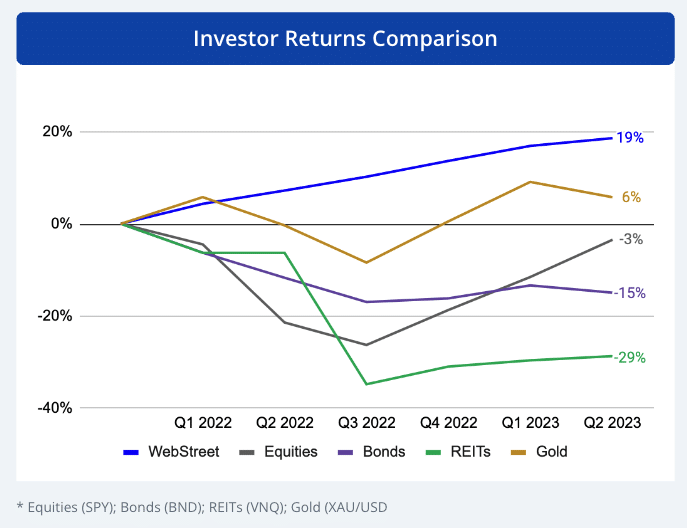

Today, we’re looking at Onfolio, a Nasdaq-listed company ($ONFO) that acquires and runs profitable online businesses.

It’s a “roll up”-type company that acquires a portfolio of under-the-radar businesses, and boosts their profitability.

I’ve been personally invested with Onfolio since the very beginning — years before they went public.

But what I didn’t realize when I first invested in Onfolio was:

- How at-risk the industry/business model was to the looming threat from A.I., and

- How the founder, Dom, realized this risk early on, and diversified away from what would otherwise be a problematic portfolio

Let’s explore how 👇

Note: This issue is sponsored by Onfolio, a publicly-traded company. I am an investor in Onfolio, and I’m proud to call Dom a business partner and friend. As always, I think you’ll find this issue informative and fair.

Table of Contents

What assets does Onfolio acquire?

The internet is chock-full of small-scale digital businesses. Think micro-SaaS products, dropshippers, and advertising/affiliate-fueled info sites, also known as content sites.

You won’t find these companies on the cover of the Wall Street Journal or Bloomberg, because most of the tech world focuses on moonshot startups that never reach profitability.

But despite not being well-known, many of these small-scale ventures are actually quite profitable.

Think of it like micro private equity. With some careful due diligence, these sites can have huge growth potential, making them a ripe target for acquisition.

This is exactly what Onfolio does. And while we reviewed Onfolio last year, Dom and his team have been incredibly active since then:

- They’ve gotten away from acquiring content sites, which are getting eaten alive by ChatGPT (and for some fascinating reasons, the rest of the industry has only started to wake up to!)

- They’re leaning heavily into agency acquisitions

- In December, they closed a deal with RevenueZen, a leading B2B marketing agency

- And, most importantly, they’re launching a new SPV to allow investors to participate in some of these attractive acquisition opportunities

We’ll get into the SPV details and Onfolio’s agency strategy shortly.

But first, let’s take a step back to understand the company as a whole —including how their roll up model can create tremendous value.

How does Onfolio work?

If you’re buying a company, there are some obvious ways to increase its value:

- Improve margins by focusing on operational efficiency

- Increase revenue through better marketing and sales

- You can also optimize the capital structure of the firm by adjusting debt levels

All these tactics are great, but value-accretion strategies get even more exciting when you consider how to weave multiple acquisitions together.

After all, if you’re in the business of buying businesses, you’re probably not just buying one. And if you can bring multiple firms under a single roof, each complementary business can leverage the same resources to achieve better economies of scale.

This is also known as a roll up model. If you’ll excuse us for the corporate buzzword, the roll up model is all about “capturing synergies!” 💼 (ugh sorry)

Under the right holding company (a firm like Onfolio that actually does the acquiring), these synergies mean that businesses become worth more than the sum of their parts.)

The idea that two $1 million businesses can become worth $3 million when put together might seem like magic, but it’s exactly this dynamic that’s made holding companies like Berkshire Hathaway and General Electric so valuable.

Roll ups get a bad rap

Of course, knowing which companies to buy, what price to pay, and how to tie them together is a complicated art.

Heck, just a few weeks ago, Thrasio, the world’s largest & most infamous Amazon aggregator, filed for bankruptcy. (After raising $3 billion in equity and debt!)

That’s exactly why a seasoned investment partner like Onfolio is so important. CEO Dom Wells has been rolling businesses up since before Thrasio was just a gleam in an MBA student’s eye.

A digital holding company

Unlike Thrasio, who rolled up physical ecommerce retailers, Onfolio has been focused rolling up digital ventures.

Since 2018, the firm has been acquiring a portfolio of online businesses (“Online Portfolio” = Onfolio. Get it?) whose existing owner isn’t maximizing the full potential of the business.

Onfolio focuses on buying and scaling businesses that are already profitable, rather than taking a risk on unproven business models (like early stage VC).

These acquisitions are integrated into the firm’s portfolio, which currently stands at 22 companies.

Onfolio leverages its own sales and marketing expertise, along with complementary resources from other acquired companies, to boost the value of its portfolio as a whole.

In a recent interview, CEO Dom Wells outlined how his initial business experience led him to formulate the Onfolio concept.

We’d identified that there were a lot of people out there who had money to invest in online businesses, but they didn’t know how to do it… With online business, it’s a pretty active investment, you have to buy the business and then figure out how to run the thing.

– Onfolio CEO Dom Wells

Onfolio’s singular focus on digital acquisitions gives them a tremendous advantage in a challenging field that (rightfully) tends to scare off “dilettante” investors.

Active for thee, passive for me

When compared to a sector like real estate, digital acquisitions require much more active management on the part of investors.

For this reason, digital acquisition activity has been lower than in other areas. (Investors don’t want to actually run a business — they just want the returns).

But Dom realized his company could manage the ‘active’ component of the acquisitions, leaving the ‘passive’ component to the investors.

After doing this for half a decade, in August 2022 Onfolio went public on the Nasdaq.

The micro PE sweet spot

Having done this for so long means Onfolio has had a long time to cultivate connections in this space.

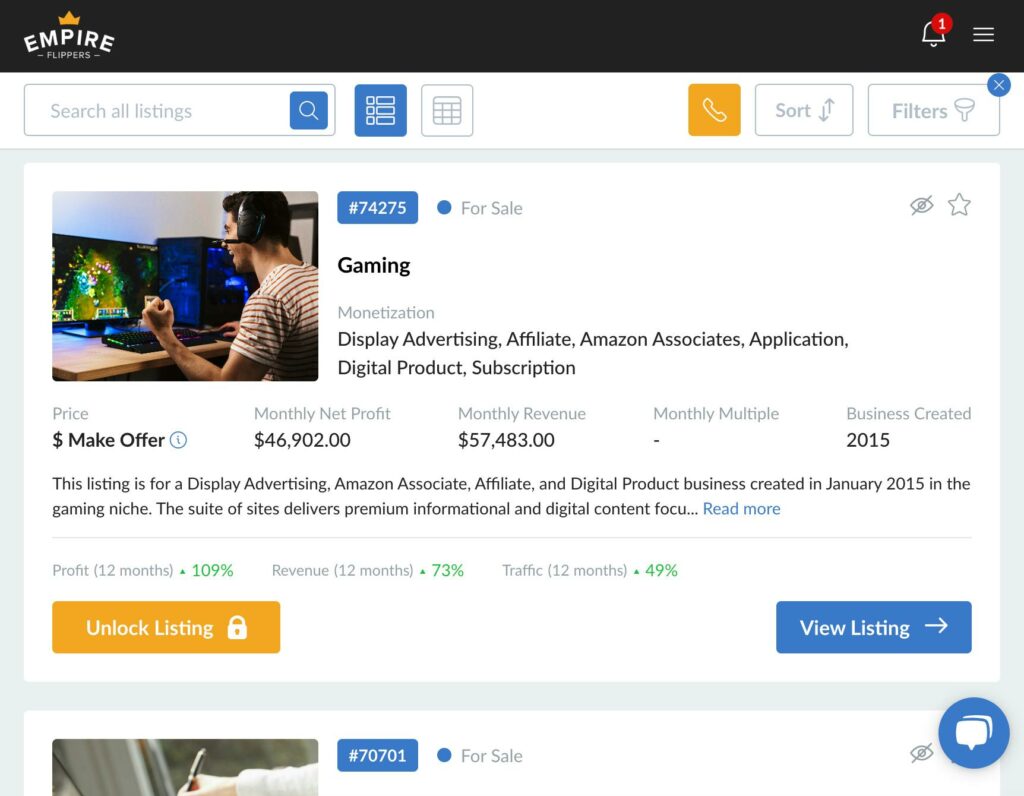

So while the rest of the market is just haggling over deals that they see on places like Acquire, Flippa or Empire Flippers, Onfolio can source additional deals from:

- Brokers

- Outbound leads (they work with 2-3 firms who do outreach)

- And inbound leads (Being public and vocal on social media, they get a ton of inbound requests from people)

Generally speaking, Onfolio looks to acquire businesses with:

- $500k – $2m EBITDA

- No more than 3-4x multiple

- Target ROI of 25% per acquisition

This is the sweet spot for micro PE deals.

But not all types of businesses make the cutoff. In fact, there is one type of business that is no longer interesting to Dom.

A few years back, Onfolio made the (very) smart decision to get away from content sites — a move the rest of the industry is now scrambling to catch up with.

Why Onfolio got away from Content sites

Onfolio’s pivot away from all-out content sites is a decision they made way back in 2020. This was years before anyone heard of ChatGPT, but it’s looking remarkably prescient right now.

Two main headwinds are creating a lot of uncertainty about the future viability of many content-driven businesses:

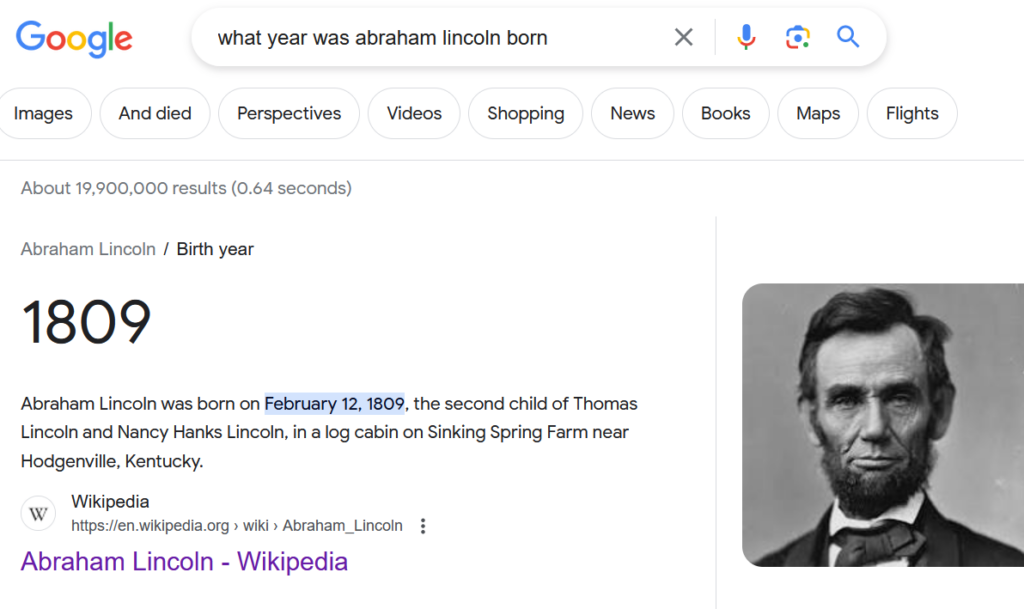

Google is becoming unreliable

Every so often, Google makes a change to their core website ranking system (what’s known as a “Core Update“)

The most recent update was just a few weeks ago, and, like previous changes, it created a mad scramble for content site owners to figure out what changed, and how they need to adjust their strategy.

Unsurprisingly, the fact that so many content sites depend on Google for their traffic is a huge source of risk. If Google decides to upend their algorithm, your website traffic (and thus, your ad revenue) can immediately and permanently sink like a stone.

Twitter is full of these horror stories:

Welp, Google's March Core Update crushed Travel Lemming an additional 65+% already 📉

— Nate Hake (@natejhake) March 10, 2024

We honestly tried our best (see my tweet below for receipts)@glenngabe says the HCU is punitive. This feels like cruel & unusual punishment though⚖️

We don't even know our crime

We don't… https://t.co/znZZDktr8C pic.twitter.com/xVja7wjUsK

Plus, Google has been pouring more resources into generating query answers right on the search page.

It may sound crazy, but estimates indicate that nearly two-thirds of all searches end without any click-through! This is a whole lot of traffic that content sites miss out on.

The rise of AI

Admittedly, the rapid rise of LLMs wasn’t something Onfolio foresaw back in 2020.

But regardless, AI writing tools have made it way easier for basically anyone to spin up & monetize a new content site.

As expected, this is creating a ton of new competition in the space; especially for the type of milquetoast content that populates most affiliate marketing & advertising-driven sites. (What many have called ”the enshittification” of the web)

Content sites are now impossible to value

What really dead here is valuations.

To accurately value a business, the acquirer needs to have a sensible idea of what future earnings & cashflow will look like. As Dom put it to us, between Google and AI, this just isn’t the case anymore with content sites:

In late 2020 we decided to stop buying content sites… We didn’t think AI would come and disrupt it like it appears to have done, but rather Google just isn’t an algorithm worth playing with when it comes to making an acquisition.

– Onfolio CEO Dom Wells

You need to be able to say: “Can I say with reasonable confidence that this website will still earn the same for the next few years?” With a content site you can’t even say that will be the case for the next month.

But just as content sites are starting to look questionable, other business lines appear particularly attractive – especially agencies.

Agency acquisitions are in vogue

Agencies are essentially independent marketing teams that sell their services directly to businesses:

- Content agencies which provide blog posts, white papers, and other written material for companies.

- SEO agencies which focus on improving the search engine performance of a business.

- Full-scale marketing agencies which might provide the above services as well as public relations, digital ad campaigns, and more.

Crucially, agencies don’t depend on the whims of the Google algorithm to earn a living, and AI can actually help their operations, rather than harm it.

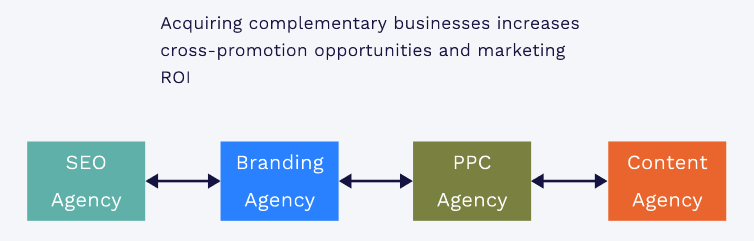

Plus, all these different agency types can create natural opportunities for synergy (there’s that buzzword again!)

By integrating different agencies together, you can cross-promote complementary services and improve margins through a shared backend.

Further, agencies have a number of lucrative benefits that can make them ideal acquisition targets:

- Small teams, meaning lower labor costs and more efficient ops

- Low capital requirements – this isn’t an asset-heavy industry

- High profit margins as a result of the nature of offering B2B services.

But here’s the thing: most acquirers avoid agencies.

Why?

Because of founder-dependency.

When you’re buying an agency, you’re really buying a) a book of clients that b) rely on the skills that the founder brings to the table.

This can be one big problem, especially if the founder navigates key sales relationships for company, and isn’t included with the sale!

However, this also creates tremendous opportunity for buyers that can navigate these issues. Lack of competition means that sellers are often highly motivated to be flexible, and more lenient on purchase price.

After several successful ventures in the world of agencies, Onfolio has proved that it has a viable strategy to solve these key problems

They’re making agencies the prime focus of their latest SPV offering.

Invest in the Onfolio Agency SPV

A strong history

Onfolio is confident they can make agency acquisitions successful because, well, they’ve already done it!

Between Outreachmama, SEOButler, and Contentellect, Onfolio has three examples where they’ve successfully replace a founder while ensuring a diversified, growing revenue base. The cash return in every case exceeded 26%.

Past performance is no guarantee of future results. But these case studies show Onfolio has a track record in the agency world that few acquirers can match.

Plus, Onfolio has a lot of brand equity compared to other potential acquirers. The fact that they’re a public company grants them access to unique deal flow that lesser-known acquisition competitors just don’t see.

It’s a buyer’s market

Combine all that with the generally weak deal market and the weak agency market specifically (both of which mean lower multiples and more motivated sellers), and Onfolio is as differentiated as they come.

It’s a buyer’s market right now. Onfolio has too many good deals coming across their desk to navigate alone. That’s why they’re opening up a new SPV to raise outside capital interested in co-investing in digital acquisitions – completely passively.

Details

- Raising up to $2.5MM in the SPV that will co-invest in multiple deals, allowing for increased investor diversification.

- Dividends are paid quarterly, likely starting in year 1. In addition, Onfolio will offer investors annual liquidity based on the current value of their holdings.

- Onfolio already has multiple agency opportunities in the pipeline – they’re looking to call investor capital and deploy funds soon.

- SPV ownership of the underlying acquisition varies on a case-by-case basis, but will generally be around 30%. Onfolio isn’t charging a traditional management fee, but they do take 10% of the distributions that investors get.

- The SPV projected ROI is around 30%. Projections aren’t guaranteed, of course, but Onfolio is acquiring businesses that already generate revenue, so forecasts tend to be a bit more reliable.

There’s no cutoff date, but this opportunity does close once the $2.5m mark is reached, so I wouldn’t wait around.

Invest in Onfolio Agency SPV →

See you next time,

Stefan

Disclosures from Alts

- This issue was sponsored by Onfolio

- I have been personally invested in Onfolio since 2020

- The ALTS 1 Fund holds no interest in any companies mentioned in this issue.

- This issue contains an affiliate link to Empire Flippers

This issue is a sponsored deep dive, meaning Alts has been paid to write an independent analysis of Onfolio and their associated markets. Onfolio has agreed to offer an unconstrained look at its business, offerings, and operations. Onfolio is also a sponsor of Alts, but our research is neutral and unbiased. This should not be considered financial, legal, tax, or investment advice, but rather an independent analysis to help readers make their own investment decisions. All opinions expressed here are ours, and ours alone. We hope you find it informative and fair.