses and content – which are asset-light, highly scalable models. High-profile companies that exemplify this trend include MasterClass and Substack.

In addition, AI has become a hot topic since the launch of ChatGPT. While some of this is just hype, AI really can offer tremendous advantages to digital companies, especially to those producing content.

In the old days (i.e. last year) you had to find and pay content writers. Now, AI enables anyone to spin up free content at the push of a button.

AI represents both a threat and an opportunity to this world. (More on this below)

Revenue-generating companies > startups

In a low-interest rate environment, the cost of borrowing is reduced and returns on traditional investments are lower. This means acquiring a young digital business that might not earn profits for years can make sense.

But when rates are high (like right now), capital discipline intensifies. Since a dollar today is worth much more than a dollar tomorrow, current revenue is emphasized, and profits matter above all else.

As rates have risen, operators have been much more strict about acquiring companies that are already producing stable profits.

The rise of roll ups

Recently, operators have been assembling distinct digital businesses into a single company, so that each complementary business can leverage the same resources and achieve better economies of scale.

This is also known as a roll up model. If you’ll excuse us for the corporate buzzword, the roll up model is all about capturing synergies! 💼

While holding companies are becoming more popular in the world of digital acquisitions, they’re not new in the business world as a whole – think of legendary companies like Berkshire Hathaway or General Electric.

One company that’s revamping this model for the digital world is Onfolio.

What is Onfolio?

Onfolio is a holding company for the digital age.

The firm acquires a portfolio of online businesses (Online Portfolio = Onfolio. Get it?) whose existing ownership (often the original entrepreneur) isn’t maximizing the full potential of the business.

Onfolio focuses on buying and scaling businesses that are already profitable, rather than taking a risk on unproven business models. These acquisitions are then integrated into the firm’s existing portfolio, which currently stands at 22 companies.

Onfolio leverages its own sales and marketing expertise, along with complementary resources from other acquired companies, to boost the value of its portfolio as a whole.

The firm was founded by CEO Dom Wells, who has his own inspiring entrepreneurial story. About a decade ago, Dom was teaching English in Taiwan for about $1,000 a month when he decided to start a digital marketing operation on the side. The business would eventually grow to become an influential player in the affiliate marketing space, before Dom sold the firm for a mid-six-figure exit. This would serve as the original seed capital for his next venture: Onfolio.

In a recent interview, Dom outlined how his initial business experience led him to formulate the Onfolio concept.

We’d identified that there were a lot of people out there who had money to invest in online businesses, but they didn’t know how to do it… With online business, it’s a pretty active investment, you have to buy the business and then figure out how to run the thing.

When compared to a sector like real estate, digital acquisitions require much more active management on the part of investors. For this reason, digital acquisition activity has been lower than in other areas. (Investors don’t want to do the hard work of actually running a business — they just want the returns)

But Dom realized his company could manage the ‘active’ component of the acquisitions, leaving the ‘passive’ component to the investors.

Onfolio has been cultivating this approach for the last half decade and in August 2022, successfully went public on the Nasdaq.

Onfolio’s strategy

If there’s one thing I learned during my time in this industry, it’s that it (surprisingly) takes just as much time & effort to run a small digital business as it does to run a large one.

Therefore, the goal is to buy the largest businesses that you can afford. Since their IPO, Onfolio has been able to scale operations and do exactly this.

Where does Onfolio source deals from?

- Marketplaces (Flippa, Empire Flippers, etc)

- Brokers

- Brokers who reach out to them with specific deals

- Outbound (they work with 2-3 firms who do outreach)

- Inbound (Being public and vocal on social media, they get a ton of inbound requests from people.)

As it stands, here’s what the target numbers look like for their roll ups:

- 25% target ROI per acquisition. Since Onfolio typically pays no more than a 3-4x EBITDA multiple to buy a business, they can target above-average returns.

- $500K-$2MM EBITDA target businesses. As Onfolio puts it, this range tends to be a soft spot in the market – too much for individual investors, but small enough to be ignored by most institutions. Moreover, businesses this size have demonstrated stability and product market fit, but still have room to grow.

- Sub 15% cost of capital. As interest rates have risen, so has Onfolio’s cost of capital. But the ten-point gap between the cost and return targets still means there’s significant accretive value in acquisitions.

In line with the trends we discussed earlier, the firm is embracing AI for its portfolio companies, rather than viewing it as a threat. Onfolio recently published their AI strategy which outlines their plan.

When I spoke to Dom, he outlined his vision for how AI will impact content sites (and digital businesses):

AI is likely going to be a value-add for most digital businesses, except maybe content sites, which could face headwinds. We pivoted away from buying all-out content sites in 2020 though, so this isn’t an issue for us. Instead, we’re excited about being able to leverage AI to improve our margins, expand reach, uncover new data, and generally uncover new software capabilities.

In one recent purchase, the firm acquired Proofread Anywhere, a course company that teaches people how to build an income online through proofreading, for about $4.5m. Other acquisitions included a company that makes software for content creation and a company providing services within the SEO niche.

Some of Onfolio’s most recent successful acquisitions present some very impressive figures. Their Proofread Anywhere purchase netted a projected cash return on investment of 20%

Other deals were even better:

- Projected cash returns of 28% on WP Folio

- 26% on SEO Butler, and

- 30% on Content Ellect

To help us understand Onfolio’s strategic vision, Dom detailed his thinking on the business clusters the firm plans to focus on moving forward:

We’re generally agnostic in the business models we go after. That said, we’ve found ourselves gravitating towards a few clusters of businesses, including SEO/content agencies and WordPress plugins.

In addition, we have big plans in the “biz op courses“ space, where we plan to acquire more businesses like Proofread Anywhere that give people information on how to build themselves a career or business online. By focusing on multiple clusters rather than going all in on one industry, we’re giving ourselves more diversification, and also exposing ourselves to more opportunities and creating an overall larger business.

In line with the insight that initially helped launch the firm, Onfolio is offering some attractive new investment opportunities that are helping investors get exposure to these digital acquisitions.

Onfolio’s investment opportunities

Since Onfolio is publicly traded on the NASDAQ ($ONFO), you can purchase shares like you would any other stock.

But Onfolio is offering two specialized investment opportunities that might be an even better fit for you. Unlike the common shares, these opportunities both offer more reliability regarding dividends.

Both of these offerings will be used to finance Onfolio’s acquisitions of new online businesses. (And since Onfolio is a public company, these opportunities come with the added trust of knowing the firm regularly publishes audited financial statements filed with the SEC.)

Onfolio Preferred Shares

In addition to their common shares, Onfolio issues preferred shares.

If you’re not familiar with preferred stock, think of it like a hybrid debt and equity instrument. It’s technically a kind of stock, but pays out a fixed dividend.

Details:

- 12% dividend. The preferred shares yield 12% annually and pay out dividends quarterly.

- Reliable returns. Onfolio has never missed or had a late dividend payment in more than 2 and a half years.

- Future liquidity. As it stands, investors can only sell their preferred shares after holding them for 12 months. But Onfolio says that the shares will be listed on an exchange soon, at which point investors can sell them at any time.

- $20,000 minimum investment. US investors have to be accredited, but non US investors do not.

You can find out more information on preferred shares here:

Invest in Onfolio Preferred Shares →

Onfolio SPV

Onfolio’s second offering is a joint venture opportunity via a “special purpose vehicle.” If you’re unfamiliar with the term, that basically just means a separate legal entity set up for a specific purpose – in this case, letting investors participate in Onfolio’s acquisitions.

Unlike the preferred shares, the SPV includes upside potential. That means if acquisitions do better than expected, you’ll participate in the excess returns.

Details:

- ~13% target return for investors. That’s from Onfolio’s 26.2% anticipated ROI, multiplied by the 49% stake in the SPV you’d purchase.

- Quarterly dividend payments. But payments will only start two quarters after Onfolio has made an acquisition.

- Accrued returns. With upside comes downside – and it’s possible Onfolio won’t always have sufficient funds to cover a quarterly payment. If this occurs, payments will accrue towards the next scheduled dividend.

- $20,000 minimum investment. In addition, you must be an accredited investor to participate in the joint venture.

You can find additional information about the SPV here:

Onfolio’s team

Onfolio has been doing this for over a decade, and they’ve built up an impressive team of professionals with deep experience in the digital acquisitions market. Here are the key figures on their leadership team.

Dominic Wells – Founder & CEO. I’ve known Dom for years and have walked you through his entrepreneurial journey. Now, Dom is on the operator side of the business, helping portfolio companies optimize and scale.

Esbe van Heerden – President. Esbe is also an entrepreneur, having previously co-founded an audiobook company. She’s a scientist as well, having studied molecular biology, forensic biology, and biomedical sciences.

Rob te Braake – Interim CFO. Formerly of ING Bank, Rob also co-founded a technology and investment company in Hong Kong.

Yury Byalik – Director of Strategy & Acquisitions. Before Onfolio, Yury worked in several industries on SEO and digital marketing. He is also a lawyer, having earned his JD from the Widener University School of Law.

Closing thoughts

Onfolio’s approach seems sound, and it’s refreshing to see a company that’s focused on sustainably growing businesses that have already achieved profitability.

However, investors should be aware that Onfolio has yet to achieve profitability itself. In 2022, Onfolio registered a net loss of about $4.2 million. In 2021, they lost about $1.9 million.

However, these losses are mainly driven by SG&A costs, which were by far the largest contributor to Onfolio’s operating expenses. These are the day-to-day costs of running a business, like salaries, marketing, and professional fees.

Onfolio says that these are largely fixed costs or one-time expenses, and they can therefore grow to profitability as revenue from previous acquisitions grows and future acquisitions are executed. The company is targeting profitability by the end of 2023.

Yes, it’s ironic that a company focused on buying profitable businesses is not yet profitable itself.

But while this lack of profitability may put some investors off, bear in mind that many innovative companies lost money for years before achieving breakout earnings. It’s on the path to profitability, and it be no surprise that Onfolio has encountered speed bumps on the road to success.

Dom is a legendary operator, and I will get there. That is part of the reason I am personally invested with this company.

Further reading

- A few years ago, Ecommerce rollups were all the rage. But the margins are razor thin, and now buzzy Amazon aggregators like Thrasio are on life support. (Note: Onfolio doesn’t acquire pure Ecommerce businesses)

- Earlier this year, Empire Flippers put out their (always terrific) State of the Industry Report

- Onfolio just announced Q2 earnings

Disclosures

- Onfolio is an Alts sponsor. This was a paid deep dive

- I have personally invested in an Onfolio SPV since 2020

- Our ALTS 1 Fund has not invested in Onfolio

- Jim Cramer has never made a call on Onfolio

- This issue contains an affiliate link to Empire Flippers and TradingView

This issue is a sponsored deep dive, meaning Alts has been paid to write an independent analysis of Onfolio. Onfolio has agreed to offer an unconstrained look at its business & operations. Onfolio is also a sponsor of Alts, but our research is neutral and unbiased. This should not be considered financial, legal, tax, or investment advice, but rather an independent analysis to help readers make their own investment decisions. All opinions expressed here are ours, and ours alone. We hope you find it informative and fair.