Today we’ve got a special issue on one of our favorite alternative investment companies: WebStreet, who just launched their sixth website investment fund.

If there’s one thing I love, it’s under-the radar companies that are spinning off cash. WebStreet buys these companies, optimizes them so they earn more revenue, and buckets them together as an investment.

Think of it like “micro private equity.” In this issue we’ll take a look at how it works, and dive into their latest fund.

Note: This is a sponsored issue, but I think you’ll find it informative and fair.

Let’s go 👇

Table of Contents

What is WebStreet?

Fractional ownership of alternative assets has been popular and lucrative in recent years, as new platforms offer investors a way to own pieces of real estate, art, wine, and more.

One of our favorite such platforms is WebStreet. They apply the fractional ownership model to the digital acquisitions space.

“Great,” you say. “But what are digital acquisitions?”

Digital acquisitions is just a fancy term for buying websites that are already making profits and optimizing them to make even more profits.

WebStreet was born out of this world. Their roots lie in the website acquisition marketplace Empire Flippers, where the team initially started out as an online business broker. (Think of it like a real estate broker, but for websites and online businesses.)

After a while, they realized that there was a huge demand for selling slices of these online businesses.

See, operating an online business is hard work, and investors don’t really want to do it themselves. They’d rather outsource the work and collect the returns.

So Empire Flippers spun out a company called Empire Flippers Capital, which allowed investors to earn money without having to handle the actual website operations.

Last year, Empire Flippers Capital rebranded to WebStreet. And here we are today.

How does WebStreet work?

WebStreet essentially operates a fixed-income digital asset fund.

Here’s how it works:

- They raise funds from investors, and find 4-8 profitable online businesses to acquire

- They hire managers to effectively manage them. Managers make day-to-day spending, hiring, and investment decisions to increase revenue.

- After optimizing the businesses, WebStreet resells them and distributes the profits to investors

Through this, WebStreet aims to return 20% per year. It’s sort of like an annuity, but paid quarterly (and without the guarantee).

The best businesses are often the more expensive ones. The funds WebStreet raises allows them to buy higher quality sites, while smoothing out downside risk.

What businesses does WebStreet buy?

Well, they aren’t exactly household names.

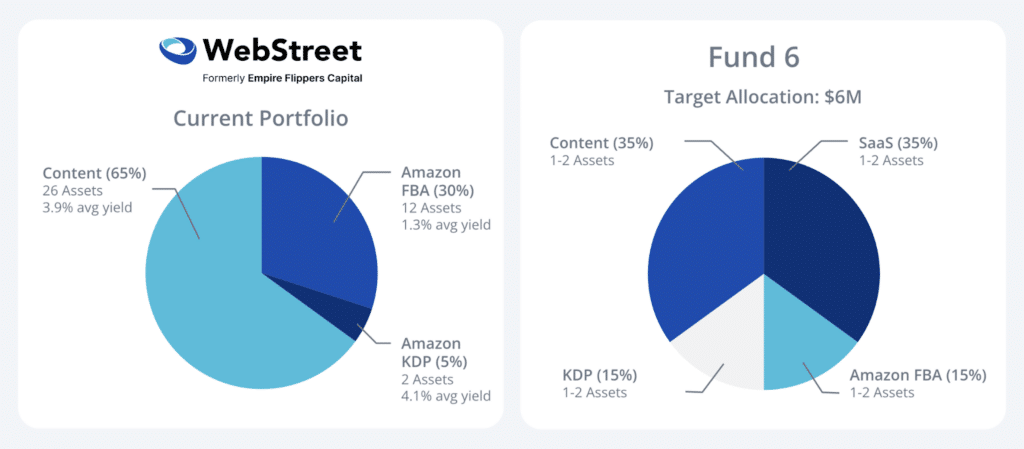

WebStreet allows investors to purchase passive pieces of online businesses that already generate cash flow, including SaaS, content, and Amazon FBA/KDP operations.

These aren’t hot startups like Tesla, OpenAI, or Klaviyo. They don’t get talked about in TechCrunch, and most of them are pretty under-the-radar.

But in my opinion, this is better than investing in startups.

Unlike the syndicates on, say, AngelList, WebStreet can spin off cash flow to its investors, as opposed to letting them participate in the profits of a future sale that, in many cases, is unlikely to ever happen.

WebStreet Fund Performance

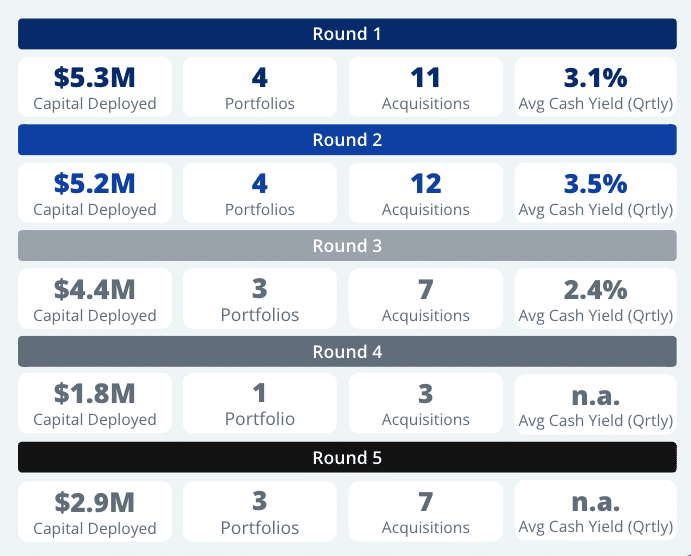

Over the course of WebStreet’s previous five funds, they’ve raised more than $27 million and acquired 40 businesses, resulting in a cash yield of 13.1% and a projected IRR of 20%+.

In fact, WebStreet’s earliest funds are now going through their first exits, selling their new and improved businesses to other operators.

Let’s look at their performance so far.

Fund 1

- $5.3 million capital deployed

- 4 portfolio manager (PM) funds

- 11 acquisitions

- 20.1% average life-to-date (LTD) cash yield

Fund 2

- $5.2 million capital deployed

- 4 PM funds

- 12 acquisitions

- 15.4% LTD cash yield

Fund 3

- $4.4 million capital deployed

- 3 PM funds

- 7 acquisitions

- 5.8% LTD cash yield

Fund 4

- $1.8 million capital deployed

- 2 PM funds

- 4 acquisitions

- LTD cash yield: In progress

Fund 5 (<– We invested in this one)

- $5.4 million capital raised

- 4 PM funds

- Acquisitions: In progress

- LTD cash yield: In progress

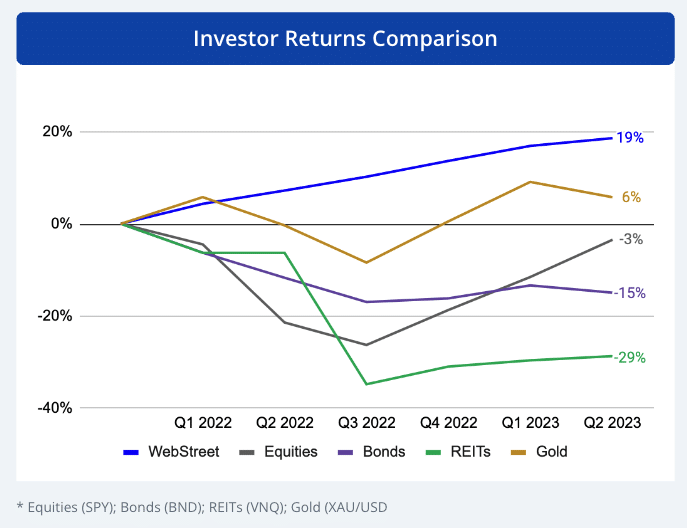

WebStreet operated a similar investment model for each of their five previous funds. And since launch, these funds have outperformed alternatives like Gold, REITs, Bonds, and even Equities.:

But with Round 6, WebStreet is taking things in a slightly new direction.

They’ve designed a fund that will be more effective at allocating investor capital to the most lucrative opportunities.

What’s new in Fund #6?

They’ve learned a ton from previous iterations. Here are the big changes WebStreet is rolling out for Fund 6.

They now invest in SaaS companies

WebStreet is targeting SaaS businesses for the first time ever.

SaaS (Software as a Service) continues to eat the world. The business model has become enormously popular in the past decade – and for good reason. It can be lucrative as heck.

With a recurring revenue model and a low incremental cost of adding new customers, SaaS businesses are highly scalable and ripe for operational improvements.

Single Fund Investment

Okay, this is the biggest change.

In WebStreet’s previous funds, investors could pick and choose the managers and business verticals they wanted access to by selecting specific “mini-funds.”

With Round 6, that’s changing: WebStreet is introducing a single, diversified fund structure.

There are three reasons why:

- Investors who diversify perform better. According to WebStreet, investors who picked individual funds performed worse than those who invested in all of them. From a purely economic perspective, this makes sense – diversification is the only ‘free lunch’ in finance.

- Acquisition flexibility. A single fund structure allows more flexibility in terms of allocating investor capital to the best opportunities. While WebStreet has a target allocation, those numbers may shift depending on where the best acquisitions are.

- Less paperwork. Taxes on this stuff can be complex, and this new structure dramatically simplifies everything. Moreover, the investor experience will align closer to the world of private equity (PE), an investing style WebStreet is actively seeking to emulate.

Private equity-like structure

I mentioned above that you could think of this world like “micro-private equity.”

As WebStreet matures, they are looking to become more and more PE-like. Fund 6 reflects that, with a few changes to bring the firm in line with PE industry standards.

WebStreet’s original LLC structure will be revamped into an LP (Limited Partnership) structure, and the firm will collect their AUM fee upfront based on the expected life of the fund.

Both of those changes should be familiar to PE investors, and, in the future, will help WebStreet target larger acquisitions in expanded business verticals to improve performance.

How to Invest in WebStreet Fund 6

It’s no secret the deal market has been choppy. Investors are more hesitant and founders are having trouble finding solid acquisition partners.

But that’s translated to more favorable terms for investors with capital to deploy right now. So the time is right for Fund 6.

If you want to be a part of this fund, WebStreet is raising capital right now.

If you invest in this round, you get lifetime early access to WebStreet’s new deals.

Fund 6 details

- Minimum investment: $60,000 USD

- Investor type: Accredited only

- Return distribution: 66.7% to Investors, 33.3% to Carried Interest (WebStreet, PMs, etc.)

- Return waterfall: Investors recoup initial investment first; increase in value split according to return distribution

- Capital Stack: 95% Investor Capital, 5% Portfolio Manager Capital (Strong “skin in the game” incentive)

- Hold Period: 2-4 Years

- Return expectations: 20% Projected Annual Returns

- Fees: 1.5% annual AUM fee on deployed capital, 1% one-time admin fee (waived for investors before October 13)

Invest in WebStreet Fund 6 here →

Closing thoughts

What I love about the world WebStreet operates in is how it’s still sort of the wild west. 🌵

Remember this is still a relatively unregulated industry, and WebStreet continues to lead the way and break new ground.

With Fund 6, they’ve realized something important:

People aren’t very good at picking winners.

It’s better for investors to spread the risk around and just invest in “the market.” WebStreet helped create this market, after all, and they know it better than most.

Where things go from here is anybody’s guess. But fractional website investing and pooling funds is one area I am especially bullish on. And I think WebStreet is just getting started.

If WebStreet can continue to deliver 20%+ returns, they could start attracting serious capital, allowing them to buy businesses worth $10m and up.

If that happens, they’ll be out of “micro” private equity, and become a fully-fledged PE firm.

Further reading

- Fund 6 Page

- Investor presentation

- SaaS investment thesis

- About the new structure

- Two-year performance review

- Even more background and history on WebStreet

Disclosures

- This issue was sponsored by WebStreet

- Our ALTS 1 Fund has invested $20,000 into WebStreet Fund 5

- This issue contains an affiliate link to Empire Flippers

This issue is a sponsored deep dive, meaning Alts has been paid to write an independent analysis of WebStreet. WebStreet has agreed to offer an unconstrained look at its business & operations. WebStreet is also a sponsor of Alts, but our research is neutral and unbiased. This should not be considered financial, legal, tax, or investment advice, but rather an independent analysis to help readers make their own investment decisions. All opinions expressed here are ours, and ours alone. We hope you find it informative and fair.